|

市場調查報告書

商品編碼

1440241

見解引擎 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Insight Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

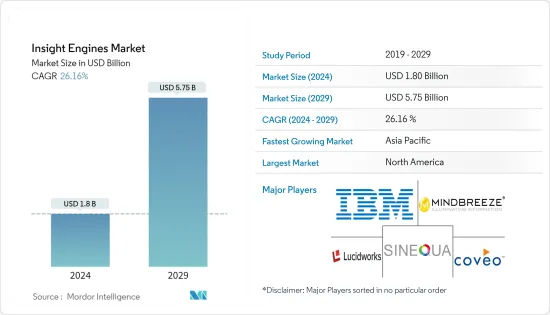

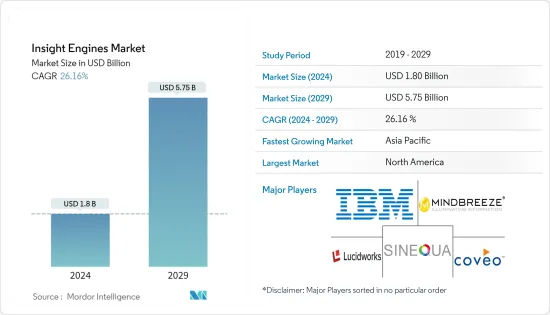

見解引擎市場規模預計到2024年為 18 億美元,預計到2029年將達到 57.5 億美元,在預測期內(2024-2029年)CAGR為 26.16%。

與提供原始來源資料連結的常見搜尋引擎不同,見解引擎可以提供有關相關事實或實體的上下文資訊。見解引擎的關鍵用例包括內部搜尋、外部搜尋和資料分析提取。

主要亮點

- 儘管公司應用了所有類型的資料和分析解決方案,但他們仍無法滿足其業務目標。公司不斷尋求更好的方法從資訊中獲得更多商業價值。因此,見解引擎透過連接到不同的資料來源來提供關鍵業務洞察來解決這個問題。據Accenture表示,可用資料量迅速成長,達到 44 zetta位元組。 80%的資料是非結構化的(文字文件、音訊、視訊、電子郵件、社交貼文等),20%保存在某種結構化系統中。為了從這個龐大的資源中獲得洞察並確定使用者或組織的需求,從文件中提取事實並將這些事實儲存在某處以便於簡單存取的能力是必要的。谷歌和必應等搜尋引擎巨頭透過在「知識圖」中儲存這些事實來做到這一點,這適合他們多年來使用的搜尋引擎。

- 對於許多組織來說,投資從資料中提取有用的見解可能成本高昂。為此,他們需要擁有自己的基礎設施和資源。這是許多公司認為認知搜尋是合適解決方案的主要原因之一。據資訊科技和服務公司 KDNuggets表示,組織預計將約 15%的 IT 投資用於認知搜尋、分析和其他基於雲端的產品。預計到2021年這項投資將增至 35%。

- 預計零售、BFSI、媒體和電信等各種最終用戶行業將在未來幾年使用該洞察計劃。例如,在 BFSI 領域,各公司不斷嘗試尋找方法,讓銀行業務對顧客來說更好、更快、更方便。該行業計劃利用高級分析能力來深入了解流程和客戶。這將有助於它了解過去的表現,做出更好的業務決策。

- 此外,在 COVID-19 之後,見解引擎加快了步伐,成為企業搜尋的最佳知識發現選項之一。市場見證了企業應用程式產生的資料顯著增加。用於開發有意義的見解以做出業務決策的時間也顯著增加。為了在 COVID-19 大流行期間推廣其見解引擎,主要市場供應商推出了具有先進功能的創新產品,以滿足特定行業和疫情後的搜尋需求。

- 例如,2020年 7月,微軟推出了醫療保健文字分析預覽功能,使開發人員能夠處理非結構化醫療資料並從中提取見解。此功能是 Azure 認知服務中文字分析的一部分。它可以處理廣泛的資料類型和任務,無需耗時且手動開發的自訂模型即可從資料中提取見解。據微軟表示,透過這項最新產品,用戶可以將非結構化文字中提到的單字和短語檢測為與醫療保健和生物醫學領域的語義類型相關的實體。這些字詞包括診斷、藥物名稱、症狀、檢查、治療、劑量和給藥途徑。

見解引擎市場趨勢

BFSI 細分市場預計將佔據重要佔有率

- 銀行在應對不斷變化的消費者格局和業務期望時面臨一系列獨特的挑戰。搜尋技術處於理解這個新金融世界的最前線。使用的資料來源的多樣性已經超越了傳統的混合。金融機構的企業員工需要存取儲存在雲端、SaaS 服務和其他孤島中的資料。見解引擎可擴展到數十億個各種格式的文檔,並連接到所有資料以進行即時存取。保險公司在試圖減輕網路風險和顛覆性創新等改變遊戲規則的趨勢的同時,擴大面臨監管環境。搜尋可以幫助這些組織保持敏捷並保持成長。

- 見解引擎利用機器學習和人工智慧從不同的資料儲存庫檢索相關結果。它讓銀行家能夠存取年度報告、風險分析、社交媒體、行業部落格和許多其他資料點,全面了解客戶。它還可以實現明智的投資決策、機會尋找和交易發起。銀行擁有多個圍繞客戶資料、索賠、客戶付款歷史記錄等的交易資料和數位互動點。見解引擎可以利用這些大量資料儲存庫來存取真實可靠的信用報告。銀行可以主動利用這些報告來預測詐欺行為,同時發現付款違規行為和其他異常活動。

- 銀行和其他金融組織也利用見解引擎透過檢查社群媒體並使用自然語言處理分析有關其服務和策略的討論來尋找和解析客戶情緒。金融服務分析師能夠編寫越來越準確的報告,並透過獲取重要的獨立資料的能力,為客戶和內部決策者提供更好的建議。使用資料實現個人化銀行業務可以提高客戶參與度並增加收入。據 Accenture表示,一家大型全球銀行利用向客戶提供的個人化見解,在短短 18 個月內將儲蓄餘額增加了 6,000 萬歐元。

- 例如,美國第三大銀行擁有 3800 萬次搜尋和 29.3 萬唯一用戶,部署了使用 Lucidworks Fusion 構建的搜尋應用程式,現在只有 0.14%的查詢結果為零,員工將其搜尋評為最其內部網路的寶貴功能。一家全球排名前五的投資銀行使用Lucidworks Fusion 建立了一個應用程式,該應用程式搜尋了2.5 億行(每個文件包含60-70 個欄位)和5000 萬行(每個文件包含1000 個欄位),總共20 億行集合。全球最大的銀行之一Credit Agricole啟動了一個計畫,提供一個新的數位化工作場所,讓超過 60,000 名內部用戶可以了解面前客戶的確切情況,為客戶找到最相關的產品。

亞太地區市場預計將出現高速成長

- 以日本、中國、印度、澳洲和韓國等國家為首,亞太地區預計將成為市場成長最快的地區。中國是亞太地區技術應用不斷成長的主要國家之一。該國擁有速度最快的網路頻段之一,並且擁有阿里巴巴等大型企業的強大影響力。

- 根據UNCTAD.org 的資料,2019年8月至2020年8月,中國線上零售額佔有率從19.4%上升至24.6%。2020年3月,泰國購物應用程式下載量在短短一周內劇增60%. -2020年的商業成長可能會在復甦期間持續下去,預計這將有助於見解引擎市場產生零售業參與者的需求。

- 中國嚴格的監管環境進一步鞏固了三方(愛奇藝、騰訊和優酷)的主導地位,這阻止了 FAANG(Facebook、亞馬遜、蘋果、Netflix、Google)等國際參與者在中國開展業務。這些國際參與者使用見解引擎,尤其是大規模推薦,並透過廣告推動其他業務。這為該地區的國內企業提供了充足的機會,導致與美國相比的適度成長。

- 此外,印度等國家的新興市場預計將為預測期內研究的市場提供巨大的機會,因為許多新的本地參與者正試圖進入特定市場。例如,2021年 9月,消費者和市場情報、分析和諮詢服務提供者 GfK 推出了 gfknewron。它是一個整合的、人工智慧驅動的軟體平台。使用 gfknewron,公司可以從單一事實來源存取市場、消費者和品牌資料。人工智慧支援的預測和實踐指導將支援永續的業務成長。 Gfknewron 是 GfK 從標準市場研究機構轉型為人工智慧驅動的資料分析和顧問公司的重要一步。

見解引擎產業概覽

由於 IBM Corporation、Mindbreeze GmbH、LucidWorks Inc. 和 Sinequa SAS 等參與者的大量存在,見解引擎市場適度分散。市場上的供應商還透過使用電腦視覺、語音轉文字功能等機器學習功能,以本地方式或透過合作夥伴關係將其內容索引功能的範圍擴展到富媒體。

- 2021年10月- Qubit 是一家為行銷團隊提供人工智慧驅動的客製化技術的供應商,被Coveo 收購,Coveo 是一個致力於透過人工智慧驅動的搜尋、推薦和個人化提供更好的數位體驗的相關平台。此次交易可能會加速Coveo在英國和歐洲市場的地理發展。

- 2021年 6月 - IntraFind Software AG 宣布其 iFinder 企業搜尋解決方案已在 Microsoft Azure Marketplace 上提供。開發完成後,使用 Azure 的公司能夠存取 IntraFind 解決方案進行企業範圍內的資訊搜尋。

- 2021年 6月 - 谷歌著名的 YouTube 影片服務的部分內容從廣告公司自己的資料中心基礎設施轉移到該公司的雲端服務。此舉表明,Google將注意力轉向內部,因為它的目標是增加其在蓬勃發展的雲端運算領域的佔有率,並減少對其搜尋引擎和其他網站上廣告的依賴。

- 2021年 3月 - ServiceNow 推出了新版本的「The Now Platform」。現在,Platform Quebec 發布了新的 Creator Workflows 和 App Engine Studio,以加快數位轉型的步伐,使整個企業能夠快速開發低程式碼應用程式,輕鬆應對日常業務挑戰。 Now Platform的最新版本包括新的低程式碼應用程式開發工具和改進的本機人工智慧功能,使公司能夠快速創新,提供卓越的體驗並提高生產力。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 競爭激烈程度

- 替代品的威脅

- COVID-19 對產業影響的評估

第5章 市場動態

- 市場促進因素

- 資料量的增加和結構化資料的需求

- 透過搜尋和自然語言處理進行的分析查詢不斷增加

- 市場限制

- 關於資料品質和資料來源驗證的擔憂

第6章 市場細分

- 依組件

- 軟體

- 服務

- 依部署類型

- 本地部署

- 雲端

- 按企業規模

- 中小企業

- 大型企業

- 依最終用戶產業

- BFSI

- 零售

- 資訊科技和電信

- 按地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Mindbreeze GmbH

- Coveo Solutions Inc.

- Sinequa SAS

- LucidWorks Inc.

- ServiceNow Inc.(Attivio Cognitive Search Platform)

- Micro Focus International PLC

- Google LLC

- Microsoft Corporation

- Funnelback Pty Ltd

- IntraFind Inc.

- Dassault Systems SA

- EPAM Systems Inc.(Infongen)

- Expert System SpA

- IHS Markit Ltd

- Insight Engines Inc.

第8章 投資分析

第9章 市場的未來

The Insight Engines Market size is estimated at USD 1.8 billion in 2024, and is expected to reach USD 5.75 billion by 2029, growing at a CAGR of 26.16% during the forecast period (2024-2029).

Insight engines can provide contextual information about the fact or entity in question, unlike the usual search engines that offer links to the original source materials. The key use cases of insight engines include internal search, external search, and extraction of data analytics.

Key Highlights

- Even though companies apply all types of data and analytics solutions, they cannot satisfy their business goals. Companies continuously seek better ways to gain more business value from the information. Thus, insight engines address this problem by connecting to varied data sources to deliver business-critical insights. According to Accenture, the amount of data available is growing rapidly, amounting to 44 zettabytes. 80% of this data is unstructured (text documents, audio, video, emails, social posts, etc.), and 20% is held in structured systems of some kind. To gain insights from this massive resource and pinpoint what a user or organization requires, the ability to extract facts from documents and store those facts somewhere for simple access is necessary. Search engine giants, like Google and Bing, do this by storing such facts during a 'knowledge graph,' which suits the search engines they have been using for several years.

- For many organizations, investing in extracting useful insights from data may be costly. For this, they need to possess their own infrastructure and resources. This is one of the main reasons that many companies consider cognitive search an appropriate solution. According to KDNuggets, an information technology, and services company, organizations are expected to direct approximately 15% of their IT investments toward cognitive search, analytics, and other cloud-based offerings. This investment was predicted to extend to 35% by 2021.

- Various end-user industries, such as retail, BFSI, media, and telecommunications, are anticipated to use the insight program in the coming years. For instance, in the BFSI sector, companies are constantly trying to find ways to make banking better, faster, and easier for patrons. This industry plans to use the ability of advanced analytics to derive insights into processes and customers. This will help it know past performances, resulting in better business decisions.

- Furthermore, in the wake of COVID-19, insight engines picked up pace as one of the best knowledge discovery options for enterprise search. The market witnessed a significant rise in data generated by enterprise apps. The time spent on developing meaningful insights to make business decisions also increased significantly. To promote its insight engine during the COVID-19 pandemic, major market vendors launched innovative product offerings with advanced features to cater to industry-specific and post-pandemic search requirements.

- For instance, in July 2020, Microsoft launched a preview feature of text analytics for healthcare, which enables developers to process and extract insights from unstructured medical data. This feature is a part of Text Analytics in Azure Cognitive Services. It processes a broad range of data types and tasks without time-intensive and manually developed custom models to extract insights from data. According to Microsoft, with this latest offering, users can detect words and phrases mentioned in the unstructured text as entities that can be related to semantic types in the healthcare and biomedical domain. These words include diagnosis, medication name, symptoms, examinations, treatments, dosage, and route of administration.

Insight Engines Market Trends

The BFSI Segment Expected to Hold a Significant Share

- Banks deal with a unique set of challenges as they navigate an ever-changing consumer landscape and business expectations. Search technology is at the forefront of making sense of this new world of finance. The variety of data sources for usage has evolved beyond the traditional mix. Enterprise workers at financial institutions need access to data stored in the cloud, behind SaaS services, and other silos. Insight engines scale to billions of documents in various formats and connect to all of the data for real-time access. Insurers increasingly face a regulatory landscape while trying to mitigate game-changing trends like cyber risk and disruptive innovation. Search can help these organizations stay nimble and maintain growth.

- Insight engines leverage ML and AI to retrieve relevant results from disparate data repositories. It gives bankers a complete view of their clients by giving them access to annual reports, risk analytics, social media, industry blogs, and many other data points. It also enables informed investment decision-making, opportunity sourcing, and deal origination. Banks have several transactional data and digital interaction points around customer profiles, claims, customer payment history, etc. Insight engines could exploit these massive data repositories to access authentic and reliable credit reports. Banks can proactively leverage these reports to anticipate fraud while uncovering payment irregularities and other unusual activities.

- Banks and other financial organizations are also utilizing insight engines to find and parse client sentiment by checking social media and analyzing discussions about their services and strategies with the usage of Natural Language Processing. Financial services analysts can compose increasingly accurate reports and give better advice to customers and internal decision makers with the capacity to get to essential and separated data. Using data to personalize banking improves customer engagement and increases revenue. According to Accenture, a major global bank used personalized insights delivered to customers to increase savings balances by EUR 60 million in just 18 months.

- For instance, the third-largest bank in the United States, with 38 million searches and 293 thousand unique users, deployed search apps built with Lucidworks Fusion, and now only 0.14% of queries have zero results, and employees rate its search as the most valuable feature of its intranet. A top five global investment bank built an app with Lucidworks Fusion that searched across 250 million rows, each with 60-70 fields per document and 50 million rows with 1000 fields per document, an entire two billion row collection. Credit Agricole, one of the largest banks in the world, has launched a project to deliver a new digital workplace, where more than 60,000 internal users can know the exact situation of the customer in front of them, which could be utilized to find the most relevant offerings for the customer.

The Asia-Pacific Region Expected to Witness a High Market Growth

- Led by countries, such as Japan, China, India, Australia, and South Korea, the Asia-Pacific region is expected to witness the fastest growth in the market. China is one of the major countries in Asia-Pacific with growing technological adoption. The country is home to one of the fastest internet bands and a strong presence of large enterprises, such as Alibaba.

- According to UNCTAD.org, China's online share of retail sales rose from 19.4% to 24.6% between August 2019 and August 2020. Thailand saw a 60% jump in the downloads of shopping apps in just one week during March 2020. The trend toward e-commerce uptake in 2020 is likely to be sustained during recovery, which is expected to contribute to the insight engine market to generate demand from retail industry players.

- The tripartite (iQiyi, Tencent, and Youku) domination is further secured by the strict regulatory environment in China, which prevents international players, such as the FAANG (Facebook, Amazon, Apple, Netflix, Google), from operating in the country. These international players use an insight engine, especially for recommendations at a large scale, and drive other businesses through advertising. This leaves the region with ample opportunities for domestic players, thus leading to moderate growth as compared to the United States.

- Furthermore, emerging markets in countries such as India are expected to provide great opportunities for the market studied during the forecast period as a number of new local players are trying to enter the given market. For instance, in September 2021, GfK, the provider of consumer and market intelligence, analytics, and consulting services, launched gfknewron. It is an integrated, AI-powered software platform. Using gfknewron, companies can access market, consumer, and brand data from a single source of truth. The AI-supported predictions and practical guidance will support sustainable business growth. Gfknewron is an important step in GfK's transformation from a standard market researcher toward an AI-powered data analytics and consulting company.

Insight Engines Industry Overview

The insight engines market is moderately fragmented due to the significant presence of players such as IBM Corporation, Mindbreeze GmbH, LucidWorks Inc., and Sinequa SAS. Vendors in the market are also extending the reach of their content indexing capabilities to rich media either natively or via partnership by using machine learning capabilities such as computer vision, speech-to-text functions, etc.

- October 2021 - Qubit, a supplier of AI-powered customization technology for merchandising teams, was purchased by Coveo, a relevant platform that strives to better digital experiences through AI-powered search, recommendations, and personalization. Coveo's geographic development into the UK and European markets is likely to be accelerated due to the transaction.

- June 2021 - IntraFind Software AG announced that its iFinder Enterprise Search solution is available on the Microsoft Azure Marketplace. Following the development, companies using Azure were able to access the IntraFind solution for enterprise-wide information search.

- June 2021 - Parts of Google's famous YouTube video service are being moved to the company's cloud service from the advertising company's own data center infrastructure. The move shows that Google is turning its attention inward as it aims to increase its part in the booming cloud-computing sector and become less reliant on adverts on its search engine and other sites.

- March 2021 - ServiceNow introduced the new version of 'The Now Platform.' Now Platform Quebec release features new Creator Workflows and App Engine Studio to accelerate the pace of digital transformation, enabling fast lowcode app development across the enterprise to easily workflow everyday business challenges. The latest edition of the Now Platform includes new low-code app development tools and improved native AI capabilities, enabling companies to innovate rapidly, offer excellent experiences, and increase productivity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volumes of Data and the Requirement of Structured Data

- 5.1.2 Rising Generation of Analytical Queries Via Search and Natural Language Processing

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding the Data Quality and Data Sources Validation

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment Type

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Size of the Enterprise

- 6.3.1 Small- and Medium-Sized Enterprises

- 6.3.2 Large Enterprises

- 6.4 By End-User Industry

- 6.4.1 BFSI

- 6.4.2 Retail

- 6.4.3 IT and Telecom

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Mindbreeze GmbH

- 7.1.3 Coveo Solutions Inc.

- 7.1.4 Sinequa SAS

- 7.1.5 LucidWorks Inc.

- 7.1.6 ServiceNow Inc. (Attivio Cognitive Search Platform)

- 7.1.7 Micro Focus International PLC

- 7.1.8 Google LLC

- 7.1.9 Microsoft Corporation

- 7.1.10 Funnelback Pty Ltd

- 7.1.11 IntraFind Inc.

- 7.1.12 Dassault Systems SA

- 7.1.13 EPAM Systems Inc. (Infongen)

- 7.1.14 Expert System SpA

- 7.1.15 IHS Markit Ltd

- 7.1.16 Insight Engines Inc.