|

市場調查報告書

商品編碼

1642186

穿戴式機器人和外骨骼 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Wearable Robots and Exoskeletons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

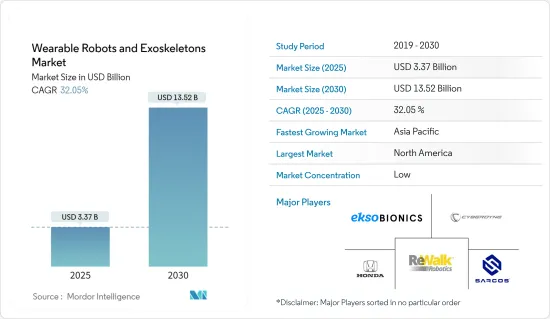

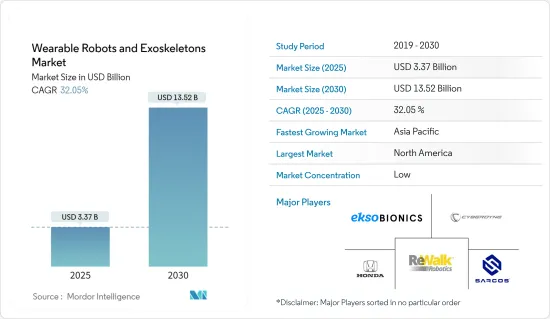

穿戴式機器人和外骨骼市場規模預計在 2025 年為 33.7 億美元,預計到 2030 年將達到 135.2 億美元,預測期內(2025-2030 年)的複合年成長率為 32.05%。

隨著新冠肺炎疫情的出現,先前各地區實施的封鎖措施導致機器人供應商在短時間內全面停擺。但另一方面,疫情也為產品和服務供應商提供了一個很好的機會,使其能夠適應不斷變化的患者需求,與臨床醫生和行業合作夥伴合作,關注並解決真正的臨床挑戰。創造了富有成效的行業機會,以增強市場存在。

關鍵亮點

- 穿戴式機器人和外骨骼正處於開發的早期階段,並且不斷發展,以在醫療、工業、軍事和國防等各個行業中得到最大程度的應用。

- 在醫療領域,外骨骼透過協助和促進中風患者和截癱患者直立行走以及重新學習失去的功能來幫助他們康復。根據 Maxon Motor AG 的一項研究,該公司估計全球每天約有 1.85 億人使用輪椅。

- 例如,Esko Bionics 的外骨骼 Ekso GT 是一款穿戴式外骨骼,旨在作為綜合運動治療工具,為患者和治療師提供無與倫比的復健體驗。此外,隨著科技的發展,法國一名部分癱瘓的男子開始利用意念控制的外骨骼行走。

- 業內各家公司已開始測試其外骨骼製造能力並為部署做好準備。例如,汽車製造商福特已採用 EksoVest,計劃在全球 15 家組裝廠部署外骨骼。當工人執行重複的高空作業時,外骨骼會為工人的手臂提供升力和支撐。在測試期間,採用 EksoVest 可將工作場所傷害減少 83%。

- 用於輔助個人行動的外骨骼的需求也日益成長。患有帕金森氏症、中風和其他身體運動障礙的人數不斷增加是推動外骨骼需求的一個主要因素。這是因為這些疾病限制了自願的身體運動並對正常的日常活動造成問題。例如,帕金森基金會估計,美國帕金森氏症患者數量預計將在2020年達到約93萬人,在2030年達到120萬人。

穿戴式機器人和外骨骼市場趨勢

醫療保健預計將佔很大佔有率

- 外骨骼機器人在從物理治療到急救服務等一系列醫療保健行業中的應用越來越廣泛。例如,總部位於德里的新興企業GenElek Technologies 提供機器人輔助系統,幫助中風、癱瘓、脊髓損傷 (SCI) 和其他神經系統疾病患者。這種外骨骼可以幫助殘障人士重新行走。外骨骼幫助殘障人士獲得獨立,帶來身體和精神上的益處。預計上述進步將推動醫療市場的發展。

- 根據印度復健委員會的報告,印度每年有超過 15,000 人因脊髓損傷或中風而失去行走能力,這意味著每年每百萬人將有 15 名新病例。

- 此外,許多市場參與企業也不斷努力創新產品並獲得醫療產業必要的核准。例如,下肢殘障人士機器人醫療設備製造商ReWalk Robotics宣布,美國食品藥物管理局(FDA)已核准向美國復健中心出售其ReStore軟外骨骼套裝系統。

- 此外,還出現了一批中小企業。例如,日本Archelis公司展出了ArchelisFX外骨骼,其詞源為日文「可行走的椅子」。該設備適用於多種情況,包括背痛患者或最近接受過手術的人。該公司表示,它可以租用或購買,價格約為 5,000 美元。

- 2021年1月,加州外骨骼技術創新公司SuitX宣布推出新型穿戴式外骨骼ShieldX。該產品專為需要穿戴重型防輻射圍裙的醫務相關人員而設計。 ShieldX 將重型輻射防護圍裙的重量 100% 轉移到使用者的肩膀和脊椎。 ShieldX 旨在減少因重型圍裙而導致的頸部和背部損傷,從而縮短職業生涯並限制非工作活動。

預計亞太地區將佔據最大市場佔有率

- 亞太地區在穿戴式機器人技術研發方面處於領先地位。尤其是韓國和日本在研發方面處於市場領先地位。例如,2021年4月,韓國機械材料實驗室的研究團隊開發了穿戴式機器人技術,這是一種西裝式穿戴設備,可用於從送貨到建築工作等各種體力任務。可佩戴於手臂、大腿等身體部位,支撐肌肉。

- 韓國一直是機器人和自動化技術的製造地。注重研發和政府對創新技術的投入是該國穿戴式機器人技術進步的關鍵因素。韓國民間企業也積極拓展穿戴式機器人、外骨骼相關技術和應用。

- 例如,三星電子於2021年6月宣布,將於2021年終實現穿戴式醫療機器人商業化。這家韓國科技巨頭正在深入研究機器人領域,並將其作為其主要推動力之一。該公司表示,計劃推出一款穿戴式機器人,可以幫助站立、行走或跑步困難的用戶,也可用作健身設備。這款穿戴式機器人的預計售價在 500 萬至 1,000 萬韓元之間,但該公司可能會降低價格,使其更實惠。

- 穿戴式機器人和外骨骼市場參與企業正在增加對亞太地區的投資。例如,2021年4月,總部位於香港的外骨骼市場產業領導者Ekso Bionics宣布與澳洲Royal Rehab建立合作夥伴關係,進一步擴大其機器人外骨骼在亞太地區的使用範圍。

- 該地區的軍方也正在為其部隊開發外骨骼機器人。例如,台灣於2021年10月推出第一代電池供電的外骨骼服,可以提高士兵的身體耐力,並增強他們在各種軍事行動中的機動性。

穿戴式機器人和外骨骼產業概況

穿戴式機器人和外骨骼市場競爭激烈,主要參與者包括 Cyberdyne Inc.、ReWalk Robotics Inc. 和 Ekso Bionics Holdings Inc.此外,許多新興企業被該市場的潛力所吸引,並紛紛進行投資,使得競爭更加激烈。許多公司透過推出新產品、業務擴張和策略併購來擴大其市場佔有率。

- 2021 年 7 月 - Cyberdyne Inc. 與 J-Workout Inc. 建立業務合作夥伴關係,並將從 2021 年 8 月起提供以下新服務。 NeuroHALFIT 明確表態是一種利用穿戴式機器人 HAL 活化大腦和神經系統的活動迴路,促進運動功能低下人群功能改善的服務。

- 2021 年 3 月-Ekso Bionics 宣布與美國復健中心合作,向醫生介紹 EksoNR 外骨骼的臨床益處。此次合作將提高醫生和其他復健治療師對 Ekso Bionics 技術的認知,並教育他們如何成功地將機器人技術融入復健計畫。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 醫療產業對機器人復健的需求不斷增加

- 增加對外骨骼技術開發的投資

- 市場限制

- 設備高成本

第6章 市場細分

- 按類型

- 動力外骨骼

- 被動外骨骼

- 按最終用戶產業

- 醫療

- 軍事和國防

- 工業的

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Cyberdyne Inc.

- ReWalk Robotics Inc.

- Ekso Bionics Holdings Inc.

- Sarcos Corporation

- Honda Motor Co. Ltd.

- Hocoma AG(DIH International Ltd.)

- Lockheed Martin Corporation

- Technaid. SL

- Skelex

- ATOUN Inc.

第8章投資分析

第9章:市場的未來

The Wearable Robots and Exoskeletons Market size is estimated at USD 3.37 billion in 2025, and is expected to reach USD 13.52 billion by 2030, at a CAGR of 32.05% during the forecast period (2025-2030).

Due to the emergence of the COVID-19 pandemic, the previously put lockdown measures across various regions significantly brought the robotic suppliers to a complete standstill for a short period. However, on the other hand, the pandemic has also created productive industry opportunities for the products and service providers to increase their presence in the market by primarily focusing on and addressing real clinical challenges in collaboration with clinicians and industry partners and in response to the evolving patients' needs.

Key Highlights

- The wearable robots or exoskeletons are in their nascent stage of development and continuously evolving to exhibit maximum adoption in various industries, like healthcare, industrial, military, and defense, as these wearable exoskeletons assist personal mobility and can be worn on the human body and control and assists the movements of the person.

- In the healthcare sector, exoskeletons are helping patients' recovery by assisting and encouraging upright walking and relearning lost functions for stroke patients and people who are paralyzed. According to a study by Maxon Motor AG, the company estimated that approximately 185 million people use a wheelchair daily worldwide.

- For instance, Ekso GT is an exoskeleton by Esko Bionics, which is a wearable exoskeleton engineered as a comprehensive gait therapy tool and provides an unparalleled rehabilitation experience for patients and therapists. Additionally, due to technological developments in technology, a paralyzed man started walking using a mind-controlled exoskeleton in France.

- Various companies in the industry have already tested exoskeletons for their manufacturing capabilities and are ready to deploy them, which is likely to augment the market in the future further. For instance, automobile manufacturer, Ford, planned to deploy exoskeletons in fifteen assembly plants worldwide and adopted the EksoVest. This exoskeleton elevates and supports the arms of workers performing repeated overhead tasks. The adoption of EksoVests reduced workplace injuries by 83% during the trial period.

- There is also an increasing demand for exoskeletons to assist in personal mobility. An increasing number of patients with body movement disorders, such as Parkinson's disease, strokes, etc., are the prime factors accelerating the exoskeleton demand, as these diseases limit voluntary body movements and create problems in daily routine activities. For instance, according to the Parkinson's Foundation estimates, the number of people in the United States with Parkinson's disease may be around 930,000 in 2020, and it is expected to reach 1,200,000 by 2030.

Wearable Robots & Exoskeletons Market Trends

Healthcare is Expected to Hold a Significant Share

- Exoskeletons have increasing applications in medical industries ranging from physiotherapy to emergency services. For example, GenElek Technologies, a Delhi-based startup, provides a robotic support system that aids people suffering from stroke, paralysis, spinal cord injury (SCI), or other neurological conditions. The exoskeleton assists disabled people in walking again. It will help them become self-reliant and independent, which will benefit them physically and mentally. These advancements mentioned above are expected to drive the healthcare market.

- According to a report of the Rehabilitation Council of India, every year, more than 15,000 people lose their ability to walk either due to a spinal injury or stroke in India, which translates to 15 new cases per million every year, which provides an opportunity for local companies to provide an externally worn robotic and exoskeleton support system that enhances a human's limbic capabilities.

- Further, many players in the market are constantly trying to innovate products for people in the Healthcare industry and get the necessary approval. For instance, ReWalk Robotics, a manufacturer of robotic medical devices for individuals with lower limb disabilities, announced that the US Food and Drug Administration had cleared its ReStore soft exo-suit system for sale to rehabilitation centers across the United States.

- Moreover, some smaller companies have also emerged. For instance, Japan-based Archelis Inc. showcased the ArchelisFX exoskeleton, which derives from the Japanese word for "walkable chair." The device is designed for several scenarios, including back pain and recently undergoing surgery. The company said it would be available to rent or buy for around USD 5,000.

- In January 2021, suitX, a California-based innovator in exoskeleton technologies, announced the launch of a novel wearable exoskeleton, shieldX. It is made for the healthcare personnel required to wear heavy anti-radiation aprons. ShieldX removes 100% of the weight of a heavy anti-radiation apron from the user's shoulders and spine. ShieldX aims to reduce neck and back injuries linked to these heavy aprons shortening careers and limiting activities outside of work.

Asia Pacific is Expected to Account for the Largest Market Share

- Asia-Pacific is the leader in the R&D of wearable robot technology. South Korea and Japan are specifically leading in the R&D of the market. For instance, in April 2021, a South Korean research team from the Korea Institute of Machinery and Materials developed a wearable robot technology, a suit-type wearable device, that can be used for a variety of physical tasks from delivery to construction work. It can be attached to the arm, thigh, and other body areas for supporting muscles.

- South Korea has always been the hub for the manufacture of robotics and automation technologies. The focus on R&D and government expenditure on innovative technologies were significant factors for the advancement of wearable robotics in the country. The private sector of the country is also actively expanding its technologies and applications range related to wearable robots and exoskeletons.

- For instance, in June 2021, Samsung Electronics Co. announced to commercialize of a wearable robot for healthcare by the end of 2021. This South Korean tech giant is delving into the robotics sector as one of its major growth drivers. According to the company, it has plans to introduce a wearable robot that helps users that have trouble standing up, walking, or running and can also be used as a fitness device. This wearable robot is expected to be priced between KRW 5 million and KRW 10 million, but the company may bring the price down to make it more affordable.

- Wearable robots and exoskeleton market players are increasingly investing in the Asia-Pacific region. For instance, in April 2021, Ekso Bionics, an industry leader in the exoskeleton market with a presence in Hong Kong, announced a partnership with Royal Rehab in Australia, further expanding the use of the company's robotic exoskeleton across Asia-Pacific.

- Militaries in the region are also developing exoskeleton robots for their troops. For instance, in October 2021, Taiwan launched the first generation of a battery-powered exoskeleton suit that can improve the physical endurance of soldiers and increase mobility in various military operations.

Wearable Robots & Exoskeletons Industry Overview

The Wearable Robots and Exoskeletons Market is competitive in nature because of the presence of major players like Cyberdyne Inc., ReWalk Robotics Inc., and Ekso Bionics Holdings Inc., among others. Further, the market potential is also attracting many startups investing in the market, thus, intensifying the competition. Many companies increase their market presence by introducing new products, expanding their operations, or entering into strategic mergers and acquisitions.

- July 2021 - Cyberdyne Inc has formed a business alliance with J-Workout Inc. (Koto-Ku, Tokyo, Japan, President: Takunori Isa, "J-Workout") to provide a new service stated below from August 2021. The Group provides Neuro HALFIT as a service to promote the functional improvement of people with reduced motor functions by activating the activity loop of the brain's nervous system with Wearable Cyborg HAL.

- March 2021 - Ekso Bionics announced a partnership with the US Physiatry to educate physicians on the clinical benefits of an EksoNR exoskeleton. The partnership will help raise awareness of Ekso Bionics technology among physicians and other rehabilitation therapists and teach them how to integrate robotics into rehabilitation programs successfully.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Robotic Rehabilitation in Healthcare Industry

- 5.1.2 Growing Investment in the Development of the Exoskeleton Technology

- 5.2 Market Restraints

- 5.2.1 High Cost of the Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Powered Exoskeletons

- 6.1.2 Passive Exoskeletons

- 6.2 By End-user Industry

- 6.2.1 Healthcare

- 6.2.2 Military and Defense

- 6.2.3 Industrial

- 6.2.4 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cyberdyne Inc.

- 7.1.2 ReWalk Robotics Inc.

- 7.1.3 Ekso Bionics Holdings Inc.

- 7.1.4 Sarcos Corporation

- 7.1.5 Honda Motor Co. Ltd.

- 7.1.6 Hocoma AG (DIH International Ltd.)

- 7.1.7 Lockheed Martin Corporation

- 7.1.8 Technaid. S.L.

- 7.1.9 Skelex

- 7.1.10 ATOUN Inc.