|

市場調查報告書

商品編碼

1438442

自動取樣器:市場佔有率分析、產業趨勢/統計、成長預測 (2024-2029)Autosamplers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

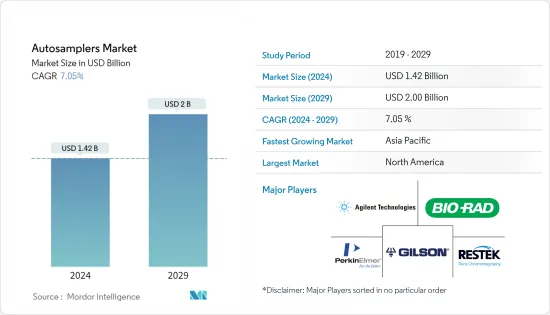

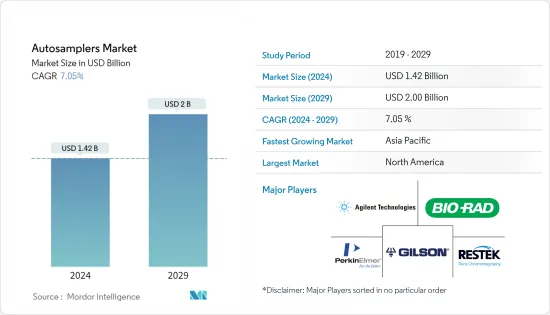

自動取樣器市場規模預計到 2024 年為 14.2 億美元,預計到 2029 年將達到 20 億美元,在預測期內(2024-2029 年)年複合成長率為 7.05%。

市場受到疫情的正面影響。由於COVID-19感染疾病數量的增加,對包括層析法技術在內的各種服務的需求也產生了積極影響並且不斷成長。研究人員正在尋求疫苗和治療方法。層析法是一種基於實驗室的強大分析技術,可幫助科學界了解 Sars-CoV-2 病毒並開發更好的治療方法、疫苗和診斷工具,以幫助對抗COVID-19 大流行。正在努力做到這一點的同時,研究人員正在採用它。例如,2020 年 6 月發表在《臨床化學和實驗醫學》雜誌上的一項研究使用液相層析法和質譜法來量化COVID-19 患者血漿中的再輸送,並發現SARS-CoV-2 作為治療劑的有效性資料。

此外,已發表的論文表明膽固醇氧化產物可用於對抗 SARS-CoV-2。儘管有些患者對緊急抗病毒藥物反應良好,但 SARS-CoV-2 需要安全有效的抗病毒藥物。層析法系統在醫療、學術和商業設施中的重要性日益增加,表明該技術正在為各個領域的研究和開發做出重大貢獻。例如,Encyclopedia Journal 於 2022 年 9 月發表的報導指出,能夠支持後基因組和後 COVID-19 時代的苛刻要求的分析平台的堅實基礎是易於獲得、靈敏、解析能力強,由各種具有極高容量的強大層析法儀器提供。因此,由於後基因組和後 COVID-19 時代的要求,醫療設施對各種顏色系統的需求不斷增加,這對自動取樣器市場產生了積極影響。

推動市場成長的具體因素包括自動取樣器的主導地位、層析法在藥物核准中日益重要的地位以及對食品安全日益成長的擔憂。自動取樣器的作用不僅僅是切換樣品和分析它們。自動取樣器旨在支援靈活有效的工作流程,從減少流程訂單和樣品資訊中的轉錄錯誤到保護複雜的樣品進行清洗和分析。根據 ModuVision Technologies 於 2021 年 9 月發表的報導,使用自動取樣器的兩個主要原因是它們高效,因為它們可以在不影響實驗室員工的情況下處理許多樣本。這與存在和品質有關。製藥業進行廣泛的研究來創造新藥,增加了對成品的需求。

此外,根據 2022 年 6 月出版的《國際藥物研究與應用期刊》,層析法被認為是一種靈敏且有效的分離方法。層析法應用於所有實驗室、製藥工業、學術機構等,是分離科學的基礎。開發新藥需要使用適當的技術,使科學家能夠以最準確、最精確和最容易理解的方式評估藥物分子。層析法憑藉其可靠、穩健的解析度、速度和靈敏度,可提供更多資訊,從而提高化學和設備工藝的生產率。因此,層析法的使用不斷增加以及在藥物開發中的重要性日益提高預計將加速市場成長。

然而,由於缺乏熟練的專業人員以及中小型市場參與者的預算限制,預計市場成長將受到限制。

自動取樣器市場趨勢

預計製藥和生物技術公司在預測期內將出現高速成長

自動取樣器透過自動選擇樣品並將其插入儀器入口來取代手動進樣和進樣。推動該行業成長的因素包括自動取樣器為公司帶來的好處以及層析法在藥物核准中日益重要的角色。根據 Rasayanika 2020 年 10 月發表的報導,層析法技術用於識別和分析樣品中是否存在化學物質和微量元素,製備大量高純度物質,分離手掌性化合物,確定混合物的純度,它用於在製藥業界執行各種任務,包括化合物鑑定和藥物開發。安捷倫科技表示,在適應性強的高效液相層析(HPLC)技術的支持下,(生物)製藥研究人員和生產設施可以全面表徵潛在的藥物和治療方法方案,可以確保藥物的生產安全可靠。因此,這些特徵預計將推動細分市場的成長。

此外,由於研發支出的增加,預計製藥業的市場在預測期內將出現良好的成長。根據EP新聞局發表的報導稱,2021年2月,政府將對投資新治療方法、化學實體或新生物實體研究以抗擊疫情的公司施加200%的權重。生物製藥的考慮扣除和專案撥款研究與開發。這進一步增加了國外的研發投入。這些措施將被考慮用於未來的津貼和一系列迷你預算,以在支持性法規環境下支持策略發展。主要企業的先進產品預計將推動該領域的成長。例如,ESI DX自動取樣器採用化學惰性結構,可為 Thermo Scientific 的 ICP-OES 和 ICP-MS 儀器提供無污染採樣。主要企業的這些產品開發預計將推動市場的細分成長。

因此,預計上述因素將在預測期內推動市場的細分成長。

北美預計將主導自動取樣器市場

由於主要市場參與者(尤其美國)的研發資金不斷增加,北美在全球市場中佔據主導地位。例如,根據《2022 年美國科學與工程狀況》,美國在研發活動上花費了 6,075 億美元,其中年度研發支出中有 1,011 億美元(17%)被歸類為初級研究。同樣,美國的大部分研發都是由企業部門資助的,其中超過 98% 的資金用於支持商業性研發活動。第二大研發資金來源是美國聯邦政府,約佔21%,為所有產業的研發提供資金。美國不斷增加的研發資金預計將推動市場發展。

該地區產品發布的增加預計將推動該地區的市場。例如,2022 年 3 月,Thermo Fisher Scientific 將推出新的 GC/GC-MS 儀器產品組合以提高效率。全新 Thermo Scientific TRACE 1600 系列氣相層析、Thermo Scientific AI/AS 1610 液體自動取樣器、Thermo Scientific ISQ 7610單四極GC-MS、Thermo Scientific TSQ 9610四極GC-MS GC/GC-MS儀器組合,包括/MS、現在的特點是技術進步,提高了易用性和生產力。主要企業推出此類產品預計將增加製藥和食品和飲料行業藥物發現的生產研發投資,並增加該地區對自動取樣器的需求。

自動取樣器產業概述

自動取樣器市場本質上是整合的,存在著少數在全球和區域營運的公司。競爭形勢包括自動取樣器市場的重要參與者,包括Agilent Technologies、Bio-Rad Laboratories, Inc.、Gilson, Inc.、PerkinElmer, Inc.、Restek Corporation、Scion Instruments、Shimadzu Corporation、Thermo Fisher Scientific 和Waters Corporation 。它包括對幾家佔據市場佔有率的知名國際和本地公司的分析。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 自動取樣器的各種優點以及層析法在藥物核准中日益重要的重要性

- 人們對食品安全的興趣日益濃厚

- 市場限制因素

- 缺乏熟練的專業人員

- 中小型市場參與者的預算限制

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依產品

- 系統

- 液相層析法自動取樣器

- 氣相層析法自動取樣器

- 配件

- 系統

- 按最終用戶

- 製藥/生物製藥公司

- 食品和飲料業

- 環境檢測產業

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東/非洲

- GCC

- 南非

- 其他中東和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭形勢

- 公司簡介

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Gilson, Inc.

- PerkinElmer, Inc.

- Restek Corporation

- Scion Instruments

- Shimadzu Corporation

- Thermo Fisher Scientific

- Waters Corporation

第7章 市場機會及未來趨勢

The Autosamplers Market size is estimated at USD 1.42 billion in 2024, and is expected to reach USD 2 billion by 2029, growing at a CAGR of 7.05% during the forecast period (2024-2029).

The market has had a positive impact due to the pandemic. Due to an increase in the infectious disease COVID-19, there has also been a positive effect and growth in demand for various services, including chromatography technologies. Researchers are seeking both vaccination and treatment. Chromatography is a powerful laboratory-based analytical method that researchers are employing as the scientific community strives to understand the Sars-CoV-2 virus and develop better therapies, vaccines, and diagnostic tools to aid in the fight against the COVID-19 pandemic. For instance, in a study published by Clinical Chemistry and Laboratory Medicine in June 2020, liquid chromatography coupled with mass spectrometry was used to quantify redeliver in the blood plasma of a COVID-19 patient and, thus, provide data on its efficacy as a treatment for SARS-CoV-2.

Furthermore, a product of cholesterol oxidation was helpful in the combat against SARS-CoV-2, according to multiple published papers. A few patients responded well to the emergency antiviral drug, but SARS-CoV-2 needed a secure and efficient antiviral medication. The expanding significance of chromatographic systems in medical facilities, academic settings, and commercial settings demonstrates the technique's massive contribution to the development of research across various fields. For instance, according to an article published by Encyclopedia Journal, in September 2022, a solid foundation for an analytical platform capable of supporting the demanding requirements of the postgenomic and post-COVID-19 era is provided by a variety of powerful chromatographic instruments that are readily available and have extremely high sensitivity, resolution, and identification capacity. Thus, the increase in demand for various chromogenic systems in medical facilities due to the requirements in the postgenomic and post-COVID-19 era is positively impacting the autosampler market.

Specific factors driving the market growth include autosamplers' advantages, chromatography's growing importance in drug approval, and increasing food safety concerns. Autosamplers can do more than merely switch between samples to analyze them. They are designed to support the flexible and effective workflow in all areas, from lowering process order and sample information transcription errors to sophisticated sample cleaning and protection for analysis. According to an article published by ModuVision Technologies in September 2021, the two main reasons autosamplers are utilized are efficiency since many samples may be handled without the influence of lab employees and quality. The pharmaceutical industry is conducting extensive research to create a new drug, driving the demand for the finished product.

Furthermore, according to the International Journal of Pharmaceutical Research and Applications published in June 2022, chromatography is accepted as a susceptible and effective separation method. Chromatography, used in all research labs, the pharmaceutical industry, academic institutions, etc., is the foundation of separation science. Developing new drugs necessitates using an appropriate technique that enables scientists to evaluate drug molecules in the most exact, precise, and straightforward manner possible. Due to its higher product reliability, robustness, resolution, speed, and sensitivity, chromatographic procedures promote the productivity of chemical and instrumentation processes by providing more information. Thus, chromatography's increasing usage and growing importance in drug development is expected to accelerate market growth.

However, the lack of skilled professionals and limitations in the budget of small and mid-size market players are expected to restrain the market growth.

Autosamplers Market Trends

Pharmaceutical and Biotechnology Companies are Expected to Witness High Growth Over the Forecast Period

Autosamplers replace manual sampling and injection by automatically selecting a sample and inserting it into the inlets of the instrument. Factors driving the segment growth include the advantages of autosamplers in the companies and the growing importance of chromatography in drug approval. According to an article published by Rasayanika, in October 2020, chromatography techniques are used by the pharmaceutical industry for a variety of tasks, including identifying and analyzing samples for the presence of chemicals or trace elements, preparing large quantities of highly pure materials, separating chiral compounds, determining the purity of mixtures, identifying unknown compounds present, and also in drug development. According to Agilent Technologies, with the support of the highly adaptable High-performance liquid chromatography (HPLC) technique, (bio-)pharmaceutical researchers and production facilities can comprehensively characterize possible drug or treatment options and guarantee that the medications are produced securely and reliably. Thus, these features are expected to drive segmental growth in the market.

Moreover, with the increasing expenditure on R&D, this market in the pharmaceutical industry is expected to attain good growth over the forecast period. According to an article published by EP News Bureau, in February 2021, for companies investing in research for new treatments, chemical entities, or new biological entities to battle outbreaks, the government looked into a 200 percent weighted deduction and a special allocation for R&D in biopharmaceuticals. This increased foreign R&D investment even further. Such steps are investigated in upcoming grants or as a series of mini budgets supporting strategic development within a supportive regulatory environment. Advanced products by the key players are expected to promote segmental growth. For instance, ESI DX Autosamplers feature chemically inert construction and deliver contamination-free sampling for Thermo Scientific ICP-OES and ICP-MS instruments. Such product development by key players is expected to promote segmental growth in the market.

Therefore, the factors mentioned above are expected to drive segmental growth in the market during the forecast period.

North America is Expected to Dominate the Autosamplers Market

North America has dominated the global market studied, owing to the increased funding in R&D by the major market players, especially in the United States (U.S.). For instance, according to The State of U.S. Science and Engineering 2022, the United States spent USD 607.5 billion in R&D activity, with USD 101.1 billion (17%) of annual R&D spending classified as primary research. Similarly, the majority of R&D in the United States is funded by the business sector, and over 98% of that financing goes toward supporting commercial R&D activities. The second-largest source of R&D financing, accounting for around 21%, is the U.S. federal government, which funds research and development across all industries. The increase in funding for R&D in the U.S. is expected to drive the market.

Increasing product launches in the region are expected to drive the market in the region. For instance, in March 2022, Thermo Fisher Scientific launches a new GC/GC-MS instrument portfolio for increased efficiency. The GC/GC-MS instrument portfolio, including the new Thermo Scientific TRACE 1600 Series Gas Chromatograph, Thermo Scientific AI/AS 1610 Liquid Autosampler, Thermo Scientific ISQ 7610 Single Quadrupole GC-MS, and Thermo Scientific TSQ 9610 Triple Quadrupole GC-MS/MS, now features technological advances that enhance usability and productivity. Such product launches by various key players are expected to increase R&D investments into the pharmaceutical industry for drug discovery as well as production in the food & beverage industry, which in turn increased the demand for autosamplers in the region.

Autosamplers Industry Overview

The autosamplers market is consolidated in nature due to the presence of a few companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold the market shares and are well known, including Agilent Technologies, Bio-Rad Laboratories, Inc., Gilson, Inc., PerkinElmer, Inc., Restek Corporation, Scion Instruments, Shimadzu Corporation, Thermo Fisher Scientific, Waters Corporation, among others, hold the substantial market share in the Autosamplers market., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Various Advantages of Autosamplers Coupled with Growing Importance of Chromatography in Drug Approval

- 4.2.2 Increasing Food Safety Concerns

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Professionals

- 4.3.2 Limitations in Budget of Small and Mid-Size Market Players

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Systems

- 5.1.1.1 Liquid Chromatography Autosamplers

- 5.1.1.2 Gas Chromatography Autosamplers

- 5.1.2 Accessories

- 5.1.1 Systems

- 5.2 By End-User

- 5.2.1 Pharmaceutical and Biopharmaceutical Companies

- 5.2.2 Food and Beverage Industry

- 5.2.3 Environmental Testing Industry

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Agilent Technologies, Inc.

- 6.1.2 Bio-Rad Laboratories, Inc.

- 6.1.3 Gilson, Inc.

- 6.1.4 PerkinElmer, Inc.

- 6.1.5 Restek Corporation

- 6.1.6 Scion Instruments

- 6.1.7 Shimadzu Corporation

- 6.1.8 Thermo Fisher Scientific

- 6.1.9 Waters Corporation