|

市場調查報告書

商品編碼

1440173

內容服務平台 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Content Services Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

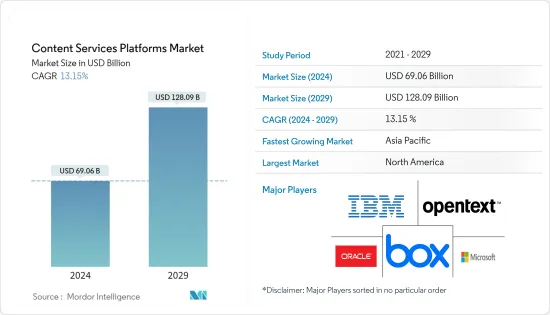

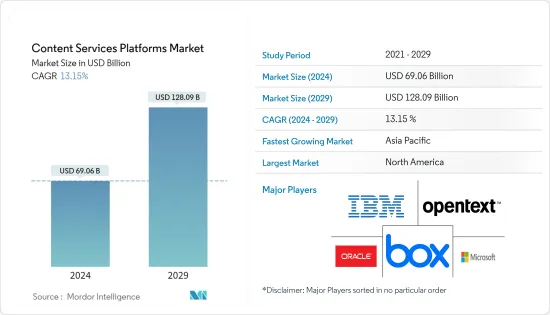

內容服務平台市場規模預計到2024年為 690.6 億美元,到2029年將達到 1280.9 億美元,在預測期內(2024-2029年)CAGR為 13.15%。

推動內容服務平台市場的主要因素包括社交、行動、分析和雲端(SMAC)技術的日益普及以及數位內容在企業中的激增。

主要亮點

- 內容服務平台(CSP)是一組整合的內容相關解決方案和工具,它們共享標準應用程式介面(API)和儲存庫以支援多個企業級內容使用。它們是傳統企業內容管理(ECM)系統的下一個演進階段。

- 許多組織走向無紙化,擁有遠端員工,或者兩者兼而有之,這使得將文件和文書工作保存在辦公室的實體文件櫃或文件箱中是不切實際的。基於雲端的文件管理系統具有節省成本的優勢。它減少了基礎設施的大量初始資本投資,並提供輕鬆的共享、可擴展性以及與第三方的整合。因此,中小企業擴大採用基於雲端的解決方案來簡化成本和營運。

- 此外,案例管理系統(也稱為客戶管理系統)可協助組織追蹤所有必要的資料,以滿足選民的需求,並向他們提供計劃和服務。醫療保健企業為各種案例管理部署整改解決方案,對全球案例管理解決方案市場的成長產生正面影響。

- 在醫療保健行業,如果組織需要遵守健康保險流通和責任法案(HIPAA),它可能希望選擇來自簽署業務夥伴協議(BAA)的供應商的案例管理系統。 BAA 在組織和供應商之間建立了有關受保護健康資訊的隱私、安全、傳輸、儲存和使用的合約協議。

- 將文件儲存在組織的共用磁碟機上不足以滿足行業合規性標準。除了法律規定之外,記錄管理策略對於組織資訊的生命週期也非常重要。組織層面的策略將控制資訊的創建、儲存、共享、追蹤和保護方式。

內容服務平台市場趨勢

本地部署模式佔據主導地位

- 預計本地部署類型將在預測期內顯著促進市場成長。 CSP 解決方案的本地部署需要組織進行初始高額投資,儘管它不需要像雲端部署類型那樣在整個所有權過程中增加成本。

- 如今,可以透過行動裝置輕鬆存取企業資料;這增加了業務方之間的資料傳輸量,並增加了網路攻擊和資料遺失的風險。因此,與客戶私有資料相關的安全性問題是選擇雲端本地部署的重要原因。此類實施在大型企業中廣泛存在。

- 例如,據Cisco Systems表示,到2022年,全球消費者 IP 流量資料量預計將達到每月 333 艾字節,年複合成長率為 27%。

- 此外,俄羅斯透過行動網際網路傳輸的資料量不斷增加。2021年,行動資料流量較上年成長131%。

- 本地部署允許使用者將解決方案保留在內部,並在對組織有意義時擴展解決方案。本地解決方案依賴基礎設施、IT 部門或其他資源,並維護和發展解決方案。本地部署意味著使用者可以成為 ECM 解決方案的內部專家,並且使用者可以輕鬆更改和增強解決方案。

- 此外,在印度等國家,對組織資訊的完整性、保密性和可取得性的威脅呈指數級成長。因此,必須致力於提供基於業務風險方法的標準化資訊安全模型,以便為客戶建立、實施、操作、監控、審查、維護和改進整體資訊安全。

亞太地區預計將獲得顯著的市場佔有率

- 在亞太地區,由於印度和中國等經濟發展中國家需要組織的資料流量不斷增加以及資料和資訊的快速成長,預計該市場將快速成長。

- 此外,隨著日本等國家人口老化和人口減少,人們對生產力和勞動力短缺的日益擔憂推動這些國家在各個領域實現數位化。此外,日本政府計劃在2026年新的日本國家檔案館大樓啟用時,對大多數公共記錄進行數位化管理,目的是防止阻礙政府發展的記錄管理問題。

- 該地區的雲端採用率快速成長,預計這將對預測期內的市場成長產生積極影響。此外,新加坡是亞太地區(APAC)雲端就緒程度最高的地區之一。在亞洲雲端運算協會(ACCA)雲端就緒指數(CRI)的最新版本中,它取代了香港的位置。此外,新加坡政府預計將在預測期內將其大部分 IT 系統轉移到商業雲端服務,以持續努力更快、更便宜地提供公民服務。預計這將對市場成長產生積極影響。

- 隨著企業試圖改善其數位計劃,公共雲端設施在該地區取得了巨大的發展勢頭。內容服務平台已成為當今公司實現更高敏捷性並滿足客戶需求的關鍵。各組織也合作最佳化實施效率並確保卓越的客戶體驗。

- 數位轉型正迅速成為多個國家的首要任務,隨著越來越多的公司實施正式策略來支持其努力,數位轉型也迅速發展。

內容服務平台產業概覽

內容服務平台市場競爭適度,由幾個主要參與者組成。目前,這些主要參與者中很少有人在市場佔有率方面佔據主導地位。內容服務平台市場的一些主要公司包括 Hyland、OpenText、Box、Laserfiche、Adobe、IBM、Nuxeo 和 Objective 等。這些在市場上佔有顯著佔有率的有影響力的參與者正致力於擴大其在國外的客戶群。這些企業利用策略協作行動來提高市場佔有率並提高獲利能力。

2022年 8月,OpenText 宣布為 Salesforce AppExchange 新增三個新解決方案。這使得 AppExchange 產品總數達到六種,並使任何規模的客戶都能從 OpenText 內容服務平台的治理、生產力和效率中受益。 OpenText Core Content 使用 SaaS 平台與 Salesforce 等程式交互,以促進現代工作,協助企業管理資訊。

2022年 6月,Box Inc. 宣佈在 Salesforce AppExchange 上增強 Box for Salesforce 整合,使客戶能夠使用 Box 作為 Salesforce 中基於簽名的流程和工作流程的內容管理解決方案。客戶可以利用 Box Sign 的功能直接從 Salesforce 發送 Box 檔案以供簽署。該版本還包括新功能和開發人員工具,使共同客戶可以輕鬆地從任何地點建立和執行協議。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 競爭激烈程度

- 替代產品的威脅

- 市場促進因素

- 越來越多採用 SMAC 技術

- 整個企業數位內容的增加

- 提供情境化使用者體驗的需求

- 市場限制

- 資料隱私和安全問題

- COVID-19 對產業影響的評估

第5章 市場細分

- 依組件

- 解決方案/軟體

- 文件和記錄管理

- 資料抓取

- 工作流程管理

- 資訊安全與治理

- 個案管理

- 其他解決方案

- 服務

- 整合部署

- 諮詢

- 支援與維護

- 解決方案/軟體

- 依部署類型

- 本地部署

- 雲端

- 依組織規模

- 中小企業

- 大型企業

- 依最終用戶行業垂直

- BFSI

- 政府和公共部門

- 醫療保健和生命科學

- 資訊科技和電信

- 運輸與物流

- 其他最終用戶行業垂直領域

- 地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- OpenText Corporation

- Box Inc.

- Oracle Corporation

- Hyland Software Inc.

- Laserfiche Inc.

- Hewlett Packard Enterprise(Micro Focus)

- Adobe Systems Inc.

- M-Files Inc.

- Newgen Software Technologies Limited

- Fabasoft AG

- Everteam SAS

- DocuWare Corporation

- Alfresco Software Inc.

第7章 投資分析

第8章 市場的未來

The Content Services Platforms Market size is estimated at USD 69.06 billion in 2024, and is expected to reach USD 128.09 billion by 2029, growing at a CAGR of 13.15% during the forecast period (2024-2029).

The major factors driving the content services platform market include the growing adoption of social, mobile, analytics, and cloud (SMAC) technologies and the proliferation of digital content across enterprises.

Key Highlights

- Content service platforms (CSP) are an integrated set of content-related solutions and tools that share standard application programming interfaces (APIs) and repositories to support multiple enterprise-level content usage. They are the next evolutionary phase of traditional enterprise content management (ECM) systems.

- Many organizations are going paperless, having remote employees, or both, making it unrealistic to keep documents and paperwork in physical filing cabinets or boxes in an office. A cloud-based document management system offers cost-saving benefits. It reduces substantial initial capital investment in infrastructure and provides easy sharing, scalability, and integration with third parties. Due to this, SMEs are increasingly adopting cloud-based solutions to streamline their costs and operations.

- Further, case management systems, also called client management systems, help an organization track all the necessary data to meet constituent needs and provide them with programs and services. Healthcare enterprises are deploying rectification solutions for a variety of case management, positively impacting the growth of the global case management solution market.

- In the healthcare industry, if an organization needs to comply with the Health Insurance Portability and Accountability Act (HIPAA), it may want to choose a case management system from a vendor that will sign a Business Associates Agreement (BAA). A BAA establishes a contractual agreement between an organization and the vendor regarding the privacy, security, transmission, storage, and use of protected health information.

- Storing files on an organization's shared drive is insufficient to meet industry compliance standards. Beyond legal mandates, records management strategy is vital to an organization's information life cycle. The strategy at an organizational level will govern how information is created, stored, shared, tracked, and protected.

Content Services Platforms Market Trends

The On-premises Deployment Mode Holds a Dominant Position

- The on-premises deployment type is anticipated to contribute to the market growth during the forecast period significantly. On-premise deployment of CSP solutions requires initial high investment by organizations, though it does not require incremental costs throughout the ownership, as in the cloud deployment type.

- Nowadays, corporate data can be accessed effortlessly from mobile devices; this has raised the amount of data transfer between business parties and has increased the risks of cyber-attacks and data losses. Therefore, security concerns associated with customers' private data are an important reason for the selection of on-premises deployment over the cloud. These kinds of implementations are widespread across large-sized enterprises.

- For instance, according to Cisco Systems, in 2022, worldwide consumer IP traffic data volume was expected to reach 333 exabytes per month at a 27% compound annual growth rate.

- Moreover, Russia's volume of data transferred via mobile internet continuously increased. In 2021, the mobile data traffic volume increased by 131% compared to the previous year.

- Deploying on-premises allows users to keep the solution in-house and grow the solution as it makes sense for the organization. An on-premises solution lives on one's infrastructure, IT department, or other resources and maintains and evolves one's solution. An on-premises deployment means one can become the in-house expert on ECM solutions, and changes and enhancements to one's solution are at the user's fingertips.

- Moreover, the threats to the integrity, confidentiality, and obtainability of organization information are increasing exponentially in countries such as India. Thus, it has become mandatory to focus on providing a standardized information security model based on a business risk approach to establish, implement, operate, monitor, review, maintain, and improve overall information security for customers.

Asia-Pacific is Expected to Gain Significant market Share

- In the Asia-Pacific region, the market is anticipated to witness rapid growth, owing to the increasing data traffic and rapidly growing data and information that needs to be organized in economically developing countries, such as India and China.

- Also, the increasing concern about productivity and shortage of labor with a greying and shrinking population in countries like Japan is driving such nations toward digitalization in every sector. In addition, the Japanese government plans to shift toward digital management of most public records by the time the new National Archives of Japan building opens in 2026, aiming to prevent the record management problems that have hindered the growth of the government.

- Cloud adoption in the region is increasing at a rapid pace, which is expected to impact the market growth over the forecast period positively. Moreover, Singapore is one of the most cloud-ready regions in Asia-Pacific (APAC). It overtook the position of Hong Kong in the latest iteration of the Asia Cloud Computing Association's (ACCA) Cloud Readiness Index (CRI). Additionally, Singapore's government is anticipated to move the bulk of its IT systems to commercial cloud services over the forecast period in ongoing efforts to deliver citizen services faster and cheaper. This is anticipated to impact the market growth positively.

- Public cloud facilities have achieved enormous momentum in the region as companies are trying to improve their digital initiatives. Content service platforms have become the essence of how companies function nowadays to attain higher company agility and meet their clients. Organizations are also collaborating to optimize implementation efficiency and ensure excellent client experience.

- Digital transformation is rapidly becoming a top priority in multiple countries and moving rapidly as a greater number of companies are implementing formal strategies to support their efforts.

Content Services Platforms Industry Overview

The Content Services Platforms Market is moderately competitive and consists of several major players. Few of these major players currently dominate the market in terms of market share. Some major companies in the Content Services Platforms Market include Hyland, OpenText, Box, Laserfiche, Adobe, IBM, Nuxeo, and Objective, among others. These influential players with a noticeable share in the market are concentrating on expanding their customer base across foreign countries. These businesses leverage strategic collaborative actions to improve their market percentage and enhance profitability.

In August 2022, OpenText announced the addition of three new solutions to the Salesforce AppExchange. This brought the total number of AppExchange offerings to six and enabled customers of any size to benefit from the governance, productivity, and efficiency of the OpenText content services platform. OpenText Core Content uses a SaaS platform that interfaces with programs like Salesforce to facilitate modern work to assist enterprises in managing information.

In June 2022, Box Inc. announced the enhancement of the Box for Salesforce integration on the Salesforce AppExchange, enabling customers to use Box as the content management solution for signature-based processes and workflows in Salesforce. Customers can send Box files for signature directly from Salesforce by utilizing the capability of Box Sign. New features and developer tools that make it simple for joint customers to establish and execute agreements from any location are also a part of this edition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Market Drivers

- 4.3.1 Increasing Adoption of SMAC Technologies

- 4.3.2 Increase of Digital Content across the Enterprises

- 4.3.3 Demand for Delivering Contextualized User Experience

- 4.4 Market Restraints

- 4.4.1 Data Privacy and Security Concerns

- 4.5 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solutions/Software**

- 5.1.1.1 Document and Records Management

- 5.1.1.2 Data Capture

- 5.1.1.3 Workflow Management

- 5.1.1.4 Information Security and Governance

- 5.1.1.5 Case Management

- 5.1.1.6 Other Solutions

- 5.1.2 Services**

- 5.1.2.1 Integration and Deployment

- 5.1.2.2 Consulting

- 5.1.2.3 Support and Maintenance

- 5.1.1 Solutions/Software**

- 5.2 By Deployment Type

- 5.2.1 On-Premises

- 5.2.2 Cloud

- 5.3 By Organization Size

- 5.3.1 Small and Medium-Sized Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry Vertical

- 5.4.1 BFSI

- 5.4.2 Government and Public Sector

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 IT and Telecom

- 5.4.5 Transportation and Logistics

- 5.4.6 Other End-user Industry Verticals

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 IBM Corporation

- 6.1.2 Microsoft Corporation

- 6.1.3 OpenText Corporation

- 6.1.4 Box Inc.

- 6.1.5 Oracle Corporation

- 6.1.6 Hyland Software Inc.

- 6.1.7 Laserfiche Inc.

- 6.1.8 Hewlett Packard Enterprise (Micro Focus)

- 6.1.9 Adobe Systems Inc.

- 6.1.10 M-Files Inc.

- 6.1.11 Newgen Software Technologies Limited

- 6.1.12 Fabasoft AG

- 6.1.13 Everteam SAS

- 6.1.14 DocuWare Corporation

- 6.1.15 Alfresco Software Inc.