|

市場調查報告書

商品編碼

1440364

全球微控制器 (MCU) - 市場佔有率分析、行業趨勢與統計、成長預測(2024 - 2029 年)Global Microcontroller (MCU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

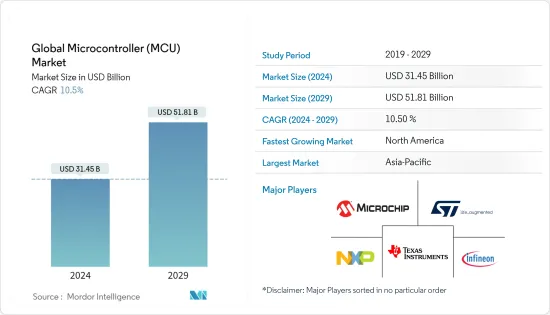

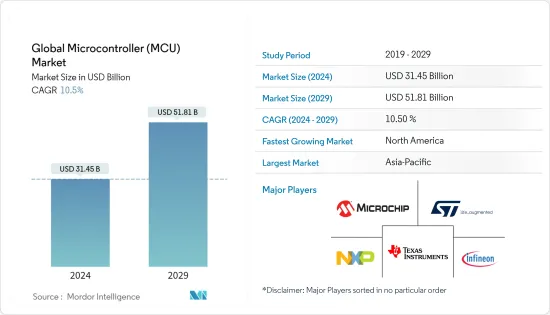

2024年全球微控制器市場規模預計為314.5億美元,預計到2029年將達到518.1億美元,在預測期內(2024-2029年)CAGR為10.5%。

在工業 4.0 和互聯技術的推動下,產業場景不斷發展。製造商不斷將新的遠端功能整合到他們的產品中,用於即時監控的供應鏈組件和微控制器有助於輕鬆地將緊湊型控制單元連接到系統。

主要亮點

- 微控制器是指控制多種週邊設備和嵌入式系統的緊湊計算單元,包括家用電器、機動車輛、機器人、工業設備和其他設備。該單元包括處理單元、輸入/輸出(I/O)連接埠、片上儲存、無線通訊模組和幾個其他整合模組,可引入這些模組來實現客製化功能。

- 擴大使用感測器來捕獲資料以監控各種製程元件,這是微控制器的基本驅動力之一。微控制器針對特定用途進行客製化,收集的資料經過處理並與流程鏈的其他方面共享。例如,公司期待整合雷達、LiDAR和鏡頭,以實現自動駕駛汽車和機器人的完整環境感知。這些感測器在專用於收集、處理和傳輸資料的微控制器的幫助下進行操作和連接。

- 此外,所需的傳輸速度和處理的資料量為屬於不同架構規模的不同類型的微控制器騰出了空間。根據應用的需要,市場主要使用 8 位元、16 位元和 32 位元微控制器。本公司遵循晶圓直徑 200 毫米等半導體製造標準,為業界提供客製化的即用型解決方案。

- COVID-19 大流行見證了在家工作電子設備的使用增加,這將半導體製造單位的重點轉移到生產更多設備。這使得人們的注意力從其他依賴微控制器和半導體晶片的重要產業(例如汽車和工業自動化)轉移。該行業正在迅速分配供應鏈資源,以重振受影響的行業。這個過程應該持續到 2022 年和 2023 年中期,見證全球微控制器的美好前景。

微控制器MCU市場趨勢

汽車應用推動 MCU 產業發展

- 在汽車行業引入新時代技術鼓勵了半導體和微控制器的參與。根據 IEEE Explore 的數據,汽車中平均使用超過 50 個微控制器單元 (MCU)。互聯技術、人工智慧、自動駕駛和其他物聯網服務的包含為 MCU 的部署創造了巨大的需求。

- MCU 可以根據架構的多功能性和功能根據任何要求進行配置。輸入/輸出 (I/O) 連接埠、微處理器、連接選項、技術平台、操作範圍、功耗和其他差異化因素增加了汽車中 MCU 的可自訂性和使用靈活性。每個 MCU 都有專門的用途。

- 隨著燃油價格飆升和氣候變化,汽車製造商正在電子控制單元 (ECU)(微控制器的形式)的幫助下,透過即時監控車輛的燃油效率來最佳化燃油消耗。 ECU 是現代車輛的中央控制單元,負責監控各種車輛功能,如加油、資訊娛樂、遠端功能、自動駕駛功能、停車輔助和電子駕駛輔助(如車道維持輔助、停車輔助功能等)。 , 和別的。因此,ECU 需要高度可靠和強大的硬體來運行相容的平台和軟體,以實現所需的關鍵功能。

- 自動駕駛車輛和感知器驅動的安全功能(例如自動煞車輔助、防撞系統等)是未來汽車的促進因素,其中包含 MCU。裝有與每個功能相關的感測器的 MCU 提供本地運算,然後進行臨時資料儲存並傳輸到主控制單元或遠端伺服器。

- 具有汽車感知器的 MCU 還需要更強大、更可靠的質量,以確保在各種環境限制下獲得準確的結果和操作。例如,2022 年 4 月,本田選擇瑞薩電子的 R-Car 和 RH850 用於 Honda SENSING 360 全方位安全和駕駛員輔助系統。 40 nm 製程 MCU 為先進汽車應用提供了良好的嵌入式安全性、低功耗和高可擴展性。

亞太地區將成為市場成長最快的地區

- 亞太地區已成為半導體製造和半導體設備的重要中心。該地區是一些最著名的電子和汽車製造公司的所在地。因此,該領域透過微控制器的各種應用(如汽車、工業自動化、製藥、消費性電子、機器人和其他最終用戶產業)做出了重大貢獻。

- 中國是最大的製造大國之一,在許多行業營運的製造單位數量方面佔據主導地位。隨著中美貿易戰的爆發,中國最近致力於推動國內微控制器製造。因此,本土廠商緊接著汽車電動化等大規模政策,對MCU產生較高需求,帶動國產MCU製造。

- 亞太地區由主要合約半導體製造商組成,例如台積電 (TSMC)。台積電生產的微控制器佔全球重要市場參與者(如恩智浦半導體、德州儀器、意法半導體等)銷售量的70% 以上。其他地區製造商包括富士康、聯發科、高通等,為該地區的成長做出了重大貢獻。

- 該地區的公司正在尋求不斷的創新和升級,以跟上全球微控制器的工業發展。例如,日本半導體製造商瑞薩電子宣布,到 2023 年,對製造能力的投資將增加 50% 以上。該公司將專注於生產更多高階微控制器以及汽車和電子產品的其他重要組件。瑞薩電子的目標是透過在晶片代工廠採購更多的外包生產線,每月生產 40,000 片 200 毫米晶圓。

微控制器MCU行業概況

由於產品的廣泛可用性,微控制器的廣泛應用加劇了主要市場參與者之間的激烈競爭。主要供應商都在產品不斷演變的過程中,採取不同的策略來佔領市場。玩家們期待與其他品牌進行策略合作並共同開發產品,以提出解決問題的解決方案。

- 2022 年 5 月 - NXP Semiconductors 的多協定 i。 MX RT 交叉微控制器具有用於網路的整合時間敏感開關,統一了工業物聯網通訊。恩智浦半導體宣布推出新的 i. MX RT1180 交叉微控制器。它是首款整合 Gb 時間敏感網路 (TSN) 交換機的微控制器,可實現工業即時和時間敏感通訊,支援多種通訊協定。它旨在彌合現有工業和工業 4.0 系統之間的差距。 i.MX RT1180 提供所需的連接,支援多種協定。為了實現這一目標,需要在工廠的所有邊緣建立統一且安全的工業物聯網通訊環境。

- 2022 年 4 月 - 國際半導體供應商意法半導體正在為電子應用產業的客戶提供服務。全球企業級無線連接解決方案一站式供應商 Seong Ji Industrial 宣布推出 SeongJi 的 LSM 模組系列,該系列採用 ST 的 STM32WL,適用於 sub-GHz LPWAN。該解決方案標誌著世界上第一個 Sigfox 和 LoRa 系統單晶片 (SoC)。 LSM100A、LSM110A 和 LSM200A 模組由 STM32WL 提供支持,兼具低功耗、小尺寸和成本效益,可最佳化 sub-GHz 無線連接,滿足廣泛的工業和消費應用需求。此模組支援 Sigfox 和 LoRa LPWAN 技術。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- 價值鏈分析

- Covid-19 對市場影響的評估

- 技術簡介

第 5 章:市場動態

- 市場促進因素

- 物聯網 (IoT) 的出現

- 提高各行業的數位化程度

- 市場課題/限制

- 供應鏈中斷

- 近年來微控制器的價格不斷下降

第 6 章:市場區隔

- 區隔 - 依產品

- 8位

- 16位

- 32位

- 區隔 -依應用

- 航太和國防

- 消費性電子及家用電器

- 汽車

- 工業的

- 衛生保健

- 數據處理和通訊

- 其他最終用戶產業

- 區隔 - 依地理位置

- 北美洲

- 歐洲

- 亞太

- 世界其他地區

第 7 章:競爭格局

- 公司簡介

- Cypress Semiconductor Corporation

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors

- Renesas Electronics Corporation

- STMicroelectronics

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

- Intel Corporation

- Zilog, Inc.

- Analog Devices, Inc.

- Broadcom Inc.

- ON Semiconductor

第 8 章:投資分析

第 9 章:市場的未來

The Global Microcontroller Market size is estimated at USD 31.45 billion in 2024, and is expected to reach USD 51.81 billion by 2029, growing at a CAGR of 10.5% during the forecast period (2024-2029).

The industry scenario is constantly evolving, driven by Industry 4.0 and connected tech. Manufacturers are continually integrating new remote features to their products, and supply chain components for real-time monitoring and microcontrollers facilitate the ease of attaching compact control units to the systems.

Key Highlights

- Microcontroller refers to compact computing units that control several peripherals and embedded systems, including home appliances, motor vehicles, robots, industrial equipment, and other devices. The unit comprises a processing unit, Input/Output (I/O) ports, on-chip storage, wireless communication modules, and several other integrative modules, which can be introduced for achieving the custom functionalities.

- The increase in the use of sensors for capturing data for monitoring various process elements is one of the fundamental driving forces for microcontrollers. The microcontroller is customized for specific usage, and the collected data is processed and shared with other aspects of the process chain. For instance, companies are looking forward to integrating RADAR, Lidar, and cameras to achieve a complete sense of the environment for autonomous vehicles and robots. These sensors are operated and interfaced with the help of microcontrollers dedicated to collecting, processing, and transferring data.

- Furthermore, the required transfer speed and the amount of data processed make room for different types of microcontrollers belonging to different architecture scales. The market majorly uses 8-bit, 16-bit, and 32-bit based microcontrollers depending upon the need of the application. Companies offer customized and ready-to-use solutions for industries, following the semiconductor manufacturing standards of wafer diameter like 200 mm.

- The COVID-19 pandemic witnessed an increment in the use of Work-from-Home electronics equipment, which shifted the focus of semiconductor manufacturing units to produce more equipment for the same. This turned the focus from other vital industries relying on microcontrollers and semiconductor chips, like automotive and industrial automation. The industry is rapidly distributing the supply chain allocation for reviving the affected industries. The process should follow through 2022 and mid-2023, witnessing promising prospects for microcontrollers globally.

Microcontroller MCU Market Trends

Automotive Applications to Drive the MCU Industry

- Introducing new-age technology in the automotive industry has encouraged the involvement of semiconductors and microcontrollers. According to IEEE Explore, an average of more than 50 Microcontroller Units (MCUs) are used in automobiles. The inclusions of connected tech, AI, autonomous driving, and other IoT services have created enormous demand for the deployment of MCUs.

- The MCUs can be configured per any requirement based on the architecture's versatility and functionality. The input/output (I/O) ports, microprocessor, connectivity options, technological platform, range of operation, power consumption, and other differentiating factors add to the customizability and flexibility of use for the MCUs in automobiles. Each MCU serves a dedicated purpose.

- In the wake of surging fuel prices and climate change, carmakers are optimizing fuel consumption by monitoring the fuel efficiency of vehicles in real-time with the help of Electronic Control Units (ECUs), which are forms of microcontrollers. An ECU is the central controlling unit in modern vehicles responsible for monitoring various vehicular functions like fueling, infotainment, remote functionality, autonomous driving functions, parking aids, and electronic driving aids (like lane-keep assist, park-assist features, etc.), and others. Hence, ECUs demand highly reliable and robust hardware to run compatible platforms and software to achieve the required crucial functions.

- Autonomous vehicles and sensor-driven safety features like automatic brake assist, collision avoidance systems, etc., are the driving factors in the future of automobiles, incorporating MCUs. The MCUs housing sensors related to each function offer local computing followed by temporary data storage and transfer to the master controlling units or remote servers.

- MCUs with automobile sensors also demand more robust and reliable quality promising accurate results and operation in various environmental constraints. For instance, in April 2022, Honda opted R-Car and RH850 by Renesas Electronics for use in the Honda SENSING 360 omnidirectional safety and driver assistance system. The 40 nm-process MCU provides good embedded security at low power consumption and high scalability for advanced automotive applications.

Asia Pacific to Exhibit the Fastest Growth in the Market

- The Asia Pacific has emerged as a significant hub for semiconductor manufacturing and semiconductor-based devices. The region is home to some of the most prominent electronics and automotive manufacturing companies. Hence, the area contributes significantly through various applications of microcontrollers like automotive, industrial automation, pharmaceutical, consumer electronics, robotics, and other end-user industries.

- China is one of the largest manufacturing giants dominating the region in the number of manufacturing units operational for many industries. With the US-China Trade war, China has been lately focussing on motivating domestic manufacturing of microcontrollers. Hence, local manufacturers are following large-scale policies of vehicle electrification and others, creating high demands for MCUs, and boosting domestic MCU manufacturing.

- APAC comprises chief contract-based semiconductor manufacturers like Taiwan Semiconductor Manufacturing Company (TSMC). TSMC accounts for manufacturing more than 70% of the global microcontrollers sold by significant market players, like NXP Semiconductors, Texas Instruments, STMicroelectronics, etc. Other regional manufacturers comprise Foxconn, MediaTek, Qualcomm, and others, contributing significantly to the region's growth.

- Companies in this region are looking at constant innovation and upgrades to keep up with global microcontrollers' industrial evolution. For instance, Japanese semiconductor manufacturer Renesas Electronics announced a higher investment in manufacturing capacity by more than 50% by 2023. The company will focus on producing more high-end microcontrollers and other vital components for cars and electronics. Renesas aims for 40,000 200mm wafers a month by procuring more lines for outsourced production at chip foundries.

Microcontroller MCU Industry Overview

With their wide-scale availability of offerings, the wide range of applications of microcontrollers contributes to intense rivalry among the key market players. The major providers are in the process of the constant evolution of products, following different strategies to capture the market. The players are looking forward to strategic collaboration with other brands and joint product developments for coming up with problem-solving solutions.

- May 2022 - NXP Semiconductors' Multi-Protocol i. MX RT crossover microcontroller, featuring an integrated time-sensitive switch for networking, unifies Industrial IoT Communication. NXP Semiconductors announced its new i. MX RT1180 crossover microcontroller. It is the first microcontroller with an integrated Gb time-sensitive networking (TSN) switch, allowing both industrial real-time and time-sensitive communications, supporting multiple communications protocols. It aims to bridge the gap between existing industrial and Industry 4.0 systems. The i.MX RT1180 provides the required connectivity, supporting multiple protocols. To accomplish this, driving a unified and safe industrial IoT communication environment at all edges of the plant.

- April 2022 - STMicroelectronics, an international semiconductor provider, is serving customers across the electronics applications industry. Seong Ji Industrial, a global one-stop supplier of enterprise-grade wireless connectivity solutions, announced the LSM module series from SeongJi powered by ST's STM32WL for sub-GHz LPWAN. The solution marks the world's first Sigfox and LoRa System-on-Chip (SoC). The LSM100A, LSM110A, and LSM200A modules, powered by STM32WL, combine low power consumption, small size, and cost efficiency to optimize sub-GHz wireless connectivity catering to a broad spectrum of industrial and consumer applications. The modules support both Sigfox and LoRa LPWAN technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Covid-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Internet of Things (IoT)

- 5.1.2 Increasing digitalization across industries

- 5.2 Market Challenges/Restraints

- 5.2.1 Disruptions in supply chain

- 5.2.2 Declining prices of microcontrollers in recent years

6 MARKET SEGMENTATION

- 6.1 Segmentation - By Product

- 6.1.1 8-bit

- 6.1.2 16-bit

- 6.1.3 32-bit

- 6.2 Segmentation - By Application

- 6.2.1 Aerospace and Defense

- 6.2.2 Consumer Electronics and Home Appliances

- 6.2.3 Automotive

- 6.2.4 Industrial

- 6.2.5 Healthcare

- 6.2.6 Data Processing and Communication

- 6.2.7 Other End-user Industries

- 6.3 Segmentation - By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cypress Semiconductor Corporation

- 7.1.2 Infineon Technologies AG

- 7.1.3 Microchip Technology Inc.

- 7.1.4 NXP Semiconductors

- 7.1.5 Renesas Electronics Corporation

- 7.1.6 STMicroelectronics

- 7.1.7 Texas Instruments Incorporated

- 7.1.8 Toshiba Electronic Devices & Storage Corporation

- 7.1.9 Intel Corporation

- 7.1.10 Zilog, Inc.

- 7.1.11 Analog Devices, Inc.

- 7.1.12 Broadcom Inc.

- 7.1.13 ON Semiconductor