|

市場調查報告書

商品編碼

1689710

實驗室氣體發生器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Laboratory Gas Generators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

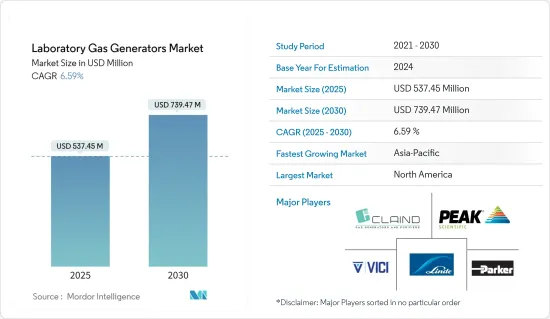

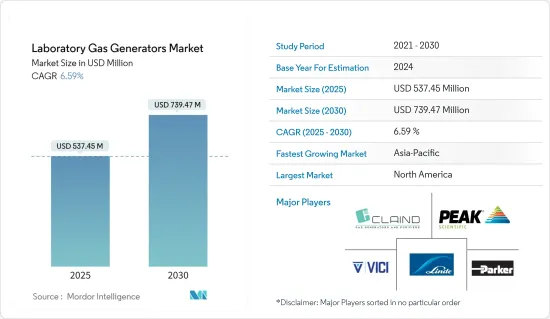

實驗室氣體發生器市場規模預計在 2025 年為 5.3745 億美元,預計到 2030 年將達到 7.3947 億美元,預測期內(2025-2030 年)的複合年成長率為 6.59%。

由於營運和供應鏈中斷、客戶需求減少以及全球經濟放緩,COVID-19 對實驗室氣體發生器市場產生了影響。因此,全球各地學術機構和實驗室的關閉導致該公司部門收益大幅損失。此外,由於與 COVID-19 相關的實驗室研發活動,疫情期間對實驗室氣體發生器的需求增加。例如,2021年6月,Novagenix在其COVID-19藥物研發研究中使用了PEAK氮氣產生器,以評估和認證土耳其藥物的功效和品質。實驗室氣體發生器在 COVID 藥物研發中的應用推動了疫情期間對實驗室氣體發生器的需求。因此,COVID-19 疫情推動了市場成長,預計在本研究的預測期內將繼續推動市場成長。

這一市場成長主要源於人們對使用傳統氣瓶的安全問題的日益關注、藥品和食品核准過程中分析技術的重要性日益提升以及目標行業研發支出的不斷增加。

分析化學在藥物開發中發揮著至關重要的作用,確保了新藥的品質、安全性和有效性。儘管在製藥領域採用了多種分析技術,但三種常見的分析技術主要用於結構測定、分析物分離和目標化合物的定量。這些包括層析法、光譜法和傳統分析化學技術。分析測試擴大應用於檢測和鑑定危險化學品,包括雜質和藥物。 藥物活性化合物。在此背景下,2022 年 3 月發表的一篇 Azo optics報導指出,紫外線/可見光 (UV/Vis) 和紅外線(IR) 光譜是用於量化成品食品中食品添加劑存在的兩種標準光譜技術。這兩種方法可以提供有關食品添加劑的化學成分、質地特性和品質相關方面的重要細節。因此,隨著食品核准過程分析測試中光譜學的應用日益廣泛,實驗室氣體發生器的興起有望推動市場的成長。

此外,高效液相層析(HPLC)技術利用含有蛋白質和磷脂質的固定形式來模擬藥物分子擴散的生物環境,稱為仿生層析法。歐洲化學學會於 2022 年 4 月發表的一篇論文描述了使用仿生層析法資料預測藥品和農藥的水生毒性。預計此類分析技術的日益普及將推動對經常用於分析的實驗室氣體發生器的需求,從而推動市場成長。

此外,根據 2022 年 7 月發表的 PharmaVoice報導,截至 2022 年的五年間,生技領域的研發支出幾乎加倍。氮氣實驗室氣體發生器主要用於生物技術實驗室,因為它們是受控環境。因此,隨著對生物技術產業的投資不斷增加,實驗室氣體發生器的需求預計將會成長。

此外,市場參與企業也參與收購、合併和產品發布等策略。例如,2022 年 8 月,Tisch Environmental 收購了 AADCO Instruments(先進分析設備公司)。 AADCO 開發了尖端的零空氣產生器系列。

因此,預計藥品和食品核准過程中分析技術重要性日益增加、研發支出不斷增加以及併購等市場參與企業活動活性化等因素將在預測期內出現成長。然而,不願取代傳統的天然氣供應方式以及熟練工人的短缺預計將抑制市場的成長。

實驗室氣體發生器市場趨勢

預計氮氣發生器將在預測期內佔據主要市場佔有率

預計預測期內氮氣發生器將促進所研究領域的成長。氮氣發生器是一種從壓縮空氣中分離氮分子的機器。它廣泛應用於食品工業、半導體、石油、化學品、研究機構等。分析技術在藥品和食品核准過程中的重要性日益增加、人們對食品安全的擔憂日益加劇以及目標行業研發支出的增加等因素正在推動這一領域的成長。此外,氮氣產生器與其他化合物的反應性低以及能夠控制環境氧氣水平等優勢,使得其在液相層析法質譜 (LC-MS) 分析、蒸發光散射檢測器(ELSD) 操作以及培養箱(IVF) 培養箱環境條件維持等方面的應用日益廣泛。

傳統的氮氣瓶有幾個缺點,包括高洩漏風險。例如,2021 年 1 月發表的一篇 NPR 調查報導記錄了喬治亞東北部一家養雞場發生危險的氮氣洩漏,造成 6 人死亡,11 人住院。報告也指出,在實驗室中儲存大量加壓、高度易燃的氮氣會增加火災和爆炸的風險。這導致對減輕這些風險的先進氮氣產生器的需求增加。這些氮氣發生器結構緊湊、性能穩定、經濟高效且易於操作。因此,這些進步正在推動對氮氣產生器的需求。

此外,公司也參與收購、合併和產品發布等行銷策略。例如,根據日機裝低溫工業清潔能源工業氣體集團報道,2021 年 9 月,日機裝 Cosmodyne 最近運作了其 TGNO-1,000 氣態氧和氮工廠。 TGNO 是一種低溫氧氣和氮氣發生器,旨在生產三種氣體產品:中高壓氮氣和氧氣。

此外,2021 年 7 月,Scientific Laboratory Supplie推出了其 SLS Lab Pro 氣體和液態氮產生器產品線,並在英國和愛爾蘭獨家經銷。該技術使實驗室能夠控制其氣體供應,並透過消除跨國運輸氣瓶的需要來促進永續性。

同樣,各種生技藥品和醫藥產品研發的增加也有望積極推動對氮氣發生器的需求。

因此,由於人們對氮氣性能而非傳統氮氣瓶的偏好日益成長,以及創新產品的推出,預計整個氮氣發生器市場將在本研究的預測期內穩步成長。

預計在預測期內,北美將佔據實驗室氣體發生器市場的大部分佔有率

由於北美地區許多製藥業和其他行業的研發活動不斷增加,預計該地區將佔據相當大的市場佔有率。推動北美實驗室氣體發生器市場成長的關鍵因素包括完善的基礎設施和製藥業不斷增加的研發支出。

預計美國各製藥公司和政府組織近期增加研發 (R&D) 支出將在預測期內推動市場成長。例如,全球製藥公司諾華公司(Novartis AG)根據其2021年年報顯示,2021年其研發投入為148.86億美元,高於2020年的141.97億美元。另一家大型製藥商輝瑞(Pfizer)在2021年年報中也表示,其2021年的研發投入為138.29億美元,較2020年的93.93億美元大幅成長。因此,製藥業研發支出的增加預計將對實驗室氣體發生器的需求產生正面影響。氣體發生器在製藥製造和下游製程中發揮著至關重要的作用,從而促進了該地區市場的成長。

此外,2021年6月,賽諾菲推出了mRNA卓越中心,投資超過4.1014億美元,以加速美國下一代疫苗的開發和交付。生產先進疫苗的製造設施的建立可能會為製藥和生物製藥行業領域使用實驗室氣體發生器創造機會。預計這將推動該地區的市場成長。

研究機構和大學正在致力於開發新技術,預計這些技術將在預測期內為該國市場的發展做出貢獻。例如,2022年2月,麻省理工學院(MIT)林肯實驗室展示了一種可攜式氫燃料發電機,這是一種將鋁轉化為氫燃料的原型設備。該設備稱為氫戰術加油點(H-TaRP)。它由鋁分配器、反應容器、水冷系統和用於填充氫氣罐的控制系統歧管組成。

因此,預計在預測期內,研發支出的增加、先進新技術的快速採用以及該地區重要的市場參與企業等因素將有助於北美市場的成長。

實驗室氣體發生器產業概況

該市場競爭較為溫和,由少數本土公司和一些國際參與企業組成。實驗室氣體發生器市場的主要企業包括 Claind Srl、ErreDue spa、F-Dgsi、Labtech SRL、LNI Swissgas、Nel ASA、Parker-Hannifin Corporation、Peak Scientific Instruments, Ltd、VICI DBS Srl 等,它們在全球範圍內提供這些產品。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概覽

- 市場促進因素

- 傳統氣瓶使用安全問題日益嚴重

- 分析技術在藥品和食品核准過程中的重要性日益增加

- 增加目標產業的研發支出

- 市場限制

- 不願取代傳統的天然氣供應方式

- 熟練勞動力短缺

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按類型

- 氮氣產生器

- 氫氣發生器

- 零空氣發生器

- TOC氣體發生器

- 其他氣體發生器

- 按最終用戶

- 食品飲料公司

- 化工和石化公司

- 製藥和生物技術公司

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作理事會國家

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章競爭格局

- 公司簡介

- Claind Srl

- ErreDue spa

- F-Dgsi

- Labtech SRL

- LNI Swissgas

- Nel ASA

- Parker-Hannifin Corporation

- Peak Scientific Instruments, Ltd.

- Linde Plc(Praxair Technology Inc.)

- Valco InstrumenValco Instruments Company, Inc(VICI DBS SRL)

- On Site Gas Systems Inc

- Isolcell SpA

- Oxymat A/S

第7章 市場機會與未來趨勢

The Laboratory Gas Generators Market size is estimated at USD 537.45 million in 2025, and is expected to reach USD 739.47 million by 2030, at a CAGR of 6.59% during the forecast period (2025-2030).

COVID-19 impacted the laboratory gas generators market due to the disruption of operation and supply chain, decreased customer demand, and global economic slowdown. Thus, the closure of academic institutions and laboratories across the globe has resulted in a significant loss of segmental revenue for businesses. Moreover, the demand for laboratory gas generators increased during the pandemic due to COVID-19-related laboratory-based research and development activity. For instance, in June 2021, Novagenix used PEAK nitrogen generators in their COVID-19 drug discovery study to assess and certify the efficacy and quality of medications in Turkey. Such usage of laboratory gas generators in drug discovery of COVID drove the demand for laboratory gas generators during the pandemic. Thus, the COVID-19 pandemic has boosted the market's growth and is expected to follow the same traction during the forecast period of the study.

The growth in this market is primarily driven by the rising safety concerns related to conventional gas cylinders use, the growing importance of analytical techniques in drug and food approval processes, and increasing R&D spending in target industries.

Analytical chemistry plays a crucial role in drug development, ensuring novel medications' quality, safety, and efficacy. Although several analytical methods are utilized in the pharmaceutical sector, three general analytical techniques are chiefly used to determine the structure, separate analytes, and quantify target compounds. These include chromatography, spectroscopy, and conventional analytical chemistry techniques. The application of analytical testing is growing for detecting and identifying dangerous chemicals, including both adulterants and pharmaceutically active compounds. In this context, the Azo optics article published in March 2022 stated that ultraviolet/visible (UV/Vis) and infrared (IR) spectroscopy are two standard spectroscopic techniques used to quantify the presence of food additives in their finished food items. These two methods can offer crucial details about the chemical composition, textural traits, and quality-related aspects of food additives. Thus, with the increasing spectroscopy use for analytical testing of the food approval process, laboratory gas generators are also expected to increase, thereby boosting the market growth.

Furthermore, high-performance liquid chromatography (HPLC) techniques use stationary phases containing proteins and phospholipids to simulate the biological environment where diffused drug molecules are known as biomimetic chromatography. The article published by European Chemical Societies in April 2022 mentioned using biomimetic chromatographic data to forecast the aquatic toxicity of drugs and pesticides. Such increasing adoption of these analytical techniques is expected to generate the demand for laboratory gas generators, frequently used to perform them, thereby driving the market growth.

Additionally, the PharmaVoice article published in July 2022 stated that in the five years running up to 2022, the biotechnology sector's R&D spending nearly doubled. As the biotechnology labs are a controlled environment, the nitrogen laboratory gas generators are primarily used in such labs. Thus, with the increasing investment in the biotechnology industries, the growth of laboratory gas generators is anticipated.

Moreover, market players are also involved in strategies such as acquisitions, mergers, and product launches, among others. For instance, in August 2022, Tisch Environmental acquired AADCO Instruments (Advanced Analytical Device Company). The company AADCO is developing a state-of-the-art line of Zero Air Generators.

Hence, factors such as the growing importance of analytical techniques in drug and food approval processes, growing R&D expenditure, and increased market player activities such as mergers and acquisitions are expected to witness growth over the forecast period. However, reluctance to replace conventional gas supply methods and lack of skilled personnel is expected to restrain the market's growth.

Laboratory Gas Generators Market Trends

Nitrogen Gas Generators is Expected to Hold Significant Share in the Market Over the Forecast Period

Nitrogen gas generator is expected to contribute to the growth of the studied segment over the forecast period. Nitrogen gas generators are machines that separate nitrogen molecules from compressed air. It is widely adopted in the food industry, semiconductors, petroleum, chemistry, and research institutes. Factors such as the growing importance of analytical techniques in drug and food approval processes, rising food safety concerns, and increasing R&D spending in target industries are driving segment growth. Additionally, advantages such as low reactivity with other compounds and the ability to control ambient oxygen levels are increasing the adoption of nitrogen gas generators in carrying out liquid chromatography-mass spectrometry (LC-MS) analysis to operating evaporative light scattering detectors (ELSDs) and maintaining environmental conditions in Vitro Fertilization (IVF) incubators.

Conventional nitrogen cylinders are associated with several downsides, such as a higher risk of leaks. For instance, an NPR study article published in January 2021 demonstrated how dangerous nitrogen leaks had killed six people and caused 11 hospitalizations in the Northeast Georgia poultry plant. The report also mentions that storing vast amounts of pressurized, highly flammable nitrogen in laboratories increases the risk of fire and explosions. Hence there is an increase in demand for advanced nitrogen gas generators as it mitigates these risks. These nitrogen gas generators are compact, consistent, cost-effective, and easy to operate. Thus, such advancements boost the demand for nitrogen gas generators.

Moreover, companies are also involved in marketing strategies such as acquisitions, mergers, and product launches. For instance, in September 2021, another company Nikkiso Cryogenic Industries' Clean Energy & Industrial Gases Group, reported that Nikkiso Cosmodyne recently commissioned its TGNO-1000 gaseous oxygen and nitrogen plant. TGNO is a cryogenic oxygen and nitrogen generator designed to produce three gaseous product streams, which are medium and high-pressure nitrogen and oxygen gas.

Additionally, in July 2021, Scientific Laboratory Supplies launched a line of SLS lab pro gas and liquid nitrogen generators, available exclusively in the UK and Ireland. This technology gives laboratories control over their gas supplies and promotes sustainability by eliminating the need for cross-country transportation of gas canisters.

Likewise, the rising research and expenditure for developing various biologics or pharmaceutical products are also expected to reflect positively on the growing demand for nitrogen gas generators.

Thus, due to the growing preference for nitrogen gas performance over conventional nitrogen cylinders and innovative product launches, the overall market for nitrogen gas generators will grow steadily over the forecast period of the study.

North America is Expected to Hold Significant Share in the Laboratory Gas Generators Market Over the Forecast Period

North America is expected to hold a significant market share, owing to the rise in research and development activities among numerous pharmaceutical and other industries in the region. The major factors driving the growth of the laboratory gas generators market in the North American region include the well-established infrastructure and increased R&D spending for the pharmaceutical industry.

The high expenditure on research and development (R&D) by various pharmaceutical companies and government organizations has been increasing recently in the US, anticipated to drive market growth over the forecast period. For instance, per the 2021 annual reports of Novartis AG, one of the global pharmaceutical companies, invested USD 14,886 million in 2021 for R&D, which increased from USD 14,197 million in 2020. In addition, another major pharmaceutical manufacturer, Pfizer Inc., invested USD 13,829 million in 2021 on R&D, which increased heavily compared to USD 9,393 in 2020, as mentioned in the 2021 annual report of the company. Thus, the increased research and development expenses in the pharmaceutical industry are expected to reflect positively on the demand for laboratory gas generators. They play a crucial role in drug production and down-streaming processes, thereby contributing to the market's growth in this region.

Additionally, in June 2021, Sanofi launched the mRNA Center of Excellence and invested over USD 410.14 million to accelerate developing and delivering next-generation vaccines in the US. Establishing manufacturing facilities to produce advanced vaccines will likely create opportunities for using laboratory gas generators in the pharmaceutical and biopharmaceutical industry segment. Thus, it is expected to drive market growth in the region.

Research organizations and universities are taking initiatives to develop new technologies, which are expected to contribute to the market growth in the country during the forecast period. For instance, in February 2022, the Massachusetts Institute of Technology (MIT) Lincoln Laboratory demonstrated a portable hydrogen fuel generator, a prototype device to convert aluminum into hydrogen fuel. The device is called the Hydrogen Tactical Refueling Point (H-TaRP). It comprises an aluminum dispenser, reactor vessel, water cooling system, and a control system manifold to fill a hydrogen tank.

Therefore, the factors such as rising research and development expenditure, quick adoption of advanced new technologies, and significant market players in this region are expected to contribute to the market's growth in North America during the forecast period.

Laboratory Gas Generators Industry Overview

The market studied is moderately competitive and consists of local players across several countries and some international players. The major players in the laboratory gas generators market include Claind S.r.l., ErreDue spa, F-Dgsi, Labtech S.R.L., LNI Swissgas, Nel ASA, Parker-Hannifin Corporation, Peak Scientific Instruments, Ltd and VICI DBS S.r.l., providing these products across the globe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Safety Concerns Related to the Use of Conventional Gas Cylinders

- 4.2.2 Growing Importance of Analytical Techniques in Drug and Food Approval Processes

- 4.2.3 Increasing R&D Spending in Target Industries

- 4.3 Market Restraints

- 4.3.1 Reluctance to Replace Conventional Gas Supply Methods

- 4.3.2 Lack of Skilled Personnel

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Type

- 5.1.1 Nitrogen Gas Generators

- 5.1.2 Hydrogen Gas Generators

- 5.1.3 Zero Air Generators

- 5.1.4 TOC Gas Generators

- 5.1.5 Other Gas Generators

- 5.2 By End User

- 5.2.1 Food and Beverage Companies

- 5.2.2 Chemical and Petrochemical Companies

- 5.2.3 Pharmaceutical and Biotechnological Companies

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Claind S.r.l.

- 6.1.2 ErreDue spa

- 6.1.3 F-Dgsi

- 6.1.4 Labtech S.R.L.

- 6.1.5 LNI Swissgas

- 6.1.6 Nel ASA

- 6.1.7 Parker-Hannifin Corporation

- 6.1.8 Peak Scientific Instruments, Ltd.

- 6.1.9 Linde Plc (Praxair Technology Inc.)

- 6.1.10 Valco InstrumenValco Instruments Company, Inc (VICI DBS SRL)

- 6.1.11 On Site Gas Systems Inc

- 6.1.12 Isolcell S.p.A

- 6.1.13 Oxymat A/S