|

市場調查報告書

商品編碼

1690140

社交機器人:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Social Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

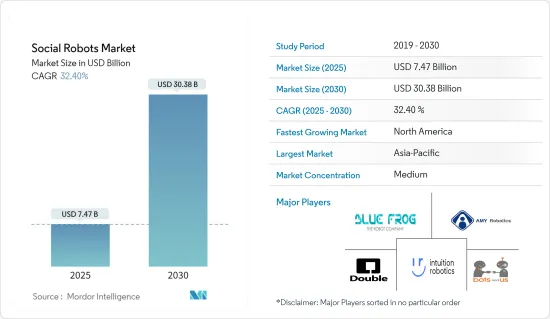

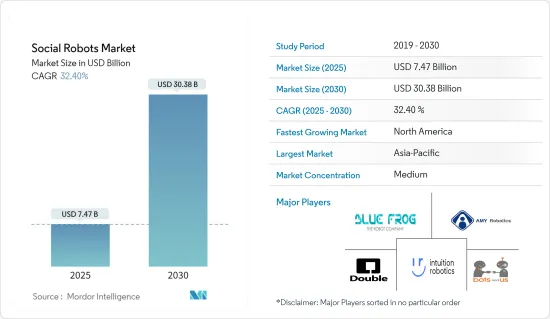

2025年社交機器人市場規模估計為74.7億美元,預計到2030年將達到303.8億美元,市場估計和預測期(2025-2030年)的複合年成長率為32.4%。

隨著先進技術在各個行業和應用中越來越廣泛的應用,機器人和自動化在保障人類安全以及實現人類與機器人共存方面發揮關鍵作用。

主要亮點

- 社交機器人與人類緊密合作,因此它們對使用者做出反應並適應其不斷變化的行為。多年來,感測器、致動器和功能的顯著改進使得人類能夠透過面部表情、眼神交流和對話自然地與機器人互動。由於這些廣泛的改進,人們對在醫療產業實施社交機器人的興趣日益濃厚。例如,與自閉症兒童與機器人互動相比,機器人的模仿、眼神接觸等社交行為對自閉症治療產生了正面的影響。

- 人們對老年人照護和關注的日益關注,以及不斷擴大的勞動力和勞動力需求,正在影響社交機器人的採用。例如,日本政府預計未來幾年將減少約38萬名技術工人,並已資助老年護理機器人的開發。此外,根據世界銀行的數據,未來幾年全球22%的人口可能年齡在60歲或以上。相關機器人的需求只會增加,使社交機器人成為一個利潤豐厚的市場。

- 在學習中使用機器人對於課堂互動來說是理想的。這是因為機器人增強了社交互動並鼓勵幼兒共同努力。與機器人一起玩耍和學習也為殘疾學生帶來了額外的好處。社交機器人行為的開發是為了改善即時通訊並提高機器人和人類用戶之間的可用性。

- 社交機器人經過編程,可以透過人類觀察和演示機器人周圍環境的行為來學習導航。該機器人配備感測器和攝影機來感知環境,並配備路徑規劃系統來計算可行路徑以實現導航目標。因此,這些社交機器人提供的幫助和指導是對機器人在周圍環境中所看到事物的模擬,並模仿同一個人類的行為。

- 此外,社交機器人的主要目的是與人類互動,而不是執行體力任務。隨著疫情的升級,社交機器人的潛在角色日益顯現。社交機器人的需求正在成長,因為它們透過提高人們對幾種常見疾病的認知和早期診斷來幫助減輕社會負擔,在某些情況下,這些疾病直到為時已晚才被診斷出來。

- 隨著人們擴大在各種教育和醫療保健業務中採用機器人,COVID-19 疫情對市場的成長做出了重大貢獻。此外,這些機器人不易感染任何疾病,因此可以安全地用於與傳染病患者融合。因此,預計未來五年社交機器人的需求將穩定成長。

社交機器人市場趨勢

醫療保健產業佔很大市場佔有率

- 社交機器人可以透過減少孤獨感、與醫生協調、監測活動和支持看護者來協助養老院。 2021年2月,維克基金會與曼尼托巴研究中心合作,啟動了一個新的遠端臨場機器人計劃,以盡量減輕看護者的負擔並失智症患者提供支持。

- 2021年7月,《2021年家庭護理選擇法案》在美國提出,得到了廣泛的居家醫療相關人員和消費者團體的支持,其中包括全國居家照護和臨終關懷協會、優質居家照護夥伴關係、 LeadingAge、美國退休人員協會和全國老齡委員會。

- 根據世界衛生組織預測,2030年,神經系統疾病患者人數將增加至1.03億,增幅約12%。神經病變的增加促進了復健機器人的發展。這種機器人可以確保在復健訓練中每次都重複相同的動作,訓練大腦獨立於肌肉活動。根據IBEF預測,到2025年,政府在醫療保健方面的支出佔GDP的比例將達到2.5%。

- 2022 年 8 月,新罕布夏大學研發部門獲得美國國立衛生研究院 (NIH) 為期五年、總額為 280 萬美元的津貼,用於測試和開發一種社交輔助機器人,以便在舒適的家中照顧阿茲海默症和相關失智症患者。例如,如果患者未能及時服藥,放置在藥瓶附近的感測器將追蹤患者未服用藥物的動作,並向輔助機器人發出警報。然後機器人會用口頭提醒患者。經過幾次嘗試後,機器人將向遠端人類看護者發出警報,如果患者不遵守服藥規定,看護者可以介入。

預計北美將實現強勁成長

- 疫情期間消費行為的快速變化導致北美對數位化和自動化的依賴增加,加速了機器人自動化的發展。庫卡集團 (KUKA AG) 等在該領域營運的公司也見證了類似的趨勢,有助於推動北美地區社交機器人的發展。

- 此外,人工智慧、增強智慧等新興技術在終端用戶領域的發展也為社交機器人的應用創造了新的機會。

- 各個地區的教育機構都在採用社交機器人,因為它們有助於吸引學生。近日,總部位於美國的輔導機器人供應商 Van Robotics 宣布,其機器人業務遍及美國30 個州,兩所查爾斯頓縣學區 (CCSD) 學校的學生正在使用 8 台 Abii 機器人。

- 該機器人旨在透過一對一輔導來幫助1至6年級的學生。每個學生都有自己獨特的登入名,機器人會提供個人化指導。此外,該機器人還可以感知注意力並透過跳舞或唱歌來幫助孩子集中注意力。機器人幫助學生贏得了關注,並提高了同儕對自己的感覺。

- 由於人口滿足社會需求的需求正在快速成長,該地區人口老化也給醫療保健環境帶來了壓力。根據美國人口普查局的數據,2020年老齡人口比例為16.9%,預計未來幾年將達到22%。根據加拿大政府預測,未來幾年加拿大老年人口數將超過950萬,佔加拿大總人口的23%。

社交機器人產業概況

社交機器人市場競爭激烈。市場規模龐大,種類繁多,集中度較高。市場的主要參與者包括 Blue Frog Robotics SAS、Haapie SAS、Double Robotics Inc.、AoBo Information Technology、Wonder Workshop Inc.、Amy Robotics、MoviaRobotics Inc. 和 BotsAndUs Ltd.。

- 2022 年 5 月:Intuition Robotics 與紐約州合作,在 800 多名老年人的家中部署了 ElliQ,這是一款旨在幫助老年人保持獨立的社交機器人。 ElliQ 最初的設計目的是提供陪伴和緩解孤獨。從那時起,ElliQ 在其產品中融入了許多其他有用的功能。它具有許多通訊功能,可幫助您與親人保持聯繫,還有支持您的健康和保健的功能,幫助您實現目標。

- 2022 年 3 月:Intuition Robotics 與 Uber Health、Mayo Clinic 和 Silver Sneakers 合作,使護理機器人對老齡化人口更有用。用戶可以告訴 ElliQ 他們感覺不舒服或要去銀行,它會整天追蹤他們的情況,直到第二天。 Intuition Robotics 表示,ElliQ 提供了一種替代形式的伴同性,以補充傳統的面對面支持。與其他語音控制的社交機器人設備不同,ElliQ 專門設計用於支援老年人在家中獨立生活。當其他技術回應指令時,ElliQ 會主動提案活動、發起對話,並透過人工智慧幫助建立背景並參與建立聯繫的後續對話。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19對社交機器人市場的影響

第5章市場動態

- 市場促進因素

- 創新預算和撥款的可用性推動了採用

- 高平均薪資鼓勵企業領導者實現自動化

- 市場挑戰

- 演算法偏見的複雜性

- 對長期承諾和意外後果的擔憂

第6章市場區隔

- 按最終用戶產業

- 衛生保健

- 教育

- 娛樂

- 零售

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章競爭格局

- 公司簡介

- Blue Frog Robotics SAS

- Amy Robotics Co. Ltd

- Double Robotics Inc.

- Intuition Robotics Ltd

- BotsAndUs Ltd

- AoBo Information Technology Co. Ltd

- MoviaRobotics Inc.

- Haapie SAS

- OhmniLabs Inc.

- KOMPAI Robotics

- SZ DJI Technology Co. Ltd

- Embodied Inc. AB

- Wonder Workshop Inc.

- Hanson Robotics Ltd

- Furhat Robotics AB

- Bionik Laboratories Corp.

- AlterG Inc.

- Motorika USA Inc.

- Blue Ocean Robotics ApS

- Matia Robotics(US)Inc.

- Camanio AB

- Kinova Inc.

- Inrobics Social Robotics SLL

第8章投資分析

第9章:市場的未來

The Social Robots Market size is estimated at USD 7.47 billion in 2025, and is expected to reach USD 30.38 billion by 2030, at a CAGR of 32.4% during the forecast period (2025-2030).

As the world is increasingly moving toward advanced technology adoption across a range of sectors and applications, robotics and automation play a crucial role in safeguarding people while enabling them to co-exist with robots.

Key Highlights

- Social robots work closely with humans; hence, they respond to the users and adapt to changing behaviors. Over several years, the massive improvements in sensors, actuators, and abilities have allowed humans to naturally interact with robots through facial expressions, eye contact, and conversation. As a result of the massive improvements, there has been a rise in interest in deploying social robots in medical industries. For instance, the behaviors of social robots, including imitation, and eye gaze, have impacted autism therapy positively compared to children with autism interacting with the robots.

- Increasing concerns about the attention and care offered to the elderly and the expanding need for workforces and labor have influenced the adoption of social robots. For instance, the Government of Japan anticipated a decline of specialized workers of about 380,000 in the next few years and has been funding the development of eldercare robots. Furthermore, according to the World Bank, 22% of the world population may be older than 60 in the next few years. The demand for allied robots is only going to increase, thus making social robots a lucrative market.

- Using robotics in learning is ideal for classroom interaction, as it improves social interaction and encourages collaboration among young children. Playing and learning with robots also offer additional benefits for students with disabilities. Social robot behaviors are developed to improve real-time communication and facilitate user-friendliness between robots and human users.

- Social robot navigation is programmed to learn from human observations or demonstrations of behavior around them. Robots are equipped with sensors and cameras that allow them to perceive the environment and a path-planning system to compute a feasible route to achieve the navigation goal. Hence, the assistance or guidance these social robots offer is a simulation of what they see around them and mimics the same human behavior.

- Additionally, the primary purpose of a social robot is not to perform physical tasks but to interact with humans. As epidemics escalate, the potential roles of social robots are becoming increasingly apparent. The demand for social robots is increasing as they help reduce strain on society through growing awareness and access to early diagnosis of multiple common diseases that, in some cases, can go undiagnosed until it's too late.

- The COVID-19 pandemic significantly contributed to the market growth as people increasingly adopt robots for various educational and healthcare tasks. Moreover, as these robots are prone to any diseases, they can be safely used for integrating with patients having contagious diseases. As such, the demand for social robots is anticipated to robust growth over the next five years.

Social Robots Market Trends

Healthcare Sector to Hold Significant Market Share

- Social robots assist care homes by reducing loneliness, connecting with doctors, monitoring activities, and supporting caregivers. In February 2021, Vic Foundation partnered with Research Manitoba for a new telepresence robot project to minimize the burden on these caregivers and support individuals living with dementia.

- In July 2021, Choose Home Care Act of 2021 was introduced by the Senate in the United States with support from a broad range of stakeholders in-home health care and consumer organizations, including the National Association for Home Care and Hospice, the Partnership for Quality Home Health Care, LeadingAge, AARP, the National Council on Aging, among others.

- According to WHO, neurological disorders are projected to increase to 103 million in 2030, approximately a 12% increase. The increase in neurological disorders is leading to the growth of rehabilitation robots. Such robots ensure the movement in rehabilitation exercises is repeated in the same way each time, training the brain to enable muscles to carry out the activities alone. By 2025, the government healthcare expenditure as a share of GDP is said to reach 2.5%, according to the IBEF.

- In August 2022, Researchers at the University of New Hampshire received a five-year grant totaling USD 2.8 million from the NIH (National Institutes of Health) to test and develop social assistive robots to aid in the care of individuals with Alzheimer's disease and related dementia in the comfort of their own homes. For instance, if a patient does not take the medication in time, a sensor strategically placed by their pill bottle would track the lack of movement, indicating the patient did not take their medicine and alert the assistive robot. The robot would then initiate a vocal reminder to the patient. After a few attempts, the robot would alert a remote human caregiver who could intervene if the patient did not respond by taking their medicine.

North America to Witness Significant Growth

- With the rapid shift in consumer behavior during the pandemic, there is a lot of dependence on digitization, and automation in North America, resulting in the acceleration of robotic automation. The companies operating in this sphere, such as KUKA AG, also witnessed similar trends, propelling social robots' growth in the North American region.

- In addition, the growth in advanced technologies, such as artificial intelligence, augmented reality, and others, in different end-user verticals also creates new opportunities for adopting social robots.

- The adoption of social robots has been witnessed in various regional educational institutions as they help capture students' attention. In recent times, Van Robotics, a US-based provider of tutoring robots that provides its robots in 30 states in the United States, announced that students are using eight Abii robots at two Charleston County School District (CCSD) schools.

- The robots are designed to help students in grades 1 through 6 through one-on-one intervention. Students each get a unique login, and the robots provide personalized instruction. Moreover, the robots detect attention spans and refocus children by dancing and singing. The robots have helped gain students' attention and make them feel better as companions.

- The aging population in the region is also putting strain on the healthcare setting due to the rapidly growing demand from the public to keep up with societal needs. According to the United States Census Bureau, the share of the old-age population accounted for 16.9% in 2020 and is expected to reach 22% in the next few years. Also, according to the Canadian government, seniors in Canada will number over 9.5 million in the next few years and makeup 23% of Canadians.

Social Robots Industry Overview

The social robots market is very competitive in nature. The market is highly concentrated due to the presence of various small and large players. Some of the significant players in the market are Blue Frog Robotics SAS, Haapie SAS, Double Robotics Inc., AoBo Information Technology Co. Ltd, Wonder Workshop Inc., Amy Robotics Co. Ltd, MoviaRobotics Inc., BotsAndUs Ltd, and many more.

- May 2022: Intuition Robotics partnered with the NY State Office to put ElliQ, a social robot designed to help older adults gain independence, in the homes of more than 800 older adults. ElliQ was initially intended to help with companionship and loneliness. Later, a lot of other sorts of helpful features were built into the ElliQ product. Lots of communication features to help people stay connected to their loved ones and health and wellness so they can achieve their goals.

- March 2022: Intuition Robotics collaborates with Uber Health, Mayo Clinic, and Silver Sneakers to make care robots more helpful for users aging in place. The users can tell ElliQ that they are not feeling well or going to the bank and can follow up throughout the day and tomorrow. According to Intuition Robotics Inc., ElliQ offers another form of companionship, supplementing traditional, in-person support. Unlike other voice-controlled social robot devices, ElliQ is explicitly made to support independence at home for older adults. While other technologies are reactive to commands, ElliQ proactively suggests activities and initiates conversations, building context through AI (artificial intelligence) to inform follow-up conversations that create a sense of relationship.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Social Robots Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Availability of Innovation Budgets and Subsidies to Drive the Adoption

- 5.1.2 High Average Wages Encouraging Business Leaders to Opt for Automation

- 5.2 Market Challenges

- 5.2.1 Complexity Pertaining to Algorithmic Bias

- 5.2.2 Concern Related to Long-term Engagement and Unintended Consequences

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Healthcare

- 6.1.2 Education

- 6.1.3 Entertainment

- 6.1.4 Retail

- 6.1.5 Others End-user Verticals

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Blue Frog Robotics SAS

- 7.1.2 Amy Robotics Co. Ltd

- 7.1.3 Double Robotics Inc.

- 7.1.4 Intuition Robotics Ltd

- 7.1.5 BotsAndUs Ltd

- 7.1.6 AoBo Information Technology Co. Ltd

- 7.1.7 MoviaRobotics Inc.

- 7.1.8 Haapie SAS

- 7.1.9 OhmniLabs Inc.

- 7.1.10 KOMPAI Robotics

- 7.1.11 SZ DJI Technology Co. Ltd

- 7.1.12 Embodied Inc. AB

- 7.1.13 Wonder Workshop Inc.

- 7.1.14 Hanson Robotics Ltd

- 7.1.15 Furhat Robotics AB

- 7.1.16 Bionik Laboratories Corp.

- 7.1.17 AlterG Inc.

- 7.1.18 Motorika USA Inc.

- 7.1.19 Blue Ocean Robotics ApS

- 7.1.20 Matia Robotics (US) Inc.

- 7.1.21 Camanio AB

- 7.1.22 Kinova Inc.

- 7.1.23 Inrobics Social Robotics SLL