|

市場調查報告書

商品編碼

1440240

資料目錄:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Data Catalog - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

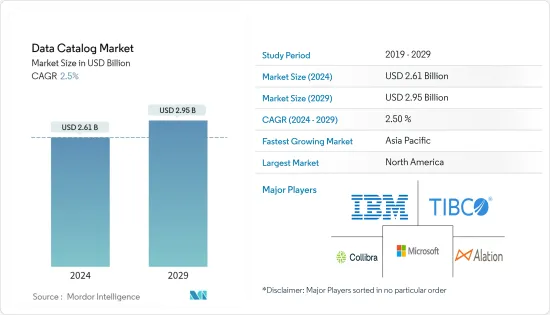

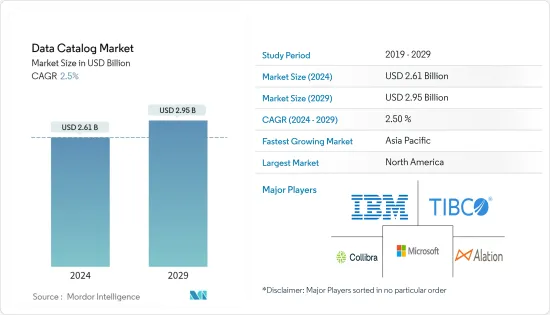

資料目錄市場規模預計在 2024 年為 26.1 億美元,預計到 2029 年將達到 29.5 億美元,在預測期內(2024-2029 年)年複合成長率為 2.5% 成長。

推動資料目錄市場成長的主要因素包括向數位轉型的轉變、擴大採用雲端基礎的解決方案。此外,全球向遠距工作的轉變進一步增加了對有助於提高工作安全性和舒適度的解決方案的需求。

主要亮點

- 目錄是包含有關資料庫、檔案和資料集詳細資訊的資訊目錄。提供有關資料集位置的資訊以及有關儲存檔案的裝置類型的其他詳細資訊。存取從各種來源收集的大量資料、產生大量資料以及引入自助式分析以獲得資料的綜合觀點以改善決策流程的需求是主要驅動力。為了市場。

- 獨特資料集的激增正在推動企業、消費者和終端市場對資料目錄的需求,為提高生產力和預測結果帶來新的觀點和見解。根據 Sisense 研究,大約 55% 的受訪公司已開始使用資料來提高效率,47% 的公司已開始使用數據來提供客戶支持,45% 的公司已開始使用數據來預測未來的結果。由於中小型企業比大公司更重視效率,該產業對資料目錄等產品的需求不斷增加。

- 雲端基礎的資料目錄解決方案由於雲端部署模式的種種優勢而備受關注。這些好處包括降低營運成本、更輕鬆地部署以及擴充性。此外,使用即時分析的公司可以獲得更大的工作自由度並簡化即時部署。 TIBCO Software、AWS 和 IBM 是雲端資料目錄解決方案供應商。

- 然而,不同公司之間缺乏資料管理標準化以及資料安全和隱私問題正在阻礙市場成長。此外,對人工智慧資料編目解決方案的投資激增和自動化技術的興起預計將在資料編目市場創造重大機會。

- 遠距工作和雲端需求的趨勢正在推動對職場效率和安全解決方案的需求。因此,對幫助企業分析資料的各種解決方案的需求顯著增加。這些解決方案也往往會得到很好的接受。因此,可以評估COVID-19對資料目錄市場產生了正面影響。由於需要資料分析以更好地了解市場,這一趨勢將在未來幾年繼續成長。

資料目錄市場趨勢

解決方案產業預計將保持更大的市場規模。

- 在整個資料目錄市場的預測期內,解決方案領域預計將擁有更大的市場規模。此整合解決方案可最佳化個人生產力、提高資料品質、消除資料重複和資料孤島,並簡化資料發現。

- 新時代業務中自我分析資料和資料豐富的進步是為資料目錄解決方案組件的成長創造有吸引力的機會的關鍵因素。例如,根據希捷的數據,去年全球創建、獲取、複製和消費的資料/資訊量為 79Zetta位元組,今年為 97Zetta位元組,預計在預測期內還會增加。數位化的加速發展使世界各地的資料量持續增加。

- 包括醫療保健、銀行、金融服務和保險 (BFSI)、零售和電子商務在內的多個行業都使用資料目錄解決方案來存取和解釋大量資料、制定商務策略。推動重要決策製作。對解決方案的需求。例如,像 Alteryx 這樣的公司可以透過 Alteryx Connect資料進行編目。透過集中指標、業務術語和定義以及資訊資產以實現可發現性和協作,該解決方案可協助使用者了解資料中包含哪些資訊、誰在使用這些資訊、資訊來自何處以及在何處。讓您可以決定訊息的呈現方式用過的。

- 最後,商業智慧主導了業務分析、資料探勘、資料視覺化、資料工具和基礎設施以及最佳實踐,以幫助公司做出更多資料驅動的決策。資料目錄透過集中儀表板和自動化報告程序來幫助商業智慧團隊執行高效分析。公司需要統計建模技術來協助制定各種與業務相關的決策,從而推動市場成長。

北美預計將主導資料目錄市場

- 由於眾多 BI 工具中資料的使用不斷擴大,以及 BFSI、醫療保健、通訊和 IT 以及製造等行業對數位技術的接受度不斷提高,預計該市場將在預測期內快速成長。該地區已成為 BI 技術創新、研發 (R&D) 和技術進步的領導者。產品發布是市場相關人員使用的主要技術之一。如果您需要 BI 工具來培養深厚的專業知識並產生有效的結果,它可以提供大量資料。這種需求使得 BI 工具成為資料目錄市場中最大的資料消費者之一。

- 由於美國和加拿大重視創新,北美被認為是收益最高的地區。這些國家的資料目錄市場是世界上最具活力和競爭力的市場之一。由於基礎設施發展速度快,各產業資料顯著成長,北美被認為是最具成長潛力的地區之一。

- 此外,北美是全球資料目錄行業的市場領導,由於數位技術的普及和全球對商業智慧產品的需求不斷成長,該地區的競爭變得非常激烈。該地區的成長是由傳統企業的加速擴張、各行業產生的大量資料以及自助分析的使用所推動的。

- 隨著北美主要解決方案供應商的出現,資料目錄市場正在不斷擴大。 Collibra NV、Alation Inc.、TIBCO Software Inc.、Informatica Inc.、IBM Corporation、Alteryx Inc.、Hitachi Vantara LLC、Amazon Web Services Inc.、Microsoft Corporation 和 Datawatch Corporation 是該地區的一些知名參與者。

資料目錄產業概述

由於全球範圍內存在多個重要參與者,資料目錄市場預計將走向碎片化。市場相關人員正在採取合作、併購和夥伴關係等先進策略,以在全球市場上獲得重要的市場佔有率。市場上的主要供應商有IBM、Informatica、Alteryx、Collibra、Alation、Microsoft、TIBCO Software、Datawatch Corporation、Zaloni等。

觀察到一些重大進展。 2022 年 10 月,IIGCC 將協助會員審查和選擇資料供應商,以支援投資者在企業(上市股票和固定收益)、房地產和主權債券三個資產類別中實施淨零承諾和推出計畫。資料目錄同樣在 2022 年 9 月,Alation 與現代資料整合領域的全球領導者 Fivetran 合作。合作後,兩家公司都希望幫助客戶理解和識別其現代資料堆疊中的整個資料上下文。此次合作使用 Fivetran元資料API 將來自多個來源的可信任、託管資料合併到單一的視角。這為決策和資料管道提供了動力,同時提高了資料可見度。

- 2022 年 8 月,資料目錄平台供應商 Alation 推出了一項新服務,旨在幫助 Snowflake Data Cloud 用戶輕鬆資料進行編目。 Alation 也發布了資料目錄更新,為使用者提供增強的資料管治功能。 Alation Cloud Service (ACS) for Snowflake 是資料目錄供應商首次提供專用特定雲端資訊服務的產品。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 雲端基礎的解決方案的採用不斷成長

- 解決方案產業預計將保持更大的市場規模。

- 市場限制因素

- 缺乏標準化和安全問題

第6章市場區隔

- 按成分

- 解決方案

- 服務

- 依部署方式

- 雲

- 本地

- 按最終用戶產業

- BFSI

- 零售與電子商務

- 衛生保健

- 製造業

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- TIBCO Software Inc.

- Collibra NV

- Alation Inc.

- Informatica Inc.

- Alteryx Inc.

- Altair Enginnering Inc.

- Amazon Web Services, Inc.

- Zaloni, Inc.

- Oracle Corporation

- Hitachi Vantara LLC

- SAP SE

- Tamr, Inc.

第8章投資分析

第9章市場機會與未來趨勢

The Data Catalog Market size is estimated at USD 2.61 billion in 2024, and is expected to reach USD 2.95 billion by 2029, growing at a CAGR of 2.5% during the forecast period (2024-2029).

The major factors driving the growth of the Data Catalog Market include the shift toward digital transformation, increasing adoption of cloud-based solutions, and the global shift towards remote working has further increased the demand for solutions that help in enhancing the security and comfort of work.

Key Highlights

- A catalog is a directory of information that includes details about databases, files, and data sets. It provides information about the location of a data set and additional details about the kind of device on which the file is stored. The need to access large amounts of data collected from various sources to obtain a consolidated perspective of the data for improving the decision-making process, the production of enormous amounts of data, and the expansion of adoption of self-service analytics are principal driving factors for the market.

- The proliferation of unique and proprietary datasets has fueled demand for data catalogs o,n companies, consumers, and end markets, which promise fresh perspectives and insights to boost productivity and forecast outcomes. According to a study by Sisense, about 55% of the companies studied have started to use data to improve efficiency, about 47% to support customers, and about 45% to predict future outcomes. Since small firms are more concerned with efficiency than larger enterprises, the industry is seeing an increase in the demand for products like data catalogs.

- Cloud-based data catalog solutions are gaining high traction due to the multiple benefits of the cloud deployment mode. These advantages include reduced operational expenses, straightforward deployments, and greater scalability in terms of networked resources. They also give businesses using real-time analysis more working freedom and simplify real-time deployment. TIBCO Software, AWS, and IBM are cloud data catalog solutions providers.

- However, the lack of standardization in data management and data security & privacy concerns among different enterprises hampers the market growth. Furthermore, a surge in investment in AI-enabled data catalog solutions and a rise in automation technology are anticipated to create significant opportunities in the data catalog market.

- The trend toward remote work and the requirement for the cloud has increased the demand for workplace efficiency and security solutions. As a result, there is a significantly higher need for various solutions that help businesses with data analytics. There is also a good acceptance trend for these solutions. Therefore, it can be assessed that COVID-19 positively impacted the data catalog market. The movement will continue to grow over the next few years, owing to the need for data analytics to understand the market better.

Data Catalog Market Trends

Solutions Segment is Expected to Hold a Larger Market Size

- The solutions segment is anticipated to possess a larger market size through the forecast period in the data catalog market. The combined solution renders optimization of individual productivity, improved data quality, elimination of data duplication and data silos, and simplified data discovery.

- The advancement of self-analytic data and the intensification of data in the new-age business are the principal factors that present attractive opportunities for the growth of data catalog solution components. For Instance, According to Seagate, The volume of data/information created, captured, copied, and consumed globally was 79 Zettabytes last year and 97 Zettabytes in the current year and is projected to increase over the forecast period. This accelerated development of digitalization adds to the ever-growing global data.

- Several industry verticals, such as Healthcare, Banking, Financial Services, Insurance (BFSI), and retail and e-Commerce, are using data catalog solutions to access and interpret massive volumes of data, form business strategies, and deliver business-critical decisions driving the demand for solution segment. For example, for firms like Alteryx, data cataloging is available through Alteryx Connect. The solution centralizes metrics, business terms and definitions, and information assets for discoverability and collaboration that lets users determine the kinds of information their data includes, who it uses, where it comes from, and how it is used.

- Lastly, to assist businesses in making more data-driven decisions, business intelligence integrates business analytics, data mining, data visualization, data tools and infrastructure, and best practices. Data catalogs help business intelligence teams perform efficient analytics by centralizing dashboards and automating the reporting procedure. Enterprises require a statistical modeling technique to assist them in making various business-related decisions, which fuels the market's growth.

North America Expected to Dominate the Data Catalog Market

- The market is predicted to grow quickly throughout the forecast period due to the expanding use of data in numerous BI tools and the increased acceptance of digital technologies in sectors like BFSI, healthcare, telecom and IT, and manufacturing. The region has emerged as a leader in BI technology innovations, research and development (R&D), and technological advancements. Product releases are one of the main techniques used by market players. In need of BI tools to develop a deep level of expertise and produce effective results, they are supplied with enormous amounts of data. This necessity has made BI tools one of the Data Catalog Market's biggest data consumers.

- Given the emphasis on innovations in the US and Canada, North America is considered the region that generates the highest revenue. The data catalog markets in these countries are the most dynamic and competitive in the world. North America is regarded as one of the top prospective areas for growth due to the faster rate of infrastructure development and the vast expansion of data from all industry verticals.

- Moreover, North America is the market leader in the global data catalog industry and is highly competitive due to the widespread use of digital technology and the expanding demand for business intelligence products globally. Growth in this region is fueled by the traditional businesses' accelerating expansion, the vast data production from every sector, and the use of self-service analytics.

- The market for data catalogs is expanding due to the leading solution providers' presence in North America. Collibra NV, Alation Inc., TIBCO Software Inc., Informatica Inc., IBM Corporation, Alteryx Inc., Hitachi Vantara LLC, Amazon Web Services Inc., Microsoft Corporation, and Datawatch Corporation are a few of the prominent players in the region.

Data Catalog Industry Overview

The Data Catalog Market is expected to move towards fragmentation owing to the presence of several significant players globally. Market players are adopting advanced strategies such as collaboration, mergers and acquisitions, and partnerships to capture a substantial market share in the global market. Major vendors in the market are IBM, Informatica, Alteryx, Collibra, Alation, Microsoft, TIBCO Software, Datawatch Corporation, and Zaloni, among others.

Some of the key developments are observed. In October 2022, IIGCC launched a data catalog to help its members review and select data vendors to support the implementation of investor net zero commitments and transition plans across three asset classes: Corporates (listed equity and debt), Real estate, and Sovereign bonds. Also, in September 2022, Alation partnered with Fivetran, a global leader in modern data integration. Following their collaboration, the businesses wanted to make it possible for their clients to understand and locate the entire data context in the latest data stack. The partnership combined reliable, controlled data from many sources into a single perspective using the Fivetran Metadata API. This enhances decision-making and data pipelines while increasing data visibility.

- In August 2022, Data catalog platform vendor Alation launched a new service designed to make it easier for Snowflake Data Cloud users to catalog data. Alation also released an update to its data catalog that provides users with enhanced data governance capabilities. The Alation Cloud Service (ACS) for Snowflake is the first time the data catalog vendor has provided a purpose-built offering for a specific cloud data service.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing adoption of Cloud Based Solutions

- 5.1.2 Solutions Segment is Expected to Hold a Larger Market Size

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization and Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment Mode

- 6.2.1 Cloud

- 6.2.2 On-Premise

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Retail & E-commerce

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 TIBCO Software Inc.

- 7.1.4 Collibra NV

- 7.1.5 Alation Inc.

- 7.1.6 Informatica Inc.

- 7.1.7 Alteryx Inc.

- 7.1.8 Altair Enginnering Inc.

- 7.1.9 Amazon Web Services, Inc.

- 7.1.10 Zaloni, Inc.

- 7.1.11 Oracle Corporation

- 7.1.12 Hitachi Vantara LLC

- 7.1.13 SAP SE

- 7.1.14 Tamr, Inc.