|

市場調查報告書

商品編碼

1440218

資料歷史學家:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Data Historian - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

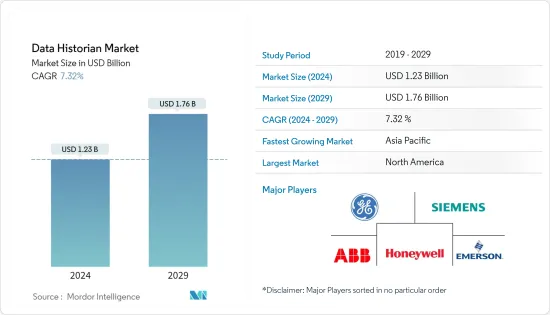

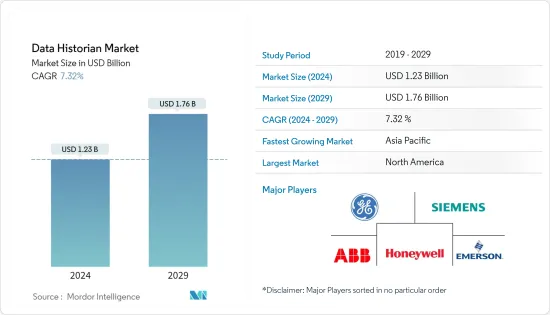

資料 Historian 市場規模預計 2024 年為 12.3 億美元,預計到 2029 年將達到 17.6 億美元,在預測期內(2024-2029 年)成長 7.32%,年複合成長率成長。

由於物聯網設備、雲端應用程式和社交媒體等各種來源產生的資料量不斷增加,對資料歷史學家的需求不斷增加。

主要亮點

- 許多行業都受到需要保存歷史資料的監管和合規要求的約束。資料歷史學家提供了一種滿足這些要求的方法,同時使組織能夠從資料中提取見解。這對於金融服務等產業尤其重要。因此,這些行業的需求正在對市場做出貢獻。

- 資料中心的發展透過提供儲存、處理和分析大量資料所需的基礎設施,促進了資料歷史學家的發展。此外,資料中心通常提供先進的處理能力,例如高效能運算資源和資料分析工具,以幫助組織從資料中提取有價值的見解和趨勢。

- 因此,資料歷史學家在資料中心和工業控制系統(ICS)中最常見,因此對資料中心的投資迅速增加,支持了市場的成長。例如,根據 NASSCOM(印度)的數據,到 2025 年,印度資料中心投資預計將從 2021 年的 38 億美元增加到 46 億美元。

- 此外,隨著工業 4.0、智慧工廠和智慧工廠的出現,世界各地的組織正在展示向在其流程的多個層面使用大量資料的轉變。這增加了組織對資料歷史解決方案的需求,以實現有效管理、穩定高效的工廠運作以及強大的分析。然而,資料功能和複雜性不斷增加、實施成本高昂以及開發有限等因素正在阻礙市場成長。

- COVID-19 對資料歷史記錄市場產生了各種影響。隨著資料產生的激增增加了對資料儲存和分析的需求,對資料歷史解決方案的需求也隨之增加。這為專門從事資料歷史技術和服務的公司提供了成長機會。

- 此外,疫情也擾亂了商業和全球經濟,導致包括資料史學家在內的新技術支出放緩。這減緩了資料歷史記錄市場的成長。此外,向遠距工作的轉變為資料收集和管理帶來了挑戰,使得資料負責人更難以提供準確和完整的資料歷史記錄。

資料歷史記錄市場趨勢

雲端採用推動市場成長

- 雲端採用率的提高是資料歷史學家發展的關鍵因素。雲端開發的成長提供了可擴展且靈活的雲端基礎設施,可以處理大量資料,使其成為資料歷史學家的理想雲端基礎設施。此外,雲端的發展使得資料歷史學家與其他雲端基礎的工具和服務(例如資料分析和視覺化)的整合變得更加容易,從而產生了對資料歷史學家的需求。

- 採用雲端服務來儲存和管理消費者資料可歸因於雲端採用率的增加。付款閘道、線上資金轉帳、數位錢包和整合客戶體驗等服務在 BFSI 行業中發揮重要作用,並支援整體向雲端部署的遷移。

- 2022 年6 月,媒體、娛樂和技術創投組合Eros Investments(Eros Media World、Eros Now、Mzaalo of Xfinite)簽署了一項協議,以推進和擴展人工智慧(AI) 和機器學習(ML)。與Wipro 簽署有限公司基於內容本地化的解決方案。 Eros Investments 和 Wipro 的聯合內容在地化服務將以兩種部署模式提供給媒體和娛樂公司:平台即服務和私有雲端部署。不同行業的公司在雲端採用領域利用解決方案的努力預計將進一步支持市場的成長。

- 此外,雲端部署允許資料歷史學家輕鬆擴展其基礎設施,以滿足客戶不斷變化的需求,從而消除對昂貴硬體的需求,並降低資料歷史學家的整體成本。這使得中小型企業更容易使用資料歷史學家。

- 疫情發生以來,許多企業對雲端運算的需求激增,雲端服務提高了基礎設施效率,降低了營運成本,並根據情勢變化最佳化業務營運,新的雲端實施模式由此誕生。

預計北美將佔據最高的市場佔有率

- 由於該地區資料歷史記錄市場創新研發支出的增加,預計北美將佔據最高的市場佔有率。此外,該地區還有Honeywell國際公司、通用電氣公司和羅克韋爾自動化公司等供應商繼續投資該市場。

- 該地區對資料歷史學家的需求正在穩步成長。這是由於對工業自動化資料的需求持續成長以提高性能、各個經濟部門擴大使用巨量資料分析以及不斷擴展的物聯網基礎設施推動了資料量不斷增加。收集並分析技術市場趨勢,例如

- 該地區也對 IT、BFSI、零售和醫療保健行業的全球資料中心需求做出了重大貢獻。世邦魏理仕等房地產專家報告稱,美國資料中心空間佔全球近90%。這進一步增加了對資料歷史記錄市場的需求。

- 例如,Google過去五年在26個州的辦公室和資料中心投資超過370億美元,這還不包括2020年和2021年在美國研發投資超過400億美元的費用。此外,2022年4月,Google宣布計劃在2022年向美國辦事處和資料中心投資約95億美元。

- 此外,北美的組織越來越認知到資料分析在決策中的價值,並正在尋找管理和儲存大量資料的解決方案。這增加了對資料歷史學家的需求。

資料歷史學家產業概述

由於市場上存在眾多參與者,資料歷史記錄市場是分散的。市場參與者正在採取合作夥伴關係、併購、新產品發布以及研發投資等策略,以進一步創新,以獲得最高的市場佔有率。這些是市場上看到的一些主要發展。 2022 年 10 月,Uptake Technologies Inc. 與 ADX 團隊合作,使用 ADX 建置了工業資料歷史資料庫。自從 Microsoft 決定停止時間序列見解 (TSI) 的開發以來,Uptake 一直致力於在 Azure Data Explorer (ADX) 上重新建置其旗艦 OT 雲端資料歷史資料庫 Fusion。 2022 年 4 月,GE Digital 最近宣布推出 Proficy Historian for Cloud,這是 AWS Marketplace 上提供的世界上第一個雲端原生營運資料史學家。這款雲端基礎的工業資料管理軟體旨在促進 OT資料從設備級到企業更簡單、更可靠地移動到雲端。 Proficy Historian for Cloud 可協助公司利用現有 IT 雲端投資並整合 OT 和企業資料。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 評估新型冠狀病毒感染疾病(COVID-19)對市場的影響

第5章市場動態

- 市場促進因素

- 對流程和效能改進的整合資料的需求不斷增加

- 工業巨量資料的興起

- 市場挑戰

- 實施成本高

第6章市場區隔

- 按成分

- 軟體

- 服務

- 依部署方式

- 本地

- 雲

- 按最終用戶產業

- 資料中心

- 石油天然氣

- 紙漿

- 水資源管理

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- General Electric Company

- Siemens AG

- ABB

- Honeywell International Inc.

- Emerson Electric Co.

- AVEVA Group plc

- Rockwell Automation Inc.

- OSIsoft LLC

- ICONICS

- Open Automation Software

第8章投資分析

第9章 市場的未來

The Data Historian Market size is estimated at USD 1.23 billion in 2024, and is expected to reach USD 1.76 billion by 2029, growing at a CAGR of 7.32% during the forecast period (2024-2029).

The increasing amount of data generated by various sources, such as IoT devices, cloud applications, and social media, is driving demand for data historians.

Key Highlights

- Many industries are subject to regulations and compliance requirements that require storing historical data. Data historians provide a way to meet these requirements while enabling organizations to extract insights from the data. This is particularly important in the industries such as financial services. Thus, demand from such sectors is contributing to the market.

- The growth of data centers facilitates the growth of data historians by providing the infrastructure necessary for storing, processing, and analyzing large amounts of data. Further, data centers often offer advanced processing capabilities, such as high-performance computing resources and data analytics tools, which can help organizations extract valuable insights and trends in their data.

- As a result, investment in data centers is rising rapidly and supporting market growth, as data historians are most common in data centers and industrial control systems (ICS). For instance, according to NASSCOM (India), the investment value in data centers in India is expected to reach USD 4.6 billion by 2025 from USD 3.8 billion in 2021.

- Moreover, with the advent of Industry 4.0, smart factories, and smart plants, organizations worldwide are demonstrating a shift to the usage of massive amounts of data at several layers of their process. This leads to organizations' growing demand for data historian solutions to achieve effective management, stable and efficient plant operations, and robust analysis. However, factors such as increasing data capabilities and complexities, high deployment costs, and limited development are stifling market growth.

- COVID-19 had a mixed impact on the data historian market. The increased demand for data storage and analysis due to the surge in data generation led to an increased demand for data historian solutions. This provided growth opportunities for companies specializing in data historian technology and services.

- Furthermore, the pandemic has also disrupted businesses and the global economy, causing a slowdown in spending on new technologies, including data historians. This has resulted in a slowdown in the growth of the data historian market. Additionally, the shift to remote work has caused data collection and management challenges, making it more difficult for data historians to provide accurate and complete data history.

Data Historian Market Trends

Cloud Deployment To Drive the Market Growth

- The growth in cloud deployment has been a key factor in the growth of data historians. The growth of cloud development has led to the availability of scalable and flexible cloud infrastructure that can handle a large amount of data, making it ideal for data historians. Further, cloud development has made it easier to integrate data historians with other cloud-based tools and services, such as data analysis and visualization, and creating demand for data historians.

- Cloud services adoption for the storage and management of consumer data can be attributed to the growth of cloud deployment. Payment gateways, online transfers of the fund, digital wallets, unified customer experiences, etc. services are playing a significant role in the BFSI industry, assisting with the overall shift to cloud deployment.

- In June 2022, Eros Investments, a media, entertainment, and technology portfolio of ventures - Eros Media World, Eros Now, and Xfinite's Mzaalo signed an agreement with Wipro Ltd to evolve and scale the Artificial Intelligence (AI) and Machine Learning (ML) based content localization solution. Eros Investments and Wipro's joint content localization service will be available to media and entertainment companies in two deployment models such as platform-as-a-service and private cloud deployment. Such initiatives from companies of different sectors to avail solutions in the area of cloud deployment are further expected to support market growth.

- Moreover, cloud deployments are allowing data historians to easily scale up their infrastructure as per the changing needs of their customers and eliminate the need for expensive hardware, reducing the overall cost of data historians. This makes it easier for small and medium-sized businesses to use data historians.

- Since the pandemic, the demand for cloud computing skyrocketed among many businesses as cloud services improve infrastructure efficiency, lower operating costs, and optimize business operations in response to changing conditions, giving rise to various cloud deployment models.

North America Expected to Hold Highest Market Share

- North America is expected to hold the highest market share owing to increasing spending on research and development for innovation in the data historian market in the region. Moreover, the region has vendors like Honeywell International Inc., General Electric Company, Rockwell Automation, Inc., etc., continuously investing in the market.

- The demand for data historians is expanding steadily in the region, fueled by consistently increasing demand for industrial automation data for performance improvement, rising use of Big Data analytics across various economic sectors, and constantly expanding IoT infrastructure, which generates an increasing amount of data that can be collected and analyzed, and other tech market trends.

- The region also contributes substantially to the global data center demand from the IT, BFSI, retail, and healthcare industries. Real estate experts, such as CBRE, have reported that the United States occupies almost 90% of data center space worldwide. This is further boosting the demand for data historian markets.

- For instance, in the past five years, Google has invested more than USD 37 billion in its offices and data centers in 26 states which is in addition to the more than USD 40 billion in research and development invested in the United States in 2020 and 2021. Further, in April 2022, Google announced plans to invest approximately USD 9.5 billion in its United States offices and data centers in 2022.

- Moreover, organizations in North America are increasingly recognizing the value of data analysis in decision-making and are looking for solutions to manage and store a large amount of data. This is driving the demand for data historians.

Data Historian Industry Overview

The data historian market is fragmented due to the many players in the market. Players in the market are adopting strategies like partnerships, mergers and acquisitions, new product launches, and investing in R&D for further innovations to capture the highest market share. Some of the key developments seen in the market are as such. In October 2022, Uptake Technologies Inc. collaborated with the ADX team to build an industrial data historian using ADX. Since Microsoft decided to stop the development of Time Series Insights (TSI), Uptake has been working to re-platform the flagship OT cloud data historian, Fusion, on Azure Data Explorer (ADX). In April 2022, GE Digital recently announced the availability of the world's first cloud-native operational data historian available in the AWS Marketplace, Proficy Historian for Cloud. This cloud-based industrial data management software is designed to facilitate a more simplified and reliable movement of OT data to the cloud spanning from device level to enterprise. Proficy Historian for Cloud helps companies leverage existing IT cloud investments and combine OT and enterprise data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment on the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Consolidated Data for Process and Performance Improvement

- 5.1.2 Rising Industrial Big Data

- 5.2 Market Challenges

- 5.2.1 High Deployment Costs

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment Mode

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End-user Industry

- 6.3.1 Data Centers

- 6.3.2 Oil & Gas

- 6.3.3 Paper & Pulp

- 6.3.4 Water Management

- 6.3.5 Manufacturing

- 6.3.6 Other End-user Industry

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 General Electric Company

- 7.1.2 Siemens AG

- 7.1.3 ABB

- 7.1.4 Honeywell International Inc.

- 7.1.5 Emerson Electric Co.

- 7.1.6 AVEVA Group plc

- 7.1.7 Rockwell Automation Inc.

- 7.1.8 OSIsoft LLC

- 7.1.9 ICONICS

- 7.1.10 Open Automation Software