|

市場調查報告書

商品編碼

1851911

無底紙標籤:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Linerless Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

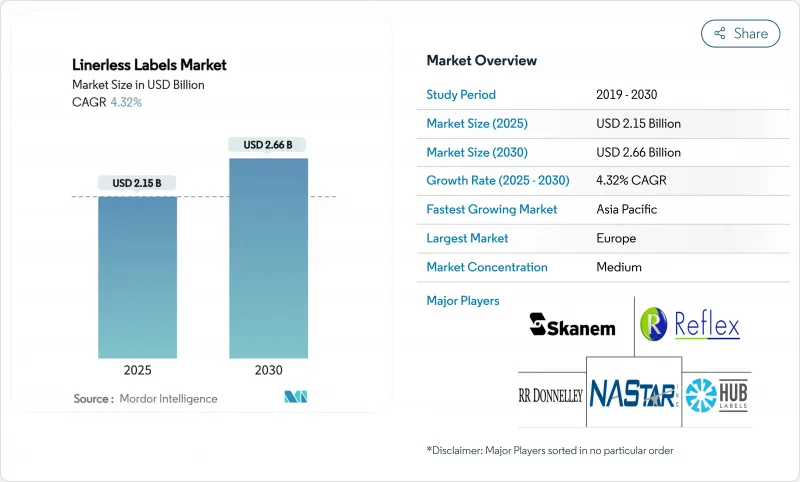

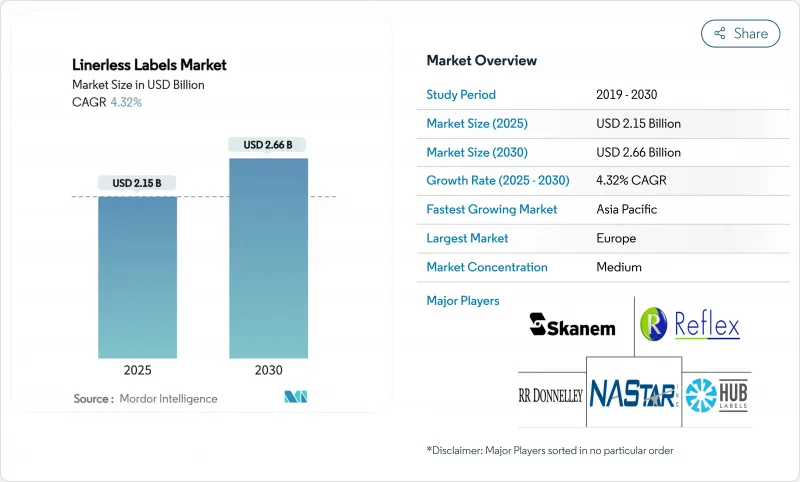

無底紙標籤市場預計到 2025 年將達到 21.5 億美元,到 2030 年將達到 26.6 億美元,年複合成長率為 4.32%。

該法規要求所有包裝在2030年前必須可回收,並爭取2040年將人均包裝廢棄物減少15%。柔版印刷繼續佔據40.32%的市場佔有率,而以噴墨和熱感技術為主導的數位印刷系統正以7.43%的複合年成長率快速成長,這主要得益於電子商務推動了對可變長度、客製印刷的需求。薄膜基材佔48.23%的市場佔有率,其中特種基材和再生基材的複合年成長率最高,達到8.11%,符合企業的循環經濟目標。水性丙烯酸膠黏劑保持其主導地位,市佔率為42.32%,而紫外光固化膠合劑正以7.84%的複合年成長率快速成長,以彌補低溫運輸性能方面的不足。歐洲以34.62%的市佔率領先,而亞太地區則在製造規模擴大和電子商務成長的推動下,以8.53%的複合年成長率快速成長。

全球無底紙標籤市場趨勢與洞察

對永續食品和飲料包裝的需求激增

為了滿足監管要求和消費者對低環境影響包裝的期望,食品品牌正在採用無底紙標籤。艾利丹尼森公司報告稱,其智慧標籤部門到2024年將實現15%的有機銷售額成長,其中大部分成長歸功於食品應用。與預襯紙產品相比,食品應用可減少30%的材料用量和49%的碳排放。生鮮食品供應商擴大指定使用無底紙解決方案,以減少掩埋的廢棄物並提高可追溯性。自動化包裝生產線正在利用動態標籤尺寸調整技術,將材料用量減少高達40%。這些因素共同加速了冷藏、冷凍和常溫產品類型的市場普及。隨著大型加工商制定供應商強制性要求並逐步推廣至整個區域價值鏈,其影響將更加顯著。對可回收面板和食品級UV固化黏合劑的投資將進一步推動已調理食品產業的應用。

物流的蓬勃發展需要可變長度的運輸標籤。

小包裹數量的快速成長迫使履約中心最佳化標籤庫存並減少浪費。東芝的DL1024工業印表機將運輸標籤和裝箱單整合到單一的可變長度格式中,從而降低40%的列印成本並消除襯紙浪費。美國郵政服務修訂後的小包裹標籤指南強調採用精簡設計以加快自動化掃描速度,間接支持了無襯紙包裝。高吞吐量設施報告稱,每卷標籤數量增加了50%,減少了換卷次數並提高了吞吐量。微型履約中心透過無襯紙包裝節省空間,提高了揀貨效率。零售商嚴格的永續發展評分標準正促使供應商轉向無襯紙系統,以避免因過度包裝而受到處罰。

改造舊式貼標生產線的成本

改用無底紙貼標機通常需要每條生產線投入 5 萬至 20 萬美元的資本升級,這對規模較小的加工商來說是一筆不小的開支,會將投資回收期延長至約兩年。 FoxJet 的全電動貼標機現在提供模組化改造套件,無需壓縮空氣,從而降低營業成本並簡化安裝。然而,員工培訓和改進的維護流程仍然會增加間接成本。許多生產商正在採用混合工作流程,使用無底紙貼標機生產新的 SKU,而使用傳統設備處理長期生產的產品。提供融資方案或訂閱模式的設備供應商可以透過減輕領先資金壓力來加快轉換速度。

細分市場分析

到2024年,彈性凸版印刷將維持40.32%的無底紙標籤市場佔有率,而數位印刷市場將以7.43%的複合年成長率成長。隨著電商企業對可變數據和即時客製化的需求日益成長,中短版數位印刷的無底紙標籤市場規模將迅速擴大。結合柔版底塗和噴墨底漆的混合印刷機可減少浪費並加快換版速度。熱感直印系統具有物流優勢,即使標籤需要承受物料輸送過程中的磨損,也能維持成本效益。數位工作流程還能減少水和溶劑的使用,進而實現永續性目標。對線上完工和雲端色彩管理的投資提高了輸出一致性,使數位印刷能夠在中等版次的印刷量上與傳統柔版印刷展開正面競爭。

與RFID嵌體插入技術的兼容性進一步增強了數位技術的作用,實現了智慧標籤的一次性生產。利用網路標籤入口網站的加工商正從需要個人化設計且無最低訂購量限制的小型經銷商中獲得新的收入。基材製造商正在推出無需底塗的薄膜,從而提高油墨附著力並降低耗材成本。摘要,印刷技術組合正在快速變化,柔版印刷更適合大宗商品SKU,而數位印刷更適合無底紙標籤市場中快速變化、數據豐富的應用。

由於其耐濕性和較長的保存期限,以PP和PET為主的薄膜面材佔據了無底紙標籤市場48.23%的佔有率。然而,在買家對循環經濟的承諾和監管機構對再生材料含量配額的推動下,特種材料和再生材料替代品的市場成長速度正在超過它們,複合年成長率高達8.11%。預計到2030年,用於食品和個人護理包裝的再生材料薄膜無底紙標籤市場規模將穩定成長。 UPM Raflatac的碳行動產品組合採用ISCC認證的材料,旨在減少從搖籃到大門的排放,並吸引那些尋求範圍3減排的品牌。

紙面材料填補了可堆肥性和觸感優先於耐用性的市場空白。混合結構將薄型聚丙烯(PP)表層與再生牛皮紙基材結合,在最佳化強度的同時降低了原生塑膠的用量。可水洗薄膜可在鹼性溶液中剝離,實現PET的閉合迴路回收,這對於尋求瓶到瓶回收系統的飲料供應商至關重要。供應商現在能夠提供與傳統複合標籤相媲美的更豐富的顏色和表面處理選擇,從而消除了特種標籤應用的一大障礙。對雙向拉伸線和解解聚合回收工廠的持續投資將擴大原料供給能力,以滿足不斷成長的需求。

區域分析

2024年,歐洲將佔全球銷售額的34.62%,這得益於其較早的監管政策、完善的零售網路和成熟的加工商基礎。 UPM Raflatac和HERMA等區域領導者率先推出了可清洗和再生材料包裝,從而帶動了自有品牌的需求成長。政府採購標準中對可回收包裝的明確規定進一步鞏固了歐洲的領先地位。北美也緊隨其後,這主要得益於電子商務的快速發展以及各州推行的生產者延伸責任制立法,該立法將包裝供應商的廢棄物成本內部化。該地區的加工商正在投資建造高速紫外線消毒生產線,以服務冷藏食品和小包裹配送中心,而CCL Industries則透過策略性收購擴大產能。

亞太地區將以8.53%的複合年成長率成為成長最快的地區,這主要得益於中國龐大的製造業規模和印度電子商務的快速發展。隨著本地加工商增加數位印刷機,以及國際品牌對美觀、永續包裝的需求不斷成長,該地區的無底紙標籤市場佔有率預計將會上升。日本Lintec Corporation公司正在投資擴大耐寒黏合劑的產能和研發,以鞏固其在該地區的技術領先地位。越南和印尼等新興市場正在採用無底紙標籤,以滿足西方零售商制定的出口認證標準。南美洲也呈現出選擇性成長,一家巴西大型飲料製造商正在寶特瓶回收計劃中試用可清洗薄膜。在中東和非洲,阿拉伯聯合大公國和南非處於領先地位,跨國快速消費品工廠正在採用全球標準。

監管協調、跨境電子商務以及對生產能力的投資都表明,該地區的需求將持續輪動。隨著資本流入亞太地區的生產能力,原料供應鏈也將隨之調整,進一步降低單價並加速生產線庫存的更新換代。歐洲仍然是監管領域的標桿,其政策創新正日益在全球範圍內得到效仿,鞏固了無內襯生產能力作為出口型製造商基本要求的地位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對永續食品和飲料包裝的需求激增

- 電子商務物流的蓬勃發展需要可變長度的運輸標籤。

- 歐洲和北美減少廢棄物的監管要求

- 按需無底紙印刷促進快餐店廚房自動化

- 採用RFID互聯包裝及微型履約

- 市場限制

- 傳統標籤生產線維修成本

- 原料價格波動(黏合劑和被覆劑);

- 低溫運輸環境中的黏合劑累積問題

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過印刷技術

- 數位(噴墨和熱感)

- 柔版印刷

- 凹版印刷

- 膠印和凸版印刷

- 透過面材

- 紙

- 薄膜(PP、PET、PE)

- 特種和再生基材

- 按黏合劑類型

- 水性丙烯酸

- 熱熔膠

- 紫外線固化型

- 溶劑型

- 按最終用戶行業分類

- 食物

- 飲料

- 醫療保健和製藥

- 化妝品和個人護理

- 家用化學品

- 物流與電子商務

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲、紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Avery Dennison Corporation

- CCL Industries(Inc. & Innovia Films)

- 3M Company

- Beontag

- UPM Raflatac

- Coveris

- Hub Labels Inc.

- Reflex Labels Ltd

- Skanem AS

- NAStar Inc.

- Optimum Group

- SATO Europe GmbH

- ProPrint Group

- Lexit Group AS

- RR Donnelley & Sons Co.

- Gipako UAB

- Lintec Corporation

- HERMA GmbH

- Zebra Technologies

- Multi-Color Corporation

第7章 市場機會與未來展望

The linerless labels market size is valued at USD 2.15 billion in 2025 and is forecast to reach USD 2.66 billion by 2030, advancing at a 4.32% CAGR.

Growth is anchored in stricter global packaging regulations, particularly the European Union's Packaging and Packaging Waste Regulation, which requires all packaging to be recyclable by 2030 and targets a 15% cut in per-capita packaging waste by 2040. Flexography continues to hold a 40.32% share, yet digital systems led by inkjet and thermal technologies are expanding at a 7.43% CAGR as e-commerce drives demand for variable-length, on-demand printing. Film facestocks account for 48.23% share, while specialty and recycled substrates post the strongest 8.11% CAGR amid corporate circular-economy goals. Water-based acrylic adhesives remain dominant at 42.32% share; UV-curable chemistries grow the fastest at 7.84% CAGR, solving cold-chain performance gaps. Europe leads with 34.62% share; however, Asia-Pacific rises at an 8.53% CAGR on the back of manufacturing scale-up and e-commerce expansion.

Global Linerless Labels Market Trends and Insights

Surge in Sustainable Food and Beverage Packaging Demand

Food brands are embedding linerless labels to meet both regulatory compliance and consumer expectations for lower-impact packaging. Avery Dennison reported 15% organic sales growth in its Intelligent Labels division during 2024, attributing much of the increase to food applications that cut material use by 30% and carbon footprint by 49% versus linered products. Fresh produce suppliers increasingly specify linerless solutions to slash landfill waste and enhance traceability, while automated packaging lines leverage dynamic label sizing to trim material usage by up to 40%. Combined, these factors accelerate market uptake across chilled, frozen and ambient product categories. The effect compounds as large processors set supplier mandates that cascade through regional value chains. Investments in recyclable facestocks and food-grade UV-curable adhesives further propel adoption in prepared-meal sectors.

E-commerce Logistics Boom Requiring Variable-Length Shipping Labels

Soaring parcel volumes force fulfillment centers to optimize label inventory and waste. Toshiba's DL1024 industrial printer merges shipping labels and packing slips into one variable-length format, lowering printing costs by 40% and eliminating liner waste. The United States Postal Service's revised parcel-labeling guide emphasizes streamlined designs that speed automated scanning, indirectly supporting linerless migration. High-volume facilities report 50% more labels per roll, translating into fewer roll changes and faster throughput. In micro-fulfillment hubs, space savings from liner elimination unlock additional picking capacity. Retailers' stricter sustainability scorecards are pushing suppliers toward linerless systems to avoid penalties linked to excess packaging.

Retrofit Costs for Legacy Labeling Lines

Switching to linerless often demands capital upgrades of USD 50,000 - 200,000 per line, a hurdle for smaller converters that extends payback periods to roughly two years. FoxJet's all-electric labelers now offer modular retrofit kits that remove compressed-air requirements, lowering operating costs and easing installation. Still, personnel training and revised maintenance routines add indirect expense. Many producers adopt hybrid workflows: linerless on new SKUs while legacy gear handles long-running products. Equipment vendors that bundle finance packages or subscription models can accelerate conversion by alleviating upfront cash pressure.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Waste-Reduction Mandates in Europe and North America

- QSR Kitchen Automation Uptake of On-Demand Linerless Printing

- Raw-Material Price Volatility Affecting Adhesives and Release Coatings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexography maintained a 40.32% slice of the linerless labels market in 2024, but the digital segment is expanding at a 7.43% CAGR. The linerless labels market size for digital presses serving short and mid runs is set to widen quickly as e-commerce brands demand variable data and real-time customization. Hybrid presses that merge flexo priming with inkjet finishing lower waste and speed changeovers, an advantage for converters chasing small batch jobs. Thermal direct systems flourish in logistics because labels must survive material-handling abrasion yet remain cost-effective. Digital workflows also reduce water and solvent use, aligning with sustainability scorecards. Investments in inline finishing and cloud-connected color management lift output consistency, helping digital formats compete head-on with conventional flexo for medium runs.

Compatibility with RFID inlay insertion further elevates digital's role, enabling one-pass production of smart labels. Converters leveraging web-to-label portals capture new revenue from small sellers needing personalized designs without minimum-order hurdles. As substrate manufacturers release primer-free films, ink adhesion improves and reduces consumable costs. In summary, the printing-technology mix is shifting rapidly, with flexo staying relevant for commoditized SKUs while digital becomes the default for fast-moving, data-rich applications across the linerless labels market.

Film-based facestocks-largely PP and PET-retain a 48.23% grip on the linerless labels market share thanks to moisture resistance and shelf appeal. Yet specialty and recycled alternatives outpace at an 8.11% CAGR, propelled by buyers' circular-economy pledges and regulatory recycled-content quotas. The linerless labels market size for recycled-content films covering food and personal-care packages is forecast to climb steadily through 2030. UPM Raflatac's Carbon Action portfolio uses ISCC-certified feedstocks to cut cradle-to-gate emissions and appeal to brands chasing Scope-3 reductions.

Paper facestocks defend niches where compostability or tactile branding trumps durability. Hybrid structures pairing thin PP overcell with recycled-kraft bases optimize strength while shrinking virgin-plastic content. Wash-off films that delaminate in alkaline baths permit closed-loop PET recycling, crucial for beverage suppliers seeking bottle-to-bottle systems. Suppliers broaden color and finish ranges to rival conventional laminated labels, removing one more barrier to specialty adoption. Continuous investment in biax-stretch lines and depolymerization recycling plants indicates that feed-stock availability will scale to meet rising demand.

The Linerless Labels Market Report is Segmented by Printing Technology (Digital, Flexography, Gravure, Offset and Letterpress), Facestock Material (Paper, Film, Specialty and Recycled Substrates), Adhesive Type (Water-Based Acrylic, Hot-Melt, UV-Curable, Solvent-Based), End-User Industry (Food, Beverage, Healthcare and Pharmaceuticals, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe commanded 34.62% of 2024 revenue on the strength of early regulatory adoption, dense retail networks and established converter bases. Regional majors such as UPM Raflatac and HERMA pioneer wash-off and recycled-content formats, creating spill-over demand among private-label brands. Government procurement criteria specifying recyclable packaging further cement Europe's lead. North America follows, buoyed by e-commerce acceleration and statewide extended-producer-responsibility bills that internalize disposal costs for packaging suppliers. Converters here invest in high-speed UV lines to serve chilled-food and parcel hubs, while CCL Industries expands capacity via strategic acquisitions.

Asia-Pacific registers the fastest 8.53% CAGR, driven by China's manufacturing scale and India's rapid e-commerce penetration. The linerless labels market share in the region is poised to climb as local converters add digital presses and overseas brands demand harmonized sustainable packaging. Japan's Lintec Corporation invests in capacity upgrades and R&D for cold-resistant adhesives, reinforcing regional technology leadership. Emerging markets such as Vietnam and Indonesia adopt linerless to meet export certification standards set by Western retailers. South America sees selective growth as Brazil's beverage giants trial wash-off films in PET bottle recycling projects. In the Middle East & Africa, uptake centers on United Arab Emirates and South Africa where multinational FMCG plants deploy global specifications.

Collectively, regulatory harmonization, cross-border e-commerce and capacity investments suggest sustained regional demand rotation. As capital flows into Asia-Pacific capacity, raw-material supply chains adapt, further lowering unit costs and accelerating substitution away from linered stock. Europe remains the regulatory bellwether; its policy innovations are increasingly mirrored worldwide, embedding linerless capability as a baseline requirement for export-oriented manufacturers.

- Avery Dennison Corporation

- CCL Industries (Inc. & Innovia Films)

- 3M Company

- Beontag

- UPM Raflatac

- Coveris

- Hub Labels Inc.

- Reflex Labels Ltd

- Skanem AS

- NAStar Inc.

- Optimum Group

- SATO Europe GmbH

- ProPrint Group

- Lexit Group AS

- R.R. Donnelley & Sons Co.

- Gipako UAB

- Lintec Corporation

- HERMA GmbH

- Zebra Technologies

- Multi-Color Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in sustainable food and beverage packaging demand

- 4.2.2 E-commerce logistics boom requiring variable-length shipping labels

- 4.2.3 Regulatory waste-reduction mandates in Europe and North America

- 4.2.4 QSR kitchen automation uptake of on-demand linerless printing

- 4.2.5 RFID-enabled connected packaging and micro-fulfillment adoption

- 4.3 Market Restraints

- 4.3.1 Retrofit costs for legacy labeling lines

- 4.3.2 Raw-material price volatility (adhesives and release coating)

- 4.3.3 Adhesive build-up issues in cold-chain environments

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Printing Technology

- 5.1.1 Digital (Inkjet and Thermal)

- 5.1.2 Flexography

- 5.1.3 Gravure

- 5.1.4 Offset and Letterpress

- 5.2 By Facestock Material

- 5.2.1 Paper

- 5.2.2 Film (PP, PET, PE)

- 5.2.3 Specialty and Recycled Substrates

- 5.3 By Adhesive Type

- 5.3.1 Water-based Acrylic

- 5.3.2 Hot-Melt

- 5.3.3 UV-Curable

- 5.3.4 Solvent-based

- 5.4 By End-user Industry

- 5.4.1 Food

- 5.4.2 Beverage

- 5.4.3 Healthcare and Pharmaceuticals

- 5.4.4 Cosmetics and Personal Care

- 5.4.5 Household Chemicals

- 5.4.6 Logistics and E-commerce

- 5.4.7 Other End-User Industry

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Avery Dennison Corporation

- 6.4.2 CCL Industries (Inc. & Innovia Films)

- 6.4.3 3M Company

- 6.4.4 Beontag

- 6.4.5 UPM Raflatac

- 6.4.6 Coveris

- 6.4.7 Hub Labels Inc.

- 6.4.8 Reflex Labels Ltd

- 6.4.9 Skanem AS

- 6.4.10 NAStar Inc.

- 6.4.11 Optimum Group

- 6.4.12 SATO Europe GmbH

- 6.4.13 ProPrint Group

- 6.4.14 Lexit Group AS

- 6.4.15 R.R. Donnelley & Sons Co.

- 6.4.16 Gipako UAB

- 6.4.17 Lintec Corporation

- 6.4.18 HERMA GmbH

- 6.4.19 Zebra Technologies

- 6.4.20 Multi-Color Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment