|

市場調查報告書

商品編碼

1440276

電動汽車電池管理系統:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Electric Vehicle Battery Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

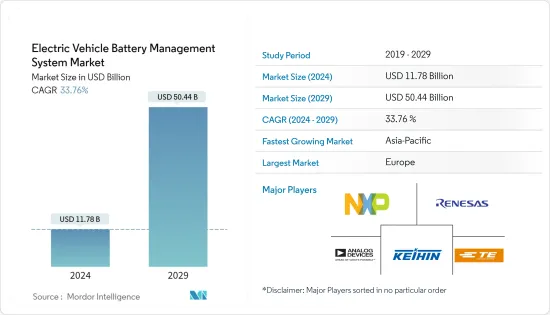

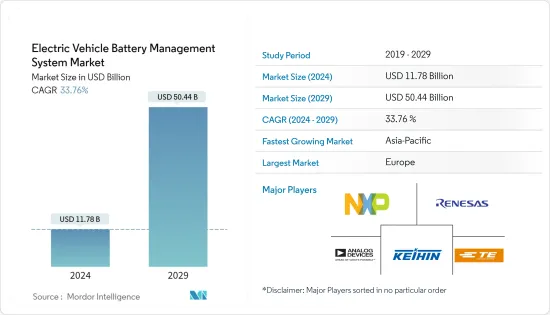

電動車電池管理系統市場規模預計到2024年為117.8億美元,在預測期內(2024-2029年)預計到2029年將達到504.4億美元,年複合成長率為33.76%。

儘管新型冠狀病毒肺炎 (COVID-19)感染疾病對全球汽車產業造成負面影響,但 2020 年全球電動車銷量仍錄得大幅成長。這主要是由於政府補貼、電動車充電基礎設施的擴張以及燃油價格上漲。 2021 年將出現同樣的成長趨勢,並且在預測期內可能會持續下去。疫情擾亂了全球供應鏈,導致 BMS 組件和系統的生產和交付出現延誤和短缺。另一方面,疫情也加速了電動車的普及,增加了BMS技術的需求。總體而言,疫情對 BMS 產業的長期影響可能是正面的。

從中期來看,對永續交通和清潔能源不斷成長的需求將推動對電池式電動車的需求。諸如車輛範圍、高昂的預付價格、有限的車型可用性和缺乏知識等消費者限制正在透過促銷活動和政府立法得到解決。這些變數將影響電動車的需求並推動電池管理系統市場。

由於電動車的普及,全球對電池管理系統 (BMS) 的需求預計將快速成長。然而,由於快速的工業化和都市化以及中國和印度等國家對電動車的需求不斷成長,預計亞太地區將引領BMS市場。北美和歐洲等其他地區的 BMS 市場預計也將顯著成長。

電動車日益成長的需求將導致電池化學和材料的技術進步,需要更先進、更有效率的BMS來確保電池的安全和性能。

電動車電池管理系統市場趨勢

電池電動車領域預計將主導市場

世界各國政府一直在積極制定政策鼓勵採用電動車。中國、印度、法國和英國已宣布計劃在 2040 年完全淘汰汽油和柴油汽車。隨著電動車需求的增加,對電池管理系統的需求也將逐漸增加。

電動車在世界各地逐漸發展,貨運公司將其現有車隊轉換為電力推進車輛。OEM正在重新定義電動車藍圖。這對目標市場的成長產生正面影響。例如,

- Lordstown Motors 是一家專注於為商用車隊市場製造電動輕型皮卡的公司,宣布其 Endurance 全尺寸 BEV 皮卡將於 2022 年 12 月在 CES Mobility 西廳 5274 號展位展出。和諧 (MIH)聯盟。

- 2022 年 12 月,洛杉磯世界機場 (LAWA) 宣布首款大型電動車 Nikolatore 抵達。這是機場向全電動機過渡的重要一步。

電動車的成長趨勢預計也將推動未來市場的成長。比亞迪、Proterra、塔塔和沃爾沃等知名公司正在努力將其產品在全部區域本地化,以減少對其他公司和進口的依賴。例如,

- 2022 年 12 月,馬來西亞沃爾沃汽車 (VCM) 推出了 C40 Recharge,這是該公司繼 XC40 Recharge 純電動車之後的第二款純電動車型。作為沃爾沃莎阿南工廠生產的本地組裝(CKD)車型,C40 也將受益於政府的 CKD EV 激勵措施,直至 2025 年 12 月 31 日。

- 2022年12月,豐田馬達歐洲公司(TMEs)推出了豐田bZ緊湊型SUV概念車,這是一款由法國豐田歐洲設計與開發公司(ED2)在歐洲設計的全電池電動車。

監管機構制定了嚴格的法規來減少燃油排放和改善道路安全。此外,消費者對碳排放和能源永續交通的趨勢為預測期內滲透目標市場提供了潛在機會。

預計歐洲將佔據很大的市場佔有率

關於電力推廣計劃,德國目前正在實施一項策略,以滿足更嚴格的排放標準。聯邦政府的氣候保護計畫旨在主要透過交通創新(重點是電動交通)來實現 2030 年氣候目標。為了推廣清潔汽車,各國推出了購買補貼、所有權稅和公司汽車稅等激勵措施和投資。

減輕重量是電動車和電器設計的首要任務。很少有公司設計整合兩個或多個組件以減輕重量的緊湊模組。例如,

海拉於 2021 年 4 月發布了 PowerPack 48 Volt。它將電力電子和電池管理整合到一款產品中,每行駛一公里可減少 5-6 克二氧化碳排放。該解決方案是海拉與中國電池製造商合作開發的,並計劃於 2024 年在上海投入量產。

各國政府也正在實施更多支持性政策,包括基礎設施投資、鼓勵普及最新低排放和零排放氣體汽車的一系列措施,以及幫助增加電動車市場佔有率的長期購買激勵措施。支持產業發展。因此,電動車電池管理系統的市場前景預計在預測期內將會增強。

- 2023 年 1 月,中國汽車製造商比亞迪本季開始在英國銷售汽車,電動車在英國的市場佔有率正在擴大。該公司在沃倫·巴菲特旗下的伯克希爾·哈撒韋公司的支持下,宣布任命四家英國經銷商合作夥伴:Pendragon、Arnold Clark、Lookers 和 LSH。比亞迪的首款車型將是 Atto 3 SUV,更多經銷商合作夥伴和定價將於 2019 年公佈。在接下來的幾週內。

- 2021年6月,義法半導體宣布與Arrival建立合作夥伴關係,為Arrival的車輛提供半導體技術和產品,包括汽車微控制器以及電源和電池管理設備。 Arrival 選擇 ST 作為其主要合作夥伴之一,將連網型電動車推向市場。 Arrival為其模組化ECU平台選擇了ST的安全汽車微控制器,以及智慧電源和電池管理設備等其他ST技術。

該公司正在開發具有電池管理系統的新型電池模組,以減輕車輛重量。例如,

2021年6月,Leclanch SA宣布開發出新一代鋰離子電池模組,名為M3。它配備了功能安全的從電池管理系統 (BMS) 單元,可與功能安全的主電池管理系統單元通訊。

考慮到這些因素,預計在預測期內,電動車電池管理系統的需求將保持在積極的一面。

電動汽車電池管理系統產業概況

電動車電池管理系統市場由瑞薩電子公司、恩智浦半導體公司、Keihin公司、TE Connectivity 和 Analog Devices 公司等幾家主要企業主導。此外,這個市場往往對新進入者非常有吸引力,並且在該市場營運的公司都專注於實施先進技術以獲得競爭優勢。例如,

- 2022年5月,博格華納宣布與一家未公開姓名的國際汽車製造商簽署了供應電池管理系統(BMS)的合約。從 2023 年中開始的車型將率先採用新的博格華納 BMS 技術,可提高電池組性能、安全性和使用壽命。

- 2022 年 1 月,飛雅特動力科技宣布推出兩款電動車橋和電池組,並配備根據客戶需求量身訂製的電池管理系統。展出了專為 Nikolatore 設計的整合式電子車橋。適用於 44 噸以下 GVW 車輛的雙馬達車橋確保了高性能和高效率,每個馬達的最大功率為 420 kW,最大扭力為 900 Nm。

- 2021 年10 月,巴拉德動力系統和Forsea Power 宣佈建立策略合作夥伴關係,共同開發完全整合的燃料電池和電池解決方案,為重型氫行動應用提供最佳化的性能、成本和安裝。宣布雙方簽署了一份合作備忘錄(MOU) )。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間敵對的強度

第5章市場區隔(金額、市場規模)

- 按成分

- 積體電路

- 截止 FET 和 FET 推動因素

- 溫度感應器

- 電量計/電流測量裝置

- 微控制器

- 其他組件

- 依推進類型

- 電池電動車

- 混合車

- 按車型

- 小客車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Infineon Technologies AG

- Silicon Laboratories

- NXP Semiconductors

- Vitesco Technologies

- TE Connectivity

- Renesas Electronics Corporation

- Keihin Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

- Visteon Corporation

第7章市場機會與未來趨勢

The Electric Vehicle Battery Management System Market size is estimated at USD 11.78 billion in 2024, and is expected to reach USD 50.44 billion by 2029, growing at a CAGR of 33.76% during the forecast period (2024-2029).

Despite the negative COVID-19 impact on the global automotive industry, electric vehicle sales for the year 2020 witnessed significant growth worldwide. This was primarily attributed to government subsidies, expanding electric vehicle charging infrastructure, and a rise in fuel prices. The same growth trend was witnessed for 2021 and will likely continue during the forecast period. The pandemic has disrupted global supply chains, causing delays and shortages in the production and delivery of BMS components and systems. On the other hand, the pandemic has also accelerated the adoption of electric vehicles, which has driven the demand for BMS technology. Overall, the long-term impact of the pandemic on the BMS industry is likely to be positive.

Over the medium term, rising demand for sustainable transportation and cleaner energy has engaged the demand for battery electric vehicles. Consumer constraints such as vehicle range, greater upfront prices, limited model availability, and lack of knowledge are being solved by promotional activities and government legislation. These variables will have an impact on the demand for electric vehicles, which will drive the battery management system market.

The demand for battery management systems (BMS) is expected to grow rapidly across the globe, driven by the increasing adoption of electric vehicles. However, Asia Pacific is expected to lead the market for BMS due to the rapid industrialization and urbanization in the region, as well as the increasing demand for electric vehicles in countries such as China and India. Other regions, such as North America and Europe, are also expected to experience significant growth in the BMS market.

The growing demand for electric vehicles will lead to technological advancements in battery chemistry and materials, which will require more sophisticated and efficient BMS to ensure the safety and performance of batteries.

Battery Management System for Electric Vehicle Market Trends

Battery Electric Vehicle Segment Anticipated to Dominate the Market

Governments around the world have been proactive in enacting policies to encourage the adoption of electric vehicles. China, India, France, and the United Kingdom have announced plans to phase out petrol and diesel vehicles before 2040 completely. As the demand for EVs increases, the demand for battery management systems will also increase gradually.

Electric mobility is gradually growing around the world, owing to which the goods transportation companies are also converting their existing fleets into electric propulsion-based vehicles. OEM is redefining its roadmap for electric vehicles. This will positively impact the target market growth. For instance,

- In December 2022, Lordstown Motors Corp., which focuses on building electric light-duty pickup trucks for the commercial fleet market, announced that the Endurance full-size BEV pickup truck will be on display at CES in the West Hall Booth 5274 of the Mobility in Harmony (MIH) Consortium.

- In December 2022, Los Angeles World Airports (LAWA) announced the arrival of its first Nikola Tre heavy-duty battery-electric vehicle, a significant step forward in the airport's transition to a fully electric fleet.

The increase in the trend of electric vehicles is also expected to drive market growth in the future. Prominent companies such as BYD, Proterra, Tata, Volvo, and others are trying to localize their products across the regions they operate to reduce the dependence on other players and imports. For instance,

- In December 2022, Volvo Car Malaysia (VCM) unveiled the C40 Recharge, the company's second BEV model after the XC40 Recharge Pure Electric. The C40, as a locally assembled (CKD) model from Volvo's Shah Alam plant, will also benefit from the government's CKD EV incentives until December 31, 2025.

- In December 2022, Toyota Motor Europe (TMEs unveiled the Toyota bZ Compact SUV Concept, a full-battery-electric vehicle designed in Europe by Toyota European Design and Development (ED2) in France.

Regulatory bodies have laid down stringent regulations about bringing down fuel emissions and increasing road safety. Furthermore, Consumer inclination toward carbon emission and energy-sustainable transportation will provide potential opportunities for target market penetration over the forecast period.

Europe Expected to Hold Significant Share in the Market

In terms of pro-electric plans, Germany is now implementing strategies to meet stricter emission standards. The federal government's climate protection program, which aims to meet its 2030 climate targets primarily through transportation innovation, places a premium on electric mobility. To promote clean cars, the country is introducing incentives and investments such as a purchase grant, ownership tax, and company car tax.

Weight reduction is a top priority in the design of electric vehicles and products. Few companies are designing compact modules integrating two or more components to save weight. For example,

Hella's introduced the PowerPack 48 Volt in April 2021, which combines power electronics and battery management in one product and saves 5 to 6 grams of CO2 per kilometer driven. This solution, which HELLA is developing in collaboration with a Chinese cell manufacturer, is set to enter series production in Shanghai in 2024.

The government is also aiding the industry growth with more supportive policies: investment in infrastructure; broader measures to encourage uptake of the latest, low and zero-emission cars; and long-term purchase incentives to help the country grow its share in the EV market. This is expected to bolster the market prospects for battery management systems for EVs during the forecast period.

- In January 2023, BYD, a Chinese automaker, began selling vehicles in the United Kingdom this quarter, where electric vehicles are gaining market share. According to the automaker, backed by Warren Buffett's Berkshire Hathaway, it has appointed four UK dealer partners in Pendragon, Arnold Clark, Lookers, and LSH.BYD's first model will be the Atto 3 SUV, and more dealer partners and pricing will be announced in the coming weeks.

- In June 2021, STMicroelectronics announced its collaboration with Arrival to provide semiconductor technologies and products for Arrival's vehicles, including automotive microcontrollers and power and battery-management devices. Arrival has chosen ST as one of its key partners in bringing its connected Evs to market. Arrival has selected ST's secure automotive microcontrollers for their modular ECU platform, as well as other ST technologies, including smart-power and battery-management devices.

Although companies are developing new battery modules with a battery management system to reduce the weight of the vehicles. For instance,

In June 2021, Leclanche SA announced that it had developed a new generation of lithium-ion battery modules called M3; it is fitted with a functionally safe slave battery management system (BMS) unit which communicates with a functionally safe master battery management system unit.

Considering these factors demand for Electric Vehicle Battery Management Systems is anticipated to remain on the positive side of the graph during the forecast period.

Battery Management System for Electric Vehicle Industry Overview

The Electric Vehicle Battery Management System Market is dominated by several key players such as Renesas Electronics Corporation, NXP Semiconductors, Keihin Corporation, TE Connectivity, Analog Devices Inc., and others. Moreover, the market tends to be highly attractive for new players, and companies operating in the market have been focusing on launching advanced technologies to gain a competitive advantage. For instance,

- In May 2022, BorgWarner Inc. announced that the company had got a deal from an undisclosed international vehicle manufacturer to supply its Battery Management System (BMS). Model years beginning in the middle of 2023 will be the first to come with the new BorgWarner BMS technology, which improves the performance, security, and lifespan of battery packs.

- In January 2022, FPT Industrial announced presenting two e-axles and a battery pack with a Battery Management System customized to meet customer needs. It displayed an integrated e-Axle designed for the Nikola Tre. A dual-electric motor axle for GVW vehicles up to 44 tons guarantees high performance and efficiency with a maximum power of 420 kW and a maximum torque of 900 Nm for each motor.

- In October 2021, Ballard Power Systems and Forsee Power announced signing a memorandum of understanding (MOU) for a strategic partnership to develop fully integrated fuel cell and battery solutions optimized for performance, cost, and installation for heavy-duty hydrogen mobility applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Million)

- 5.1 By Components

- 5.1.1 Integrated Circuits

- 5.1.2 Cutoff FETs and FET Driver

- 5.1.3 Temperature Sensor

- 5.1.4 Fuel Gauge/Current Measurement Devices

- 5.1.5 Microcontroller

- 5.1.6 Other Components

- 5.2 By Propulsion Type

- 5.2.1 Battery Electric Vehicles

- 5.2.2 Hybrid Electric Vehicles

- 5.3 By Vehicle Type

- 5.3.1 Passenger Car

- 5.3.2 Commercial Vehicles

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Infineon Technologies AG

- 6.2.2 Silicon Laboratories

- 6.2.3 NXP Semiconductors

- 6.2.4 Vitesco Technologies

- 6.2.5 TE Connectivity

- 6.2.6 Renesas Electronics Corporation

- 6.2.7 Keihin Corporation

- 6.2.8 Texas Instruments Incorporated

- 6.2.9 Analog Devices Inc.

- 6.2.10 Visteon Corporation