|

市場調查報告書

商品編碼

1438490

IT服務:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

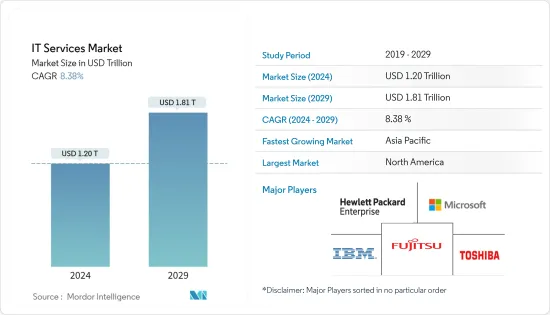

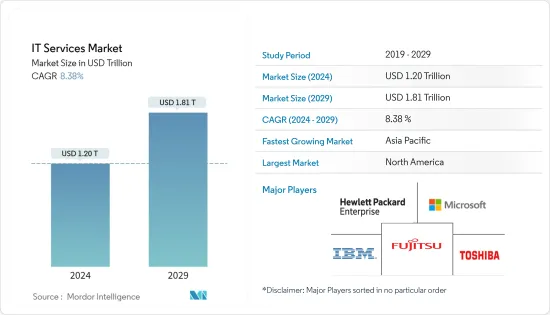

IT服務市場規模預計到2024年將達到1.2兆美元,預計到2029年將達到1.81兆美元,在預測期內(2024-2029年)年複合成長率為8.38%。

在全球範圍內,IT 支出的增加,加上 SaaS 和雲端基礎的產品的普及,顯示了該行業對 IT 服務的需求。隨著IT基礎設施的改進,與資料相關的威脅(資料外洩)也隨之增加。因此,需要比傳統安全解決方案更先進的安全解決方案。隨著這些趨勢滲透到市場中,公司開始投入資源來增強先進的保全服務。

主要亮點

- 5G、區塊鏈、AR和人工智慧等趨勢可能會影響IT服務的提供。隨著 5G 技術的出現,公司將能夠在其場所內建立網路。數位化轉型有望實現基於區域頻率的新網路建置以及LTE現有網路的升級。這需要建立一個即時 IT 中心,以促進複雜系統的自動化和自治。

- 在科技的支持下,資料主導的分析正在為世界各地的策略決策提供動力。此外,世界各地產生的資料量正在急劇增加。據希捷科技 PLC 稱,全球創建的資料量預計將從 2015 年的 12Zetta位元組增加到 2020 年的 47Zetta位元組,到 2025 年增加到 163Zetta位元組。為了充分利用這些累積的資料,IT 服務提供者需要開發智慧 IT 服務和平台來提取和分析資料。

- 由於最終用戶產業大規模採用雲,IT 雲端服務正在見證成長。例如,美國市場是全球領先雲端供應商的所在地,擁有非常高的雲端儲存佔有率。該國產生的資料量是雲端採用的主要驅動力。

- 不斷增加的資料外洩、對產品客製化的成本擔憂以及資料遷移是對市場構成威脅的一些原因。例如,2022 年 7 月,T-Mobile 同意支付 3.5 億美元,以和解因去年公開的影響數千萬人的資料外洩事件而在美國引發的多起集體訴訟。

- COVID-19 暴露了供應鏈的漏洞。對大多數 IT 組織而言,脆弱的生態系統還包括關鍵 IT 服務的提供者。在家工作的要求迫使服務提供者確保關鍵任務企業客戶擁有工具和技術來實現服務的速度、安全性、品質和整體有效性。此外,大流行後時期見證了組織對 IT 服務市場的大量投資。預計它將滿足各個最終用戶行業日益數位轉型帶來的未來需求和功能,並支援混合工作場所。

IT服務市場趨勢

隨著雲端基礎平台的出現,雲端服務將成為驅動力

- 近年來,雲端雲端處理取得了長足的進步,因為雖然雲端解決方案提供了許多好處,但託管資料面臨重大風險,包括隱私和身分盜竊。採用雲端處理的組織應考慮實施可以分析所有執行、應用程式和網路連線的 IT 服務。

- 跨雲端基礎平台的 IT 營運的進步使 IT 服務更加資料主導和即時,為企業創造了巨大的價值,特別是在營運效率、機會發現和遠端存取最佳化方面。

- 根據 Cloudward 2022 年發布的報告,Google Drive 是迄今為止全球使用率最高的雲端儲存服務,使用率為 94.44%。其次是 OneDrive (39.35%)、iCloud (38.89%)、MEGA (5.09%)、Box (4.17%) 和 pCloud (1.39%)。

- 由於企業部門IT和通訊業不斷成長的巨大需求,預計未來幾年對雲端服務的需求將成長,並且這些最終用戶提供的IT基礎設施服務的範圍預計將迅速擴大。

- 為了提高生產力、管治和控制,許多組織正在尋求在雲端部署其系統的核心。市場上的各個供應商正在推動投資以加速數位轉型。例如,2022 年 11 月,IBM 宣布推出 IBM Cloud for VMware 即服務。這項新解決方案將 VMware 的功能與 IBM 的混合雲端部署目標結合,協助客戶實現工作負載現代化。

預計北美市場在預測期內將出現顯著成長

- 全球IT服務市場大幅擴張,美國已成為全球主要IT市場之一。智慧技術的日益採用和安全投資的增加是推動美國IT 服務需求的關鍵因素。

- 在銀行業成長加速和經濟基本面改善的幫助下,美國銀行和金融機構正在加速 IT 服務支出。一些金融服務機構擁有內部資源和員工來滿足這些需求,而其他金融服務機構則外包給有能力的 IT 服務提供者。

- 該地區的許多公司已經開始採用新的方法和流程來獲得競爭優勢,從而產生了人工智慧、物聯網、機器學習 (ML)、區塊鏈、機器人、資料科學等新興技術的採用正在增加。由於數位化的提高以及商業和工業中連網型設備的使用增加,預計該地區的物聯網應用和銷售將會增加。這一轉變為該地區 IT 服務的成長開拓了空間。

- 疫情以來,遠距辦公迅速普及,數位化加速。因此,客戶期望IT解決方案顧問和顧問公司專注於數位化,並利用科技進行數位轉型。主題專業知識 (SME)、客戶投資回報率、增強策略的需求以及專業化的需求都是至關重要的。為了保持競爭力,顧問需要跟上新趨勢。

- 北美的大多數組織都認知到諮詢、行銷、培訓和託管服務等專業服務可以幫助提高業務績效。然而,國內對IT服務的大部分需求是由外國公司滿足的。例如,2022年4月,Wipro收購了Convergence Acceleration Solutions (CAS Group),這是一家總部位於美國的顧問和專案管理公司,專門為大型通訊服務供應商提供業務和技術轉型。此次收購旨在創建一家合資企業,為 Wipro 的客戶提供從策略制定和規劃到執行和實施的服務。

IT服務業概況

IT 服務市場競爭非常激烈,只有少數幾個主要參與者。從市場佔有率來看,目前少數參與者佔據市場主導地位。然而,隨著 IT 諮詢服務的進步,新參與者正在增加其在市場上的影響力並擴大企業發展。

- 2023 年 2 月 -英國保險和金融服務供應商Phoenix Group 與塔塔諮詢服務公司簽訂了價值 6 億歐元的數位轉型合約。作為計劃的一部分,TCS 將為 Phoenix 建立自助服務能力並提供端到端的客戶服務數位化。

- 2022 年 6 月 - 思科和 Kindril 建立技術合作夥伴關係,以加速企業客戶向資料主導企業的轉型。兩家公司共同提供雲端處理服務,提高可見度、控制力、彈性並簡化困難的混合IT 管理,幫助企業改善業務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

- 市場促進因素

- 越來越重視透過非核心業務外包來發揮核心能力

- 獲得更多人才和創新潛力(而不是入職專業知識)

- 隨著雲端基礎平台的出現,雲端服務受到關注

- 市場挑戰

- 營運挑戰(例如失去控制的感覺和確定關鍵目標)

第5章市場區隔

- 服務類型

- 專業(系統整合與諮詢)

- 管理

- 規模

- 中小企業

- 主要企業

- 最終用戶產業

- BFSI

- 通訊

- 衛生保健

- 零售業

- 製造業

- 政府機關

- 其他最終用戶產業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 新加坡

- 印尼

- 馬來西亞

- 越南

- 泰國

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Citrix Systems Inc.

- Cisco Systems Inc.

- Dell EMC

- IBM Corporation

- Hewlett Packard Enterprise

- Microsoft Corporation

- TCS Limited

- Toshiba Corporation

- Verizon Communications Inc.

- Fujitsu Ltd

第7章 主要廠商相對定位

第8章 市場機會及未來趨勢

The IT Services Market size is estimated at USD 1.20 trillion in 2024, and is expected to reach USD 1.81 trillion by 2029, growing at a CAGR of 8.38% during the forecast period (2024-2029).

Globally, the increased IT spending, coupled with the widespread adoption of software-as-a-service and increased cloud-based offerings, indicates the demand for IT services in the industry. With an improved IT infrastructure, threats related to data (data breaches) are also on the rise. This demands advanced security solutions over traditional ones. With this trend gaining traction in the market, companies have started to invest their resources in enhancing their advanced security offerings.

Key Highlights

- Trends like 5G, Blockchain, AR, and AI, are likely to have an impact on the offerings of IT services. With 5G technology on its way, it is likely to ensure that companies may set up networks on their premises. The digital transformation is expected to enable either setting up new networks as per local frequencies or upgrading existing networks on LTE. This requires the creation of real-time IT locations to facilitate the automation and autonomy of complex systems.

- Data-driven analysis, supported by technology, is driving strategic decisions globally. Moreover, the amount of data generated worldwide is increasing tremendously. According to Seagate Technology PLC, the volume of data created globally is expected to increase to 47 zettabytes and 163 zettabytes in 2020 and 2025, respectively, from 12 zettabytes in 2015. To optimally utilize these data reserves, IT service providers must develop smart IT services and platforms to analyze the data for extraction and analysis.

- IT cloud services are witnessing growth due to the massive cloud deployments across the end-user industries. For instance, the US market houses the headquarters for the leading global cloud providers, where the country has a huge share of cloud storage. The amount of data being generated in the country has led to a significant driver of cloud adoption.

- Growing data breaches, cost concerns over product customization, and data migration are some of the reasons posing a threat to the market. For instance, in July 2022, T-Mobile agreed to pay USD 350 million to settle multiple class-action suits in the US stemming from a data breach disclosed last year affecting tens of millions of people.

- During COVID-19, the vulnerability of supply chains has been exposed. For most IT organizations, fragile ecosystems include providers of critical IT services. Work-from-home mandates have led the service providers to ensure that mission-critical enterprise customers have the tools and technologies to enable the speed, security, quality, and overall efficacy of services. Additionally, the post-pandemic period has witnessed significant investment by the organization in the IT Services market. They will look to meet future needs and capabilities owing to rising digital transformation across various end-user industries and to support the hybrid workplace.

IT Services Market Trends

Cloud Services is Gaining Traction Due to the Emergence of Cloud-based Platform

- There has been a significant breakthrough in cloud computing over the past few years, as cloud solutions offer various advantages but expose data hosted to substantial risks, including privacy and identity theft, among others. Organizations adopting cloud computing should consider implementing IT services that can analyze all executions, applications, and network connections.

- Due to advancements in IT operation across the cloud-based platform, IT services have become more data-driven and real-time, creating greater value for the business, especially in operational efficiency, business opportunity discovery, and remote access optimization.

- According to a report published by Cloudward in 2022, with 94.44%, Google Drive was by far the most used cloud storage service globally. In next place is Dropbox, used for cloud storage for collaboration, with a still impressive 66.2%, followed by OneDrive (39.35%), iCloud (38.89%), MEGA (5.09 %), Box (4.17%), and pCloud (1.39%).

- As the demand for cloud services is expected to grow over the next few years, with immense demand from the IT and telecommunication industry across the ever-growing corporate sector, the scope for IT infrastructure services from these end users is expected to grow rapidly.

- To increase productivity, governance, and control, many organizations aim to deploy their systems' core to the cloud. Various market vendors are driving their investments to accelerate digital transformation. For instance, in November 2022, IBM announced the availability of IBM Cloud for VMware as a Service. The new solution combines VMware capabilities with IBM's hybrid cloud deployment ambitions to help its clients modernize workloads.

North America Expected to Register Significant Market Growth During the Forecast Period

- The global IT services market is expanding significantly, and the United States represents one of the major IT markets in the world. The rising adoption of smart technologies and increasing security investment are some of the major factors driving the demand for IT services in the United States.

- The banking and financial institutions in the United States are accelerating spending on information technology services, helped by higher growth in the banking sector and improving economic fundamentals. Some Financial Service organizations have the resources and staff available to meet these demands in-house, while others outsource to a qualified IT Service provider.

- Many enterprises in the region have begun adhering to newer methods and processes to gain a competitive advantage, resulting in the increasing adoption of emerging technologies, like AI, IoT, machine learning (ML), Blockchain, robotics, and data science. With the growing digitalization and usage of connected devices in business and industry, IoT applications and sales are anticipated to increase in the region. This transformation is developing space for the growth of IT services in the region.

- Since the pandemic, remote work has quickly gained popularity, and the digital transition has accelerated. Clients will thus anticipate that the IT Solution Consultants they work with and the consulting firms they work with will emphasize digitalization and use technologies for digital transformation. The importance of subject matter expertise (SMEs), client ROIs, a stronger need for strategy, and the requirement to specialize will all be given top priority. To maintain their competitiveness, consultants must stay current on emerging trends.

- Most North American organizations recognize that professional services, such as consultancy, marketing, training, and managed services, can help enhance their business performance. However, most domestic IT services' demands are fulfilled by foreign companies. For instances, in April 2022, Wipro acquired Convergence Acceleration Solutions (CAS Group), a consultancy and program management firm located in the United States that specializes in business and technological transformation for large communications service providers. This acquisition has been aimed to create a joint business that provides the clients of the company with services spanning from strategy formulation and planning through execution and implementation.

IT Services Industry Overview

The IT services market is highly competitive and has a few major players. In terms of market share, some of the players currently dominate the market. However, with the advancement in IT consultancy services, new players are increasing their market presence, thereby expanding their business footprint across emerging economies.

- February 2023 - The UK-based Phoenix Group, an insurance and financial services provider, has given Tata Consultancy Services a EUR 600 million contract for digital transformation. As part of the project, TCS would create self-service capabilities and offer Phoenix end-to-end customer service digitization.

- June 2022 - Cisco and Kyndryl have established a technology alliance to speed up the conversion of enterprise clients into data-driven companies. Both companies would support organizations to improve their operations by offering cloud computing services that simplify difficult hybrid IT management with increased visibility, manageability, and flexibility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the market

- 4.4 Market Drivers

- 4.4.1 Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations

- 4.4.2 Greater Access to a Larger Pool of Talent and Scope for Innovation (as Opposed to Onboarding Expertise)

- 4.4.3 Cloud Services is Gaining Traction Due to the Emergence of Cloud-based Platform

- 4.5 Market Challenges

- 4.5.1 Operational Challenge (such as Perceived Loss of Control and Identification of Key Goals)

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Professional (System Integration and Consulting)

- 5.1.2 Managed

- 5.2 Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 End-user Industry

- 5.3.1 BFSI

- 5.3.2 Telecommunication

- 5.3.3 Healthcare

- 5.3.4 Retail

- 5.3.5 Manufacturing

- 5.3.6 Government

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Singapore

- 5.4.3.5 Indonesia

- 5.4.3.6 Malaysia

- 5.4.3.7 Vietnam

- 5.4.3.8 Thailand

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Citrix Systems Inc.

- 6.1.2 Cisco Systems Inc.

- 6.1.3 Dell EMC

- 6.1.4 IBM Corporation

- 6.1.5 Hewlett Packard Enterprise

- 6.1.6 Microsoft Corporation

- 6.1.7 TCS Limited

- 6.1.8 Toshiba Corporation

- 6.1.9 Verizon Communications Inc.

- 6.1.10 Fujitsu Ltd