|

市場調查報告書

商品編碼

1440217

二手和翻新智慧型手機:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Used and Refurbished Smartphone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

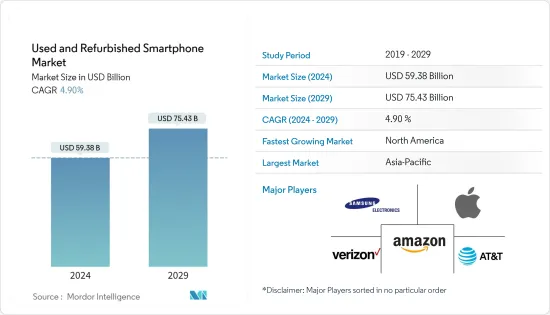

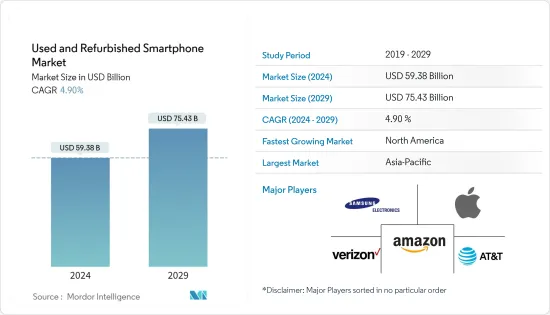

二手和翻新智慧型手機市場規模預計到 2024 年為 593.8 億美元,在預測期內(2024-2029 年)預計到 2029 年將達到 754.3 億美元,年複合成長率為 4.90%。

主要亮點

- 高階智慧型手機領域的多種產品推出、更多的品牌選擇、新的價格分佈以及升級智慧型手機的整體理想價值是推動二手智慧型手機產業在全球快速擴張市場的關鍵因素。

- 利用以前擁有的設備為購買新設備或二手設備提供資金對於二手和翻新智慧型手機市場的成長也很重要。以舊換新加上不斷增加的融資計劃 (EIP) 預計將成為預測期內二手和翻新智慧型手機設備的主要驅動力。

- 升級成本的增加是市場成長的主要原因之一。高階智慧型手機價格上漲導致一些消費者持有智慧型手機的時間比預期長得多。但同時,這項因素也提高了二手設備的平均售價。

- 由於供應問題、高庫存水準以及高通膨導致的客戶需求減少,行動裝置產業出現下滑。由於 5G 和雲端人工智慧等融合趨勢,智慧型手機在未來十年將擴大充當中心樞紐,直到它們完全被穿戴式螢幕、無處不在的語音助理和環境介面所取代。

- 新型冠狀病毒(COVID-19)的出現引發了一場廣泛的在家工作和在家學習的運動。過去十年中,遠距工作的趨勢穩定成長。然而,COVID-19 的影響在短期內極大地加速了這一趨勢,迫使各種規模的企業迅速適應世界各國政府建議的自我隔離措施。我做到了。由於供應鏈限制和可支配現金減少,導致新設備的採購因疫情而推遲,該國對翻新智慧型手機的需求已達到新的里程碑。

二手和翻新智慧型手機市場趨勢

二手和翻新智慧型手機的電子商務平台越來越受歡迎

- 市場見證了多家參與者進行策略性投資和收購,以進軍不斷成長的智慧型手機二級市場。 2022 年 1 月,Flipkart Group 收購了電子電子商務公司 Yaantra,收購金額未公開,作為加強其電子商務業務並增強其對智慧型手機領域客戶的售後服務的一部分。

- 提供翻新智慧型手機的線上平台的成長正在提高市場滲透率,尤其是在新興國家。電子商務平台上智慧型手機的便利使用以及節日和夏季期間提供的折扣將吸引新客戶。因此,電子商務平台的增加將創造對二手和翻新智慧型手機的需求。

- 買賣平台的激增提高了意識,使賣家能夠以合理的價格購買舊行動電話。這規範了智慧型手機次市場,也加劇了市場內不同參與者之間的競爭。

- 世界各地的電子產品、電腦、智慧型手機和其他電子設備產生的電子廢棄物正在迅速成長,美國、中國、日本、德國和印度等國家的電子垃圾產生量是城市廢棄物的三倍。有。在澳大利亞,市場情緒正轉向購買翻新智慧型手機,以減少碳排放和回收成本,此舉受到 Boost Mobile、Cole's 和 Phoenix Cellular 等多家廠商的關注。預計這些因素將在預測期內推動市場成長。

- 亞馬遜是世界上最大的線上零售商,有專用的翻新設備專區。顧客可以將舊智慧型手機賣給亞馬遜,以換取新產品的折扣。承包商將檢查它們並進行必要的維修,以保持它們的外觀和工作像新的一樣。這些設備在翻新部分出售。它還附帶有限的供應商或製造商保固。

- 供應鏈問題和晶片短缺也推動了再製造業的發展。企業正在轉向再製造電子產品供應商來滿足這一需求,預計這將推動再製造電子產業,尤其是智慧型手機的發展。

預計北美地區將出現顯著成長

- 智慧型手機功能的不斷進步和 5G 智慧型手機範圍的擴大是推動北美二手和翻新智慧型手機市場成長的一些關鍵因素。美國是全球智慧型手機供應商最發達的市場之一。該地區有著開發創新智慧型手機的歷史,特別是與蘋果等供應商合作,改變了全球智慧型手機市場的市場動態。

- GSMA表示,通訊業者持續的網路投資以及不同價格分佈5G智慧型手機選擇的不斷擴大,將推動北美5G連接數到2022年達到10億,到2025年達到20億,預計將超過。到2025年,北美地區預計將成為第一個5G連線數佔總連線數超過50%的地區。

- 由於沃爾瑪和百思買等科技公司,翻新智慧型手機的銷售量在北美尤其是美國不斷成長。翻新行動裝置越來越受歡迎,因為它們為買家和賣家提供了價格實惠的選擇,從而為雙方節省了成本。當地賣家以批發價提供高品質翻新行動電話。透過在一個平台上提供所有品牌,客戶可以購買理想的智慧型手機和行動電話配件,同時最大限度地降低成本。由於日益受歡迎,該地區對二手和翻新智慧型手機的市場需求不斷成長。

- 該地區也出現了低階智慧型手機和中階設備的趨勢,許多智慧型手機製造商希望在受 COVID-19感染疾病影響的市場條件下減少低階智慧型手機的數量。我們認為這更具永續性。其他品牌和產品線也可供選擇,但主要是 iPhone 和高階三星旗艦產品佔據了重要的市場佔有率。不斷變化的趨勢可能會推動該地區二手和翻新智慧型手機市場的發展。

- 過去幾年,隨著職場和勞動力的變化,企業和消費者更新和升級他們的設備,北美以舊換新服務供應商的產品業務成長。例如,2月份,為行動電話和消費性電子品牌提供以舊換新服務的Phobio被任命為三家新公司的以舊換新供應商:Hyperion Partners、Amazon Canada和Drone Nerds。該公司去年的收益幾乎加倍,隨著新業務的增加,這種勢頭仍在繼續。

二手和翻新智慧型手機產業概述

由於世界各地存在不同的智慧型手機品牌,二手和翻新智慧型手機供應商之間的競爭非常激烈。三星、華為、蘋果、小米、一加等主要智慧型手機巨頭正在全球爭奪市場佔有率。近年來,由於智慧型手機在新興國家的廣泛普及,對翻新智慧型手機的需求激增。因此,越來越重視獲取客戶和建立分銷管道作為保持競爭優勢和市場佔有率的關鍵策略。

Fairphone 是一家致力於打造道德智慧型手機市場的荷蘭社會企業,宣佈於 2022 年 9 月推出,旨在提高智慧型手機的使用壽命,以減少電子廢棄物並節省寶貴的資源。我們已開始透過我們的網站銷售翻新智慧型手機、Fairphone 3 和New Life Edition 。

2022 年 3 月,iPhone 12 和 iPhone 12 Pro 機型登陸蘋果官方授權翻新店。從 Apple 授權翻新店購買的產品包括新電池、新外殼、正品 Apple 零件更換(如果需要)和一年保固。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代品的威脅

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 高階行動電話的趨勢(升級成本增加)

- 二手和翻新智慧型手機的電子商務平台越來越受歡迎

- 通訊業者專注於具有有吸引力計劃的二手設備

- 市場挑戰

- 智慧型手機銷量下降的短期影響

- 電子商務對智慧型手機銷售的影響

第6章 分析師對全新、二手和翻新智慧型手機的市場趨勢和前景的評論

第 7 章:分銷通路形勢- OEM與第三方供應商/平台

第 8 章 5G 對二手和翻新智慧型手機的影響

第9章市場區隔

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第10章競爭形勢

- 公司簡介

- Samsung Electronics Co. Ltd

- Apple Inc.

- Amazon.com Inc.

- Verizon Communications Inc.

- AT&T Inc.

- Reboxed Limited

- NIPPON TELEPHONE INC.

- Best Buy Co. Inc.

- Woot Inc.(Amazon.com Inc.)

- Paytm(One97 Communications)

- Back Market

- FoneGiant.com

- Flipkart Internet Private Limited(Walmart Inc.)

第11章投資分析

第12章市場的未來

The Used and Refurbished Smartphone Market size is estimated at USD 59.38 billion in 2024, and is expected to reach USD 75.43 billion by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

Key Highlights

- Multiple product launches in the premium smartphone segment, more brand options, new price points, and the overall aspirational value of an upgraded smartphone are some of the significant factors rapidly driving the second-hand smartphone industry to increase its market globally.

- Using a previously owned device to fund the purchase of either a new or used instrument is also crucial in the growth of the used and refurbished smartphone market. The trade-in, combined with the increase in financing plans (EIP), is also anticipated to act as a significant driver for the used and refurbished smartphone devices over the forecast period.

- An increase in the upgrade cost has been one of the prominent reasons for the market's growth. An increase in the prices of premium smartphones led to multiple consumers holding on to their phones much longer than expected. However, at the same time, this factor also raised the average selling price of a pre-owned device.

- The mobile device industry has declined due to supply concerns, significant inventory levels, and reduced customer demand due to high inflation. The smartphone will spend the next decade acting increasingly as a central hub until completely replaced by wearable screens, ubiquitous voice assistants, and ambient interfaces, thanks to converging trends, such as 5G and AI in the cloud.

- The emergence of COVID-19 led to a movement toward working and studying from home. The trend toward remote work has been steadily growing over the past decade. However, the effect of COVID-19 dramatically accelerated this trend in a brief period, forcing companies, irrespective of their size, to adapt quickly to the self-isolation measures that governments across the world were recommending. Due to the pandemic, delayed availability of new handsets owing to supply chain constraints and lower disposable cash has pushed local demand for refurbished smartphones to new milestones.

Used & Refurbished Smartphone Market Trends

Growing Popularity of E-commerce Platforms for Used and Refurbished Smartphones

- The market witnessed several players making strategic investments and acquisitions to tap into the growing secondary smartphone market. In January 2022, Flipkart Group acquired Yaantra, an electronics recommerce company, for an undisclosed amount as part of efforts to strengthen its recommerce business and enhance its recommerce business after-sale offerings for its customers in the smartphones segment.

- The growth of online platforms offering refurbished smartphones increases market penetration, especially in emerging economies. The easy availability of smartphones on e-commerce platforms and the discounts offered during the festival and summer seasons will attract new customers. Therefore, a rise in e-commerce platforms creates a demand for used and refurbished smartphones.

- An increase in buy and sell platforms has, in turn, increased visibility and helped sellers to get the right price for their old phones. It has standardized the secondary smartphone market and has also increased competition among different players in the market.

- As e-waste that is generated from electronics, computers, smartphones, and other electronic appliances in the world is growing faster, at a rate three times faster than general waste in countries such as the US, China, Japan, Germany, India, and Australia, the market sentiments have switched over to buying refurbished smartphones, reducing the carbon footprint and recycling costs, that has gained traction among several players such as Boost Mobile, Cole's, and Phoenix Cellular. Such factors are expected to drive the market's growth during the forecast period.

- Amazon, the world's largest online retailer, has a dedicated section for refurbished devices. Customers can sell their old smartphones to Amazon in exchange for a discount on a new gadget. The business inspects them and makes any required repairs to seem and function as new. These devices are then sold in the refurbished sector. They are even backed by a vendor or manufacturer's limited warranty.

- Supply chain concerns and chip shortages are also helping to propel the refurbishing sector forward. Businesses are turning to refurbished electronics suppliers to meet this demand, which is projected to drive the refurbished electronics industry, particularly smartphones.

North America Expected to Register Significant Growth

- The growing advancements in smartphone features and the expanding scope of 5G smartphones are some of the major factors driving the growth of North America's used and refurbished smartphone market. The United States is one of the most advanced markets for smartphone vendors globally. The region has a history of developing innovative smartphones, especially with vendors like Apple, that have changed the market dynamics of the global smartphone market.

- According to GSMA, North America will surpass 1 billion 5G connections by 2022 and 2 billion by 2025, driven by continued network investments from operators and the expanding range of 5G smartphones at varying price points. By 2025, North America is expected to become the first region where 5G accounts for more than 50% of total connections.

- Refurbished smartphone sales are rising in North America, especially in the US, because of tech-enabled firms like Walmart and BestBuy. Refurbished mobile devices offer affordable choices for buyers and sellers, and they are growing in popularity due to the money they save for both parties. Local merchants also provide high-quality refurbished mobile phones at wholesale prices. With all brands available on one platform, customers can shop for their ideal smartphones and mobile phone accessories while minimizing costs. The rising popularity drives the market demand in this region for used and refurbished smartphones.

- The region is also witnessing the trend of low-end smartphones and mid-range devices, as many smartphone manufacturers believe it is more viable during the market situation affected by the COVID-19 pandemic. Although other brands and product lines are available, iPhones and premium Samsung flagship products mainly accounted for significant market shares. The changing trends can drive the region's used and refurbished smartphone market.

- North American trade-in service providers witnessed product business growth in the last few years due to companies and consumers updating and upgrading their devices due to the changes in the workplace and workforce. For instance, in February, Phobio, a trade-in service for mobile operators and consumer electronics brands, was named a trade-in provider to three new companies: Hyperion Partners, Amazon Canada, and Drone Nerds. The company approximately doubled its revenue last year, and this momentum continued as it added new businesses.

Used & Refurbished Smartphone Industry Overview

The competitive rivalry amongst the used and refurbished smartphone providers is very high, owing to the presence of various smartphone brands across the world. Some major smartphone giants, including Samsung, Huawei, Apple, Xiaomi, and OnePlus, are competing for market shares worldwide. The demand for refurbished smartphones has spiked in recent years due to the massive smartphone penetration across developing countries. This has led to an increased focus on customer acquisition and formulating distribution channels as critical strategies to maintain competitive advantage and market share.

In September 2022, Fairphone, the Dutch social enterprise building a market for ethical smartphones, started selling refurbished smartphones, Fairphone 3, New Life Edition, through its website to promote longevity in smartphones to reduce e-waste and save valuable resources.

In March 2022, the iPhone 12 and iPhone 12 Pro models were introduced to Apple's official Certified Refurbished store. A new battery, a new outer shell, authentic Apple part replacements (if necessary), and a one-year warranty are included with products purchased from Apple's Certified Refurbished store.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Trend Toward Premium Phones (Rise in Upgrade Costs)

- 5.1.2 Growing Popularity of E-commerce Platforms for Used and Refurbished Smartphones

- 5.1.3 Telecom Operators Focusing on Used Phones with Attractive Plans

- 5.2 Market Challenges

- 5.2.1 Short-term Impact of Decreasing Smartphone Sales

- 5.2.2 Impact of e-Commerce on Smartphone Sales

6 ANALYST COMMENTARY ON MARKET TRENDS AND OUTLOOK FOR NEW VS USED AND REFURBISHED SMARTPHONES

7 LANDSCAPE OF DISTRIBUTION CHANNEL - OEMs VS THIRD-PARTY VENDORS/PLATFORMS

8 IMPACT OF 5G ON USED AND REFURBISHED SMARTPHONES

9 MARKET SEGMENTATION

- 9.1 By Geography

- 9.1.1 North America

- 9.1.2 Europe

- 9.1.3 Asia-Pacific

- 9.1.4 Rest of The World

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 Samsung Electronics Co. Ltd

- 10.1.2 Apple Inc.

- 10.1.3 Amazon.com Inc.

- 10.1.4 Verizon Communications Inc.

- 10.1.5 AT&T Inc.

- 10.1.6 Reboxed Limited

- 10.1.7 NIPPON TELEPHONE INC.

- 10.1.8 Best Buy Co. Inc.

- 10.1.9 Woot Inc. (Amazon.com Inc.)

- 10.1.10 Paytm (One97 Communications)

- 10.1.11 Back Market

- 10.1.12 FoneGiant.com

- 10.1.13 Flipkart Internet Private Limited (Walmart Inc.)