|

市場調查報告書

商品編碼

1692101

電子簽章平台:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global E-Signature Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

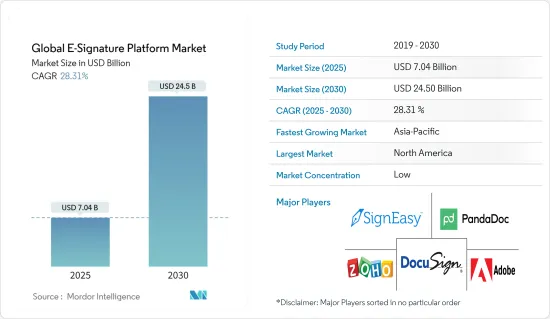

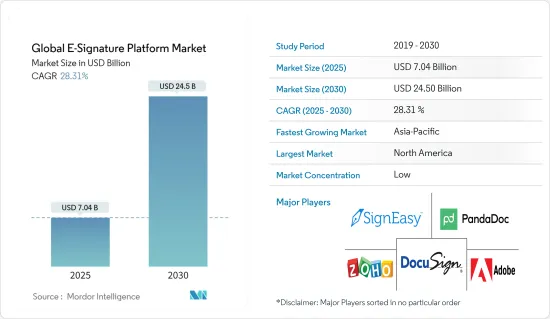

2025 年全球電子簽章平台市場規模預估為 70.4 億美元,預計到 2030 年將達到 245 億美元,預測期內(2025-2030 年)的複合年成長率為 28.31%。

在廣泛的數位轉型的推動下,各行業的企業都在迅速採用電子簽章平台。遠距辦公的興起,尤其是在疫情期間,促使企業更加重視數位工具,尤其是簡化文件簽名。因此,對安全、高效和遠端簽名解決方案的需求不斷成長,推動了對電子簽章平台的需求激增。

主要亮點

- 此外,越來越多的企業採用電子簽章取代傳統簽名,以減輕法律糾紛並提高證據的可靠性。隨著電子商務和網路銀行的快速發展,在傳輸敏感資訊時,資料安全已變得至關重要。公司知道,確保網路安全對於贏得客戶信任至關重要。這種緊迫性促使了電子簽章的迅速普及,電子簽名是電子文件真實性的最終印章。

- 雲端基礎的解決方案正在徹底改變電子簽章流程,使其更快、更易於使用且更經濟可行。電子簽章整合到雲端平台的普及度激增,主要是因為消除了繁瑣且容易出錯的實體文書工作。

- 全球連通性的增強使得公司能夠在全球範圍內外包業務。透過利用海外熟練、低成本的勞動力,公司可以降低開支並簡化業務。印度、中國、馬來西亞、印尼、越南、菲律賓和泰國等亞太國家躋身全球服務業位置指數(GSLI)前十名,該指數衡量一個國家對外包商業服務的吸引力。

- 近年來,網路犯罪已成為個人、組織和社會的重大威脅。網路和數位服務的普及使其成為犯罪分子的有利可圖的目標。例如,英國國家犯罪局報告稱,網路犯罪已經超過了所有形式的傳統犯罪。

電子簽章平台市場趨勢

BFSI 佔很大佔有率

- BFSI 產業是電子簽章平台最重要的使用者之一。這些平台對於處理合約和貸款協議、接納新客戶以及按照嚴格的監管標準安全有效地處理金融交易至關重要。

- 電子簽章簡化了文件處理和交易,使客戶和銀行家在貸款核准和開戶等方面受益。此外,自助服務和網路銀行入口網站的興起正在推動電子簽章平台的採用。這種自動化正在加速數位借貸、小額融資、小型企業貸款、黃金貸款、二輪車貸款等領域的交易,進一步推動市場成長。

- 全球各地的銀行、保險公司紛紛採用電子電子簽章等數位簽章方式,實現開戶、簽章數位化,加速企業及機構投資人的開戶速度,大幅降低成本及處理時間。電子簽章的好處包括顯著降低與開設銀行帳戶相關的整體營運成本和減少文書工作。

- 提案的技術將增強客戶關係並減少時間和精力。電子簽章使銀行和金融服務公司能夠完全在線上處理交易,使他們從行政和營運業務中解放出來。此外,它還用於新客戶的線上入職,有助於維持客戶滿意度。

- 保險公司和銀行正在採用電子簽章平台來支持數位化的成長,同時遵守符合法律和監管要求的資料安全通訊協定,這表明市場具有成長潛力。

- 例如,2024 年 6 月,塞浦路斯人壽和健康保險公司 Eurolife 與塞浦路斯產物保險Genix Insurance 合作,與 Printec 建立為期五年的策略夥伴關係關係。此次合作將使兩家保險公司都採用電子簽章。透過此次合作,Eurolife 和 Genix Insurance 將能夠利用 Printec 的服務滿足其電子識別和文件簽名需求,為其客戶提供增強的數位服務。

亞太地區強勁成長

- 中國已實施了自己的分級電子簽章法,這與採用寬鬆/最低限度或規定性電子簽章法規的其他國家有所不同。這種兩部分方法不僅可以識別數位簽章和電子簽章簽名,而且使虛擬簽名合法。

- 中國的法律體制與分級模式不同,承認合格的電子簽章為有效電子簽章。與其他司法管轄區不同,中國對電子簽章的類型沒有具體要求。根據中國法律,傳統簽名並不是合約真實性的先決條件。只要協議是由具有法律行為能力的個人達成的,無論是口頭的、電子的、還是手寫簽名的,合約都是有效的。 《電子簽章法》進一步規定,合約不能只因為是電子合約而解除。然而,根據中國法律,這些協議將面臨審查,並可能需要提供額外的證據以供法庭檢驗。

- 根據日本法律,基於證書的電子簽章在可接受性和可執行性方面與其他電子簽章處於同一水平。這種平價為市場供應商鋪平了道路。然而, 《電子簽章法》確實要求提供某些身分驗證服務,並強調了授權服務提供者和日本公開金鑰基礎建設的重要性。

- 為了增強服務品質並吸引更多客戶,日本的許多市場參與者擴大轉向策略併購和聯盟。例如,2024年1月,韓國辦公室套件軟體開發商Hancom Inc.宣布收購專門從事B2B數位文件創建的本地公司Clipsoft。此次收購的財務條款仍未披露。 Clipsoft 專門提供電子彙報和文件格式化解決方案。該公司的軟體套件以電子簽章系統為特色,服務於包括企業、醫院、大學和政府機構在內的廣泛客戶群。它主要服務國內市場。

電子簽章平台產業概況

競爭對手之間的競爭非常激烈,市場分散,定義為 DocuSign Inc.、Zoho Corporation Pvt. 等現有參與者之間的競爭。 Ltd、Adobe Inc.、SignEasy 和 PandaDoc Inc. 控制這股力量的關鍵因素是透過創新、市場滲透、競爭策略廣告支出和企業集中度來維持競爭優勢。

電子簽章市場正在經歷多個參與者(主要是國內和國際參與者)爭奪市場空間。技術進步也為企業提供了永續的競爭優勢。雲端等技術正在重塑市場趨勢。

大公司透過其研究、開發和整合活動對市場具有強大的影響力。該市場的特點是滲透率高且碎片化程度日益加深。

公司的品牌形象對市場有重大影響。老字型大小企業有望佔據優勢,因為強大的品牌意味著更好的解決方案。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

- 研究框架

- 二次調查

- 初步調查

- 資料三角測量與洞察生成

第 3 章執行摘要和主要發現

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估宏觀經濟因素對市場的影響

- 電子簽章類型(SES、AES、QES)和提供不同電子簽章的供應商

第5章 市場動態

- 市場促進因素

- 電子簽章的興起與雲端基礎服務的採用

- 遠距工作文化和海外合約的興起

- 市場挑戰/限制

- 更容易受到網路攻擊和詐騙

第6章 市場細分

- 按部署

- 本地

- 雲

- 按組織規模

- 中小型企業

- 大型企業

- 按最終用戶產業

- BFSI

- 政府和國防

- 衛生保健

- 石油和天然氣

- 資訊科技/通訊

- 物流與運輸

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 中國

- 日本

- 韓國

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- DocuSign Inc.

- Zoho Corporation Pvt. Ltd

- Adobe Inc.

- SignEasy

- PandaDoc Inc.

- Dropbox Inc.

- airSlate Inc.

- Yousign

- OneSpan Inc.

- ShareFile

第8章 市場投資

第9章:市場的未來

The Global E-Signature Platform Market size is estimated at USD 7.04 billion in 2025, and is expected to reach USD 24.50 billion by 2030, at a CAGR of 28.31% during the forecast period (2025-2030).

Businesses across diverse sectors rapidly embrace e-signature platforms, driven by a broader digital transformation. The rise of remote work, particularly during the pandemic, led companies to emphasize digital tools, notably streamlining document signing. As a result, the demand for e-signature platforms has surged, fueled by the growing demand for secure, efficient, and remote-friendly signing solutions.

Key Highlights

- In addition, enterprises increasingly adopt electronic signatures over traditional ones to mitigate legal disputes and bolster evidence authenticity. As e-commerce and online banking surged, data security became paramount in sensitive information transmission. Companies recognized that securing their networks was essential to instill customer confidence. This urgency catalyzed the swift adoption of electronic signatures, which serve as a definitive seal of authenticity on electronic documents.

- Cloud-based solutions are revolutionizing the e-signature process, rendering it quicker, user-friendly, and economically viable. The surge in popularity of integrating e-signatures into cloud platforms is evident primarily because it eliminates tedious and error-laden physical paperwork.

- With rising global connectivity, companies can now outsource work worldwide. By leveraging skilled, low-cost labor overseas, firms reduce expenses and streamline operations. Asia-Pacific nations, including India, China, Malaysia, Indonesia, Vietnam, the Philippines, and Thailand, are among the top 10 countries in the Global Services Location Index (GSLI) that measures a country's attractiveness for outsourcing business services.

- In recent years, cybercrimes have become a significant threat to individuals, organizations, and society. The global embrace of the internet and the surge of digital services have made them lucrative targets for criminals. For example, the National Crime Agency in the United Kingdom reported that cybercrimes have outpaced all forms of traditional crime.

E-Signature Platform Market Trends

BFSI Holds Major Share

- The BFSI sector is one of the most significant users of e-signature platforms. These platforms are crucial for processing contracts and loan agreements, onboarding new customers, and handling financial transactions securely and efficiently, complying with strict regulatory standards.

- Electronic signatures streamline document processing and transactions, benefiting customers and bankers in areas including loan approvals and account openings. Furthermore, the rise of self-service and online-assisted banking portals is leveraging E-signature platforms. This automation accelerates agreements in digital lending, microfinance, SME lending, gold loans, and two-wheeler loans, further propelling the growth of the market.

- Banks and insurance companies worldwide accelerated account openings for corporate and institutional clients by introducing a digital signature through E-signature, digitizing account openings, and document signings, significantly reducing costs and processing times. The advantages of E-signatures include a considerable percentage reduction in the overall operating costs associated with opening bank accounts and a reduction in the quantum of paper formalities.

- The suggested technology can enhance customer engagement, minimizing time and work efforts. E-signature allows banking and financial service firms to process paperwork entirely online and take their attention off paperwork and operational tasks, which helps identify new opportunities and serve clients better. Moreover, they are used for the online onboarding of new customers, which helps maintain customer satisfaction.

- Insurance companies and banks are implementing e-signature platforms to support their digitalization growth while following the data security protocols for legal and regulatory requirements, showing the growth potential of the market.

- For instance, in June 2024, Eurolife, a Cyprus-based life and health insurance provider, collaborated with Genikes Insurance, a player in the country's general insurance sector, to form a five-year strategic partnership with Printec. This collaboration would introduce electronic signatures to both insurance firms. With this initiative, Eurolife and Genikes Insurance would access services by Printec tailored for electronic identification and document signing requirements, ensuring their customers receive advanced digital services.

Asia Pacific to Register Major Growth

- China implements a unique tiered electronic signature law, setting it apart from other nations that adopt either permissive/minimalist or prescriptive electronic signature regulations. This two-tiered approach not only recognizes both digital and electronic signatures but also legitimizes virtual signatures.

- China's legal framework diverges from the tiered model, recognizing Qualified Electronic Signatures as valid E-signatures. Unlike other jurisdictions, China imposes no specific conditions on types of electronic signatures. According to Chinese PRC law, a traditional signature isn't a prerequisite for a contract's credibility. As long as legally competent individuals reach an agreement, be it verbally, electronically, or through a physical signature, the contract holds validity. The E-signature Law further asserts that contracts cannot be dismissed solely on the basis of being electronic. However, under Chinese law, these contracts face scrutiny and might require additional evidence for court validation.

- The Japanese law equates certificate-based digital signatures with other electronic signatures in terms of admissibility and enforceability. This equivalence opens up lucrative avenues for market vendors. However, the E-signature Act delineates specific authentication service mandates, underscoring the significance of authorized service providers and the Japanese public key infrastructure.

- In a bid to enhance their offerings and draw in more customers, numerous market players in the country are increasingly turning to strategic mergers, acquisitions, and partnerships. For instance, in January 2024, Hancom Inc., a South Korean developer of office suite software, announced its acquisition of Clipsoft, a local firm specializing in B2B digital document production. The financial terms of the deal remain undisclosed. Clipsoft specializes in electronic reporting and document formatting solutions. Its software suite, which features an E-signature system, caters to a diverse clientele, including corporations, hospitals, universities, and government entities. While primarily serving the domestic market.

E-Signature Platform Industry Overview

The intensity of competitive rivalry is high and fragmented in the market, defined as the competition prevailing among established players, such as DocuSign Inc. and Zoho Corporation Pvt. Ltd, Adobe Inc., SignEasy, PandaDoc Inc.. The significant factors governing this force are sustainable competitive advantage through innovation, market penetration levels, advertising expense power of competitive strategy, and firm concentration ratio.

The e-signature market primarily comprises multiple domestic and international players fighting for market space. Technological advancements also impart a sustainable competitive advantage to companies. Technologies, such as the cloud, are reshaping the market trends.

Major companies strongly influence the market through R&D and consolidation activities. The market is characterized by high levels of penetration and increasing levels of fragmentation.

The brand identity associated with the companies significantly influences the market. Strong brands are synonymous with better solutions, so long-standing players are expected to have the upper hand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Defination

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation And Insight Generation

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Assessment of Impact Of Macroeconomic Factors on the Market

- 4.4 Types of E-Signatures (SES, AES and QES) and Vendors Offering Different E-Signatures

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise In E-signatures And Adoption Of Cloud-based Services

- 5.1.2 Increase In Remote Work Culture And Overseas Contracts

- 5.2 Market Challenges/Restraints

- 5.2.1 Increasing Vulnerability Related To Cyber-attacks and Frauds

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprise

- 6.2.2 Large Enterprise

- 6.3 By End-User Industry

- 6.3.1 BFSI

- 6.3.2 Government and Defense

- 6.3.3 Healthcare

- 6.3.4 Oil and Gas

- 6.3.5 IT and Telecom

- 6.3.6 Logistics and Transportation

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 South Korea

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DocuSign Inc.

- 7.1.2 Zoho Corporation Pvt. Ltd

- 7.1.3 Adobe Inc.

- 7.1.4 SignEasy

- 7.1.5 PandaDoc Inc.

- 7.1.6 7.1.6 Dropbox Inc.

- 7.1.7 airSlate Inc.

- 7.1.8 Yousign

- 7.1.9 OneSpan Inc.

- 7.1.10 ShareFile