|

市場調查報告書

商品編碼

1689788

核能發電-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Nuclear Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

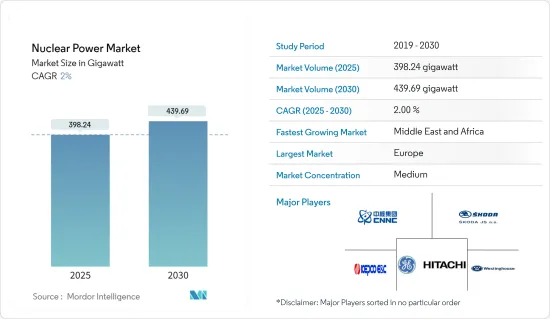

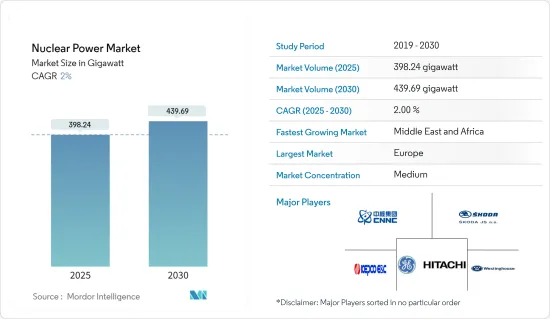

預計 2025 年核能發電市場規模為 398.24 吉瓦,到 2030 年將達到 439.69 吉瓦,預測期內(2025-2030 年)的複合年成長率為 2%。

關鍵亮點

- 從中期來看,市場成長受到核能發電的可能性的推動,因為與石化燃料相比,核能發電產生的二氧化碳排放較少。

- 然而,建立核能發電廠的高初始成本以及可再生能源等替代能源的可用性可能會在預測期內抑制市場成長。

- 世界各國都在進行第四代核能技術研發,推動安全、技術、經濟、先進的小型模組核子反應爐。因此,未來市場可能會提供多種商業機會。

- 由於中國和印度的核能佔有率龐大,預計預測期內亞太地區的核能發電市場將顯著成長。

核能發電市場趨勢

能源領域預計將主導市場

- 核能以質子和中子的形式從原子核或原子核中釋放出來。核能是由核分裂(原子核分裂成幾個獨立的部分)或核融合(原子核的聚變)所產生的。當今世界,核分裂產生電能,核融合技術正處於研發階段,以產生電能。截至 2022 年,全球核能發電發電量約為 2,679 TWh,而 2021 年約為 2,802 TWh。

- 核能發電廠能夠長時間連續運行,提供穩定的電力供應。這對於滿足已開發國家和開發中國家日益成長的能源需求至關重要。

- 此外,這一能源領域為全球減緩氣候變遷的努力做出了重大貢獻。核能發電在運作過程中幾乎不排放溫室氣體,是減少二氧化碳和其他有害空氣污染物的重要工具。

- 根據2022年世界能源統計評論,核能總發電量與2021年相比下降了近4.4%,但2013年至2022年的年成長率約為1%。

- 此外,即將開工的核能發電廠計劃預計將在預測期內增加發電能力。例如,2023年4月,據印度核能部稱,印度政府授予在印度五個不同邦建立10座核子反應爐的許可證和財政核准。

- 這些核子反應爐每座容量為 700 兆瓦,是以艦隊形式建造的本土加壓重水反應器。將建造這些核子反應爐的邦包括卡納塔克邦、哈里亞納邦、中央邦和拉賈斯坦邦。

- 此外,印度已進入三階段核能計畫的第二階段。 2024 年 3 月,印度首批自主建造的快滋生式反應爐(500 Mwe)之一在清奈約 70 公里的卡爾帕卡姆開始運作。

- 因此,鑑於上述情況,預計能源部門將在預測期內主導核能發電市場。

亞太地區預計將經歷強勁成長

- 與北美和歐洲多年來核能發電裝置容量成長受限不同,亞太地區的一些國家正在規劃和建造新的核能發電廠,以滿足日益成長的綠能需求。

- 例如,中國正致力於創新主導成長、低碳發展、城鄉一體化、深化社會包容和人口老化。 「十四五」規劃強調高品質綠色發展,高度重視創新作為現代化發展的基礎。在第一個「十三五」成果的基礎上,我們計畫降低經濟體的碳強度,在2030年實現二氧化碳排放達到高峰。

- 此外,根據2021年3月發布的《第十四個五年規劃(2021-2025年)》草案,政府計劃在2025年底將核能發電容量提高到7,000萬千瓦。

- 此外,中國國家能源局(NEA)正在考慮在未來十年提高國家清潔能源計畫的目標。國家能源局提案,到2030年,中國40%的電力應來自核能和可再生,目標是2030年核能發電裝置容量達到120-150吉瓦。

- 印度政府致力於擴大核能發電能力,以滿足該國日益成長的電力需求。印度政府預計,到2031年,該國核能發電量將達到約2,250萬千瓦。

- 根據印度中央電力局(CEA)預測,2024年1月,印度核能發電廠將達到748萬千瓦,包括23座核子反應爐和7座在建核子反應爐,總合裝置容量為5398萬千瓦。

- 根據永續能源政策研究所 (ISEP) 的數據,核能發電量在 2014 年最初降至零,但此後有所回升,佔 2019 年發電量的 6.5%。然而,2020 年這一比例下降到 4.3%,然後在 2021 年上升到 5.9%,然後在 2022 年再次下降到 4.8%。

- 因此,由於上述因素,預計亞太地區在預測期內將出現顯著的市場成長。

核能發電業概況

核能發電市場是半靜態的。市場的主要企業(不分先後順序)包括通用電氣日立核能公司、西屋電氣公司、韓國電力工程建設公司、斯柯達 JS AS 和中國核工業集團公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 裝置容量及2029年預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 清潔能源需求不斷成長

- 有利措施延長植物壽命

- 限制因素

- 來自可再生能源的激烈競爭

- 事故和成本效益的不確定性

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按用途(定性分析)

- 能源

- 防禦

- 其他

- 核子反應爐類型

- 壓水式反應爐/加壓重水核子反應爐

- 沸水式反應爐

- 高溫反應爐

- 液態金屬快滋生反應器

- 其他核子反應爐

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 俄羅斯

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 伊朗

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 合併、收購、合資、合作和協議

- 主要企業策略

- 公司簡介

- Electricite de France SA(EDF)

- GE-Hitachi Nuclear Energy Inc.

- Westinghouse Electric Company LLC

- Duke Energy Corporation

- SKODA JS AS

- China National Nuclear Corporation

- Bilfinger SE

- BWX Technologies Inc.

- Doosan Enerbility Co. Ltd

- Mitsubishi Heavy Industries Ltd

- Bechtel Group Inc.

- Japan Atomic Power Company

- Rosatom State Atomic Energy Corporation

- KEPCO Engineering & Construction

- 市場排名/佔有率(%)分析

第7章 市場機會與未來趨勢

- 先進小型模組化反應堆

簡介目錄

Product Code: 68252

The Nuclear Power Market size is estimated at 398.24 gigawatt in 2025, and is expected to reach 439.69 gigawatt by 2030, at a CAGR of 2% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the ability of nuclear energy to generate electricity with lower carbon emissions compared to fossil fuels have been driving the market's growth over the medium term.

- On the other hand, the high initial cost of setting up a nuclear power plant and the availability of alternative power generation sources, such as renewable energy, is likely to restrain the market's growth during the forecast period.

- Nevertheless, nations worldwide are researching and developing generation IV nuclear energy technologies to promote safety, technical, economic, and advanced small modular reactors. This, in turn, is likely to create several future opportunities for the market.

- Asia-Pacific is expected to witness significant growth in the nuclear power market during the forecast period, owing to its substantial share of nuclear energy in China and India.

Nuclear Power Market Trends

Energy Segment Expected to Dominate the Market

- Nuclear energy is released from the nucleus or the core of an atom of protons and neutrons. Nuclear energy can be produced either in nuclear fission (when the nuclei of atoms split into several parts) or by fusion (when nuclei fuse). In today's world, nuclear fission produces electricity, while nuclear fusion technology produces power in the research and development (R&D) phase. As of 2022, the global nuclear power generation was about 2,679 TWh compared to around 2,802 TWh in 2021.

- Nuclear power plants can operate continuously for extended periods, providing a consistent supply of electricity, which is crucial in meeting the increasing energy demands of industrialized and developing nations.

- Furthermore, the energy segment contributes significantly to global efforts to mitigate climate change. Nuclear power generates virtually no greenhouse gas emissions during operation, making it a vital tool for reducing carbon dioxide and other harmful atmospheric pollutants.

- According to the Statistical Review of World Energy in 2022, the total electricity generated through nuclear energy was down by almost 4.4% compared to 2021 but recorded an annual growth rate of almost 1% between 2013 and 2022.

- Moreover, with the upcoming nuclear energy power plant projects, the generation capacity is expected to increase during the forecast period. For instance, in April 2023, according to the Atomic Energy Ministry, the Indian government granted authorization and financial approval for establishing ten nuclear reactors in five different states throughout India.

- With a capacity of 700 MW each, these reactors will be indigenous pressurized heavy water reactors constructed in fleet mode. The states where these reactors are scheduled to be set up include Karnataka, Haryana, Madhya Pradesh, and Rajasthan.

- Moreover, India entered the second stage of the country's three-stage nuclear program. In March 2024, the country commenced one of its first indigenous fast-breeder reactors (500 Mwe) in Kalpakkam, around 70 km from Chennai.

- Therefore, the energy segment is expected to dominate the nuclear power market during the forecast period due to the abovementioned points.

Asia-Pacific Expected to Witness Significant Growth

- In contrast to North America and Europe, where growth in nuclear electricity generating capacity has been limited for many years, several countries in Asia-Pacific are planning and building new nuclear power plants to meet their increasing demand for clean electricity.

- For instance, China focuses on innovation-driven growth, low-carbon development, integrating urban and rural areas with deeper social inclusion, and population aging. The 14th Five-Year Plan highlights high-quality green development, emphasizing innovation as the basis for modern development. By capitalizing on the accomplishments of the 13th Plan, the country intends to reduce the economy's carbon intensity and peak carbon dioxide emissions by 2030.

- Further, according to a draft of the 14th Five-Year Plan (2021-2025) released in March 2021, the government intends to reach 70 GW of nuclear capacity by the end of 2025.

- Furthermore, China's National Energy Administration (NEA) is examining the possibility of increasing the ambition of the country's clean energy programs this decade. The NEA proposes that China obtain 40% of its electricity from nuclear and renewable sources by 2030 and set its nuclear capacity target to 120-150 GW by 2030.

- The Indian government is dedicated to growing its nuclear power generation capacity to meet the increasing electricity demand in the country. According to the Indian government, the country's nuclear capacity is expected to reach about 22.5 GW by 2031.

- As per the Central Electricity Authority (CEA), India had 7.48 GW of nuclear power plants in India till January 2024, with 23 nuclear reactors and seven reactors with a combined capacity of 5,398 MWe under the construction stage.

- According to the Institute for Sustainable Energy Policies (ISEP), electricity generation initially dropped to zero for nuclear power in 2014 but witnessed a resurgence, accounting for 6.5% of electricity generation in 2019. However, it decreased to 4.3% in 2020, increased to 5.9% in 2021, and then declined again to 4.8% in 2022.

- Therefore, owing to the above factors, Asia-Pacific is expected to witness significant market growth during the forecast period.

Nuclear Power Industry Overview

The nuclear power market is semi-consolidated. Some of the major players in the market (in no particular order) include GE-Hitachi Nuclear Energy Inc., Westinghouse Electric Company LLC, KEPCO Engineering & Construction, SKODA JS AS, and China National Nuclear Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in Demand for Clean Energy

- 4.5.1.2 Plant Lifetime Extensions With Favorable Policies

- 4.5.2 Restraints

- 4.5.2.1 Intense Competition From Renewable Energy Sources

- 4.5.2.2 Accidents and Uncertainty over the Cost Effectiveness

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application (Qualitative Analysis)

- 5.1.1 Energy

- 5.1.2 Defense

- 5.1.3 Other Applications

- 5.2 By Reactor Type

- 5.2.1 Pressurized Water Reactor and Pressurized Heavy Water Reactor

- 5.2.2 Boiling Water Reactor

- 5.2.3 High-temperature Gas-cooled Reactor

- 5.2.4 Liquid-metal Fast-breeder Reactor

- 5.2.5 Other Reactor Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Russia

- 5.3.2.4 France

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Iran

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Electricite de France SA (EDF)

- 6.3.2 GE-Hitachi Nuclear Energy Inc.

- 6.3.3 Westinghouse Electric Company LLC

- 6.3.4 Duke Energy Corporation

- 6.3.5 SKODA JS AS

- 6.3.6 China National Nuclear Corporation

- 6.3.7 Bilfinger SE

- 6.3.8 BWX Technologies Inc.

- 6.3.9 Doosan Enerbility Co. Ltd

- 6.3.10 Mitsubishi Heavy Industries Ltd

- 6.3.11 Bechtel Group Inc.

- 6.3.12 Japan Atomic Power Company

- 6.3.13 Rosatom State Atomic Energy Corporation

- 6.3.14 KEPCO Engineering & Construction

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advanced Small Modular Reactors

02-2729-4219

+886-2-2729-4219