|

市場調查報告書

商品編碼

1440538

特種肥料:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2030)Global Specialty Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

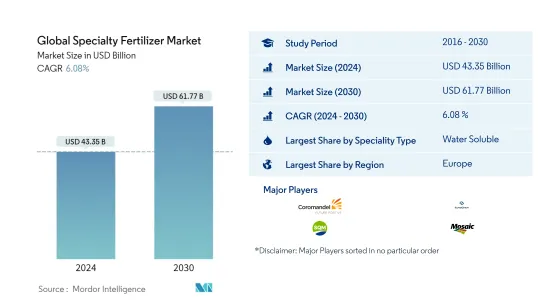

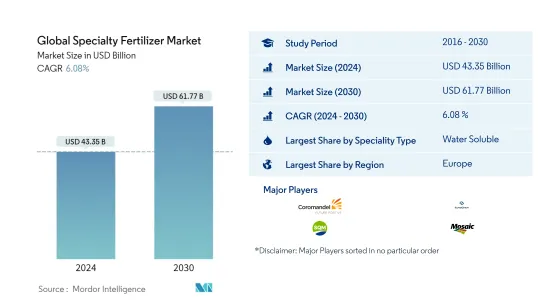

2024 年全球特種肥料市場規模估計為 433.5 億美元,預計到 2030 年將達到 617.7 億美元,在預測期間(2024-2030 年)以 6.08% 的複合年增長率增長。

主要亮點

- 依特殊類型分類的最大區隔市場 - 水溶性:水溶性肥料有助於有效減少化肥散佈25-30%。這些肥料還有助於將它們均勻地分佈在田間。

- 生長最快的特殊類型 - SRF:SRF 對土壤和環境安全,因為它在整個種植季節精確地將養分釋放到土壤中,並減少養分淋失。

- 依作物類型分類的最大部分 - 草坪和觀賞植物:人們對世界各地污染和生態旅遊擴張的日益擔憂正在增加耕地面積,從而增加了此類作物對肥料的需求。

- 美國:該國精密技術的引入增加了對專用肥料的需求,因為建議肥料必須適量使用。

特種肥料市場趨勢

依特種類型分類,水溶性是最大的區隔市場。

- 全球特種肥料市場約佔全球肥料市場總量的48.0%。 2021年市值約749.6億美元。研究期間市場成長了約 23.0%。由於人們對環境的日益關注,特種肥料的使用越來越多,預計將在預測期內推動特種肥料市場的發展。

- 水溶性肥料在全球特種肥料市場佔據主導地位,約佔市場價值的40.5%。亞太、中東和非洲主導水溶性肥料市場。 2021年,這兩個地區均佔全球水溶肥市值的50.0%以上。

- 液體肥料佔據全球特種肥料市場第二大市場,約佔市場價值的35.5%。在液體肥料市場中,歐洲是第二大市場,其次是亞太地區。歐洲大型微灌溉地區正在推動液體肥料市場的成長。

- 控釋/緩釋肥料佔據了特種肥料的剩餘市場價值。然而,緩釋性肥料比緩釋性肥料在市場上的滲透率更高。 2021年控制釋放肥料約佔全球特種肥料市場價值的16.8%。

- 肥料使用效率高、特種肥料的採用增加以及噴灌和微灌溉系統總面積的增加趨勢等因素預計將在預測期內推動全球特種肥料市場的發展。

依地區分類,歐洲是最大的部分。

- 歐洲在全球特種肥料市場佔據主導地位,約佔市場總量的31.75%,2021年將達到約201億美元。歐洲特種肥料市場以田間作物為主,佔消費量的86.8%,其次是牧草。 2021年,觀賞市場佔有率為7.6%,園藝作物作物為6.2%。

- 亞太地區是特種肥料第二大市場,2021年約佔總市場價值的21.32%。亞太地區特種肥料市場以田間作物為主,佔消費量的84.98%。其次是園藝作物,到 2021 年將佔 14.37%,草坪和觀賞作物將佔不到 1%。

- 就特種肥料市場總量而言,中國以43.04%領先田間作物領域,其次是印度(17.15%)、日本(約16.35%)和印尼(5.67%)。 2021年澳洲佔亞太特種肥料市場價值的4.07%。

- 南美洲約佔市場價值的18.48%,2021年價值約117億美元。巴西在南美洲特種肥料市場佔據主導地位。 2021年巴西特種肥料市場價值44億美元,當年消費量量為470萬噸。

- 整個特種肥料市場的數量和金額均呈成長趨勢,但 2020 年市場價值因冠狀病毒感染疾病(COVID-19) 大流行導致供應鏈中斷而下降。

- 在全球範圍內,人們對過度使用化學肥料造成的化肥污染的擔憂日益加劇,這可能會在預測期內推動全球特種肥料市場的發展。

特種肥料行業概況

全球特種肥料市場較分散,前五名企業佔32.33%。該市場的主要企業包括(依字母順序排列)Coromandel International Ltd.、EuroChem Group、Sociedad Quimica y Minera de Chile SA、The Mosaic Co 和 Yara International ASA。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章執行摘要和主要發現

第2章 提供報告

第3章簡介

- 研究假設和市場定義

- 調查範圍

- 調查方法

第4章 產業主要趨勢

- 主要作物種植面積

- 平均養分施用量

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 特種

- CRF

- 聚合物塗層

- 聚合物硫塗層

- 其他

- 液體肥料

- SRF

- 水溶性

- CRF

- 如何使用

- 施肥

- 葉子

- 土壤

- 作物類型

- 田裡的作物

- 園藝作物

- 草坪和裝飾

- 地區

- 亞太地區

- 澳洲

- 孟加拉

- 中國

- 印度

- 印尼

- 日本

- 巴基斯坦

- 菲律賓

- 泰國

- 越南

- 其他亞太地區

- 歐洲

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 其他歐洲國家

- 中東和非洲

- 奈及利亞

- 沙烏地阿拉伯

- 南非

- 土耳其

- 其他中東和非洲

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

- 亞太地區

第6章 競爭形勢

- 重大策略舉措

- 市場佔有率分析

- 公司形勢

- 公司簡介

- Compo Expert GmbH

- Coromandel International Ltd.

- EuroChem Group

- Haifa Group

- Kingenta Ecological Engineering Group Co., Ltd.

- Koch Industries Inc.

- Nutrien Ltd.

- Sociedad Quimica y Minera de Chile SA

- The Mosaic Co.

- Yara International ASA

第7章 CEO 面臨的關鍵策略問題

第8章附錄

- 世界概況

- 概述

- 波特的五力框架

- 全球價值鏈分析

- 市場動態(DRO)

- 來源和參考文獻

- 表格和圖形列表

- 重要見解

- 資料包

- 詞彙表

The Global Specialty Fertilizer Market size is estimated at USD 43.35 billion in 2024, and is expected to reach USD 61.77 billion by 2030, growing at a CAGR of 6.08% during the forecast period (2024-2030).

Key Highlights

- Largest segment by Speciality Type - Water Soluble : Water-soluble fertilizers help in efficiently reducing fertilizer application by 25-30%. These fertilizers also help in providing an even distribution throughout the field.

- Fastest growing by Speciality Type - SRF : SRFs are safe for the soil and environment as they precisely release nutrients into the soil throughout the cropping season and reduce the leaching of nutrients.

- Largest Segment by Crop Type - Turf & Ornamental : The increasing area under cultivation with increasing concern over pollution and growing ecotourism across the globe has increased the fertilizer demand for such crops.

- Largest segment by Country - United States : The adoption of precision technologies in the country has boosted the need for specialty fertilizers, as it needs a modest application of recommended fertilizers.

Specialty Fertilizers Market Trends

Water Soluble is the largest segment by Speciality Type.

- The global specialty fertilizers market accounts for about 48.0% of the overall global fertilizer market value. It was valued at about USD 74.96 billion in 2021. The market grew by about 23.0% in the study period. The increasing adoption of specialty fertilizers is due to the increasing concern over the environment, which is expected to drive the specialty fertilizer market during the forecast period.

- Water-soluble fertilizers dominate the global specialty fertilizer market, accounting for about 40.5% of the market value. Asia-Pacific and Middle East & Africa dominate the water-soluble fertilizers market. Both regions accounted for more than 50.0% of the global water-soluble fertilizer market value in 2021.

- Liquid fertilizers occupy the second-largest market in the global specialty fertilizer market and account for about 35.5% of the market value. In the liquid fertilizers market, Europe is the second-largest market, followed by Asia-Pacific. The large micro-irrigated area in Europe is driving the growth of the liquid fertilizers market.

- The controlled/slow-release fertilizers account for the remaining market value of specialty fertilizers. However, controlled-release fertilizers have penetrated more into the market than slow-release fertilizers. Controlled-release fertilizers accounted for about 16.8% of the global specialty fertilizer market value in 2021.

- Factors like high fertilizer-use efficiency, the increased adoption of specialty fertilizers, and the increasing trend in the overall area under sprinklers or micro-irrigation systems are expected to drive the global specialty fertilizer market during the forecast period.

Europe is the largest segment by Region.

- Europe dominates the global specialty fertilizer market, accounting for about 31.75% of the total market value, valued at about USD 20.1 billion in 2021. The European specialty fertilizer market was dominated by field crops, accounting for 86.8% of consumption volume, followed by turf and ornamental crops for 7.6% and horticultural crops for 6.2% of the market share in 2021.

- The Asia-Pacific region is the second-largest market for specialty fertilizers, and it accounted for about 21.32% of the total market value in 2021. The Asia-Pacific specialty fertilizers market was dominated by field crops, accounting for 84.98% of the consumption volume, followed by horticultural crops for 14.37% and turf and ornamental crops for less than 1% in 2021.

- China leads the field crops segment in terms of total specialty fertilizer market value with 43.04%, followed by India with 17.15%, Japan with about 16.35%, and Indonesia with 5.67%. Australia occupied 4.07% of the Asia-Pacific specialty fertilizer market value in 2021.

- South America accounted for about 18.48% of the market value, valued at about USD 11.7 billion in 2021. Brazil dominates the South American specialty fertilizer market. The specialty fertilizer market in Brazil was valued at USD 4.40 billion in 2021, with a volume consumption of 4.7 million metric ton in the same year.

- There has been an increasing trend observed in the overall specialty fertilizer market, both in terms of volume and value, except for a decrease in market value in 2020 due to supply chain disruptions caused by the COVID-19 pandemic.

- The increasing concern over fertilizer pollution caused due to overuse of fertilizers around the world may drive the global specialty fertilizer market during the forecast period.

Specialty Fertilizers Industry Overview

The Global Specialty Fertilizer Market is fragmented, with the top five companies occupying 32.33%. The major players in this market are Coromandel International Ltd., EuroChem Group, Sociedad Quimica y Minera de Chile SA, The Mosaic Co. and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.2 Average Nutrient Application Rates

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION

- 5.1 Speciality Type

- 5.1.1 CRF

- 5.1.1.1 Polymer Coated

- 5.1.1.2 Polymer-Sulfur Coated

- 5.1.1.3 Others

- 5.1.2 Liquid Fertilizer

- 5.1.3 SRF

- 5.1.4 Water Soluble

- 5.1.1 CRF

- 5.2 Application Mode

- 5.2.1 Fertigation

- 5.2.2 Foliar

- 5.2.3 Soil

- 5.3 Crop Type

- 5.3.1 Field Crops

- 5.3.2 Horticultural Crops

- 5.3.3 Turf & Ornamental

- 5.4 Region

- 5.4.1 Asia-Pacific

- 5.4.1.1 Australia

- 5.4.1.2 Bangladesh

- 5.4.1.3 China

- 5.4.1.4 India

- 5.4.1.5 Indonesia

- 5.4.1.6 Japan

- 5.4.1.7 Pakistan

- 5.4.1.8 Philippines

- 5.4.1.9 Thailand

- 5.4.1.10 Vietnam

- 5.4.1.11 Rest Of Asia-Pacific

- 5.4.2 Europe

- 5.4.2.1 France

- 5.4.2.2 Germany

- 5.4.2.3 Italy

- 5.4.2.4 Netherlands

- 5.4.2.5 Russia

- 5.4.2.6 Spain

- 5.4.2.7 Ukraine

- 5.4.2.8 United Kingdom

- 5.4.2.9 Rest Of Europe

- 5.4.3 Middle East & Africa

- 5.4.3.1 Nigeria

- 5.4.3.2 Saudi Arabia

- 5.4.3.3 South Africa

- 5.4.3.4 Turkey

- 5.4.3.5 Rest Of Middle East & Africa

- 5.4.4 North America

- 5.4.4.1 Canada

- 5.4.4.2 Mexico

- 5.4.4.3 United States

- 5.4.4.4 Rest Of North America

- 5.4.5 South America

- 5.4.5.1 Argentina

- 5.4.5.2 Brazil

- 5.4.5.3 Rest Of South America

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Compo Expert GmbH

- 6.4.2 Coromandel International Ltd.

- 6.4.3 EuroChem Group

- 6.4.4 Haifa Group

- 6.4.5 Kingenta Ecological Engineering Group Co., Ltd.

- 6.4.6 Koch Industries Inc.

- 6.4.7 Nutrien Ltd.

- 6.4.8 Sociedad Quimica y Minera de Chile SA

- 6.4.9 The Mosaic Co.

- 6.4.10 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms