|

市場調查報告書

商品編碼

1440329

磷酸鹽 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Phosphonate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

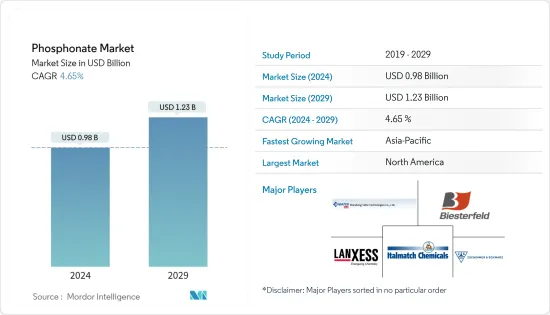

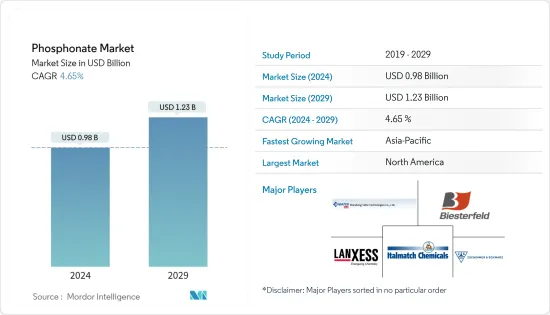

2024年磷酸鹽市場規模預計為9.8億美元,預計到2029年將達到12.3億美元,在預測期內(2024-2029年)CAGR為4.65%。

COVID-19 大流行對市場產生了負面影響,嚴重影響了國際貿易,並阻礙了製造業、建築業等多個行業。然而,目前估計市場已達到疫情前的水準。

主要亮點

- 膦酸鹽在水處理行業的廣泛應用以及清潔劑和洗滌劑行業的快速成長是推動所研究市場需求的主要因素。

- 另一方面,由於其不可分解的性質而造成的環境影響預計將阻礙市場的成長。

- 膦酸鹽在前藥和奈米多孔膦酸鹽中的新興應用預計將為所研究的市場提供新的機會。

- 預計亞太地區將主導全球市場,其中大部分需求來自中國和印度。

膦酸鹽市場趨勢

水處理產業需求不斷成長

- 化學水處理是利用化學物質消除和防止結垢、減少腐蝕、殺菌和藻類、淨化水的化學技術。水處理化學品主要分為三種:絮凝劑、殺菌劑和阻垢劑。

- HEDP膦酸鹽通常用作各種工業水處理過程中的化學添加劑; HEDP是一種阻垢劑,可以防止水垢和污垢。

- 與其他阻垢劑相比,HEDP具有許多優點:優異的耐污性、低污染、良好的溶解性、良好的協同作用。

- 近年來,工業部門對水的需求不斷增加,以及政府為防止水污染和控制行動計畫而製定的法規不斷變化,增加了對水處理的需求。

- 隨著水資源短缺和資源減少,全球對水處理的需求不斷增加,這將為預測期內的膦酸鹽提供龐大的市場。

亞太地區將主導全球市場

- 亞太地區主導全球市場。隨著中國、印度和日本等國用水量的增加,該地區膦酸鹽的消耗量也增加。

- 由於洗滌劑和清潔劑、水處理、油田化學品、化妝品、建築材料等行業的產品需求不斷增加,預計中國膦酸鹽市場將成長。

- 瓷磚和木地板在中國很常見,因此隨著新冠病毒相關衛生意識的提高,高品質的地板清潔產品成為必要。預計這種趨勢將增加該國對洗滌劑和清潔劑的需求。

- 印度是全球最大的洗滌劑生產國和供應商之一。此外,印度對織物洗滌劑的需求主要受到洗衣機普及率不斷上升的推動。這又增加了印度市場的需求。

膦酸鹽產業概況

全球膦酸鹽市場本質上是分散的,沒有一家公司能夠佔據所研究市場的重要佔有率。市場主要製造商(排名不分先後)包括Italmatch AW、Shandong Taihe Water Treatment Technologies、Biesterfeld AG、LANXESS、Zschimmer & Schwarz Mohsdorf GmbH & Co. KG 等。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 促進要素

- 膦酸鹽在水處理產業的廣泛應用

- 清潔劑和洗滌劑行業的快速成長

- 限制

- 不可分解性對環境的影響

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章 市場細分

- 類型

- ATMP

- HEDP

- DTPMP

- 其他類型

- 最終用戶產業

- 洗滌劑和清潔劑

- 水處理

- 油田化學品

- 化妝品

- 建築材料

- 其他最終用戶產業

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第6章 競爭格局

- 併購、合資、合作與協議

- 市佔率(%)**/排名分析

- 領先企業採取的策略

- 公司簡介

- Aquapharm Chemical Pvt Ltd

- Biesterfeld AG

- Changzhou Kewei Fine Chemicals Co. Ltd

- Excel Industries

- Henan Qingshuiyuan Technolog

- Italmatch AWS

- IRO Group

- Jiangsu Yuanquan Hongguang Environmental

- LANXESS

- MKS DevO Chemicals

- Bozzetto Group

- Protection Technology Co. Ltd

- Shandong Taihe Watre Treatment Technologies Co. Ltd

- Shandong Xintai Water Treatment Technology Co. Ltd

- Zaozhuang Kerui Chemicals Co. Ltd

- ZSCHIMMER & SCHWARZ CHEMIE GMBH

- Uniphos Chemicals

第7章 市場機會與未來趨勢

- 膦酸鹽在前藥和奈米多孔膦酸鹽中的新興應用

The Phosphonate Market size is estimated at USD 0.98 billion in 2024, and is expected to reach USD 1.23 billion by 2029, growing at a CAGR of 4.65% during the forecast period (2024-2029).

The COVID-19 pandemic impacted the market negatively, severely affected international trade, and hampered several industries, including manufacturing, building, and construction. However, the market has now been estimated to have reached pre-pandemic levels.

Key Highlights

- Wide applications of phosphonates in the water treatment industry and rapid growth of the cleaners and detergents industry are the major factors driving the demand for the market studied.

- On the flip side, environmental impact due to its non-degradable nature is expected to hinder the market's growth.

- Emerging applications of phosphonates in pro-drugs and nano-porous phosphonates are expected to provide new opportunities for the market studied.

- Asia-Pacific region is expected to dominate the market across the world, with the majority of demand coming from China and India.

Phosphonate Market Trends

Increasing Demand in the Water Treatment Industry

- Chemical water treatment is a chemical technique that uses chemicals to eliminate and prevent scaling, reduce corrosion, kill bacteria and algae, and purify water. There are three main types of water treatment chemicals: flocculants, biocides, and scale inhibitors.

- HEDP phosphonate is commonly used as a chemical additive in various industrial water treatment processes; HEDP is one type of scale inhibitor that can prevent scale and dirt.

- Compared to other scale inhibitors, HEDP has many advantages: it provides excellent dirt resistance, low pollution, good dissolution, and good synergy.

- Increasing water requirements from the industrial sector and changing government regulations to prevent water pollution and control action plans have increased the demand for water treatment in recent years.

- With rising water scarcity and fewer resources, the demand for water treatment is increasing globally, which will provide a huge market for phosphonates in the forecast period.

Asia-Pacific to Dominate the Global Market

- Asia-Pacific dominates the global market. With the increase in water usage in countries such as China, India, and Japan, the consumption of phosphonate is increasing in the region.

- The phosphonate market is anticipated to witness growth in China owing to the increasing product demand in industries such as detergent and cleaning agents, water treatment, oil field chemicals, cosmetics, building materials, and others.

- Tiles and wood floorings are common in China, thus necessitating high-quality floor cleaner products in the wake of rising COVID-related hygiene awareness. Such trends are projected to boost the demand for detergent and cleaning agents in the country.

- India is one of the largest producers and suppliers of detergent globally. In addition, the demand for fabric detergents in India is mainly driven by the rising penetration of washing machines. This, in turn, has been increasing the demand for the market in India.

Phosphonate Industry Overview

The global phosphonate market is fragmented in nature, with no player capturing a significant share of the market studied. The major manufacturers (not in any particular order) of the market include Italmatch AW, Shandong Taihe Water Treatment Technologies Co., Ltd., Biesterfeld AG, LANXESS, and Zschimmer & Schwarz Mohsdorf GmbH & Co. KG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Wide Applications of Phosphonates in the Water Treatment Industry

- 4.1.2 Rapid Growth of the Cleaners and Detergents Industry

- 4.2 Restraints

- 4.2.1 Environmental impact due to non-degradable nature

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Types

- 5.1.1 ATMP

- 5.1.2 HEDP

- 5.1.3 DTPMP

- 5.1.4 Other Types

- 5.2 End-user Industry

- 5.2.1 Detergent and Cleaning Agent

- 5.2.2 Water Treatment

- 5.2.3 Oil field chemicals

- 5.2.4 Cosmetics

- 5.2.5 Building Materials

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aquapharm Chemical Pvt Ltd

- 6.4.2 Biesterfeld AG

- 6.4.3 Changzhou Kewei Fine Chemicals Co. Ltd

- 6.4.4 Excel Industries

- 6.4.5 Henan Qingshuiyuan Technolog

- 6.4.6 Italmatch AWS

- 6.4.7 IRO Group

- 6.4.8 Jiangsu Yuanquan Hongguang Environmental

- 6.4.9 LANXESS

- 6.4.10 MKS DevO Chemicals

- 6.4.11 Bozzetto Group

- 6.4.12 Protection Technology Co. Ltd

- 6.4.13 Shandong Taihe Watre Treatment Technologies Co. Ltd

- 6.4.14 Shandong Xintai Water Treatment Technology Co. Ltd

- 6.4.15 Zaozhuang Kerui Chemicals Co. Ltd

- 6.4.16 ZSCHIMMER & SCHWARZ CHEMIE GMBH

- 6.4.17 Uniphos Chemicals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications of Phosphonates in Pro-drugs and Nano-porous Phosphonates