|

市場調查報告書

商品編碼

1440141

系統整合商:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)System Integrators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

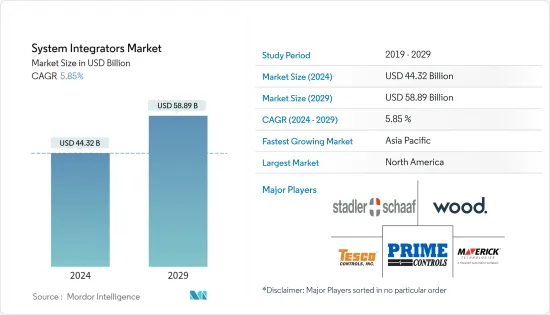

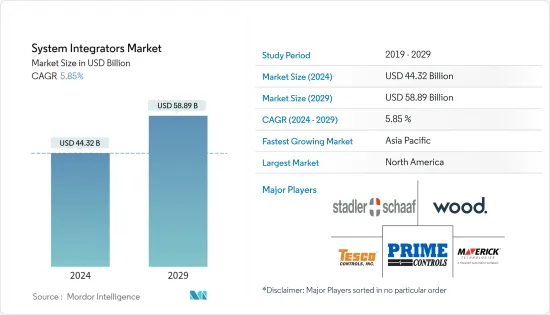

2024 年系統整合商市場規模估計為 443.2 億美元,預計到 2029 年將達到 588.9 億美元,在預測期間(2024-2029 年)以 5.85% 的複合年增長率增長。

系統整合商專注於將組件子系統組合在一起作為一個整體執行,並確保這些子系統協同工作。在當今時代,製造公司正在實施彈性製造系統 (FMS),以打破可靠性和品質之間的傳統權衡。

FMS 減少了勞動力和流程變化並提高了產品品質。 FMS 由各種生產、物料輸送和電腦控制模組組成。為此,由於需要彈性的控制軟體,系統整合商也需要能夠輕鬆地將機器與PLC系統和資料庫系統整合。

主要亮點

- 對低成本和節能生產流程的需求正在推動市場發展。就最終能源需求和溫室氣體排放而言,工業部門是最大的最終使用部門之一。系統整合商已經開展了許多與減少能源使用嚴格相關的傳統效率改進活動,例如更換馬達和安裝逆變器。然而,系統整合商還可以幫助公司透過營運最佳化來減少對環境的影響。

- 將來自生產工廠的資訊與能耗資訊和銷售點 (POS) 詳細資訊相結合,可以提供報告以幫助確定可能的優化,但將所有資訊分開是沒有好處的。 此外,通過加入系統集成商計劃,您可以獲得低成本的開發工具以及必要的培訓和支援。

- 此外,物聯網在工業自動化中的日益普及正在推動市場發展。在大多數公司中,物聯網解決方案的使用已從 IT 部門的職責轉移到營運部門,營運部門和系統整合商之間現有的關係為自動化系統整合商提供了機會。供系統整合商與 IIoT 供應商合作。

- 由於物聯網在工業自動化的應用越來越多,因此存在廣泛的市場拓展機會。大多數企業以及系統整合商和市場營運之間的現有關係為自動化系統整合商提供了許多機會。市場參與者對靈活製造供應商的需求不斷成長,也增加了系統整合商業務在未來幾年穩定成長的機會。

- 在當今技術主導的商業環境中,巨量資料已成為製造商提高生產力和效率的關鍵驅動力之一。互聯設備和感測器的高採用率以及 M2M通訊的可用性顯著增加了製造業中產生的資料點數量。

- 然而,由於COVID-19感染疾病,由於製造業和基礎建設的停頓,2020年上半年市場成長較2019年大幅放緩。 COVID-19感染疾病讓石油和天然氣產業措手不及,使其對形勢的巨大變化措手不及。隨著非石油輸出國組織(OPEC)成員國的原油出口國最初打開水龍頭,油價大幅下跌。

SIer市場趨勢

工業物聯網 (IIoT) 的進展

- 透過實施工業物聯網等自動化技術,發電廠操作員可以收集即時資料並遠端監控設備,以提高生產效率並發現未來的問題。渦輪機、往復式引擎、太陽能電池和電池板可以有效運作。配電系統可提高運作、降低成本、改善資料收集、改善警報和監控系統,並實現自主問題解決。

- 工業物聯網正在推動工廠的更高水準的連接,特別是在機器人自動化系統中。這種連接性顯著提高了生產力並增加了自動化設備的投資收益。

- 工業自動化技術的日益普及,尤其是在中國和印度,也促進了市場的成長。主要電子合約製造商已經開始實現業務自動化。大型電池製造設施也在建設中,以滿足電動和混合動力汽車日益成長的需求。工業自動化需求預計將擴大系統整合商市場。

- 此外,2022 年 6 月,加速運算技術的領導者 READY Robotics 宣布對軟體定義自動化領域的先驅 Robotics 進行策略性投資。幾十年來,機器人供應商之間的軟體孤島限制了製造業。標準介面打破了這些障礙,簡化了企業的部署,大大拓展了自動化產業的市場機會。

- SCADA 系統是工業流程的基礎,可協助組織滿足現代需求。例如,橫河馬達致力於發展SCADA,以實現SCADA應用的高性能、高可用性、廣泛的擴充性和平台獨立性。因此,組織可以受益於橫河馬達的SCADA軟體(Fast/Tools)、全面且完全整合的SCADA應用套件以及橫河馬達的強大功能和彈性。預計各行業將擴大採用此類工具將推動全球對系統整合商的需求。

- 此外,工業物聯網的採用是一個成熟的過程,隨著公司從基本的機器連接轉向分析、自動化和邊緣運算等先進方法,公司將獲得越來越多的好處。隨著組織意識到採用 IIoT 的好處越來越大,73% 的技術採用者預計他們的投資將在未來 12 個月內增加,其中石油和天然氣領域以運輸和製造業主導。用戶期望未來幾年的持續投資能夠進一步實現自動化和即時監控等業務優先事項。

北美佔有很大的市場佔有率

- 預計北美將在整個系統整合商市場中佔據很大佔有率。該地區人才緊缺,熟練複雜流程的人才價格昂貴。因此,公司正在提高製造工廠的自動化程度。

- 由於技術進步,北美在工業自動化市場具有較高的競爭力,而美國是接受先進技術進行工業運作的已開發國家。隨著 5G 無線技術變得越來越廣泛,自動化解決方案在各行業中變得越來越普及。此外,隨著擴增實境(AR)和虛擬實境(VR)需求的增加,工業自動化和物聯網市場也不斷擴大。

- 2022 年 3 月,歐姆龍自動化美洲公司宣布將 RAMP Inc. 加入其認證系統整合商計畫中。 RAMP 是一家創建客自訂自動化和機器人系統的技術開發公司。這將使客戶能夠利用工業物聯網來改造他們的工廠並安全有效地整合機器人技術。

- 此外,該地區機器人技術的使用正在增加。全球通用機器人解決方案先驅 Flexiv 與主要企業Cardinal Machine 於 2023 年 5 月宣佈建立新的合作夥伴關係。 Flexiv 為 Cardinal 提供業界領先的力敏感度和人工智慧。現在可以完全自動化以前需要手工勞動的任務,例如拋光、拋光、堆疊和精密組裝。

系統整合商行業概況

由於存在不同的國家、地區和國際參與者,系統整合商市場變得分散。而且,球員的收購建立了較高的市場競爭力。主要參與者包括 John Wood Group Plc、Tesco Controls Inc.、Prime Controls 和 LP。 o 為了維持市場競爭力,頂尖公司與各種創造性產品競爭。為了滿足不同行業的需求,市場主要企業正在使用不同的方法。合作、合作和收購是市場的兩大發展策略。

- 2023 年 6 月 - OSARO SightWorks 是支援機器學習的電子商務機器人領域的先驅,現已向系統整合商和第三方物流公司 (3PL) 開放,為履約業務提供獨特的解決方案。這包括揀選、卸棧、開機、配套和其他自動化作業。透過執行此活動,解決方案供應商可以為其客戶的系統提供新的提高生產力的功能。此外,OSARO 在爆炸性成長的電子商務領域的影響力也將顯著擴大。

- 2022 年 1 月 - Proud Automation 成為北美行動工業機器人 (MiR) 認證系統整合商。 RG 集團子公司 Proud Automation 被北美領先的自主移動機器人和移動工業機器人 (MiR) 製造商指定為認證系統整合商。此外,MiR AMR 的採用正以驚人的速度加速,企業已做好滿足客戶需求的準備。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

第5章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間敵對的強度

- 促進因素

- 數位轉型和工業 4.0 舉措

- 抑制因素

- 自動化實施和維護需要大量投資

- 評估 COVID-19 對市場的影響

第6章市場區隔

- 依最終用戶產業

- 油和氣

- 車

- 航太和國防

- 衛生保健

- 能源和電力

- 化學和石化

- 其他

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- John Wood Group

- TESCO CONTROLS, INC.

- STADLER+SCHAAF

- Prime Controls, LP

- MAVERICK Technologies, LLC

- Adsyst Automation Ltd.

- George T. Hall Company

- Avanceon Ltd.

- Wunderlich-Malec Engineering, Inc.

- Burrow Global, LLC

第8章投資分析

第9章市場的未來

The System Integrators Market size is estimated at USD 44.32 billion in 2024, and is expected to reach USD 58.89 billion by 2029, growing at a CAGR of 5.85% during the forecast period (2024-2029).

System Integrators specialize in conducting component subsystems together into a whole and ensuring that those subsystems function together. In today's era, manufacturing companies are introducing Flexible Manufacturing Systems (FMS) to break the classic trade-off between dependability and quality.

FMS reduces labor and process variability, improving the quality of the product, and consists of various production, material handling, and computer control modules. This further demands system integrators where the requirement of highly flexible control software makes it simple to integrate the machines with a system such as the PLC system and database.

Key Highlights

- The demand for low-cost and energy-efficient production processes drives the market. The industry sector is one of the largest end-use sectors in terms of final energy demand and greenhouse gas emissions. System integrators have been involved in many traditional efficiency improvement activities like a motor replacement, inverters installation, etc., which are strictly related to energy usage reduction. But system integrators can also help a company reduce its environmental impact through operations optimization.

- Connecting the information coming from the production plant and then crossing them with energy consumption information and point-of-sale (POS) details can provide reports that can help identify possible optimizations, whereas having all the information separate could not have been enlightening. Further, one can expect low-cost development tools and the necessary training and support by participating in the system integrator program.

- Further, the growing use of IoT in industrial automation drives the market. The automation systems integrators are equipped with opportunity because, in most businesses, the usage of IoT solutions is shifted from being handled by the IT department to operations, and due to an existing relationship between operations and system integrators, it will, therefore, be easy for systems integrators to cooperate with IIoT vendors.

- Due to the increasing use of the Internet of Things in industrial automation, there will be a wide range of opportunities for market expansion. The vast majority of businesses as well as the already-existing relationship between system integrators and market operations offer automation systems integrators a plethora of opportunity. The market players' growing need for flexible manufacturing suppliers also increases the likelihood that the system integrator business will grow favorably over the next years.

- In the current business environment, which is technology-driven, Big Data stands as one of the primary drivers of manufacturers' productivity and efficiency. With the high rate of adoption of connected devices and sensors and the enabling of M2M communication, there has been a massive increase in the data points generated in the manufacturing industry.

- However, with the COVID-19 pandemic, there is a significant market slowdown in the first half of 2020 due to the stoppage of manufacturing units, infrastructure construction, etc., compared to the 2019 growth. The COVID-19 pandemic caught the oil and gas industry off guard, leaving them unprepared for a drastically altered landscape. Countries exporting crude oil but not members of the Organization of Petroleum Exporting Countries (OPEC) initially opened the taps, causing oil prices to fall dramatically.

System Integrators Market Trends

Advancement of the Industrial Internet of Things (IIoT)

- Implementing automation technologies such as IIoT enables power plant operators to collect real-time data and remotely monitor equipment to improve production efficiency and detect future problems. Running turbines, reciprocating engines, and solar cells/panels efficiently are possible. Power distribution systems improve uptime, lower costs, improve data collection, improve alarm and monitoring systems, and enable autonomous problem resolution.

- The IIoT is driving higher levels of connectivity in factories, especially in robotic automation systems. This connectivity enables significant productivity improvements and enhances return on investment in automation equipment.

- The increased adoption of industrial automation technologies, particularly in China and India, has also contributed to market growth. Major electrical product contract manufacturers have already begun to automate their operations. Massive battery manufacturing facilities are also being built to meet the growing demand for electric and hybrid vehicles. The need for industrial automation is expected to bolster the system integrator market.

- Furthermore, in June 2022, READY Robotics, the leader in accelerated computing technology, announced a strategic investment in Robotics, the pioneers in software-defined automation. For decades, software silos between robot vendors have constrained manufacturing. It has broken down those barriers with a standard interface that simplifies enterprise deployment and significantly expands the market opportunity for the automation industry.

- SCADA systems are at the root of industrial processes, assisting organizations in meeting modern demands. Yokogawa, for example, focuses on SCADA evolution to deliver high performance, high availability, broad scalability, and platform independence in their SCADA applications. As a result, organizations benefit from Yokogawa's SCADA software (Fast/Tools), a comprehensive, fully-integrated SCADA application suite, and the company's power and flexibility. Increasing adoption of such tools across industries is anticipated to boost the global demand for system integrators.

- Further, the adoption of industrial IoT is a maturation process in which businesses gain increasing levels of benefit as they progress from basic machine connectivity to advanced approaches such as analytics, automation, and edge computing. As organizations realize the growing benefits of implementing IIoT, 73% of technology adoption expect their investment to increase in the next 12 months, with transportation and manufacturing leading O&G. Users anticipate increased achievement of business priorities such as automation and real-time monitoring as a result of this ongoing investment over the coming years.

North America to Hold a Significant Market Share

- North America is anticipated to hold a significant share of the overall system integrator market. Human resources are scarce in the region, and skilled resources for complex processes are expensive. As a result, companies have increased automation in their manufacturing plants.

- Due to technological advancements, North America has been highly competitive in the industrial automation market, with the United States being a developed country that accepts advanced technologies for industrial operations. Automation solutions across industries are becoming more prevalent as 5G wireless technology becomes more widely available. Furthermore, as demand for augmented reality (AR) and virtual reality (VR) grows, the industrial automation and IoT markets are expanding.

- In March 2022, Omron Automation Americas announced that it had added RAMP Inc. to its Certified System Integrator plan. RAMP is a technology development firm that creates custom automation and robotic systems. It enables customers to use IIOT to transform their factories and integrate robotics safely and effectively.

- Additionally, the region is witnessing a rise in the use of robotic technologies. For Flexiv, a global pioneer in general-purpose robotics solutions, and Cardinal Machine, a major player in machine building and systems integration, announced their new collaboration in May 2023. Flexiv will give Cardinal the tools necessary to implement robotic systems that make use of industry-leading force sensitivity and AI. It will be possible to fully automate operations like sanding, polishing, palletizing, and delicate assembling that would traditionally need manual labor.

System Integrators Industry Overview

The system integrator market is fragmented as various local, regional, and international players exist. Further, the players' acquisition is setting high market competitiveness. The key players are John Wood Group Plc, Tesco Controls Inc., Prime Controls, and LP. o stay competitive in the market, the top firms compete with a variety of creative goods. To meet demand originating from diverse industries, the market's top players are using a variety of methods. In the market, partnerships, collaborations, and acquisitions are the two main development tactics.

- June 2023 - OSARO SightWorks, a pioneer in machine learning-enabled robotics for e-commerce, is now accessible to system integrators and third-party logistics companies (3PLs) that provide distinctive solutions for fulfillment operations. This includes picking, depalletizing, induction, kitting, and other automated jobs. By taking this activity, solution providers can give clients' systems new capabilities that increase productivity. Additionally, it significantly expands OSARO's reach in the explosively growing e-commerce sector.

- January 2022 - Proud Automation has been added to North America's Mobile Industrial Robots (MiR) certified system integrators. Proud Automation, an RG Group subsidiary, has been named a Certified Systems Integrator by North America's leading manufacturer of autonomous mobile robots and Mobile Industrial Robots (MiR). Furthermore, the adoption of MiR AMRs is accelerating at an incredible rate, and companies are poised to meet customers' demands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Industry Attractiveness - Porter's Five Forces Analysis

- 5.2.1 Threat of New Entrants

- 5.2.2 Bargaining Power of Buyers/Consumers

- 5.2.3 Bargaining Power of Suppliers

- 5.2.4 Threat of Substitute Products

- 5.2.5 Intensity of Competitive Rivalry

- 5.3 Drivers

- 5.3.1 Digital Transformation and Industry 4.0 initiatives

- 5.4 Restraints

- 5.4.1 Requirement of High Investments for Automation Implementation and Maintenance

- 5.5 Assessment of the COVID-19 Impact on the Market

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Oil and Gas

- 6.1.2 Automotive

- 6.1.3 Aerospace and Defense

- 6.1.4 Healthcare

- 6.1.5 Energy & Power

- 6.1.6 Chemical and Petrochemical

- 6.1.7 Others

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 John Wood Group

- 7.1.2 TESCO CONTROLS, INC.

- 7.1.3 STADLER + SCHAAF

- 7.1.4 Prime Controls, LP

- 7.1.5 MAVERICK Technologies, LLC

- 7.1.6 Adsyst Automation Ltd.

- 7.1.7 George T. Hall Company

- 7.1.8 Avanceon Ltd.

- 7.1.9 Wunderlich-Malec Engineering, Inc.

- 7.1.10 Burrow Global, LLC