|

市場調查報告書

商品編碼

1438419

工具機:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Machine Tools - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

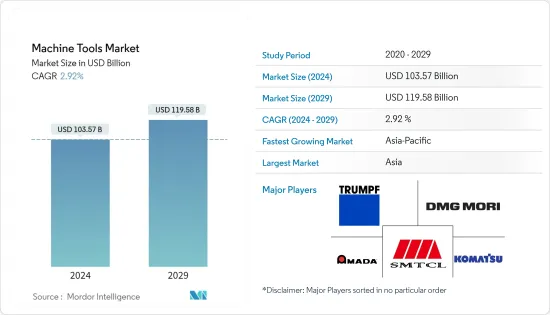

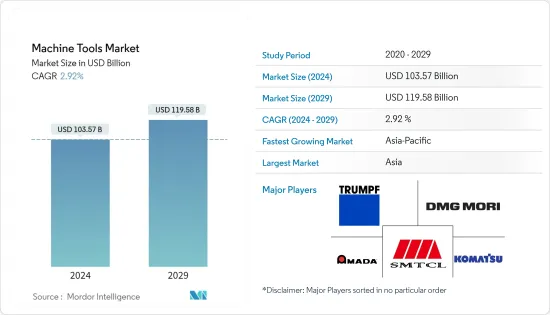

預計2024年工具機市場規模為1,035.7億美元,預估至2029年將達1,195.8億美元,預測期(2024-2029年)年複合成長率為2.92%。

主要亮點

- 全球運動控制市場的成長正在推動對運動控制產品的巨大需求,特別是在機器人、電子組裝、半導體、工具機和可再生能源產業。控制組件的進步有助於簡化機器設計。

- 更準確地說,產值將從2020年的下滑中恢復的過程中從730億美元增加到850億美元,工具機整體消費將從2020年的700億美元增加到2021年的800億美元。全球整體產量超過消費量 50 億美元。這種差異可能至少部分歸因於工具機製造商試圖預測供應鏈問題。工具機價格可能面臨刀具過剩的壓力,但更有可能面臨全球供應鏈中斷的壓力。

- 前六名的國家(中國、德國、義大利、日本、韓國和美國)與 2020 年相比保持不變。美國產量將比2020年增加20億美元,到2021年達到75億美元。由於日本產量增加,德國產量略有下降,日本超越德國成為世界第二大經濟體。儘管義大利的產量增加,但美國的增幅更大,超過義大利,升至第四位。

- 隨著汽車公司越來越注重電動車 (EV) 的開發和生產,這項舉措被最近的大流行所掩蓋。運動仍然是工具機製造商和其他傳統汽車零件供應商的重點關注點。

工具機市場趨勢

汽車產業的成長推動市場

到 2030 年,印度可能成為共用交通領域的世界領導者,為電動和無人駕駛汽車打開大門。為了減少污染物,電動車變得越來越普及。到2030年,電動車產業預計將創造5兆個就業機會。 2000年4月至2022年3月,汽車業累積吸引股權直接投資約328.4億美元。印度政府預計,2023年,汽車業將吸引國內外投資80億美元至100億美元。 2021年,全球汽車產量為7,910萬輛,較2020年成長1.3%。在此資訊圖表中可以看到 2020 年和 2021 年的世界汽車產量數據。

歐洲汽車工業協會 (ACEA) 敦促政策制定者為復甦和向零排放汽車過渡創造有利的環境。 2021 年,ZEV 新註冊量達到了一個重要里程碑,佔所有新註冊量的 5.2%。在加拿大,2021年新車登記量為160萬輛,與前一年同期比較增加6.5%。 2021年,加拿大最大的三個省份佔新零排放車輛登記量的93.4%:魁北克省佔42.8%,不列顛哥倫比亞省佔27.7%,安大略省佔22.9%。

數控工具機可望主導市場

電腦數值控制(CNC)工具機透過減少生產時間並最大限度地減少人為錯誤來簡化業務流程。由於工業領域對自動化製造的需求不斷增加,CNC工具機的使用不斷增加。此外,亞太地區製造設施的建立也刺激了電腦數值控制在該領域的使用。

許多製造商都專注於高效的製造技術以獲得競爭優勢。他們正在重新設計設備,包括CNC工具機。此外,3D列印機和CNC工具機的整合正在成為一些新生產單元的常見補充,預計將提供更強大的多材料能力並減少資源浪費。事實確實如此。

此外,隨著人們對全球暖化和能源枯竭的日益擔憂,數控機床擴大用於發電,因為該過程需要廣泛的自動化。

工具機產業概況

工具機市場相對分散,參與者既有全球大公司,也有本土中小企業。主要參與者包括通快集團、瀋陽工具機集團、Amada、DMG Mori Seiki、Falcon Machine Tools 等。該市場的區域中心包括中國、德國、日本和義大利。此外,隨著自動化趨勢的不斷發展,公司正在專注於開發更自動化的解決方案。此外,該行業也出現了透過併購進行整合的趨勢。這些策略幫助公司進入新的市場領域並獲得新客戶。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

- 研究框架

- 二次調查

- 初步調查

- 對資料進行三角測量並產生見解

- 計劃流程和結構

- 參與框架

第3章執行摘要

第4章市場動態

- 目前的市場狀況

- 市場動態

- 市場促進因素

- 市場限制因素

- 市場機會

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 針對製造業的主要政府法規和舉措

- 金屬加工產業簡介

- 技術簡介

- 連網型和自動化機器

- 先進的控制/運動控制系統

- 數位化和工業4.0

- 用於精密金屬切削的人工智慧 (AI)

- COVID-19 對市場的影響

第5章市場區隔

- 按類型

- 銑床

- 鑽床

- 車床

- 研磨

- 放電處理機

- 其他

- 按最終用戶

- 車

- 加工及工業機械製造

- 海洋/航太/國防

- 精密工程

- 其他最終用戶

- 按地區

- 亞太地區

- 北美洲

- 歐洲

- 中東/非洲

- 拉丁美洲

第6章 競爭形勢

- 市場集中度概覽

- 公司簡介

- Trumpf Group

- Shenyang Machine Tool Group

- Amada Co. Ltd

- Dalian Machine Tool Group

- Komatsu Ltd

- Dmg Mori Seiki Co. Ltd

- Schuler AG

- Jtekt Corporation

- Okuma Corporation

- Mag

- Makino Milling Machine Co. Ltd*

第7章 市場的未來

第8章附錄

- 以主要國家活動分類的 GDP 分佈

- 資本流動洞察主要國家

- 製造業經濟統計

- 世界製造業統計數據

The Machine Tools Market size is estimated at USD 103.57 billion in 2024, and is expected to reach USD 119.58 billion by 2029, growing at a CAGR of 2.92% during the forecast period (2024-2029).

Key Highlights

- The growth of the global motion control market has triggered a substantial demand for motion control products, particularly in the robotics, electronics assembly, semiconductor, machine tool, and renewable energy industries. Advancements are being made in control components and have aided the simplification of machine design.

- To be more exact, production climbed from USD 73 billion to USD 85 billion on the path to recovering from dips in 2020, while overall machine tool consumption increased from USD 70 billion in 2020 to USD 80 billion in 2021. Production worldwide outstripped consumption by USD 5 billion. This discrepancy might be caused, at least in part, by machine tool manufacturers seeking to anticipate supply chain problems. Machine tool prices may be under pressure due to the consequent surplus of tools, but they are more likely to be under pressure due to interruptions in the global supply chain.

- With some jockeying for position, the top six producers; China, Germany, Italy, Japan, South Korea, and the United States; remain the same as in 2020. Due to a USD 2 billion rise from 2020, U.S. production reached USD 7.5 billion in 2021. Due to increased production in Japan and a modest decline in output in Germany, Japan overtook Germany as the world's second-largest economy. Italy's output increased, but the U.S.'s increase was more significant, allowing it to overtake Italy and move to the number four spot.

- Despite being overshadowed by the recent impact of the pandemic, the movement toward e-mobility remains a significant point of focus for machine tool producers and other traditional automotive part suppliers, as automotive firms are increasingly focusing on developing and producing electric vehicles (E.V.s).

Machine Tools Market Trends

Growth of the Automotive industry driving the market

By 2030, India might be a global leader in shared transportation, opening doors for electric and driverless vehicles. To cut pollutants, electric vehicles are becoming more popular. By 2030, the electric car industry is anticipated to generate five crore employment. Between April 2000 and March 2022, the automobile industry attracted cumulative equity FDI inflows of around 32.84 billion USD. By 2023, the Indian government anticipates that the vehicle industry will draw 8-10 billion USD in domestic and foreign investments. Around the world, 79.1 million automobiles were produced in 2021, a 1.3% rise from 2020. The number of motor vehicles produced globally in 2020 and 2021 may be found in this infographic.

The European Automobile Manufacturers' Association (ACEA) urges policymakers to create an environment that will allow the market to recover and transition to zero-emission vehicles, as the EU car market is anticipated to contract by more than a quarter in 2019 compared to pre-pandemic 2019 levels. ZEV new registrations reached a significant milestone in 2021, accounting for 5.2% of all newly registered motor vehicles. In Canada, 1.6 million new cars were reported in 2021, a 6.5% increase from the previous year. Together, the three largest provinces in Canada accounted for 93.4% of new zero-emission vehicle registrations in 2021; 42.8% were in Quebec, 27.7% in British Columbia, and 22.9% in Ontario.

CNC Machine Tools Expected to Dominate the Market

Computer numerical control (CNC) machines streamline operational processes by reducing production time and minimizing human error. The growing demand for automated manufacturing in the industrial sector has resulted in the increasing usage of CNC machines. Also, the establishment of manufacturing facilities in Asia-Pacific has spurred the use of computer numerical controls in the sector.

Many manufacturers focus on efficient manufacturing techniques to try and gain a competitive advantage. They redesign their facilities, which contain CNC machines. Also, the integration of 3D printing with CNC machines is becoming a common addition to some new production units, which is expected to offer better multi-material capability and little resource wastage.

Furthermore, with the rising concerns over global warming and the depletion of energy reserves, CNC machines are actively being used in power generation, as this process requires wide-scale automation.

Machine Tools Industry Overview

The Machine Tools Market is relatively fragmented, with significant global and small and medium-sized local players. Some considerable players include TRUMPF Group, Shenyang Machine Tool Group, Amada Co. Ltd, DMG Mori Seiki Co., Ltd, Falcon Machine Tools Co. Ltd, and many others. The regional hubs in the market include China, Germany, Japan, and Italy. Companies are also focusing on developing more automated solutions with an increasing preference for automation. Furthermore, the industry is witnessing a trend of consolidation through mergers and acquisitions. These strategies help the companies enter new market areas and gain new customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defination

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

- 2.5 Project Process and Structure

- 2.6 Engagement Framework

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.2 Market Restraints

- 4.2.3 Market Opportunities

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers/Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Key Government Regulations and Initiatives for the Manufacturing Sector

- 4.6 Metalworking Industry Snapshot

- 4.7 Technology Snapshot

- 4.7.1 Connected and Automated Machines

- 4.7.2 Advanced Controls/Motion Control Systems

- 4.7.3 Digitalization and Industry 4.0

- 4.7.4 Artificial Intelligence (AI) for Accurate Metal Cutting

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Milling Machines

- 5.1.2 Drilling Machines

- 5.1.3 Turning Machines

- 5.1.4 Grinding Machines

- 5.1.5 Electrical Discharge Machines

- 5.1.6 Others

- 5.2 By End User

- 5.2.1 Automotive

- 5.2.2 Fabrication and Industrial Machinery Manufacturing

- 5.2.3 Marine and Aerospace & Defense

- 5.2.4 Precision Engineering

- 5.2.5 Other End Users

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 Middle East and Africa

- 5.3.5 Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Trumpf Group

- 6.2.2 Shenyang Machine Tool Group

- 6.2.3 Amada Co. Ltd

- 6.2.4 Dalian Machine Tool Group

- 6.2.5 Komatsu Ltd

- 6.2.6 Dmg Mori Seiki Co. Ltd

- 6.2.7 Schuler AG

- 6.2.8 Jtekt Corporation

- 6.2.9 Okuma Corporation

- 6.2.10 Mag

- 6.2.11 Makino Milling Machine Co. Ltd*

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 GDP Distribution by Activity - Key Countries

- 8.2 Insights into Capital Flows Key Countries

- 8.3 Economic Statistics for the Manufacturing Sector

- 8.4 Global Manufacturing Industry Statistics