|

市場調查報告書

商品編碼

1440436

不鏽鋼 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Stainless Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

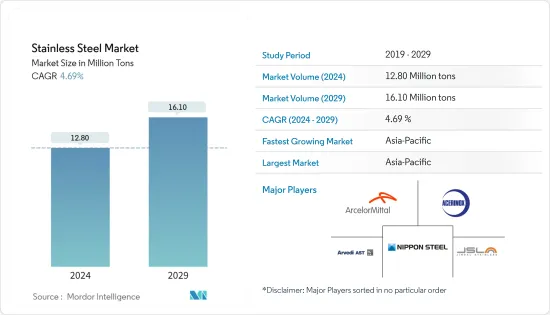

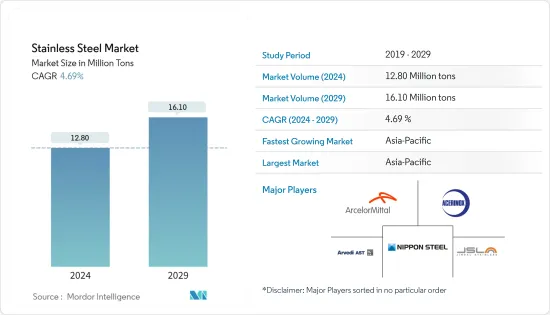

2024年不鏽鋼市場規模預估為1,280萬噸,預估至2029年將達到1,610萬噸,在預測期間(2024-2029年)CAGR為4.69%。

主要亮點

- COVID-19 大流行對市場產生了負面影響。這是因為製造設施和工廠因封鎖和限制而關閉。供應鏈和運輸中斷進一步對市場造成了障礙。然而,2021年該產業出現復甦,使研究市場的需求反彈。

- 短期內,建築和汽車行業需求的增加是推動所研究市場成長的一些因素。

- 另一方面,高昂的生產成本和原料價格的波動可能會阻礙所研究市場的成長。

- 然而,亞太地區的工業和基礎設施發展可能為所研究的市場提供機會。

- 亞太地區預計將主導市場,並且在預測期內也可能出現最高的CAGR。

不銹鋼市場趨勢

增加建築業的使用

- 不銹鋼用於建築、建築和建築的各個方面。由於具有更好的耐腐蝕性,大多數建築設計和結構工程公司更喜歡在腐蝕性更強的場所使用合金含量更高的含鉬不銹鋼。

- 不銹鋼是建築業中成長最快的部門。不銹鋼產品用於梁、柱等結構應用及一般建築應用。它可用於多種應用,包括欄桿、屋頂、電梯、樓梯、游泳池遮陽簾和中庭。

- 由於人口成長和城市化進程,世界各地對住宅和商業建築以及醫院建設的需求不斷成長。都市化進程的加速需要開發更多的建築物和基礎設施。例如,預計印度仍將是二十國集團經濟成長最快的國家。印度政府宣布三年(2023-2025年)基礎建設投資目標為3,765億美元,其中1,205億美元用於發展27個產業集群,753億美元用於公路、鐵路和港口互聯互通計畫。因此,基礎設施項目投資的增加預計將為不銹鋼市場創造上行需求。

- 此外,沙烏地阿拉伯正在進行許多商業項目,這可能會促使該國出現更多的商業建築。耗資5000億美元的未來巨型城市「Neom」計畫-紅海計畫一期預計於2025年完工,擁有14家豪華和超豪華酒店,共3000間客房,分佈在五個島嶼和兩個內陸度假村, Qiddiya 娛樂城、超豪華健康旅遊目的地阿瑪拉以及讓努維爾位於歐拉的 Sharaan 度假村。因此,商業建設項目投資的增加預計將為不銹鋼市場創造上行需求。

- 美國是世界上最大的建築業之一,2022年建築業產值為17,920億美元,2021年為16,265億美元。此外,2022年建築業為美國國內生產毛額(GDP)增加價值約1兆美元。這比上年GDP增加9588億美元有大幅成長。

- 根據美國人口普查局統計,美國商業建築市場在2008年經濟衰退期間明顯下滑後,已完工商業建築價值已恢復至經濟衰退前的水平,到2022年將達到1150億美元,與2021 年相比成長了21.4%。2022 年 美國商業建築開工價值因房產類型而異。學校和學院開工建設以及製造業是市場佔有率最高的類別。 2022年倉庫開工金額將超過270億美元。因此,預計該國的不銹鋼市場將受到該國商業建築業的上行需求。

- 此外,根據美國建築師協會 (AIA) 建築共識預測小組的數據,2023 年美國非住宅建築支出可能會增加 5.8%。到 2023 年,所有主要商業和機構類別預計將增加 5.8%。見證至少相當健康的收益。隨後的成長預計將增強預測期內不銹鋼市場的成長。

- 由於所有這些因素,不銹鋼市場在預測期內可能會在全球範圍內成長。

亞太地區將主導市場

- 亞太地區不銹鋼產業顯著成長;中國和印度等國家佔據了重要的消費佔有率。外國公司在亞太地區的不斷成長也產生了建造新辦公室和建築的需求。

- 在預測期內,汽車產業不斷成長的需求進一步提振了該地區的不銹鋼市場。

- 隨著消費者對電池驅動電動車的偏好上升,中國汽車產業正在經歷轉變的趨勢。中國汽車產業的擴張預計將有利於不銹鋼需求。根據國際汽車製造商組織(OICA)的數據,中國是世界上最大的汽車生產國,佔全球產量的近34%。 2022年,全國汽車產量為2,70,20,615輛,較2021年的2,61,21,712輛成長24%。因此,汽車產量的增加預計將帶動不銹鋼需求的上升市場。

- 此外,中國在不銹鋼市場上佔有亞太地區最大的市場佔有率。由於該國投資和建設活動的增加,預計在整個預測期內不銹鋼市場的需求將上升。中國是一個巨大的貢獻者,因為它在過去幾年中一直是全球基礎設施的主要投資者之一。例如,根據中國國家統計局(NBS)的數據,2022年,中國建築工程產值達27.63兆元人民幣(41,085.81億美元),比2021年成長6.6%。建築業投資的增加預計將為該國不銹鋼市場創造上行需求。

- 此外,印度汽車工業的投資增加和進步預計將增加高強度鋼材的消費。例如,2022年4月,塔塔汽車宣布計畫未來5年向乘用車業務投資30.8億美元。預計這將對國內不銹鋼市場產生正面影響。

- 基礎設施部門是印度經濟的關鍵驅動力。該產業對推動印度整體發展負有重要責任。例如,根據印度品牌資產基金會 (IBEF) 的數據,2022 年 12 月,AAI 和其他機場開發商的目標資本支出約為 100 盧比。未來五年,機場部門將投入 9,800 億盧比(118 億美元),用於擴建和改造現有航站樓、新航站樓以及加固跑道等活動。因此,這種擴張預計將為不銹鋼市場創造上行需求。

- 據OEC稱,2022年2月至2023年2月期間,日本不鏽鋼線材出口額從17.5億日圓(0.134億美元)下降至16.5億日圓(0.127億美元),減少了9,680萬日圓(- 5.54%)[74.5萬美元]。),進口額增加1,340 萬日元(+1.09%)[10.3 萬美元],從12.3 億日元(0.009471 億美元)增至12.4 億日元(0.009548 億美元) 。因此,國內不銹鋼絲的減少預計將影響該國的不銹鋼市場。

- 由於所有這些因素,預計該地區的不銹鋼市場在預測期內將穩定成長。

不鏽鋼業概況

不銹鋼市場本質上是部分整合的。該市場的主要參與者(排名不分先後)包括新日本製鐵公司、Acerinox、安賽樂米塔爾、金達爾不銹鋼有限公司和 Acciai Speciali Terni SpA 等。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 建築業不斷成長的需求

- 汽車產業需求不斷成長

- 其他司機

- 限制

- 替代品的可用性

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第 5 章:市場區隔(市場規模依數量計算)

- 產品

- 冷平

- 熱線圈

- 冷吧

- 熱吧

- 熱板和片材

- 其他產品

- 應用

- 汽車與交通

- 建築與施工

- 金屬製品

- 馬達

- 機械工業

- 其他應用

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第 6 章:競爭格局

- 併購、合資、合作與協議

- 市佔率(%)**/排名分析

- 領先企業採取的策略

- 公司簡介

- Acciai Speciali Terni SpA

- Acerinox

- Aperam

- ArcelorMittal

- Baosteel Group

- China Baowu Steel

- JFE Steel Corporation

- Jindal Stainless Limited

- NIPPON STEEL CORPORATION

- Outokumpu

- POSCO

- thyssenkrupp Stainless GmbH

- TSINGSHAN HOLDING GROUP

第 7 章:市場機會與未來趨勢

- 亞太地區工業和基礎設施發展

- 其他機會

簡介目錄

Product Code: 91424

The Stainless Steel Market size is estimated at 12.80 Million tons in 2024, and is expected to reach 16.10 Million tons by 2029, growing at a CAGR of 4.69% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

- Over the short term, increasing demand from the building and construction and automotive industries are some of the factors driving the growth of the market studied.

- On the flip side, high production costs and rising fluctuations in raw material prices is likely to hinder the growth of the market studied.

- However, industrial and infrastructure development in Asia-Pacific is likely to act as an opportunity for the studied market.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Stainless Steel Market Trends

Increasing Usage in the Construction Industry

- Stainless steel is used in all aspects of architecture, construction, and building. Due to the better corrosion resistance, most architectural design and structural engineering firms prefer more highly alloyed molybdenum-containing stainless steels for more corrosive locations.

- Stainless Steel is the fastest-growing sector in the construction industry. Stainless Steel products are used in structural applications such as beams, columns, and general architectural applications. It is used in a variety of applications, including railings, roofing, lifts, staircases, swimming pool shades, and atriums.

- Due to rising population and urbanization, there is a growing demand for the construction of residential and commercial buildings, as well as hospitals, all over the world. Increased urbanization necessitates the development of more buildings and infrastructure. For instance, India is anticipated to remain the fastest-growing G20 economy. The Indian government announced a target of USD 376.5 billion in infrastructure investment over three years (2023-2025), including USD 120.5 billion for developing 27 industrial clusters and USD 75.3 billion for road, railway, and port connectivity projects. Therefore, the increasing investments in infrastructure projects are expected to create an upside demand for the stainless steel market.

- Moreover, Saudi Arabia is working on a lot of commercial projects, which will likely lead to more commercial buildings in the country. The USD 500 billion futuristic mega-city "Neom" project, the Red Sea Project - Phase 1, which is expected to be completed by 2025 and has 14 luxury and hyper-luxury hotels with 3,000 rooms spread across five islands and two inland resorts, Qiddiya Entertainment City, Amaala - the uber-luxury wellness tourism destination, and Jean Nouvel's Sharaan resort in Al-Ula. Therefore, the increasing investments in commercial construction projects are expected to create an upside demand for the stainless steel market.

- The United States has one of the world's largest construction industries, valued at USD 1,792 billion in 2022 and USD 1,626.5 billion in 2021. Furthermore, in 2022, the value added to the gross domestic product (GDP) of the United States by the construction industry was around USD 1 trillion. This was a large increase from the previous year when USD 958.8 billion were added to the GDP.

- According to the US Census Bureau, after a noticeable drop in the United States commercial construction market during the 2008 recession, the value of commercial construction that has been put in place has recovered to pre-recession figures, reaching USD 115 billion in 2022, which showed an increase of 21.4% compared to 2021. The value of commercial construction starts in the United States in 2022 varied significantly depending on the property type. School and college construction starts were the categories, along with manufacturing, with the highest market share. The construction starts of warehouses amounted to over USD 27 billion in 2022. Therefore, the stainless steel market in the country is expected to have an upside demand from the country's commercial construction industry.

- Furthermore, according to the American Institute of Architects (AIA) Construction Consensus Forecast Panel, nonresidential building construction spending in the United States is likely to witness a growth of 5.8% in 2023. By 2023, all the major commercial and institutional categories are projected to witness at least reasonably healthy gains. The subsequent increase is expected to enhance the growth of the stainless steel market in the forecast period.

- Owing to all these factors, the market for stainless steel is likely to grow globally during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region has seen significant growth in the stainless steel industry; countries such as China and India account for significant consumption shares. The growing presence of foreign companies in the Asia-Pacific region has also created a demand for the construction of new offices and buildings.

- The growing demand from the automotive industry further boosted the market for stainless steel in the region during the forecast period.

- The automobile industry in China is experiencing shifting trends as consumer preference for battery-powered electric vehicles rises. The expansion of China's automotive sector is expected to benefit stainless steel demand. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the world's largest automobile producer, accounting for nearly 34% of global volume. In 2022, the country produced 2,70,20,615 units of automobiles, registering an increase of 24% compared to 2,61,21,712 units in 2021. Therefore, increasing in the production of automobiles is expected to create an upside demand for stainless steel market.

- Moreover, China holds the largest Asia-Pacific market share for stainless steel market. The demand for the stainless market is expected to rise throughout the forecast period due to rising investments and construction activity in the country. China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to CNY 27.63 trillion (USD 4108.581 billion), an increase of 6.6% compared with 2021. Therefore, the rising investments in the construction industry is expected to create an upside demand for stainless steel market in the country.

- Furthermore, increased investments and advancements in the automobile industry in India is expected to increase the consumption of high strength steel. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. This is expected to have a positive impact on the stainless steel market in the country.

- Infrastructure sector is a key driver for the Indian economy. The sector is highly responsible for propelling India's overall development. For instance, according to India Brand Equity Foundation (IBEF), in December 2022, AAI and other Airport Developers have targeted capital outlay of approximately Rs. 98,000 crore (USD 11.8 billion) in airport sector in the next five years for expansion and modification of existing terminals, new terminals and strengthening of runways, among other activities. Therefore, this expansion is expected to create an upside demand for stainless steel market.

- According to OEC, between February 2022 and February 2023 the exports of Japan's Stainless Steel Wire have decreased by JPY 96.8 million (-5.54%) [USD 0.745 million] from JPY 1.75 billion (USD 0.0134 billion) to JPY 1.65 billon (USD 0.0127 billion), while imports increased by JPY 13.4 million (+1.09%) [USD 0.103 million] from JPY 1.23 billion (USD 0.009471 billion) to JPY 1.24 billion (USD 0.009548 billion). Therefore, decrease in the stainless steel wires from the country is expected to affect the stainless steel market in the country.

- Due to all such factors, the market for Stainless Steel in the region is expected to have a steady growth during the forecast period.

Stainless Steel Industry Overview

The Stainless Steel Market is partially consolidated in nature. The major players in this market (not in a particular order) include NIPPON STEEL CORPORATION, Acerinox, ArcelorMittal, Jindal Stainless Limited, and Acciai Speciali Terni S.p.A., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Construction Industry

- 4.1.2 Increasing Demand from Automotive Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product

- 5.1.1 Cold Flat

- 5.1.2 Hot Coils

- 5.1.3 Cold Bars

- 5.1.4 Hot Bars

- 5.1.5 Hot Plate and Sheet

- 5.1.6 Other Products

- 5.2 Application

- 5.2.1 Automtoive and Transportation

- 5.2.2 Building and Construction

- 5.2.3 Metal Products

- 5.2.4 Electrical Machinery

- 5.2.5 Mechanical Engineering

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Acciai Speciali Terni S.p.A.

- 6.4.2 Acerinox

- 6.4.3 Aperam

- 6.4.4 ArcelorMittal

- 6.4.5 Baosteel Group

- 6.4.6 China Baowu Steel

- 6.4.7 JFE Steel Corporation

- 6.4.8 Jindal Stainless Limited

- 6.4.9 NIPPON STEEL CORPORATION

- 6.4.10 Outokumpu

- 6.4.11 POSCO

- 6.4.12 thyssenkrupp Stainless GmbH

- 6.4.13 TSINGSHAN HOLDING GROUP

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Industrial and Infrastructural Development in Asia-Pacific

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219