|

市場調查報告書

商品編碼

1642175

大尺寸顯示器 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Large Format Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

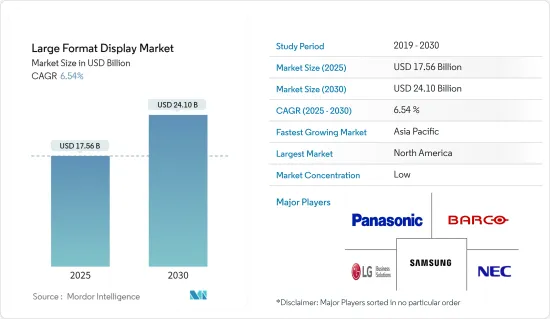

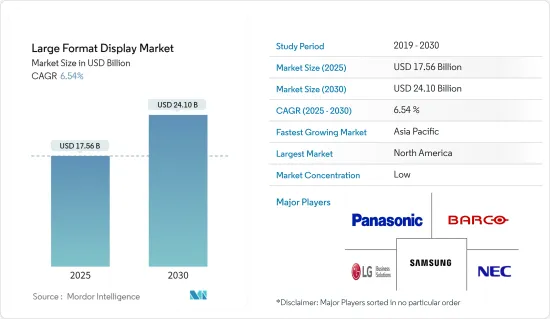

大尺寸顯示器市場規模預計在2025年為175.6億美元,預計到2030年將達到241億美元,預測期內(2025-2030年)的複合年成長率為6.54%。

近年來,大螢幕顯示器市場見證了許多重大的技術進步,包括直視細像素 LED 顯示技術和窄邊框 LCD。以前體積龐大、佔用空間的顯示器已經演變成纖薄、無邊框的顯示器。目前用於各種應用的顯示設備比傳統顯示器具有更高的對比度、更高的解析度並且消耗更少的電量。

關鍵亮點

- 隨著數位連接的採用和顯示技術的最新進步,我們預計公共資訊顯示器 (PID) 將會快速普及。數位顯示面板的尺寸越來越大且價格越來越便宜,吸引了尋求獨特產品實現的新參與企業,從而推動了數位螢幕的快速普及。一些國家用 LED 組成的數位電子看板取代廣告牌,這推動了大尺寸LED 顯示器產品的成長。

- 網路廣告日益複雜,廣告攔截器、行銷和廣告收費高昂,促使企業尋求替代解決方案來展示他們的廣告和訊息。此因素可能為戶外大顯示器領域帶來有利機會,在預測期內提升其滲透率。

- 顯示技術的進步使得觸控螢幕技術融入更大的顯示器中,以改善使用者體驗。這些觸控螢幕顯示器的主要應用包括公司會議室、控制室、零售店和教育機構。市場領先的供應商正在提供觸控螢幕顯示器以滿足消費者日益成長的需求。

- 傳統室內電視牆(有時稱為顯示牆)通常由多個以矩形排列的顯示器組成,以建立合適尺寸和寬高比的牆壁。目前的格式在過去十年中一直是主流,而且解決方案具有價格競爭力並且有效。此方法是利用薄邊框液晶顯示器(LCD)。

- 大尺寸尺寸顯示器在數位電子看板中的應用日益廣泛,為研究市場創造了巨大的機會。隨著互動性成為新型數位電子看板網路部署的核心,該技術將從單點觸控顯示器發展到多點觸控螢幕,並最終轉向多用戶、多點觸控、超高清/4K 顯示器。有可能的。

- 然而,在新冠疫情期間,參與企業專注於大型互動式顯示器的非接觸式技術創新。使用靠近顯示表面的所有物體和人的懸停或電容圖像與大顯示器互動是一種直覺的新互動方式。

大螢幕顯示器 (LFD) 市場趨勢

商業領域佔據主要市場佔有率

- 這主要是由於越來越多的商家在商場、零售店安裝各種尺寸的大螢幕,增加品牌活動和提供廣告。

- 此外,許多供應商提供者使用顯示器,這些顯示器具有與消費顯示器相比的功能,例如縱向模式操作、附加輸入連接埠、環境商務用、延長保固、全天候運行能力和更高的亮度。服務。

- LFD 旨在成為一種可靠的資產,經過專門最佳化並適合用途,可在不影響商務用領域品質的情況下提供完美的性能。截至2022年1月31日,沃爾瑪美國在全美經營4,742家門市。沃爾瑪(原沃爾瑪百貨有限公司)是世界上最知名、最有價值的品牌之一。電視牆技術在商業街上越來越受歡迎,正成為不斷發展的商業廣告中越來越有吸引力和有用的工具。從客戶的觀點,數位顯示器可以改變他們的購買內容,因為它們顯示的資訊更接近購買點,從而推動商業領域對大尺寸尺寸顯示器的需求。

- 此外,預測期內,用於建立平滑電視牆的細像素 LED 顯示器預計在商業領域也將迎來高需求。此外,隨著消費者對電視牆優勢的認知不斷提高,預計將大大推動全球需求。

北美成長強勁

- 預計北美將在預測期內出現顯著成長,這得益於該地區大量參與企業的存在、該地區大尺寸顯示器的採用日益增多以及廣泛的研發活動。

- 推動該區域市場成長的主要因素是戶外廣告的興起。根據美國互動廣告局(IAB)統計,近年來美國網路廣告收入成長了35.4%。這包括數位戶外廣告,包括街道家具、交通廣告、地點媒體和廣告看板。由於產業前景樂觀,預測期內該地區大尺寸顯示器市場預計將穩定成長。

- 透過策略夥伴關係關係,生態系統參與企業緊密合作,進行研究,將新技術推向市場。預計該因素將在預測期內推動對大尺寸尺寸顯示器的需求。

- 電視牆為所有影像提供高品質的像素密度和均勻的亮度。因此,電視牆在商業、工業和基礎設施應用中的採用正在顯著成長。預計從長遠來看它的使用量將會增加。例如,2022 年 10 月,紐約旅遊聖地時代廣場的萬豪侯爵酒店 (Marriott Marquis) 配備了全球最大的 LED電視牆,涵蓋了整個酒店街區。

- 該酒店由 Host Hotels and Resorts 擁有,在其維修的大廳安裝了兩面 50 英尺寬、8 英尺高的 1.8 毫米細間距 LED電視牆。 LG 表示,DVLED 顯示器在震撼力和應用靈活性方面超越多面板安裝,從而推動了北美地區對電視牆的需求。

- 在北美,三星、LG 等主要企業正在利用廣告看板進行廣告宣傳。因此,預計預測期內此類技術的使用不斷增加將促進市場研究。

大尺寸顯示器 (LFD) 產業概覽

大尺寸尺寸顯示器市場競爭激烈,有許多大大小小的參與企業向國內和國際市場供應產品。主要企業正在採用產品創新、併購、聯盟和夥伴關係等策略來擴大其地理覆蓋範圍並獲得競爭優勢。市場的主要企業包括三星電子、LG 電子、NEC、夏普株式會社、巴可公司、松下公司和優派公司。

2022 年 7 月,三星與亞洲娛樂公司 CJ ENM 合作創建了新的虛擬製作場景。它是世界上最大的顯示器之一,配備了微型 LED 技術、牆體系統和即時連接的攝影機。 CJ ENM Studio 是一個客製化設計的橢圓形自訂,直徑20 米,高7 米,並在一個1,000 英寸的螢幕上顯示三星的microSD 卡,該螢幕被稱為“The Wall”,解析度為30,720p (32K) x 4,320p (4K)。該牆可以根據內容創作者和空間的要求進行客製化,包括以凸面或凹面設計安裝在屋頂上。

2022年3月,三星電子與泰國最重要的房地產開發計劃MQDC的The Forestias合作,將林業與住宅和商業區結合在一起。森林館位於曼谷計劃的中心地帶,擁有三星尖端的顯示技術“The Wall”,可提供最身臨其境的影院體驗。 The Wall 是世界上第一種模組化 MicroLED 技術,不受尺寸、解析度或外形的限制,可提供令人難以置信的清晰度。這項技術突破將使森林館的 360 度劇場成為現實,為觀眾提供獨一無二的影像體驗。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠疫情對大螢幕顯示器市場的影響

第5章 市場動態

- 市場促進因素

- 不斷增加 LED 顯示器的創新

- 數位電子看板的使用日益增多

- 市場問題

- 網路廣告的興起

第6章 市場細分

- 按顯示類型

- 電視牆

- 獨立

- 按應用

- 室內的

- 戶外的

- 按最終用戶

- 商業的

- 基礎設施

- 設施

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他地區(拉丁美洲、中東和非洲)

第7章 競爭格局

- 公司簡介

- Panasonic Corporation

- Barco NV

- LG Electronics

- Samsung Electronics Co., Ltd

- NEC Corporation

- Sharp Corporation

- ViewSonic Corporation

- Prysm Inc.

- Sahara Presentation Systems PLC(Boxlight Corporation)

- STERIS PLC

- SigmaSense

第8章投資分析

第9章:市場的未來

The Large Format Display Market size is estimated at USD 17.56 billion in 2025, and is expected to reach USD 24.10 billion by 2030, at a CAGR of 6.54% during the forecast period (2025-2030).

The large display market has witnessed many significant technological advancements in the past few years, such as direct-view fine-pixel LED display technology and narrow-bezel LCDs. The previously used bulky and space-consuming displays have evolved into bezel-less and slim displays. The display devices currently used for various purposes have improved contrast ratio and high resolution and consume less power than traditional displays.

Key Highlights

- The adoption of digital connectivity and recent advancements in display technologies are expected to drive the rapid adoption of public information displays (PID). The increasing panel size and affordable price of digital displays are a few significant factors resulting in the entry of several new players that find unique product implementations, helping digital screen adoption rapidly. The replacement of billboards with digital signage that comprises LEDs in several countries has aided the growth of the large format LED display products.

- With increasing complexity around online advertising and the premium pricing charged for ad blockers, marketing, and advertising, companies are looking for alternative solutions that may enable them to display their advertisements or messages. This factor presents the outdoor large-format display segment with a lucrative opportunity, which may boost its adoption over the forecast period.

- The technological advancements in display technology have led to the incorporation of touchscreen technology into large format displays that can offer enhanced user experience. The significant applications of these touchscreen displays are in corporate meetings, control rooms, retail stores, and educational institutes. Major vendors in the market are offering touchscreen displays to cater to the rising demand from consumers.

- The traditional indoor video wall sometimes referred to as a display wall, is generally comprised of multiple displays arranged in a rectangular array to create appropriate wall size and aspect. The current format appears to have prevailed for the last decade, and the solution is price-competitive and effective. The approach is to leverage thin bezel liquid crystal displays (LCDs).

- The rising applications of large format displays in digital signage create significant opportunities for the studied market. As interactivity becomes more central to new digital signage network deployments, the technology will likely evolve from single-touch displays to multi-touch screens before ultimately transitioning into multi-user, multi-touch, and ultra-HD/4K displays.

- However, during the COVID-19 pandemic, players focused on innovation based on touchless technologies for interactive large-format displays. Large display interaction using hover and capacitive imaging of all objects and people near the display surface is an intuitive new way to interact.

Large Format Display (LFD) Market Trends

Commercial Segment to Hold Significant Market Share

- The commercial segment is expected to witness significant growth during the forecast period, primarily owing to the increased brand activity and advertisements of offers by various organizations increasingly deploying large screens of different sizes in shopping malls and retail stores.

- Moreover, compared to consumer displays, commercial displays from many vendors are offered additional features and services such as portrait mode operation, other input ports, environment resistance, extended warranty, ability to operate all day, and higher brightness.

- LFDs are designed to be a reliable asset, specially optimized to perform perfectly, fit for purpose, and without compromising quality in the commercial segment. Walmart United States had 4,742 stores throughout the United States as of January 31, 2022. Walmart, formerly known as Wal-Mart Stores, Inc., is one of the world's most well-known and valuable brands. Growing in popularity across the high street, video wall technology is an increasingly engaging and beneficial tool for commercials as it continues to evolve. The customer's viewpoint is that digital displays can change what they buy because of the information displayed close to the point of purchase, thus driving the demand for large format displays in the commercial segment.

- Furthermore, the fine-pixel LED displays used to construct smooth video walls are also expected to experience high demand from the commercial sector during the forecast period. Also, the increasing awareness of the benefits of video walls among customers is expected to increase their demand across the globe drastically.

North America to Witness Significant Growth

- The North American region is expected to witness significant growth over the forecast period due to some essential players in the region, coupled with the extensive R&D activities resulting in the full-scale adoption of the large format displays in the area.

- The primary factor driving the growth of this regional market is rising outdoor advertisements. According to IAB (U.S.), online advertising revenue in the United States has grown 35.4 percent in recent years. It includes digital out-of-home and comprises street furniture, transit advertising, place-based media, and billboards. With such a positive outlook from the industry, the large format display market is expected to grow steadily in the region over the forecast period.

- Through strategic partnerships, the players in the ecosystem are working closely to introduce new technologies into the market studied. This factor will fuel the demand for large-format displays over the forecast period.

- The video walls offer a high-quality pixel density and uniform brightness for every picture. As a result, the inclination towards the deployment of video walls in applications such as commercial, industrial, and infrastructural has increased significantly. It is expected to gain traction in the long run. For instance, in October 2022, the Marriott Marquis in New York's tourist mecca of Times Square had one of the more enormous LED video walls on the planet lining an entire block of the hotel, and now that building also has two jumbo LED video walls inside, aimed at guests.

- The hotel owned by Host Hotels and Resorts factored a pair of 50-foot wide, eight-foot-tall 1.8mm fine pitch LED video walls in its renovated lobby, on bulkheads that flank a split-floor walkway. According to LG, a DVLED display would blow away a multi-panel installation in terms of wow factor and usage flexibility, thus driving the demand for videowalls in the North American region.

- Several prominent players in North America such as Samsung, LG, and many more are launching campaigns that use billboards to promote ad campaigns among the region's people. Thus, this increased technology usage is expected to boost the market studied over the forecast period.

Large Format Display (LFD) Industry Overview

The Large Format Display Market is highly competitive owing to the presence of many small and large players in the market supplying their products in the domestic and international markets, with the major players adopting strategies like product innovation and mergers and acquisitions, collaborations, and partnerships to expand their geographical reach and stay ahead of the competition. Some of the major players in the market are Samsung Electronics Co., Ltd, LG Electronics, NEC Corporation, Sharp Corporation, Barco NV, Panasonic Corporation, ViewSonic Corporation, and many more.

In July 2022, Samsung created a new virtual production set in collaboration with the Asian entertainment company CJ ENM. It is one of the largest in the world, with micro LED technology, a wall system, and real-time connected cameras. The CJ ENM studio has the micro LED technology from Samsung via 'The Wall,' a screen of more than 1,000" with a custom oval design 20 meters in diameter and seven meters high that supports a 30,720 p resolution (32K) x 4,320p (4K). 'The Wall's' specifications are customizable to suit the requirements of content creators and the space, such as installation on the roof with a convex or concave design.

In March 2022, Samsung Electronics partnered with The Forestias by MQDC, Thailand's most significant property development project, combining forest with residences and commercial areas. Samsung supplied its state-of-the-art display technology, The Wall, to The Forest Pavilion, located at the heart of the project in Bangkok, to showcase the most immersive cinematic experience. The Wall is the world's first modular MicroLED technology that delivers incredible definition without size, resolution, or form restrictions. This innovation enables a 360-degree theater in The Forest Pavilion that lets the audience enjoy a one-of-a-kind visual experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Large Format Display Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Innovation in LED Display

- 5.1.2 Increased Applications for Digital Signage

- 5.2 Market Challenges

- 5.2.1 Increased Online Advertisement

6 MARKET SEGMENTATION

- 6.1 By Display Type

- 6.1.1 Video Wall

- 6.1.2 Standalone

- 6.2 By Application

- 6.2.1 Indoor

- 6.2.2 Outdoor

- 6.3 By End User

- 6.3.1 Commercial

- 6.3.2 Infrastructural

- 6.3.3 Institutional

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World (Latin America, Middle East and Africa)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Panasonic Corporation

- 7.1.2 Barco NV

- 7.1.3 LG Electronics

- 7.1.4 Samsung Electronics Co., Ltd

- 7.1.5 NEC Corporation

- 7.1.6 Sharp Corporation

- 7.1.7 ViewSonic Corporation

- 7.1.8 Prysm Inc.

- 7.1.9 Sahara Presentation Systems PLC (Boxlight Corporation)

- 7.1.10 STERIS PLC

- 7.1.11 SigmaSense