|

市場調查報告書

商品編碼

1440124

低程式碼開發平台 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Low-code Development Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

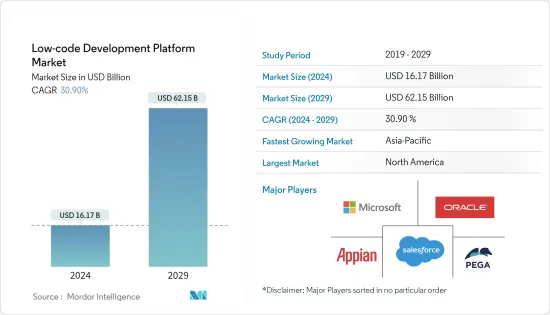

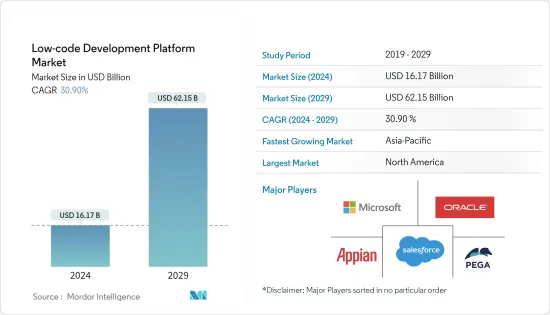

低程式碼開發平台市場規模預計到2024年為 161.7 億美元,預計到2029年將達到 621.5 億美元,在預測期內(2024-2029年)CAGR為 30.90%。

主要亮點

- 在企業轉向數位現代化之後,低程式碼採用率迅速成長,其中包括改善使用者體驗、自動化流程和升級關鍵系統。由於成本低廉,低程式碼開發平台被證明是理想的選擇。

- 低程式碼的優點是它的拖放介面,可以節省時間。在低程式碼中,每個流程都在圖形介面的幫助下直覺地顯示,使一切都更容易理解。開發人員更容易創建他們的應用程式。

- 儘管低程式碼解決方案並不新鮮,但由於公司面臨滿足利害關係人對更多數位轉型的需求的挑戰,因此對該技術的需求在過去兩年中激增。透過更快的業務應用程式交付,公司可以使用低程式碼工具擴展數位轉型工作。此外,使用低程式碼工具可以大幅減少創新所需的時間。

- 低程式碼解決方案使組織能夠比傳統的本地開發更快、更敏捷地產生工作解決方案和整合。整合曾經是一個勞力密集的 IT 流程,需要雙方進行客製化開發。

- 低程式碼解決方案可能與任何競爭對手或類似供應商不相容。即使使用者可以匯出原始碼,也會依賴廠商的平台來運作,使用者只能作為備份。

- COVID-19 大流行造成的破壞增加了企業採用低程式碼平台的趨勢。以前沒有低程式碼平台系統的公司無法輕鬆快速地調整其 ERP 系統以應對遠端操作的新挑戰。另一方面,擁有低程式碼平台的公司適應速度明顯更快。

低程式碼開發平台市場趨勢

資訊科技領域將顯著成長

- IT企業在主導低程式碼開發平台市場中發揮了關鍵作用。這是因為在這個垂直領域營運的公司需要為自己和客戶開發許多應用程式,無論是行動應用程式還是線上應用程式(或兩者兼而有之)。

- 低程式碼開發平台的優勢使得應用程式能夠快速創建、共享和更新,提高生產力並最佳化資源利用率。因此,它推動了 IT 公司對 LCDP 的需求。

- 在過去的幾年裡,IT 行業的企業對 LCDP 表現出了更大的興趣,因為依靠其軟體應用程式為開發人員和客戶帶來了可觀的回報。

- 根據 Caspio 最近進行的研究,63%的低程式碼平台用戶擁有滿足自訂應用程式需求的技能和資源,而 61%的用戶表示他們能夠按時、按範圍、在預算範圍內成功交付自訂應用程式。此外,58%使用低程式碼平台的受訪者表示他們可以滿足企業對自訂應用程式請求的需求。

- 此外,在 COVID-19 大流行期間,隨著企業對透過網路與客戶和客戶互動的打包軟體和應用程式的需求不斷增加,該行業出現了大量積壓。因此,IT企業需要部署這些平台來確保競爭優勢並最佳化資源利用。

亞太地區預計將佔據最大的市場佔有率

- 由於行動應用程式的日益普及,預計亞太地區在預測期內將大幅成長。此外,該地區的許多中小企業資源有限,迫使他們採用託管服務。該地區政府也採取了行動優先策略,為公民提供更好的服務,推動市場發展。

- 華為全球技術服務推出通用數位引擎(GDE)平台。 GDE採用「1+4+N」架構:「1」是開放的雲端原生平台。 「4」是資料共享、生產流程智慧化、能力共享、整合低程式碼自主開發四種能力。該平台將數位化、智慧化技術引進營運商規劃、建設、維護、最佳化、營運流程,幫助營運商向數位化營運商和合作夥伴轉型,使能營運創新「N」個應用場景。

- 2023年 11月 14 日,OutSystems Japan 宣佈在日本市場推出用於雲端原生應用程式開發的低程式碼解決方案 OutSystems Developer Cloud。 OutSystems 為開發人員和企業開發人員提供高效能、低程式碼的應用程式平台。它可以安全地用於大型應用程式,並允許從前端到後端的全端開發。

- 2022年 1月,總部位於舊金山的低程式碼平台 Retool 宣布,它可能會透過獨家產品擴大在印度的業務,因為它可能會受到 IT 服務提供者和新創公司的巨大吸引力。

- 印度進行許多數位化措施和開發,包括低程式碼平台。2022年7月,位於清奈的SaaS公司Kissflow發布了統一的低程式碼/無程式碼工作平台,加速了業務數位轉型。新平台結合了企業級用戶的全方位任務管理。最終用戶、團隊、團隊經理、流程專家、公民開發人員和 IT 開發人員都包括在內。

低程式碼開發平台產業概況

低程式碼開發平台市場適度分散,參與者眾多,全球治理面臨重大挑戰,較小的供應商逐漸佔據了主要市場佔有率。財力雄厚的市場廠商積極參與策略併購活動,而小公司則參與產品創新策略以獲取市場佔有率。

- 2022年 11月 - SAP 推出了新的低程式碼應用程式開發工具包,以解決業界合格程式設計師的稀缺問題,並向更廣泛的業務用戶提供軟體開發技能。 SAP 表示,這將使非技術業務使用者能夠建立和修改業務應用程式、自動化業務流程以及設計企業網站。

- 2022年 3月 - Zoho Corporation 宣布發布最新版本的低程式碼解決方案 Zoho Creator,該解決方案可協助企業客戶和個人開發人員創建業務應用程式。透過此次升級,Zoho 的 Creator 平台將應用程式開發、商業智慧和分析以及流程自動化等功能整合到一個平台中,同時也協助 IT 團隊管理安全性、合規性和治理。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- COVID-19對產業影響的評估

第5章 市場動態

- 市場促進因素

- 對快速客製化和可擴展性的需求不斷增加

- 提高企業流動性

- 消除所需 IT 技能方面的差距

- 市場挑戰

- 對供應商提供的客製化的依賴

第6章 新興科技趨勢

第7章 市場細分

- 依應用類型

- 基於網路

- 基於行動裝置

- 基於桌面和伺服器

- 依部署類型

- 本地部署

- 雲端

- 依組織規模

- 中小企業

- 大型企業

- 依最終用戶垂直領域

- BFSI

- 零售及電子商務

- 政府和國防

- 資訊科技

- 能源和公用事業

- 製造業

- 衛生保健

- 其他最終用戶垂直領域

- 按地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第8章 競爭格局

- 公司簡介

- Microsoft Corporation

- Appian Corporation

- Oracle Corporation

- Pegasystems Inc.

- Magic Software Enterprises Ltd

- AgilePoint Inc.

- Outsystems Inc.

- Mendix Inc.

- ZOHO Corporation

- QuickBase Inc.

- Clear Software LLC

- Kony Inc. 8.14 ServiceNow Inc.

- Skuid Inc.

第9章 供應商市場定位分析

第10章 投資分析

第11章 市場機會與市場未來

The Low-code Development Platform Market size is estimated at USD 16.17 billion in 2024, and is expected to reach USD 62.15 billion by 2029, growing at a CAGR of 30.90% during the forecast period (2024-2029).

Key Highlights

- The rapid growth of low-code adoption happened after businesses moved to digital modernization, which included improving user experiences, automating processes, and upgrading critical systems. Due to their low cost, low-code development platforms proved ideal.

- The advantage of low code is its drag-and-drop interface, which saves time. In low code, every single process is shown visually with the help of a graphical interface that makes everything easier to understand. It is easier for developers to create their applications.

- Although low-code solutions are not new, the demand for the technology soared in the last two years as companies were challenged to meet stakeholder demand for more digital transformation. Through faster business application delivery, companies can expand digital transformation efforts with low-code tools. In addition, the time it takes to innovate is dramatically reduced with low-code tools.

- Low-code solutions allow organizations to produce working solutions and integrations with more speed and agility than traditional on-premise developments. Integration used to be a labor-intensive IT process requiring custom development on both sides.

- The low-code solution might not be compatible with any competitor or similar provider. Even if the user can export the source code, it will depend on the vendor's platform to work, and the user can only use it as a backup.

- The disruption caused by the COVID-19 pandemic increased the tendency of enterprises to adopt low-code platforms. Companies that did not previously contain low-code platform systems could not easily and quickly adapt their ERP system to the new challenges of remote operations. On the other hand, companies with a low-code platform adapted significantly faster.

Low Code Development Platform Market Trends

Information Technology Segment to Witness Significant Growth

- IT enterprises played a key role in dominating the low-code development platform market. This is because the firms operating in this vertical need to develop many applications, either for mobile or online (or both), for themselves and their clients.

- The benefits of low-code development platforms enabled apps to be created, shared, and updated quickly, leading to improved productivity and optimized resource utilization. It is thus driving the demand for LCDPs among IT companies.

- Over the past few years, enterprises operating in the IT sector showed greater interest in LCDPs, owing to their significant payoffs for their developers and customers relying on their software applications.

- As per recent research conducted by Caspio, 63% of low-code platform users include the skill and resources to fulfill the demand for custom apps, whereas 61% suggest that they successfully deliver custom apps on time, on scope, and within budget. Further, 58% of respondents using low-code platforms indicated that they can keep up with the business's demand for custom app requests.

- Further, amid the COVID-19 pandemic, the sector witnessed huge backlogs with the rising request for packaged software and apps from enterprises to engage with customers and clients over the Internet. Thus, IT enterprises are required to deploy these platforms to ensure a competitive advantage and optimized resource utilization.

Asia Pacific is Expected to Hold the Largest Market Share

- The Asia-Pacific region is anticipated to grow significantly over the forecast period, owing to the increasing adoption of mobile applications. Additionally, the region includes many SMEs with limited resources, forcing them to adopt managed services. The governments in the region also adopted a mobile-first strategy to provide better services to their citizens, thereby driving the market.

- Huawei Global Technical Service launched the General Digital Engine (GDE) platform. The GDE adopts the "1+4+N" architecture: "1" is an open cloud-native platform. "4" means four capabilities that enable data sharing, intelligent production flow, capability sharing, and integrated low-code self-development. The platform introduces digital and smart technologies into carriers' planning, construction, maintenance, optimization, and operation processes to help them transform into digital carriers and partners, enabling operations to innovate "N" application scenarios.

- On November 14th, 2023, OutSystems Japan Co., Ltd. announced the debut of their low-code solution OutSystems Developer Cloud for cloud-native application development in the Japanese market. OutSystems offers a high-performance, low-code application platform for developers and enterprise developers. It can be utilized securely in large-scale applications and allows full-stack development from front-end to back-end.

- In January 2022, San Francisco-based low-code platform Retool announced that it might expand its presence in India with exclusive offerings as it could see massive traction from IT service providers and startups.

- Many digital initiatives and development, including low-code platforms, are occurring in India. In July 2022, Kissflow, a Chennai-based SaaS firm, released its unified low-code/no-code work platform, accelerating business digital transformation. The new platform combines the whole range of task management for enterprise-wide users. End users, teams, team managers, process specialists, citizen developers, and IT developers are all included.

Low Code Development Platform Industry Overview

The low-code development platform market is moderately fragmented, with many players, significant governance challenges globally, and smaller vendors cumulatively holding a major market share. The market vendors with deep pockets are actively involved in strategic M&A activities, while small companies are involved in product innovation strategies to gain market share.

- November 2022 - SAP introduced a new low-code application development toolkit to address the industry's scarcity of qualified programmers and to deliver software development skills to a broader audience of business users. According to SAP, this will enable non-technical business users to construct and modify business applications, automate business processes, and design corporate websites.

- March 2022 - Zoho Corporation announced the release of the newest edition of its low-code solution, Zoho Creator, which assists corporate customers and individual developers in creating business applications. With this upgrade, Zoho's Creator platform integrates, among other things, application development, business intelligence and analytics, and process automation into a single platform while also assisting IT teams in managing security, compliance, and governance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID -19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Rapid Customization and Scalability

- 5.1.2 Increasing Enterprise Mobility

- 5.1.3 Elimination of Gaps in Required IT Skills

- 5.2 Market Challenges

- 5.2.1 Dependency on Vendor Supplied Customization

6 EMERGING TECHNOLOGY TRENDS

7 MARKET SEGMENTATION

- 7.1 By Application Type

- 7.1.1 Web-based

- 7.1.2 Mobile-based

- 7.1.3 Desktop- and Server-based

- 7.2 By Deployment Type

- 7.2.1 On-premise

- 7.2.2 Cloud

- 7.3 By Organization Size

- 7.3.1 Small and Medium Enterprises

- 7.3.2 Large Enterprises

- 7.4 By End-user Vertical

- 7.4.1 BFSI

- 7.4.2 Retail and E-commerce

- 7.4.3 Government and Defense

- 7.4.4 Information Technology

- 7.4.5 Energy and Utilities

- 7.4.6 Manufacturing

- 7.4.7 Healthcare

- 7.4.8 Other End-user Verticals

- 7.5 By Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia-Pacific

- 7.5.4 Latin America

- 7.5.5 Middle-East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Microsoft Corporation

- 8.1.2 Appian Corporation

- 8.1.3 Oracle Corporation

- 8.1.4 Pegasystems Inc.

- 8.1.5 Magic Software Enterprises Ltd

- 8.1.6 AgilePoint Inc.

- 8.1.7 Outsystems Inc.

- 8.1.8 Mendix Inc.

- 8.1.9 ZOHO Corporation

- 8.1.10 QuickBase Inc.

- 8.1.11 Clear Software LLC

- 8.1.12 Kony Inc. 8.14 ServiceNow Inc.

- 8.1.13 Skuid Inc.