|

市場調查報告書

商品編碼

1685930

聚光型太陽熱能發電(CSP) - 市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Concentrated Solar Power (CSP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

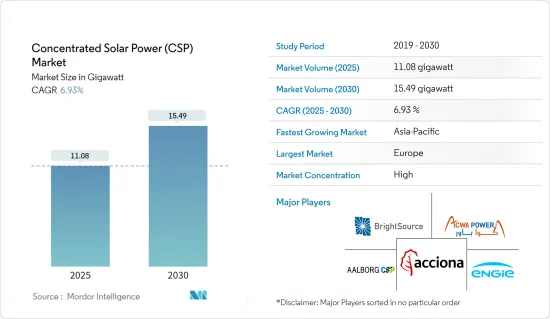

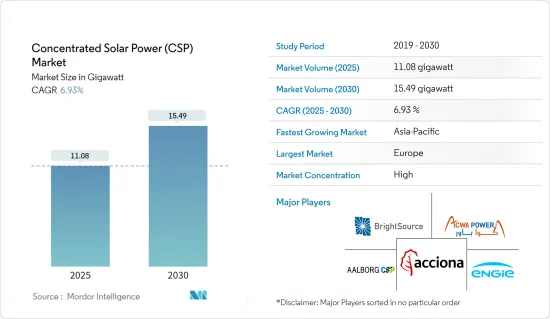

預計2025年聚光型太陽光電市場規模為11.08吉瓦,預計2030年將達到15.49吉瓦,預測期間(2025-2030年)的複合年成長率為6.93%。

主要亮點

- 從長遠來看,預計聚光型太陽光電技術成本的下降將推動市場發展。

- 然而,預計預測期內太陽能和其他可再生技術的日益普及將阻礙市場成長。

- 然而,技術改進和將聚光型太陽光電併入混合發電廠將對環境產生積極影響。這將對環境產生積極影響,預計氣候變遷將為未來的聚光型太陽光電市場創造若干機會。

- 由於電力需求上升、新計畫的出現以及注重利用再生能源來源來抑制污染水平,預測期內對 CSP 的需求將增加,因此預計歐洲將主導該地區的太陽能領域。

聚光型太陽熱能發電(CSP)市場趨勢

槽式太陽能電站佔市場主導地位

- 槽式聚光器 (PTC) 由具有線性軸追蹤的長 U 形鏡子組成。鏡子沿著焦線反射直射陽光,焦線放置吸收管。接收器/吸收器管由鋼製成。它們塗有選擇性塗層,可在太陽頻譜中保持高吸收率,在紅外線頻譜中保持高反射率(即發出盡可能少的光)。

- 最常用的流體是熱感,但在這種配置中也使用水/蒸氣和熔鹽。這些是 CSP 部署最廣泛的配置。

- 槽式拋物鏡型集熱器是全球最常用的 CSP 之一,用於家庭供暖、海水淡化、冷凍系統、工業供熱、發電廠和抽水灌溉。根據美國國家可再生能源實驗室(NREL)的數據,截至2022年6月,槽式光熱電站佔全球光熱發電裝置容量的63.5%。

- 槽式集熱器(PTC)的操作和維護比同類產品稍微複雜一些。太陽能場運作和維護最常見的活動是定期測量鏡子的反射率並清洗。鏡子的反射率直接影響太陽能集熱器提供的寶貴熱能的數量。您可能還需要高大的車輛或起重機來進行定期清洗和維護。

- 例如,2020年,印度理工學院馬德拉斯分校的研究人員開發了一種低成本的太陽能槽式集熱器(PTC)裝置,用於集中太陽能用於海水淡化、空間加熱和空間冷卻等工業應用。該系統在印度開發,重量輕,在各種氣候和負載條件下效率高。

- 因此,預計在預測期內,槽式太陽能發電系統將主導聚光型太陽熱能發電市場。

歐洲主導市場

- 在歐洲,電力業造成了75%以上的溫室氣體排放。增加可再生能源的佔有率是應對氣候變遷的潛在選擇。

- 太陽能產業推出新計畫以滿足日益成長的電力需求,並致力於利用再生能源來源來抑制全部區域的污染水平。 2022年歐洲CSP裝置容量約為2.3GW。據IRENA稱,預計2030年歐洲將安裝4吉瓦的聚光型太陽光電(CSP)。

- 在歐洲,MUSTEC(太陽熱能發電市場引入)等能源合作旨在根據歐盟2030年氣候和能源框架,重點在該地區聯合開發CSP計劃。 MUSTEC 的目標是在南歐開發 CSP計劃,以滿足中歐和北歐國家的電力需求。

- 同樣,歐洲 CSP/太陽能熱能研究平台 EU Solaris ERIC 旨在進行 CSP 研究相關活動和應用開發。它將開發工具和技術、新功能、解決方案、常規標準和通訊協定,以增強該地區的 CSP 技術。

- 此外,2022年,德國政府將對CSP安裝提供55%的補貼,以加速清潔能源向工業綠色供熱的轉型。它還設想將 CSP 技術的投資回收期縮短至三年以內。這可能會對德國 CSP 的採用率提高做出重大貢獻。

- 同樣,西班牙於 2002 年成為歐洲第一個推出 CSP 上網電價計畫的國家,為 CSP 的普及做出了貢獻。此外,2007年,西班牙運作了PS10太陽能塔,這是世界上第一座採用塔式技術的商業化CSP工廠。

- 此外,2022年,西班牙生態轉型部透過競標機制獲得了220兆瓦的CSP裝置容量,這將推動該國CSP計劃的發展。西班牙政府也宣布,將在2025年前對600MW的CSP容量進行競標。

- 因此,隨著裝置容量的增加,預計歐洲將在預測期內主導 CSP 市場。

聚光型太陽熱能發電(CSP)產業概況

聚光型太陽熱能發電(CSP) 市場適度整合。該市場的主要企業(不分先後順序)包括 Aalborg CSP、Acciona SA、ACWA Power、Brightsource Energy Inc. 和 Engie SA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概述

- 介紹

- 2028 年市場規模與需求預測

- CSP裝置容量及2028年預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 聚光型太陽熱能發電技術成本下降

- 限制因素

- 政府對其他再生能源來源的支持政策

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 技術領域

- 槽式太陽能電站

- 線性菲涅爾

- 電力塔

- 碟/英鎊

- 傳熱介質

- 熔鹽

- 水性

- 油性

- 其他傳熱介質

- 地區

- 北美洲

- 美國

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 義大利

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 智利

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Nextera Energy Inc.

- Acciona SA

- ACWA Power

- Brightsource Energy Inc.

- Engie

- SR Energy

- Aalborg CSP

- Chiyoda Corporation

第7章 市場機會與未來趨勢

- 混合發電廠聚光型太陽光電的技術改善與整合

簡介目錄

Product Code: 49456

The Concentrated Solar Power Market size is estimated at 11.08 gigawatt in 2025, and is expected to reach 15.49 gigawatt by 2030, at a CAGR of 6.93% during the forecast period (2025-2030).

Key Highlights

- Over the long term, the declining cost of concentrated solar power technologies is expected to drive the market.

- On the other hand, the increasing adoption of solar photovoltaics and other renewable technologies is expected to hinder the market growth during the forecast period.

- Nevertheless, technology improvements and integration of concentrated solar power in hybrid power plants. This will positively impact the environment, and climate change is expected to create several opportunities for Concentrating the solar power market in the future.

- Europe is expected to dominate the market as the solar sector in the region is witnessing new projects at the outset of growing electricity demand and focusing on using renewable energy sources to curb pollution levels, therefore resulting in increasing demand for CSP during the forecast period.

Concentrated Solar Power (CSP) Market Trends

Parabolic Trough Segment to Dominate the Market

- Parabolic-trough collectors (PTCs) consist of long U-shaped mirrors with a linear axis tracking system. The mirrors reflect direct solar radiation along their focal line, where an absorber tube is located. The receiver/absorber tube is made of steel. It has a selective coating that maintains high absorbance in the solar spectrum wavelength range but high reflectance in the infrared spectrum (i.e., it emits as little as possible).

- The most commonly used fluid is thermal oil, although water/steam or molten salt are also used for this configuration. These are some of the most widely deployed configurations for CSPs.

- Parabolic trough collectors are one of the most commonly deployed CSPs around the globe; they can be deployed in domestic heating, desalination, refrigeration systems, industrial heat, power plants, pumping irrigation water, etc. According to the National Renewable Energy Laboratory (NREL), as of June 2022, Parabolic trough accounts for a share of 63.5% of total global CSP installed capacity.

- The Parabolic Trough Collector (PTC) 's operations and maintenance part is slightly complicated compared to its counterparts. The most frequent activities related to solar field operations and maintenance are the periodic measurement of mirror reflectivity and washing. Mirror reflectivity directly affects the amount of valuable thermal energy solar collectors deliver. It may also require tall vehicles or cranes to perform routine cleaning and maintenance.

- For instance, in 2020, researchers from the Indian Institute of Technology Madras created a low-cost Solar Parabolic Trough Collector (PTC) device for concentrating solar energy for industrial uses such as desalination, space heating, and space cooling. This system, created and developed in India, is lightweight and highly efficient under various climate and load circumstances.

- Hence, the parabolic trough is expected to dominate the market for concentrated solar power during the forecast period.

Europe to Dominate the Market

- In Europe, the power sector accounts for more than 75% of greenhouse gas emissions in the region. Increasing the share of renewable energy has become a potential option for the region to tackle climate change.

- The solar sector is witnessing new projects at the outset of growing electricity demand and focusing on using renewable energy sources to curb pollution levels across the region. In 2022, Europe had about 2.3 GW of installed CSP capacity. As per IRENA, by 2030, Europe will likely install 4 GW of concentrated solar power (CSP)

- In Europe, Energy cooperation such as MUSTEC or Market Uptake of Solar Thermal Electricity intends to focus on the collaborative development of CSP projects in the region, given the EU 2030 climate and energy framework. MUSTEC aims to deploy CSP projects in Southern Europe to meet the electricity demand of Central and North European countries.

- Likewise, the EU Solaris ERIC, the European Research Infrastructure for CSP/Solar thermal energy, aims to develop CSP research-related activities and applications. The development of tools and techniques, new capacities, solutions, everyday standards, and protocols to ramp up CSP technology in the region.

- Further, in 2022, the German government introduced a 55% subsidy to install CSP to speed up the clean energy transition to green heating for industrial applications. It also envisages lowering payback time to below three years for CSP technology. This would significantly help CSP installations to increase in Germany.

- Similarly, Spain was the first European country to initiate feed-in-tariff mechanisms for CSP in 2002, which helped ramp up CSP deployment. Moreover, in 2007, Spain commissioned the PS10 solar power tower as the first commercial CSP plant to use tower technology worldwide.

- Further, in 2022, the Ministry of Ecological Transition, Spain, awarded 220 MW capacity for CSP installation through an auction mechanism that would give rise to the development of CSP projects in the country. Spain's government also announced to float tenders for 600 MW of CSP capacity by 2025.

- Hence, with the increasing installed capacities, Europe is expected to dominate the CSP market during the forecast period.

Concentrated Solar Power (CSP) Industry Overview

The concentrated solar power (CSP) market is moderately consolidated. Some of the key players in this market (in no particular order) include Aalborg CSP, Acciona SA, ACWA Power, Brightsource Energy Inc., and Engie SA., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Installed CSP Capacity and Forecast in MW, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Declining Cost of Concentrated Solar Power Technologies

- 4.6.2 Restraints

- 4.6.2.1 Supportive Government Policies for Other Renewable Energy Sources

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Parabolic Trough

- 5.1.2 Linear Fresnel

- 5.1.3 Power Tower

- 5.1.4 Dish/Stirling

- 5.2 Heat Transfer Fluid

- 5.2.1 Molten Salt

- 5.2.2 Water-based

- 5.2.3 Oil-based

- 5.2.4 Other Heat Transfer Fluids

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Mexico

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 Italy

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 South Korea

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Chile

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nextera Energy Inc.

- 6.3.2 Acciona SA

- 6.3.3 ACWA Power

- 6.3.4 Brightsource Energy Inc.

- 6.3.5 Engie

- 6.3.6 SR Energy

- 6.3.7 Aalborg CSP

- 6.3.8 Chiyoda Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technology Improvements and Integration of Concentrated Solar Power in Hybrid Power Plants

02-2729-4219

+886-2-2729-4219