|

市場調查報告書

商品編碼

1438553

草坪保護:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Turf Protection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

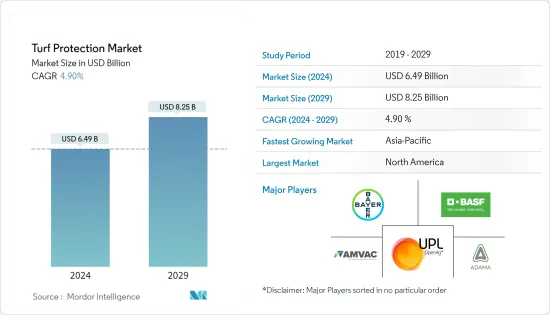

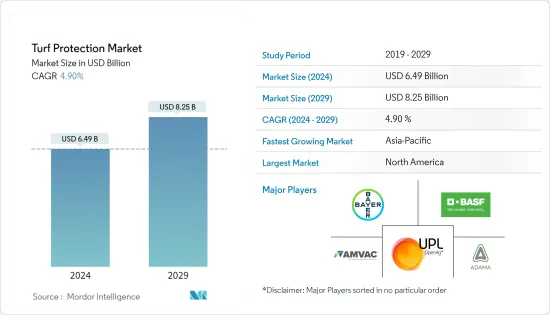

草坪保護市場規模預計2024年為64.9億美元,預計到2029年將達到82.5億美元,在預測期內(2024-2029年)年複合成長率為4.90%成長。

COVID-19感染疾病擾亂了多個市場的活動,包括全球草坪保護市場。疫情影響了供應鏈網路,對企業造成了損失。供給方面,由於流通瓶頸,短期內移工短缺,導致農藥生產所需工人數量出現較大缺口。然而,COVID-19感染疾病對市場成長產生了短期影響,但可能會提振投資。由於強勁的成長和不斷變化的趨勢,草坪護理行業多年來已經發生了轉變。

維護草坪是一項艱鉅的任務,因此您需要保護它以防止害蟲和雜草造成的損失。對板球、高爾夫和足球等運動的高需求可能會在預測期內刺激市場。創新公司能夠快速適應變化並獲得高報酬率。草坪保護市場的主要企業見證了出口導向市場和國內市場的收益成長。然而,本土企業之間的競爭、買方議價能力的增強以及低成本高品質供應的競爭等挑戰正在限制市場預測。

草坪保護市場趨勢

拓展體育活動

所有體育賽事均由世界各地的城市主辦,這表明根據規模、要求和目標並行組織不同規模的體育賽事的需求不斷成長。因此,草坪維護對於商業體育用途至關重要。對住宅和商業草坪的需求不斷增加也創造了對草坪保護市場的需求。從而推動預測市場在不久的將來的成長。根據美國體育活動委員會的數據,參與者人數從 2017 年的 2.169 億增加到 2020 年的 229.7 人。因此,足球和高爾夫活動的增加可能會進一步增加草坪保護的要求。

例如,德國以其體育活動而聞名,更確切地說,是足球、德甲聯賽和其他體育項目,這些體育場通常都是爆滿的。這是令人鼓舞的,並可能導致體育場入場人數增加並推動預測期內的市場成長。

在草坪中採用綜合害蟲管理可以為草坪保護市場帶來更多紅利。為了減少健康危害和提高成本效益而對生物來源保護的需求不斷成長,這可能會推動市場的發展。

北美市場佔據主導地位

與其他區域市場相比,北美在產生收入方面主導草坪保護市場。該地區主要參與者的存在和運動場數量的增加是推動草坪保護成長的主要因素。根據美國體育活動委員會的數據,參與體育活動的比例從 2017 年的 72.7% 上升到 2020 年的 75.6%。其中包括一個大型住宅,設有遊樂場、公共和眾多高爾夫球場。定義區域市場範圍的因素。美國佔據該地區草坪和裝飾化學原料的大部分市場佔有率,其次是加拿大。由於氣候條件惡劣,墨西哥仍處於早期階段。然而,由於氣候相對溫暖,南部地區預計將大幅成長。

2021年,BASF專門針對高爾夫球場市場推出了Alucion 35 WG殺蟲劑。這種新型雙活性、開放式產品為高爾夫球場管理者提供了一種高效的解決方案,用於控制各種表麵食性昆蟲。這種殺蟲劑可以保護您的草坪免受螞蟻、金龜子、甘藍夜蛾和一年生綠象鼻蟲等害蟲的侵害。

草坪防護產業概況

草坪保護市場適度整合,主要廠商佔較大市場佔有率。拜耳作物科學股份公司、安道麥有限公司、先正達股份公司、BASF股份公司、AMVAC 化學公司和 UPL 是市場上的主要企業,能夠透過關鍵的產業策略來適應市場的快速變化。專注於跨區域業務擴張和產品創新的領導企業。報告中包含了領先的草坪保護製造商的業務概況,以提供有關營運公司的見解。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 目的

- 庭園綠化

- 高爾夫球

- 運動的

- 草坪種植者

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 市場佔有率分析

- 最採用的策略

- 公司簡介

- ADAMA Ltd

- AMVAC Chemical Corporation

- UPL

- BASF SE

- Bayer Cropscience AG

- Nufarm

- Marrone Bio Innovations

- Syngenta AG

- Sumitomo Chemical Australia

第7章市場機會與未來趨勢

第 8 章 評估 COVID-19 疾病對市場的影響

The Turf Protection Market size is estimated at USD 6.49 billion in 2024, and is expected to reach USD 8.25 billion by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

The COVID-19 pandemic disrupted the working of several markets, including the turf protection market globally. The pandemic affected the supply chain networks, resulting in losses for companies. In terms of supply, a short-term shortage of migrant laborers amidst distribution bottlenecks created a wide gap between the number of workers required for pesticide production. However, the COVID-19 pandemic had a short-term effect on the market growth but is likely to boost investment. The turf protection industry has been transforming over the years, with robust growth and changing trends.

Maintaining a lawn is a difficult task, and thus it needs turf protection to prevent losses caused by pests and weeds. Increasing high demand for sports like cricket, golf, and football is likely to fuel the market during the forecast period. Companies with high innovation are quickly adapting to the changes and earning a high margin. An increase in both export-oriented and domestic market revenue is observed for major players in the turf protection market. However, challenges such as competition between local players, increasing buyer bargaining power, and competition for good quality supply with low cost are the restraints to the forecast market.

Turf Protection Market Trends

Expansion of Sports Activities

All of the sports events found host cities globally, indicating increasing parallel demand to stage sporting events of varying sizes depending on the scale, requirements, and objectives. Thus, maintaining turf is essential for commercial sports purposes. Increasing demand for turf for residential and commercial properties, in turn, creates demand for the turf protection market. Thus, driving the growth of the forecast market in the near future. According to the Physical Activity Council, United States, the number of participants increased from 216.9 million in 2017 to 229.7 in 2020. Thus, the turf protection requirements are likely to increase due to the increasing football and golf activities.

For instance, Germany is famous for its sports activities, more precisely for football, the Bundesliga League, and others for which the stadiums are usually jam-packed. This is encouraging and bringing a high entry of attendees to the stadium, which is likely to boost the market growth over the forecast period.

Adoption of integrated pest management in the turf is likely to add a bonus to the turf protection market. Growing demand for bio-based protections to reduce health hazards and cost-effectiveness are likely to gear up the market.

North America Dominates the Market

North America dominates the turf protection market in terms of revenue generation as compared to that of markets of other regions. The presence of major players and an increasing number of sports fields in the region are major factors to drive the growth of turf protection. According to the Physical Activity Council, US, the participation rate in sports activities increased to 75.6% in 2020 from 72.7% in 2017. Huge residential regions with plenty of play areas, public parks, and a large number of golf courses are some of the factors that define the extent of the market in the region. The United States occupies the majority of the turf and ornamental chemical inputs market share within the region, followed by Canada. Mexico, due to its harsh climatic conditions, is still in a nascent stage. However, it is expected to grow considerably due to comparatively warmer southern regions.

In 2021, BASF introduced Alucion 35 WG insecticide specifically for the golf course market. This new dual-active, non-restricted use product provides golf course superintendents with a highly effective solution for controlling a wide range of surface-feeding insects. The insecticide protects turf from insect pests, including nuisance ants, chinch bugs, cutworms, and annual bluegrass weevils.

Turf Protection Industry Overview

The turf protection market is moderately consolidated, with major players holding a significant share in the market. Bayer CropScience AG, ADAMA Ltd, Syngenta AG, BASF SE, AMVAC Chemical Corporation, and UPL are the major players in the market who are adaptable to quick changes in the market through key industry strategies. The leading companies focused on the expansion of the business across regions and product innovations. To provide insights into the operating companies, business profiles of leading turf protection manufacturers are included in the report.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Landscaping

- 5.1.2 Golf

- 5.1.3 Sports

- 5.1.4 Sod Growers

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Italy

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 ADAMA Ltd

- 6.3.2 AMVAC Chemical Corporation

- 6.3.3 UPL

- 6.3.4 BASF SE

- 6.3.5 Bayer Cropscience AG

- 6.3.6 Nufarm

- 6.3.7 Marrone Bio Innovations

- 6.3.8 Syngenta AG

- 6.3.9 Sumitomo Chemical Australia