|

市場調查報告書

商品編碼

1439855

塗層鋼板:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Coated Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

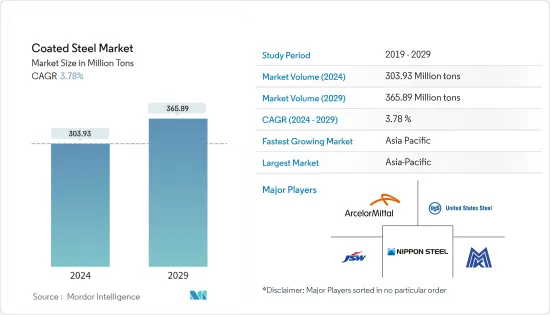

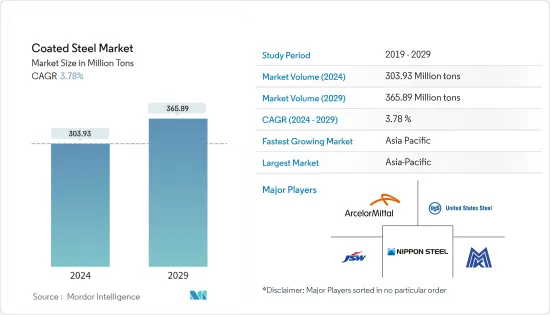

預計2024年塗層鋼市場規模為30393萬噸,預計2029年將達到36589萬噸,在預測期內(2024-2029年)年複合成長率為3.78%。

COVID-19 對 2020 年和 2021 年上半年的全球經濟產生了負面影響。 COVID-19 影響了多個工業部門,包括塗漆鋼,擾亂了供應鏈。封鎖和關閉改變了零售業務、國際供應鏈和各行業的購買行為。然而,一旦2021年下半年限制解除,由於汽車和建設活動的增加,預計市場將穩定成長,從而逐步復甦。

主要亮點

- 短期內,電氣和電器產品行業需求的增加以及建設產業的擴張預計將推動所研究市場的成長。

- 原料價格上漲預計將在預測期內抑制全球塗層鋼板市場的成長。

- 防護鋼在防腐應用的使用預計將為全球市場提供利潤豐厚的成長機會。

- 預計亞太地區將在預測期內主導塗層鋼市場。

塗層鋼板市場趨勢

建築和建築構件產業的需求不斷成長

- 彩塗鋼板是建築施工領域使用的重要材料。主要應用於工業屋頂及覆層材料、冷藏庫及倉庫、機場、商場中庭、展示室、天花板、照明燈具等。

- 彩色塗漆鋼板在建築應用中的使用具有創新美觀、易於加工和 100% 可回收性等優點。

- 彩塗鋼板的主要功能是作為保護膜,保護鋼筋不會被腐蝕。環氧彩色塗料非常堅韌。環氧樹脂具有優良的耐化學性,能耐受混凝土的鹼性環境。

- 全球建設產業正在蓬勃發展。亞太地區正在經歷建築業的重大繁榮。根據 2021 年 10 月發表的報導,馬來西亞財政部 (MoF) 宣布,由於所有子部門的表現有所改善,馬來西亞基礎設施建設行業預計將在 2022 年實現 11.5% 的成長。

- 根據中國國家統計局的數據,2021年中國付加價值約8兆元(1.15兆美元)。中國建築業不斷擴張,2021年總產值約80,138億元人民幣(11,456.2億美元)。

- 北美和歐洲在建築領域也取得了進展。根據2030年聯邦交通基礎設施計畫(FTIP),德國政府計畫在2016年至2030年間投資2,696億歐元(3,189.2億美元)建設高容量交通網路,其中公路將佔49.3%,鐵路將佔41.6%,水路將佔9.1 %。

- 所有上述因素預計將在未來幾年推動塗層鋼板市場的發展。

亞太地區主導市場

- 亞太地區是最大的市場,由於中國、印度和日本等國家的消費量不斷增加,預計亞太地區將成為預測期內成長最快的市場。

- 根據中國民航局統計,目前全國機場計劃已復工80%以上,全國已建成機場65個。

- OICA 的數據顯示,2021 年中國汽車產量為 26,082,220 輛,高於 2020 年的 25,225,242 輛。 2021年的成長率為3%。此外,中國汽車工業協會預測,由於小客車領域的需求不斷成長,汽車產量將進一步增加。

- 根據中國國家統計局數據,2021年家電及電器產品產業銷售收入達9,3464萬元。預計2025年市場規模將達1,756.7億美元,年增率為2.04%。

- 印度政府正在積極推動住宅建設,目標是為約13億人提供住宅。未來七年,該國預計將投資約1.3兆美元用於住宅建設,並建造6000萬套新住宅。此外,最近的房地產法、商品及服務稅和房地產投資信託基金等政策改革預計將在未來幾年減少核准延遲並加強建築業。

- 塗漆鋼板用於對電動車電池進行塗漆。印度的電動車生產得到政府補貼和支持製造實踐的優惠政策的支持。該國電動車市場主要由二輪車細分市場驅動,2021年佔超過48%。根據道路運輸和公路部 (MoRTH) 的數據,2021 年該國電動車銷量為 329,190 輛,比 2020 年銷量成長 168%。

- 綜上所述,亞太地區預計將在預測期內主導塗層鋼市場。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 電氣和家電產業的需求不斷增加

- 建築業的擴張

- 抑制因素

- 原物料價格上漲

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 產品類別

- 熱鍍鋅

- 電鍍鋅

- 鍍鋁

- 熱鍍鋅

- 其他產品類型

- 目的

- 汽車零件

- 家用電器

- 建築部分

- 管道/管材

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- AM/NS INDIA

- ArcelorMittal

- Baosteel Group

- ChinaSteel

- JFE Steel Corporation

- JSW

- KOBE STEEL LTD

- NIPPON STEEL CORPORATION

- NLMK

- NUCOR CORPORATION

- POSCO Maharashtra Steel Pvt Ltd

- PJSC MMK

- Salzgitter Flachstahl GmbH

- SEVERSTAL

- SSAB AB

- Tata Steel

- Thyssenkrupp AG

- United States Steel

- voestalpine Stahl GmbH

第7章 市場機會及未來趨勢

- 防護鋼板在防鏽應用的商機

- 其他機會

The Coated Steel Market size is estimated at 303.93 Million tons in 2024, and is expected to reach 365.89 Million tons by 2029, growing at a CAGR of 3.78% during the forecast period (2024-2029).

COVID-19 had a negative impact on the global economy in 2020 and H1-2021. It affected several industrial sectors, such as coated steel, hindering their supply chain. The lockdown and shutdown changed the behavior of retail businesses, international supply chains, and purchases across various sectors. However, the market is projected to grow steadily due to increased automotive and construction activities after lifting restrictions in the second half of 2021, gradually leading to market recovery.

Key Highlights

- Over the short term, the growing demand from the electrical and domestic appliance industry and expanding construction industry are expected to drive the growth of the market studied.

- High price volatility of raw materials is expected to restrain the growth of the global coated steel market over the forecast period.

- Nevertheless, the use of protected steel in anti-corrosion applications is likely to create lucrative growth opportunities for the global market.

- The Asia-Pacific region is expected to dominate the coated steel market over the forecast period.

Coated Steel Market Trends

Growing Demand from the Construction and Building Components Industries

- Color-coated steel is a crucial material used in the building and construction sector. It is used majorly for industrial roofing and cladding, cold storage and warehouses, airports, atriums in malls, showrooms, false ceilings, lighting fixtures, etc.

- The use of color-coated steel for building applications gives the benefit of innovative aesthetics, easier working, and 100% recyclability.

- The primary role of color-coated steel is to function as a protective coating to protect steel bars from corrosion. Epoxy color-coated steel coatings are very tough. Epoxies are chemical resistant and have the ability to withstand the alkali environment of concrete.

- The global construction industry is on a boom. Asia-Pacific is experiencing a major boom in the construction segment. As per an article published in October 2021, the Malaysian infrastructure construction sector is projected to turn around with a growth of 11.5% in 2022 due to better performance in all subsectors, as per the Ministry of Finance (MoF).

- Acoording to National Bureau of Statistics of China, the construction industry in China generated an added value of approximately CNY 8 trillion (USD 1.15 trillion) in 2021. China's construction industry has been continuously expanding, with total output accounting for about CNY 8,013.8 billion (USD 1,145.62 billion) in 2021.

- North America and Europe are also progressing in the construction sector. Under the 2030 Federal Transport Infrastructure Plan (FTIP), the German government planned to invest EUR 269.6 billion (USD 318.92 billion) between 2016 and 2030 for its high-capacity transport network, of which the road accounts for 49.3%, rail accounts for 41.6%, and waterway accounts for 9.1% of the allocated funds.

- All the above factors are expected to drive the market for coated steel in the coming years.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region represents the largest market and is expected to be the fastest-growing market over the forecast period, owing to increasing consumption from countries like China, India, and Japan.

- According to the Civil Aviation Administration of China, the government resumed construction work on more than 80% of total airport projects, representing 65 airports across the country, of which 27 are major national airport projects.

- The OICA recorded the production of automobiles in China at 26,082,220 units of passenger cars and light vehicles in 2021, up from 25,225,242 units in 2020. The growth in 2021 was recorded at 3%. Moreover, the CAAM estimates the production of automobiles is further likely to ascend with the growing demand from the passenger cars segment.

- According to the National Bureau of Statistics of China, the revenue in the consumer electronics and household appliances segment reached CNY 934.64 million in 2021. The revenue is expected to show an annual growth rate of 2.04%, resulting in a projected market volume of USD 175,670 million by 2025.

- The Indian government has been actively boosting housing construction, aiming to provide homes to about 1.3 billion people. The country is likely to witness around USD 1.3 trillion of investment in housing over the next seven years and is likely to witness the construction of 60 million new houses. Moreover, recent policy reforms, such as the Real Estate Act, GST, REITs, etc., are expected to reduce approval delays and strengthen the construction sector over the next few years.

- Coated steel is used in coatings of electric vehicle batteries. The production of electric vehicles in India is supported by government subsidies and favorable policies that support manufacturing practices. The electric vehicles market in the country is majorly driven by the 2-wheeler segment, which accounted for over 48% in 2021. According to the Ministry of Road Transport & Highways (MoRTH), 329,190 electric vehicles were sold in the country in 2021, representing an increase of 168% compared to the sales in 2020.

- Thus, owing to the factors above, the Asia-Pacific region is expected to dominate the market for coated steel during the forecast period.

Coated Steel Industry Overview

The global coated steel market is fragmented. Major players in the market include (in no particular order) NIPPON STEEL CORPORATION, PJSC MMK, JSW Steel, United States Steel, and ArcelorMittal, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Electrical and Domestic Appliance Industry

- 4.1.2 Expanding Construction Industry

- 4.2 Restraints

- 4.2.1 High Price Volatility of Raw Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Hot-dipped

- 5.1.2 Electro Galvanized

- 5.1.3 Aluminized

- 5.1.4 Galvannealed

- 5.1.5 Other Product Types

- 5.2 Application

- 5.2.1 Automotive Components

- 5.2.2 Appliances

- 5.2.3 Construction and Building Components

- 5.2.4 Pipe and Tubular

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AM/NS INDIA

- 6.4.2 ArcelorMittal

- 6.4.3 Baosteel Group

- 6.4.4 ChinaSteel

- 6.4.5 JFE Steel Corporation

- 6.4.6 JSW

- 6.4.7 KOBE STEEL LTD

- 6.4.8 NIPPON STEEL CORPORATION

- 6.4.9 NLMK

- 6.4.10 NUCOR CORPORATION

- 6.4.11 POSCO Maharashtra Steel Pvt Ltd

- 6.4.12 PJSC MMK

- 6.4.13 Salzgitter Flachstahl GmbH

- 6.4.14 SEVERSTAL

- 6.4.15 SSAB AB

- 6.4.16 Tata Steel

- 6.4.17 Thyssenkrupp AG

- 6.4.18 United States Steel

- 6.4.19 voestalpine Stahl GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Opportunities for Protected Steel in Anti-Corrosion Applications

- 7.2 Other Opportunities