|

市場調查報告書

商品編碼

1440420

全球紙張和紙板包裝 - 市場佔有率分析、行業趨勢與統計、成長預測(2024 - 2029)Global Paper and Paperboard Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

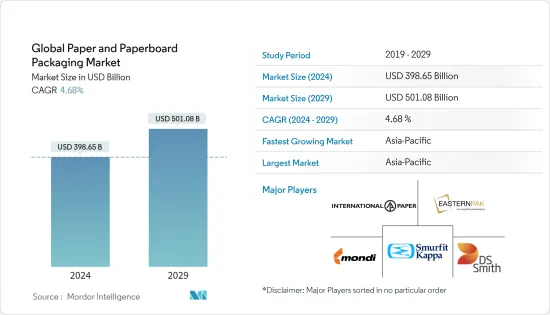

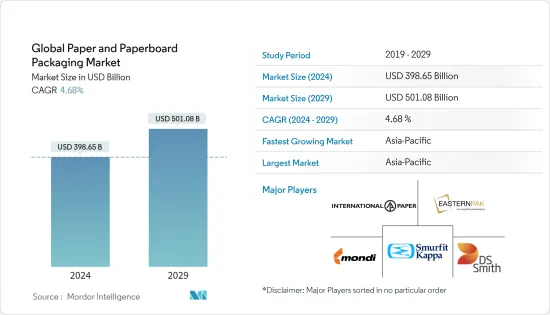

2024年,全球紙張和紙板包裝市場規模預計為3986.5億美元,預計到2029年將達到5,010.8億美元,在預測期內(2024-2029年)CAGR為4.68%。

紙板和折疊紙盒一樣,是製造容器最常用的材料。紙板必須經過製漿、可選的漂白、精煉、紙張成形、乾燥、壓光和捲繞等過程才能製造紙張。與金屬和塑膠等其他材料相比,紙包裝材料可以輕鬆重複使用和回收。

主要亮點

- 紙板包裝是包裝食品市場的首選。它存在於各種食物中,包括湯、調味品和乳製品。紙板通常覆蓋有聚合物或塑膠,以保持其清潔和不被損壞。與玻璃和金屬相比,它有助於減輕最終產品的總重量,同時保持食品的新鮮度。由於其氣味和味道中性,紙板是完美的包裝材料。

- 電子商務銷售的擴大和折疊紙盒包裝需求的上升是推動市場的兩大因素。然而,高性能替代品的出現可能會限制市場的成長。紙板包裝是最受歡迎的環保包裝選擇之一。與其他體積較大的包裝解決方案相比,這種包裝格式可以以較小的佔地面積創建各種尺寸,使其適用於幾乎所有最終用戶領域。

- 世界各地的消費者越來越意識到包裝對環境的危害,並正在將他們的購買習慣轉向更環保的選擇。消費者、政府和媒體向製造商施加壓力,要求其產品、包裝和工藝更加環保。人們願意為環保包裝付出更多的錢。因此,紙板包裝行業預計將由於這些趨勢而成長。

- 然而,儘管對紙包裝的需求增加,但不負責任的森林砍伐很快就會造成原料損失,嚴重影響紙板包裝產業。據憂思科學家聯盟稱,紙張等「木製品」約佔森林砍伐總量的 10%。其他主要來源包括牛、大豆和棕櫚油。

- COVID-19 大流行對包裝行業造成了嚴重破壞,全國範圍內的封鎖造成了影響,企業將採購從中國轉移出去,包裝中使用的材料也被重新考慮。儘管紙包裝的供應面受到了實質影響,但特定應用領域最終用戶需求的大幅成長顯著擴大了紙包裝的範圍。

紙和紙板包裝市場趨勢

食品和飲料行業的需求增加

- 食品和飲料製造商正在做出更大的努力,提供永續的材料和包裝、功能性和方便的展示以及更健康的食品選擇,以滿足消費者的需求。紙袋在餐廳、飯店、咖啡館和其他食品場所越來越受歡迎。同樣,外帶和線上送餐服務的日益普及也增加了食品服務中對紙袋的需求。

- 推動飲料趨勢的相同基本要素也會影響飲料包裝的趨勢,也就是消費者的偏好。由於永續發展、客製化和電子商務,消費者的期望發生了變化,這激發了包裝創新。

- 為了滿足消費者的需求,領先的國際食品和飲料企業制定了使所有包裝可回收或可生物分解的目標。例如,百加得表示打算透過發明新型紙質飲料瓶,在 2030 年消除塑膠,加入全球反對一次性塑膠的行動。這種對循環經濟概念的奉獻可以為造紙業帶來更大的進步。

- 此外,永續發展在食品和飲料行業中得到了重視,快速消費品解決了產品包裝產生的大量碳足跡。根據聯合國統計,塑膠垃圾已從 1950 年的 200 萬噸增加到 2017 年的 3.48 億噸,預計到 2040 年將增加一倍。

預計亞太地區將佔據重要佔有率

- 亞太地區是最大的折疊紙盒包裝市場之一,由於其巨大的潛在擴張,需求可能會擴大。這主要是由中國推動的,中國是折疊紙盒的主要買家,就像許多其他行業一樣。隨著經濟從製造業轉向服務業,中國的經濟成長率預計將放緩。

- 一些亞洲新興國家的市場需求預計將強勁,而東北亞等老市場的成長預計將緩慢。亞太地區主導全球折疊紙盒包裝產業。由於中國、印度和東南亞國家對即食食品的需求不斷成長,市場需求增加。

- 隨著人們關注的重點轉向環保和永續實踐,亞太地區多個行業的折疊紙盒需求不斷成長,包括食品和飲料、醫療保健、個人護理、家庭護理、零售等。消費者對永續包裝偏好、原料可用性、紙張的輕質、可生物分解和可回收特性以及森林砍伐的認知都促進了該地區對折疊紙盒包裝的需求。

- 由於印度和東南亞消費量的成長,對折疊紙盒包裝的需求可能會增加。少數重要參與者定義了市場。回收級包裝因其用於非接觸類別(例如早餐麥片和茶)而最受歡迎。

- 印度、中國、日本和韓國是亞太地區正在經歷工業化浪潮的主要國家,為瓦楞包裝產品製造商提供了大量機會。瓦楞紙箱廣泛應用於食品飲料、電子和電子商務等眾多行業。隨著人們越來越意識到生態和經濟高效的包裝選擇,這些盒子在該地區的需求不斷增加。

- 此外,受益於日益活躍的消費者基礎,中國的個人護理市場一直是過去幾年成長最快的行業之一,這也促進了所研究市場的成長。

紙和紙板包裝產業概述

全球紙板包裝市場相當分散。主要公司包括日本製紙工業公司、Mondi、METS BOARD、WestRock Company 和 ITC Limited。兩家公司不斷創新並建立策略夥伴關係,以維持其市場佔有率。

2022 年 12 月,Mondi 與 FRESH!PACKING 合作,打造了一款尖端的冷藏袋,供消費者運輸冷凍或冷藏食品。 Fresh!Bag 的外層完全由 Mondi 的堅固牛皮紙製成,將冷卻保護提高了 2.5 倍,取代了先前使用的多材料、不可回收的包裝。袋子的冷卻部分由紙漿製成。它採用 Mondi 牛皮紙封裝,該牛皮紙經過認證,可在歐洲當前的紙張廢物流中完全回收。由於紙張具有高拉伸性,將多層縫合在一起形成堅固的袋子結構變得簡單。

2022 年 9 月,Smurfit Kappa 透露,已同意收購位於裡約熱內盧以東 70 公里的 Saquarema 的包裝工廠 PaperBox。由於 Smurfit Kappa 已在米納斯吉拉斯、南里奧格蘭德州和塞阿拉開展業務,此次收購大大拓寬了 Smurfit Kappa 在巴西的營運基礎。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- 產業生態系統分析

- COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- 食品和飲料行業的需求不斷增加

- 塑膠包裝產品的法規促進了更高的需求

- 電子商務的不斷成長創造了對各種紙和紙板包裝類型的需求

- 市場課題

- 原料成本增加和外包

- 森林砍伐對紙和紙板包裝的影響

第 6 章:市場區隔

- 北美洲

- 依產品類型

- 折疊紙盒

- 瓦楞紙箱

- 其他產品類型

- 依最終用戶垂直領域

- 食物

- 飲料

- 衛生保健

- 個人護理

- 電力

- 其他最終用戶垂直領域

- 依國家/地區

- 美國

- 加拿大

- 依產品類型

- 歐洲

- 依產品類型

- 折疊紙盒

- 瓦楞紙箱

- 其他產品類型

- 依最終用戶垂直領域

- 食物

- 飲料

- 衛生保健

- 個人護理

- 電力

- 其他最終用戶垂直領域

- 依國家/地區

- 英國

- 德國

- 法國

- 義大利

- 波蘭

- 歐洲其他地區

- 依產品類型

- 亞太

- 依產品類型

- 折疊紙盒

- 瓦楞紙箱

- 其他產品類型

- 依最終用戶垂直領域

- 食物

- 飲料

- 衛生保健

- 個人護理

- 電力

- 其他最終用戶垂直領域

- 依國家/地區

- 中國

- 印度

- 韓國

- 日本

- 印尼

- 泰國

- 澳洲

- 亞太其他地區

- 依產品類型

- 中東和非洲

- 依產品類型

- 折疊紙盒

- 瓦楞紙箱

- 其他產品類型

- 依最終用戶垂直領域

- 食物

- 飲料

- 衛生保健

- 個人護理

- 電力

- 其他最終用戶垂直領域

- 依國家/地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 以色列

- 卡達

- 中東和非洲其他地區

- 依產品類型

- 拉丁美洲

- 依產品類型

- 折疊紙盒

- 瓦楞紙箱

- 其他產品類型

- 依最終用戶垂直領域

- 食物

- 飲料

- 衛生保健

- 個人護理

- 電力

- 其他最終用戶垂直領域

- 依國家/地區

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 拉丁美洲其他地區

- 依產品類型

第 7 章:貿易情勢

- 歷史進出口分析

- 主要進口國名單

- 主要出口國名單

- 重點

第 8 章:競爭格局

- 公司簡介

- International Paper Company

- Eastern Pak Limited

- Mondi Group

- Smurfit Kappa Group

- DS Smith PLC

- WestRock Company

- Packaging Corporation of America

- Cascades Inc.

- Nippon Paper Industries Ltd

- Sonoco Products Company

第 9 章:市場的未來前景

The Global Paper and Paperboard Packaging Market size is estimated at USD 398.65 billion in 2024, and is expected to reach USD 501.08 billion by 2029, growing at a CAGR of 4.68% during the forecast period (2024-2029).

Paperboard, like folding cartons, is the most common material used to make containers. The paperboard must undergo processes such as pulping, optional bleaching, refining, sheet forming, drying, calendaring, and winding to manufacture paper. Paper packaging materials can be easily reused and recycled compared to other materials, such as metals and plastics.

Key Highlights

- Paperboard packaging is the preferred option in the packaged food market. It can be found in various foods, including soups, seasonings, and dairy products. Paperboard is usually covered with polymers or plastics to keep it clean and unspoiled. Compared to glass and metal, it helps reduce the final product's total weight while maintaining the freshness of the food product. Due to its odor and taste neutrality, paperboard is the perfect packing material.

- The expansion of e-commerce sales and the rising demand for folded carton packaging are two major factors driving the market. However, the availability of high-performance substitutes is likely to restrain the growth of the market. Paperboard packaging is one of the most popular eco-friendly packaging options. Compared to other bulkier packaging solutions, this packaging format can be created in various sizes with a small footprint, making it suitable for use in almost all end-user sectors.

- Consumers worldwide are becoming more conscious of the environmental hazards of packaging and are moving their purchasing habits to more environment-friendly options. Consumers, the government, and the media put pressure on manufacturers to make their products, packaging, and processes more environment friendly. People are willing to pay more for environment-friendly packaging. Thus, the paperboard packaging industry is expected to grow due to these trends.

- However, despite an increase in demand for paper packaging, irresponsible deforestation will severely impact the paperboard packaging industry by causing a loss of raw materials soon. According to the Union of Concerned Scientists, "wood products," such as paper, account for around 10% of total deforestation. Other major contributors include cattle, soybeans, and palm oil.

- The COVID-19 pandemic wreaked havoc on the packaging sector, with the impacts of nationwide lockdowns, corporations shifting their sourcing away from China, and materials used in packaging being reconsidered. Although there has been a substantial impact on the supply side of paper packaging, large growth in end-user demand in specific applications has significantly expanded the scope of paper packaging.

Paper & Paperboard Packaging Market Trends

Increase in Demand from the Food and Beverage Sector

- Food and beverage manufacturers are making more significant efforts to provide sustainable materials and packaging, functional and convenient displays, and healthier food options to meet consumer demands. Paper bags are becoming increasingly popular in restaurants, hotels, cafes, and other food establishments. Similarly, the growing popularity of on-the-go meals and online food delivery services has increased the demand for paper bags in food service.

- The same essential element that drives trends in drinks also influences trends in beverage packaging, which is consumer preference. Consumer expectations have changed due to sustainability, customization, and e-commerce, which motivates package innovation.

- In response to consumer demand, leading international food and beverage businesses have set objectives to make all packaging recyclable or biodegradable. For instance, Bacardi stated its intention to eliminate plastic by 2030 by inventing new paper-based beverage bottles, joining the global push against single-use plastics. This dedication to circular economy concepts can result in greater advancements in the paper industry.

- Furthermore, sustainability has gained prominence in the food and beverage industry, with CPGs addressing the significant carbon footprint incurred by product packaging. According to the United Nations, plastic waste has increased from 2 million metric tons in 1950 to 348 million metric tons in 2017, which is expected to double by 2040.

Asia-Pacific is Expected to Hold Significant Share

- The Asia-Pacific region is one of the largest folding carton packaging markets, and the demand is likely to expand due to its significant potential expansion. This is mainly driven by China, a major buyer of folding cartons, as it is in many other industries. It is expected to slow in China as the economy shifts from manufacturing to services.

- The market's demand in some emerging Asian countries is expected to be strong, while growth in older markets, such as North-East Asia, is expected to be slow. The Asia-Pacific region dominates the global folding carton packaging industry. The demand for the market increases due to the rising demand for ready-to-eat meals in China, India, and Southeast Asian countries.

- As the focus is changing to eco-friendly and sustainable practices, folding carton demand has been growing across several industries in the Asia-Pacific, including food and beverage, healthcare, personal care, homecare, retail, and others. Consumer awareness of sustainable packaging preferences, raw material availability, the lightweight, biodegradable, and recyclable characteristics of paper, and deforestation have all contributed to the demand for folding carton packaging in the region.

- Demand for folding carton packaging is likely to rise due to rising consumption in India and Southeast Asia. A small number of significant participants define the market. Recycled-grade packaging is the most popular due to its use in non-contact categories, such as breakfast cereals and tea.

- India, China, Japan, and South Korea are major countries in the Asia-Pacific region experiencing a surge in industrialization, providing substantial opportunities for corrugated packaging product manufacturers. Corrugated boxes are used in numerous industries, such as food and beverage, electronics, and e-commerce. These boxes are witnessing increased demand in the region as people become more aware of ecological and cost-effective packaging options.

- Furthermore, the personal care market in China has been one of the fastest-growing sectors in the last few years, benefitting from an increasingly engaged consumer base, which is augmenting the growth of the market studied.

Paper & Paperboard Packaging Industry Overview

The global market for paperboard packaging is quite fragmented. Nippon Paper Industries Co. Ltd, Mondi, METS BOARD, WestRock Company, and ITC Limited are among the major companies. The corporations continue to innovate and form strategic partnerships to maintain their market share.

In December 2022, in collaboration with FRESH!PACKING, Mondi created a cutting-edge cooler bag for consumers to transport frozen or chilled foods. While boosting cooling protection by up to 2.5 times, the Fresh!Bag's exterior layer is entirely made of sturdy kraft paper from Mondi, replacing the multi-material, non-recyclable packaging that was previously utilized. The cooling portion of the bag is made from pulp. It is enclosed in kraft paper from Mondi, which is certified as completely recyclable in Europe's current paper waste streams. Due to the paper's high stretchability, stitching the many plies together to form a sturdy bag structure was made simple.

In September 2022, Smurfit Kappa disclosed that it had agreed to buy PaperBox, a packaging facility in Saquarema, 70 kilometers east of Rio de Janeiro. Since it already operates in Minas Gerais, Rio Grande do Sul, and Ceara, this acquisition considerably widened Smurfit Kappa's operational base in Brazil.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from the Food and Beverage Sector

- 5.1.2 Regulations on Plastic-based Packaging Products Contribute to Higher Demand

- 5.1.3 Increasing Growth of E-commerce Creates Demand for Various Paper and Paperboard Packaging Types

- 5.2 Market Challenges

- 5.2.1 Increasing Raw Material Costs and Outsourcing

- 5.2.2 Effects of Deforestation on Paper and Paperboard Packaging

6 MARKET SEGMENTATION

- 6.1 North America

- 6.1.1 By Product Type

- 6.1.1.1 Folding Cartons

- 6.1.1.2 Corrugated Boxes

- 6.1.1.3 Other Product Types

- 6.1.2 By End-user Vertical

- 6.1.2.1 Food

- 6.1.2.2 Beverage

- 6.1.2.3 Healthcare

- 6.1.2.4 Personal Care

- 6.1.2.5 Electrical

- 6.1.2.6 Other End-user Verticals

- 6.1.3 By Country

- 6.1.3.1 United States

- 6.1.3.2 Canada

- 6.1.1 By Product Type

- 6.2 Europe

- 6.2.1 By Product Type

- 6.2.1.1 Folding Cartons

- 6.2.1.2 Corrugated Boxes

- 6.2.1.3 Other Product Types

- 6.2.2 By End-user Vertical

- 6.2.2.1 Food

- 6.2.2.2 Beverage

- 6.2.2.3 Healthcare

- 6.2.2.4 Personal Care

- 6.2.2.5 Electrical

- 6.2.2.6 Other End-user Verticals

- 6.2.3 By Country

- 6.2.3.1 United Kingdom

- 6.2.3.2 Germany

- 6.2.3.3 France

- 6.2.3.4 Italy

- 6.2.3.5 Poland

- 6.2.3.6 Rest of Europe

- 6.2.1 By Product Type

- 6.3 Asia-Pacific

- 6.3.1 By Product Type

- 6.3.1.1 Folding Cartons

- 6.3.1.2 Corrugated Boxes

- 6.3.1.3 Other Product Types

- 6.3.2 By End-user Vertical

- 6.3.2.1 Food

- 6.3.2.2 Beverage

- 6.3.2.3 Healthcare

- 6.3.2.4 Personal Care

- 6.3.2.5 Electrical

- 6.3.2.6 Other End-user Verticals

- 6.3.3 By Country

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 South Korea

- 6.3.3.4 Japan

- 6.3.3.5 Indonesia

- 6.3.3.6 Thailand

- 6.3.3.7 Australia

- 6.3.3.8 Rest of Asia-Pacific

- 6.3.1 By Product Type

- 6.4 Middle East and Africa

- 6.4.1 By Product Type

- 6.4.1.1 Folding Cartons

- 6.4.1.2 Corrugated Boxes

- 6.4.1.3 Other Product Types

- 6.4.2 By End-user Vertical

- 6.4.2.1 Food

- 6.4.2.2 Beverage

- 6.4.2.3 Healthcare

- 6.4.2.4 Personal Care

- 6.4.2.5 Electrical

- 6.4.2.6 Other End-user Verticals

- 6.4.3 By Country

- 6.4.3.1 Saudi Arabia

- 6.4.3.2 United Arab Emirates

- 6.4.3.3 Egypt

- 6.4.3.4 Israel

- 6.4.3.5 Qatar

- 6.4.3.6 Rest of Middle East and Africa

- 6.4.1 By Product Type

- 6.5 Latin America

- 6.5.1 By Product Type

- 6.5.1.1 Folding Cartons

- 6.5.1.2 Corrugated Boxes

- 6.5.1.3 Other Product Types

- 6.5.2 By End-user Vertical

- 6.5.2.1 Food

- 6.5.2.2 Beverage

- 6.5.2.3 Healthcare

- 6.5.2.4 Personal Care

- 6.5.2.5 Electrical

- 6.5.2.6 Other End-user Verticals

- 6.5.3 By Country

- 6.5.3.1 Brazil

- 6.5.3.2 Mexico

- 6.5.3.3 Argentina

- 6.5.3.4 Colombia

- 6.5.3.5 Rest of Latin America

- 6.5.1 By Product Type

7 TRADE SCENARIO

- 7.1 Historical Import-Export Analysis

- 7.2 List of Major Importing Countries

- 7.3 List of Major Exporting Countries

- 7.4 Key Takeaways

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 International Paper Company

- 8.1.2 Eastern Pak Limited

- 8.1.3 Mondi Group

- 8.1.4 Smurfit Kappa Group

- 8.1.5 DS Smith PLC

- 8.1.6 WestRock Company

- 8.1.7 Packaging Corporation of America

- 8.1.8 Cascades Inc.

- 8.1.9 Nippon Paper Industries Ltd

- 8.1.10 Sonoco Products Company