|

市場調查報告書

商品編碼

1440132

採購軟體:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Procurement Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

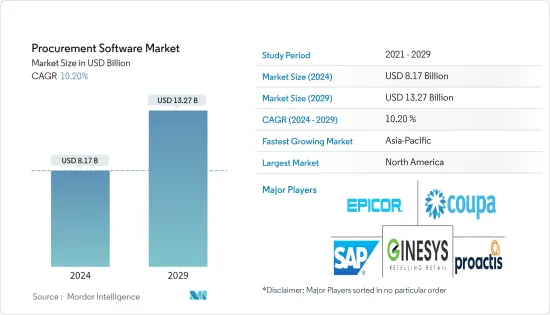

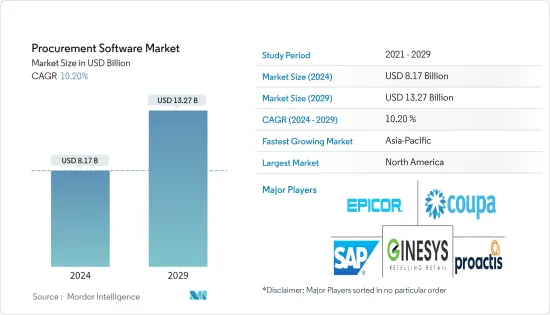

採購軟體市場規模預計2024年為81.7億美元,預計到2029年將達到132.7億美元,在預測期內(2024-2029年)年複合成長率為10.20%。

軟體公司越來越關注需求技術,並重新探索為客戶服務的創新方式。推動採購軟體行業的主要因素是人工智慧等開發技術的日益整合,這有助於高品質的報告和保持準確性的功能。

主要亮點

- 隨著採購程序自動化的需求不斷增加,電子採購技術的成熟預計將為預測期內的市場成長開闢新的途徑。此外,防止重複記錄的需求預計將在未來幾年推動採購軟體產業的成長。此外,政府政策的落實也有利於市場的開拓。跨境外貿流量的增加將進一步加快市場進步。供需因素之間的市場協同效應預計將影響未來的市場成長。

- 人們越來越希望自動化採購業務以提高效率並節省時間。它還可以將負責人從耗時且不必要的任務中解放出來,從而加快流程。採購流程的自動化變得越來越普遍,特別是在採購申請、採購訂單、申請管理、供應商管理和合約核准方面。

- 電子採購軟體可協助組織整合和自動化整個採購流程。 ERP 透過加快採購流程、騰出時間專注於其他業務以及透過將電子採購工具與 ERP 解決方案相連接來實現更有效的業務,從而使供應商管理變得更加輕鬆。Masu。除此之外,ERP 解決方案還支援改善業務報告、更好的客戶服務、降低庫存成本、增加現金流量、節省成本、資料和雲端安全性以及供應鏈管理。這些因素推動市場擴張。

- 由於許多組織缺乏運作遺留系統所需的基礎設施,預計軟體採購市場在預測期內將面臨挑戰。相反,缺乏熟練的勞動力阻礙了市場的成長。

- 新冠肺炎 (COVID-19) 危機給多個行業帶來了挑戰,並導致技術支出減少。該公司仍在適應新的 COVID-19 經濟,包括新的內部物流,例如在家工作和建立基礎設施以滿足新需求。供應鏈中斷、需求佔有率波動、經濟形勢以及 COVID-19 的直接和長期影響對採購軟體市場的成長產生了負面影響。

採購軟體市場趨勢

零售業預計將佔據重要市場佔有率

- 零售業預計將佔據很大佔有率。競爭的加劇、報酬率的下降和品牌忠誠度的下降迫使零售商尋求新的方法來保持盈利和競爭力。零售企業領導者越來越依賴採購團隊來降低成本、降低供應風險並創造更多價值。這使得採購軟體在零售業得以實施。

- 採購軟體可協助零售商整合業務流程並提高其業務的整體價值。這有助於提高財務供應鏈和合約細節的透明度,以建立申請來完成付款。據印度零售商協會稱,預測期內印度零售市場規模預計約為1.7兆美元。因此,採購服務在預測期內有巨大的需求來推動其成長。

- 此外,採購軟體工具允許零售商自動化採購任務,並透過競標從供應商獲得最佳價格,這使得零售商採購大量商品變得至關重要。透過實施採購軟體解決方案,公司可以與供應商協作、追蹤事件並獲取警報,並分析商業智慧資料以深入了解採購流程,以進行預測和規劃。

- 此外,該技術透過整合供應鏈和促進庫存管理,簡化了需求和銷售預測的決策流程。它還具有營運成本最低、營運效率更高等優勢,預計在未來幾年加快零售業市場的成長速度。

- 例如,Ginesy 等公司提供使用者友善的 POS 軟體,支援快速申請功能。它還提供了一種快速、簡單的申請方法,具有持續的資料同步功能。被印度頂級零售公司使用,使其成為印度最好的 POS 軟體。

北美佔最大市場佔有率

- 對集中採購流程的需求不斷成長導致北美在全球佔據主導地位。此外,該地區成立的公司的整合預計將推動未來市場的成長。根據 Business.org 統計,該生態系統中排名前 20 的Start-Ups均位於北美。例如,奧斯汀和德克薩斯擁有超過 5,500 家Start-Ups以及 Facebook、Google 和 Apple 等大型科技公司。這將顯著增加軟體採購的需求。

- 美國正大力尋求提高生產力和加強製造業,重點是改善國內工業部門供應鏈的活動。北美零售市場的電子零售商熱衷於透過涵蓋當日配送來改善客戶體驗,而這可以透過有效的供應鏈管理來有效實現。

- 此外,自動化文件建立和合約起草流程可顯著簡化合約生命週期,與新的採購軟體趨勢保持一致。例如,CobbleStone Software 發布了 Contract Insight Enterprise 17.6.1。此版本提供了許多新的和改進的功能,以增強領先的合約管理、供應商管理、採購和採購平台。 Contract Insight 的拖放記錄佇列允許使用者在自己的時間啟動和管理用於記錄建立的文檔,並擴展對基於人工智慧的流程的控制。

- 此外,甲骨文、微軟等在北美提供採購軟體服務的市場參與者的存在及其創新和併購正在推動該地區的市場成長。

採購軟體行業概況

採購軟體市場集中度中等,市場上有許多大大小小的參與者活躍於國內和國際市場。市場參與者正在採取產品創新、策略夥伴關係、併購等關鍵策略。市場的一些主要發展是:

- 2022 年 10 月,SaaS 採購軟體平台公司 Tropic 與 B2B 先買後付 (BNPL) 供應商 Tranch 合作,讓客戶能夠支付軟體費用。根據這項合作關係,Tropic 客戶可以透過 Tranch 提交申請,並使用靈活的 EMI 付款,期限最長為 12 個月。 Tropic 客戶必須立即透過 Plaid 關聯銀行帳戶才能開始使用並獲得核准。

- 2022年9月,採購和供應鏈服務公司GEP將在阿布達比開設新辦事處,並擴大與中東航空、消費品(CPG)、能源和金融領域多個客戶的合作範圍。服務以及石油和天然氣行業的採購軟體服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 市場促進因素

- 對自動化採購流程的需求不斷增加

- 電子採購應用程式和 ERP 解決方案的整合

- 零售業預計將佔據重要市場佔有率

- 市場挑戰

- 與現有系統整合和供應商入職的複雜性

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對全球採購軟體市場的影響

第5章市場區隔

- 按配置

- 本地

- 雲

- 按最終用戶產業

- 零售

- 製造業

- 運輸和物流

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- SAP SE

- Proactis Holdings PLC

- Epicor Software Corporation

- Ginesys(Ginni Systems Limited)

- Coupa Software Inc.

- Zycus Inc.

- GT Nexus(Infor Inc.)

- Ivalua Inc.

- Microsoft Corporation

- Oracle Corporation

- Basware AS

- Mercateo AG

- GEP Corporation

- Jaggaer Inc.

第7章 投資分析

第8章市場機會及未來趨勢

The Procurement Software Market size is estimated at USD 8.17 billion in 2024, and is expected to reach USD 13.27 billion by 2029, growing at a CAGR of 10.20% during the forecast period (2024-2029).

Software companies are increasing their focus on in-demand technologies and re-exploring innovative ways to serve their clients. The primary factor driving the procurement software industry is the increased integration of developing technologies, such as Artificial Intelligence, and assists in high-quality reports and features to maintain accuracy.

Key Highlights

- With the growing requirement to automate procurement procedures, the maturation of e-procurement technology is expected to offer up new avenues for market growth over the forecast period. Furthermore, the need to prevent duplicate records is projected to drive the growth of the procurement software industry in the future years. Moreover, the implementation of government policies encourages market development. The increase in the flow of foreign transactions across borders fuels the market's progress even further. The market synergy between supply and demand drivers is predicted to affect future market growth.

- There is a growing desire to automate procurement operations to improve efficiency and reduce time. It also expedites the process by relieving personnel of time-consuming and unneeded tasks. Procurement process automation is becoming increasingly popular, especially in buy requests, purchase orders, invoice management, vendor management, and contract approval.

- E-procurement software helps an organization integrate and automate its whole procurement process. ERP assists in easing supplier management by facilitating the procurement processes, freeing time to concentrate on other tasks, and enabling a more effective business made possible when e-procurement tools are connected with ERP solutions. Among other things, ERP solutions support improved business reporting, better customer service, lower inventory costs, increased cash flow, cost reductions, data & cloud security, and supply chain management. These factors encourage market expansion.

- The market for procurement software is expected to have challenges during the forecast period because many organizations lack the infrastructure necessary to work with traditional systems. On the contrary, the lack of skilled personnel impedes the market growth.

- The COVID-19 crisis has created challenges across multiple industries and has led to a reduction in technology spending. Enterprises are still adjusting to the COVID-19 economy, from new internal logistics like WFH or building infrastructure to cope with new demand. Disruptions in the supply chain, fluctuations in demand share, and economic situations, along with the immediate & long-term impact of the novel coronavirus, possessed a negative effect on the procurement software market growth.

Procurement Software Market Trends

Retail Industry is Expected to Hold Significant Market Share

- The retail industry is anticipated to cater to a significant share. The growing competition, falling margins, and diminishing brand loyalty have made retailers look for new ways to remain profitable and competitive. Business leaders at retail enterprises are increasingly turning to their procurement teams to reduce costs, mitigate supply risks, and create more value. This has enabled the adoption of procurement software in the retail industry.

- Procurement software helps retailers to integrate business processes and improve the overall value of businesses. It facilitates transparency in financial supply chains and contract details for generating invoices to complete payments. According to the Retailers Association of India, the retail market size is expected to be around USD 1.7 trillion over the forecast period in India. So, Procurement services have a huge requirement that drives growth over the forecast period.

- Further, procurement software tools enable retail companies to automate procurement tasks and procure the best rates from vendors for their tender, making it essential for retail companies to procure a large volume of goods. With the implementation of procurement software solutions, companies can collaborate with suppliers, track events and get alerts, and analyze business intelligence data to gain insights into the procurement process for forecasting and planning purposes.

- Moreover, this technology simplifies the decision-making process that concerns demand and sales forecast by consolidating the supply chain and facilitating inventory management. Also, it offers advantages such as minimum operational cost, higher operational efficiency, etc., which are presumed to increase the growth pace of the market in the retail industry in the upcoming years.

- For instance, Companies like Ginesy offer user-friendly POS software that supports fast billing features. It also provides a quick and easy approach to billing with continuous data synchronization. It is being used by the top retail companies in India, making it the best POS software in India.

North America Accounts For the Largest Market Share

- North America dominates globally due to the rising demand for centralized procurement processes. Also, the consolidation of companies incorporated in the region is expected to provide an impetus to market growth in the future. According to Business.org, the top 20 startups of ecosystems are located in North America. For instance, Austin and Texas have more than 5,500 startups and big tech giant firms, like Facebook, Google, and Apple. This enhances the demand for procurement software significantly.

- The United States is rigorously looking to strengthen its manufacturing industry by enhancing its productivity by emphasizing improving activities across the supply chain within the industrial sector in the country. The e-retailers in the North American retail market are rigorously trying to enhance the customer experience by incorporating same-day delivery, which can effectively be achieved through effective supply chain management.

- Moreover, automated document creation and contract writing process that significantly streamlines the contract lifecycle cater to new procurement software trends. For instance, CobbleStone Software released Contract Insight Enterprise 17.6.1. This release brings numerous new and improved features to enhance the leading contract management, vendor management, procurement, and sourcing platform. Contract Insight's drag-and-drop record queue allows users to initiate and manage documents for record creation on their time with expanded control over their AI-based process.

- Further, the presence of the market players involved in providing procurement software services, such as Oracle, Microsoft, and others, are located in North America, boosting the market growth in the region along with their innovations and merger and acquisition.

Procurement Software Industry Overview

The procurement software market is moderately concentrated, owing to the presence of a few large and small players in the market operating in the domestic as well as in the international market. Players in the market are adopting key strategies, such as product innovation, strategic partnerships and mergers, and acquisitions. Some of the key developments in the market are:

- In October 2022, Tropic, a SaaS procurement software platform company, partnered with Tranch, a B2B Buy Now Pay Later (BNPL) provider, to allow their customers to pay their software costs. Under this partnership, Tropic customers submit their invoices through Tranch and can pay them in flexible EMIs for up to 12 months. Tropic customers must instantly link their bank account via Plaid to start and be approved.

- In September 2022, GEP, a procurement and supply chain service company, expanded its presence with the launch of a New Office in Abu Dhabi, working with several middle eastern clients in the fields of aviation, consumer packaged goods (CPG), energy, financial services, and oil and gas sectors for procurement software services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand to automate the procurement processes

- 4.2.2 Integration between E Procurement applications and ERP solutions

- 4.2.3 Retail Industry is Expected to Hold Significant Market Share

- 4.3 Market Challenges

- 4.3.1 Complexity Regarding Integration with Existing System and Supplier Onboarding

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of Covid-19 on the Global Procurement Software Market

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.2 By End-user Industry

- 5.2.1 Retail

- 5.2.2 Manufacturing

- 5.2.3 Transportation and Logistics

- 5.2.4 Healthcare

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE

- 6.1.2 Proactis Holdings PLC

- 6.1.3 Epicor Software Corporation

- 6.1.4 Ginesys (Ginni Systems Limited)

- 6.1.5 Coupa Software Inc.

- 6.1.6 Zycus Inc.

- 6.1.7 GT Nexus (Infor Inc.)

- 6.1.8 Ivalua Inc.

- 6.1.9 Microsoft Corporation

- 6.1.10 Oracle Corporation

- 6.1.11 Basware AS

- 6.1.12 Mercateo AG

- 6.1.13 GEP Corporation

- 6.1.14 Jaggaer Inc.