|

市場調查報告書

商品編碼

1440077

汽車智慧照明:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Automotive Smart Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

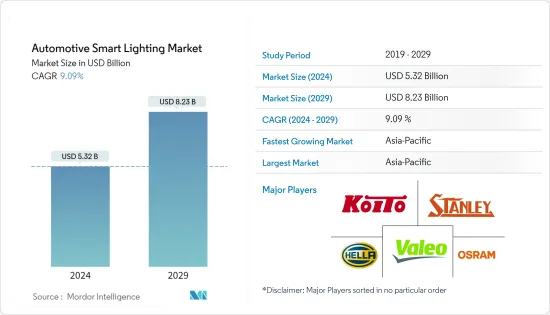

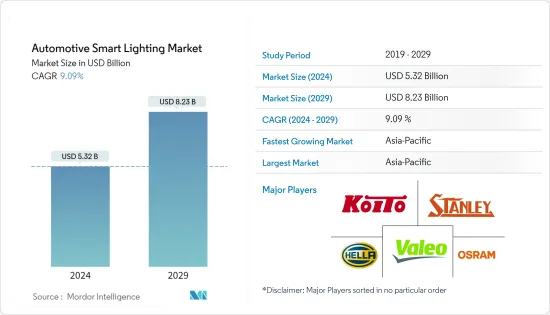

汽車智慧照明市場規模預計2024年為53.2億美元,預計到2029年將達到82.3億美元,在預測期內(2024-2029年)成長9.09%,年複合成長率為

冠狀病毒感染疾病(COVID-19)大流行損害了所研究的市場,這主要是由於製造活動的暫停。經濟放緩以及對照明和其他產品進口徵收關稅預計將阻礙該市場的成長。此外,針對外部輔助燈的國家特定法規可能會影響市場成長。然而,隨著2021年新車和商用車銷量的增加,對具有智慧照明功能(例如汽車遠光燈、主動式頭燈、手勢控制車內燈)的豪華車的需求將會增加,從而導致智慧照明的需求增加。汽車增加了。

從長遠來看,許多汽車製造商都對將 LED 燈整合到他們的車輛中表現出極大的興趣,因為與鹵素燈或 HID 燈相比,LED 燈的功耗更低,使用壽命更長。此外,LED 燈具有耐用性、強度和高品質。

汽車製造商正在投資開發新的照明技術和解決方案,重點關注主要照明應用:車頭燈。OEM正在推出主動式轉向頭燈的車輛,以提供更安全的夜間駕駛體驗。

推動智慧汽車照明研究和開發的關鍵因素有幾個,包括電動車的採用和銷售。它旨在擴大電力驅動的範圍並採用現有和未來車輛的先進功能。此外,預計這種情況未來還將持續。

從事汽車智慧照明市場的主要企業包括Stanley Electric)、法雷奧集團(Valeo Group)和歐司朗照明公司(Osram Licht AG)。這些公司專注於升級其產品系列併投資新技術,以為客戶提供創新的解決方案。

汽車智慧照明市場趨勢

外部照明引領汽車智慧照明市場。

汽車製造商和政府特別關注開發和普及小客車安全駕駛技術。這些技術中的大多數預計將變得至關重要。例如,加拿大政府宣布對所有車輛進行安全測試,並推出自動駕駛和連網汽車,同時提高人們對駕駛輔助技術的認知。

為了減少該國的事故數量,道路運輸和公路部宣布正在努力推動汽車強制安裝 ADAS(高級駕駛員輔助系統)。

該部正在考慮自適應頭燈、促瞌睡警報系統、盲點資訊系統、車道偏離警告系統和前方碰撞警報等駕駛輔助系統。因此,隨著新車配備各種 ADAS 功能,對智慧照明技術的需求不斷增加。領先的公司正在投資新的研發設施,以在這個競爭激烈的市場中獲得優勢。

2021年7月,麥格納國際公司宣布計畫收購領先的汽車安全技術公司安全技術巨頭Veoneer Inc.。透過此次收購,麥格納旨在加強和擴大其 ADAS 產品組合和產業地位。

汽車製造商擴大尋找在競爭激烈的汽車行業中脫穎而出的方法。這是透過開發新的外部和內部照明系統風格特徵來實現的。新技術在多種應用和車輛類型中提高了彈性和擴充性,使汽車設計師能夠創造出獨特的風格、外觀和感覺。

亞太地區可望引領汽車智慧照明市場

亞太地區是2021年全球主要汽車生產國和市場之一,其中中國2021年銷售汽車約2,628萬輛。中國、印度和日本是該區域市場的主要經濟體,預計在全球市場成長更快。

近年來,中國對豪華車的需求不斷增加。消費習慣的增強和經濟的繁榮可歸因於強勁的需求。 2021年,SERES旗下AITO品牌正式發表全新豪華智慧SUV文傑M5。該車共有三種版本,目前已開放預訂,售價為25萬元至32萬元。配備10.4吋曲面全液晶儀錶板、15.6吋2K HDR智慧中央控制台螢幕、總面積約2平方公尺的全景天窗、智慧互動照明、L2+自動駕駛功能等。

製造商在研發和創新方面投入巨資,開發與駕駛輔助系統和接近感測器相容的汽車照明系統,預計將增加市場收益。此外,不斷增加的道路事故引發了人們對車輛和乘員安全的擔憂,從而增加了對汽車照明解決方案的需求。政府和交通主管機關制定了嚴格的法規來改善道路安全並增加市場收益。

近期,兩項汽車照明系統GB標準更新。原標準GB 5920-2008擬由GB 5920-2019《機動車輛及掛車前後尾燈、端輪廓燈及煞車燈光度特性》及GB 23255-2009取代。可能被GB 23255-2019(《機動車輛日間行車燈光度特性》)取代。

2021 年 12 月,豐田合成開發了一款全彩 LED 燈泡,用於照亮汽車內部。您可以從 64 種顏色中自由調整顏色,以適應使用者的心情,滿足各種品味。

起亞汽車於 2021 年 8 月宣布,其 EV6 電動跨界車配備了一流的安全性和便利性功能,包括一套先進的駕駛輔助系統 (ADAS)。採用前照明系統(IFS)技術,使每個LED獨立發光。

考慮到上述因素和發展,成本影響顯然會影響消費者的購買行為。由於電動車和自動駕駛汽車中技術的不斷融入,中端類別將進一步影響成本因素。

汽車智慧照明產業概況

汽車智慧照明市場適度整合,主要由小糸製造、Stanley Electric、法雷奧集團、Osram Licht AG 和 Magneti Marelli SpA 等少數幾家廠商主導。該市場主要受到先進技術、感測器使用增加、研發計劃投資增加以及電動和自動駕駛汽車市場成長等因素的顯著推動。領先的汽車智慧照明製造商正在收購較小的公司,以開發面向未來的新技術並擴大其市場範圍。例如,

2022 年 5 月,Grupo ZKW 投資 1.02 億美元的瓜納華托錫勞工廠第三期擴建工程奠基,該工廠生產車頭燈、霧燈和輔助燈。佔地15,700平方公尺的擴建工程預計每年可生產150萬隻車頭燈,ZKW將為寶馬、福特和通用汽車的電動車和SUV生產車頭燈和中心條燈。

2021 年4 月,福特宣布開發出一種預測性智慧車頭燈系統,可以在駕駛員看到光束之前將光束引導到下一個拐角,從而更快、更有效地照亮危險區域和其他道路使用者。這款原型車的先進照明系統利用GPS定位資料、先進技術和高度準確的道路幾何資訊來準確識別前方道路的彎道。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 按車型

- 小客車

- 商用車

- 按使用類型

- 室內照明

- 外部照明

- 依技術類型

- 鹵素

- 氙

- LED

- 其他技術

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Koito Manufacturing Co. Ltd

- Stanley Electric Co. Ltd

- Valeo Group

- OsRam Licht AG

- Magneti Marelli SpA

- HELLA KGaA Hueck &Co.

- Hyundai Mobis

- Mitsuba Corporation

- Lumax Industries

- Koninklijke Philips NV

第7章市場機會與未來趨勢

The Automotive Smart Lighting Market size is estimated at USD 5.32 billion in 2024, and is expected to reach USD 8.23 billion by 2029, growing at a CAGR of 9.09% during the forecast period (2024-2029).

The COVID-19 pandemic harmed the market studied, primarily attributed to halted manufacturing activities. The economic slowdown, coupled with the tariffs imposed on importing lights and other products, is expected to hamper the growth of this market. In addition, country-specific regulations for external auxiliary lights may affect the market's growth. However, with new car and commercial vehicle sales increasing in 2021, the demand for luxury cars with smart lighting features such as auto high-beam headlamps, active headlamps, and gesture-controlled interior lights increased demand for luxury cars with smart lighting features such as auto demand for smart lighting increased.

Over the long term, many vehicle manufacturers show great interest in integrating LED lights into their vehicles, as these lights use less power and have a longer lifespan than halogen and HID lights. Furthermore, LED lights offer durability, strength, and high quality.

The automotive manufacturers are investing in developing new lighting technologies and solutions focusing on the major lighting application, headlights. OEMs are launching vehicles with adaptive headlights to provide a safe driving experience at night.

A few major factors drive the research and development in automotive smart lighting, such as the adoption and sales of electric vehicles. It is to extend the range of electric drives and adopt advanced features from existing and upcoming vehicles. Moreover, this scenario is expected to continue in the future.

Some major players operating in the automotive smart lighting market are Stanley Electric Co. Ltd, ValeoGroup, Osram Licht AG, and others. These players are focusing on upgrading their product portfolio and are investing in new technologies to offer innovative solutions to their customers.

Automotive Smart Lighting Market Trends

Exterior lightening will lead the automotive smart lighting market.

Automobile manufacturers and governments focus on developing and promoting safe driving technologies, especially passenger vehicles. Most of those technologies are expected to become essential. For instance, the Canadian government announced the safe testing of every vehicle and deployed automated and connected vehicles while creating awareness regarding driver-assistance technologies.

To lower the number of accidents in the nation, the Ministry of Road Transport and Highways announced that it was working on making ADAS (advanced driver assistance systems) essential for automobiles.

Driver assistance systems, such as adaptive headlights, driver drowsiness attention systems, blind-spot information systems, lane-departure warning systems, forward collision warnings, and others, were under discussion by the ministry. Hence, the demand for smart lighting technology is increasing as new vehicles are loaded with various ADAS features. The major players are investing in new R&D facilities to stay ahead in this competitive market.

In July 2021, Magna International Inc. announced its plans to acquire safety tech major VeoneerInc., a leading player in automotive safety technology. With this acquisition, Magna aimed to strengthen and broaden its ADAS portfolio and industry position.

Automakers are increasingly looking for ways to differentiate themselves in the competitive automotive business. It is accomplished by developing new external and interior lighting system style characteristics. New technologies offering greater flexibility and scalability across several applications and vehicle types allow automotive designers to establish their distinct styles, appearance, and feel.

Asia-Pacific is Anticipated to Lead the Automotive Smart Lighting Market

The Asia-Pacific was among the leading global automobile producers and markets in 2021, and China sold around 26.28 million vehicles in 2021. China, India, and Japan are the major economies in the regional market that are anticipated to grow faster in the global market.

In recent years, China has seen an increase in demand for luxury automobiles. The increased spending habits and booming economy can be attributable to the strong demand. In 2021, the AITO brand of SERES officially released the Wenjie M5, an all-new luxury smart SUV. The vehicle is offered in three versions and is now available for pre-order, with prices ranging from CNY 250,000 to CNY 320,000. The vehicle has features such as a 10.4-inch curved full LCD dashboard, a 15.6-inch 2K HDR intelligent center console screen, a panorama sunroof covering a total area of about 2 square meters, intelligent interactive lighting, and L2+ autonomous driving functions.

Manufacturers' significant investments in research and development and innovation to develop automobile lighting systems compatible with driver assistance systems and proximity sensors are expected to boost market revenue. In addition, the growing number of road accidents has raised concerns regarding vehicle and passenger safety, driving up demand for automobile lighting solutions. Government and transportation authorities' strict restrictions to increase road safety and boost the market's revenue.

Recently, two GB standards regarding automotive lighting systems have been updated. The old standard GB 5920-2008 is expected to be replaced by GB 5920-2019 ("Photometric characteristics of front and rear position lamps, end-outline marker lamps and stop lamps for motor vehicles and their trailers"), and GB 23255-2009 may be superseded by GB 23255-2019 ("Photometric characteristics of daytime running lamps for power-driven vehicles").

In December 2021, Toyoda Gosei Co. Ltd created full-color LED bulbs illuminating automobile interiors. The color may be freely adjusted from 64 variations to meet the user's mood and respond in various ways to individual preferences.

In August 2021, ZKW developed a micromirror module for dynamic lighting function, with Silicon Austrian Labs, Evatec, EV Group, and TDK Electronics joining teams to onboard micromirror technology, which can be used in headlamps, rear lamps, side projection, and LIDAR systems for optical distance measurement.

In August 2021, Kia announced that the EV6 electric crossover was equipped with class-leading levels of safety and convenience, including an advanced suite of driver assistance systems (ADAS). It got Front-lighting System (IFS), a technology that enables each LED to light independently.

Considering the factors mentioned above and developments, it is evident that the impact of cost can influence the purchasing behavior of consumers. The mid-level category will further influence the cost factor with the rising embedment of technology in electric and autonomous vehicles.

Automotive Smart Lighting Industry Overview

The automotive smart lighting market is moderately consolidated and majorly dominated by a few players, such as Koito Manufacturing Co. Ltd, Stanley Electric Co. Ltd, Valeo Group, Osram Licht AG, and Magneti Marelli SpA. The market is highly driven by factors like advanced technology, more use of sensors, growing investment in R&D projects, and a growing market of electric and autonomous vehicles. Major automotive smart lighting manufacturers are developing new technology for the future and acquiring small players to expand their market reach. For instance,

In May 2022, Grupo ZKW laid the first stone of the third phase of a USD 102 million expansion at its Silao, Guanajuato plant that produces headlights, fog lamps, and auxiliary lamps. In the 15,700-square-meter expansion, which is expected to have the capacity to produce 1.5 million headlights per year, ZKW will manufacture headlights and center bar lamps for BMW, Ford, and GM EVs and SUVs.

In April 2021, Ford announced it had developed a predictive smart headlight system that directs beams into upcoming corners even before drivers see them, illuminating hazards and other road users more quickly and effectively. The prototype advanced lighting system uses GPS location data, advanced technologies, and highly accurate street geometry information to accurately identify turns in the road ahead.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Application Type

- 5.2.1 Interior Lighting

- 5.2.2 Exterior Lighting

- 5.3 By Technology Type

- 5.3.1 Halogen

- 5.3.2 Xenon

- 5.3.3 LED

- 5.3.4 Other Technologies

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Koito Manufacturing Co. Ltd

- 6.2.2 Stanley Electric Co. Ltd

- 6.2.3 Valeo Group

- 6.2.4 OsRam Licht AG

- 6.2.5 Magneti Marelli SpA

- 6.2.6 HELLA KGaA Hueck & Co.

- 6.2.7 Hyundai Mobis

- 6.2.8 Mitsuba Corporation

- 6.2.9 Lumax Industries

- 6.2.10 Koninklijke Philips NV