|

市場調查報告書

商品編碼

1438409

快速消費品物流:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)FMCG Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

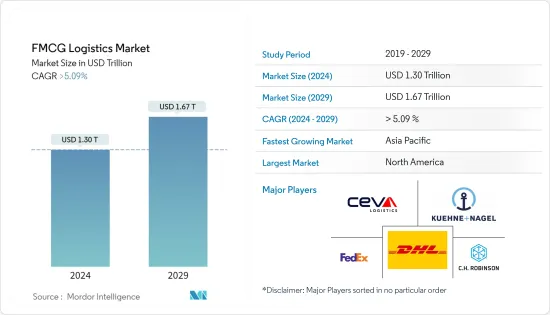

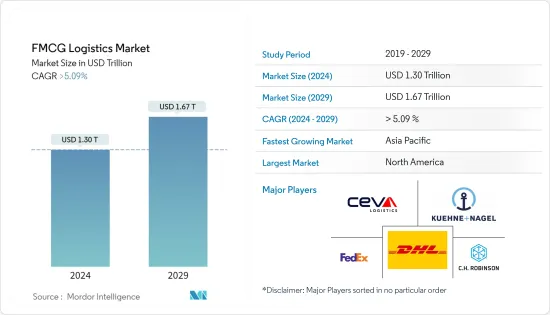

快速消費品物流市場規模預計到 2024 年將達到 1.3 兆美元,預計到 2029 年將達到 1.67 兆美元,預測期內(2024-2029 年)年複合成長率將超過 5.09%。

主要亮點

- 快速消費品被認為是一種獨特的經營模式,需要在製造、品牌、廣告和物流方面具有競爭優勢。消費品產業的主要成長動力是生活方式的改變、交通便利性以及消費者習慣的快速變化。消費者希望本地商店和網路上隨時可以買到各種產品。為了實現這一目標,消費品公司與高效、敏捷和永續性的全球供應鏈合作。快速消費品製造商正在採用協作物流解決方案,以更快、更有經濟地將產品運送到商店。最近電子商務的蓬勃發展也為快速消費品產業帶來了福音。

- 從傳統的倉儲、採購、物料管理,到綜合物料管理,產業正進入供應鏈管理的新時代。快速消費品產業的物流業務通常採用中心輻射模式,物流中心位於主要城鎮,為批發商和零售商提供服務。消費者期望跨多個管道快速履行訂單。為了實現這一目標,消費品公司將物流業務外包,以彌合銷售計劃和業務流程之間的差距、改善預測、簡化庫存並縮短交貨時間。

- 快速消費品企業預計將增加對物流服務供應商(LSP)的依賴,以滿足新消費模式的需求。對供應鏈自動化的投資、現有製造設施的擴建以及倉儲中心的出現是當前市場研究的重點領域。除了強大的供應鏈策略外,物流設施和地理位置很快將在快速消費品營運商的成功中發揮關鍵作用。為了保持更好的競爭力並進入關鍵需求群體,公司必須策略性地考慮位置以滿足不斷成長的需求。

快消品物流市場趨勢

隨著電子商務的日益普及,需要高效率的物流運作。

電子商務正在重塑全球零售市場。到目前為止,電子商務的繁榮不僅使旅遊業受益,也使服裝和電子量販店受益。目前,電子商務在全球快速消費品市場的佔有率不足7%。線上快速消費品普及的主要原因之一是確保新鮮和生鮮食品以最佳狀態到達消費者手中所面臨的物流挑戰。此外,在已開發市場,特別是在德國等人口稠密的市場,許多快速消費品在實體店中很容易買到,而且離消費者很近。

然而,消費者對便利性的需求不斷成長,技術和其他有利條件的改進正在加速全球線上快速消費品的成長。快速消費品的線上成長持續超過線下成長,大多數零售商和製造商需要全通路策略以確保未來的成功。未來幾年,全球快速消費品的線上銷售額將加倍,新興市場和發展中市場的成長速度預計將是已開發市場的兩倍。預計亞洲地區將在未來五年內為線上快速消費品提供最大的成長機會。

當今的線上市場提供多種運輸選項,包括庫存狀態和預計交貨時間的可見性、免費追蹤選項和輕鬆退貨。為了提供免費送貨,零售商需要從物流提供者獲得低成本的解決方案。同樣,為了快速提案消費者當日配送選擇等服務,零售商需要高度優先且完全可靠的物流服務。

人口成長推動快速消費品產業擴張

人口成長是推動全球快速消費品產業擴張的主要原因之一。事實上,人口的快速成長與消費品消費的增加呈負相關。類似的因素包括定期產品發布、消費者對各種快速消費品的認知度提高、中階可支配收入的增加、消費品的獲取便利性,開發中國家消費者生活方式的重大變化、強力的品牌廣告和有吸引力的價格分佈。其中包括此類公司強大的物流和分銷管道、線上商務的擴張以及市場現有企業和新參與企業增加的研發支出。

此外,社交媒體和網際網路的增加使用在過去創造了豐富的發展可能性,並且在未來肯定會繼續這樣做。作為佔領相當一部分市場的主要方式之一,一些業內頂尖的國際公司致力於為消費者提供個人化的解決方案。其中一些策略包括產品介紹和收購。

現今的消費者越來越需要便利、更健康的替代品以及本地採購的有機產品。這種對便捷的需求創造並繁榮了電子商務。公司正在大力投資數位分析,許多人認為零售業可能是消費產業中轉型最成熟的產業。

快消品物流行業概況

快消品物流市場高度分散,既有大型企業,也有中小型本地企業,相當數量的企業佔市場佔有率。 DHL 集團、CH Robinson、Kuehne+Nagel、Ceva Logistics、DB Schenker、DSV 和 XPO Logistics 是全球主要競爭對手。世界上大多數物流公司都設有零售和消費品物流部門,以滿足市場的需求和需求。此外,本地公司正在日益加強其在庫存處理、服務提供、處理產品和技術方面的能力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 調查先決條件

- 調查範圍

第2章調查方法

- 分析調查方法

- 調查階段

第3章執行摘要

第4章市場概況

- 目前的市場狀況

- 市場動態

- 促進因素

- 消費者對快速高效運輸的需求不斷成長

- 簡化供應鏈營運的需要

- 抑制因素

- 運輸成本高

- 生鮮產品管理的複雜性

- 機會

- 引進先進技術

- 擴大電子商務平台

- 促進因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 政府法規和舉措

- 全球物流業(概述、LPI 得分、主要貨運統計數據等)

- 聚焦全球快消品產業(概況、通路、主要產品類型等)

- 聚焦-電商對傳統快消品物流供應鏈的影響

- 快消零售業快速補貨週期對物流市場的影響

- 重視合約物流和綜合物流需求*

第5章市場區隔

- 按服務

- 運輸

- 倉儲、運輸和庫存管理

- 其他附加價值服務

- 按產品類型

- 食品和飲料

- 個人護理

- 家務護理

- 其他消耗品

- 按地區

- 亞太地區

- 北美洲

- 歐洲

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- DHL Group

- CH Robinson

- Kuehne+Nagel

- Ceva Logistics

- XPO Logistics

- DB Schenker

- Hellmann Worlwide Logistics

- DSV

- Bollore Logistics

- Rhenus Logistics

- FM Logistic

- Kenco Logistics

- Penske Logistics*

- 其他公司

第7章 市場的未來

第8章附錄

- 以主要活動國家分類的 GDP 分佈

- 快消品零售統計

- 經濟統計 運輸和倉儲業對經濟的貢獻(主要國家)

- 世界消費品流量統計

The FMCG Logistics Market size is estimated at USD 1.30 trillion in 2024, and is expected to reach USD 1.67 trillion by 2029, growing at a CAGR of greater than 5.09% during the forecast period (2024-2029).

Key Highlights

- FMCG is considered a unique business model that requires competitive advantages in manufacturing, branding, advertising, and logistics. The key growth drivers for the consumer goods industry are changing lifestyles, ease of access, and rapidly changing consumer habits. Consumers expect a wide array of products to be always available in local stores and online. to achieve this, consumer goods companies tie up with global supply chains that are highly efficient, agile, and sustainable. FMCG manufacturers are adopting collaborative logistics solutions that deliver products to stores faster and more cost-effectively. The recent e-commerce boom has also been a blessing for the FMCG industry.

- From traditional storekeeping, purchasing, materials management, and integrated materials management, the industry is entering a new era of supply chain management. The logistics operations in FMCG businesses are typically operated on a hub-and-spoke model type with distribution hubs in major towns and cities serving both the wholesalers and retailers. Consumers are expecting fast order fulfilment through multiple channels. To make this possible, consumer goods companies outsource their logistics operations to bridge the gap between sales planning and operational processes, improve forecasting, streamline inventory, and speed up delivery times.

- FMCG players are expected to rely more on logistics service providers (LSPs) to meet demand from new consumption patterns. Investment in supply chain automation, expansion of existing manufacturing facilities, and the emergence of warehouse hubs are essential areas of focus in the current market study. Distribution facilities and locations, along with a strong supply chain strategy, will play a critical role in the success of FMCG operators soon. To maintain a better competitive position and access key demand demographics, businesses will need to consider the location strategically to meet the growing demand.

FMCG Logistics Market Trends

Growing Penetration of E-commerce Demands Efficient Logistics Operations

E-commerce is reshaping the global retail market. Till date, the e-commerce boom has favored the travel sector, as well as apparel and electronics retailers. E-commerce currently contributes less than 7% of the global fast-moving consumer goods (FMCG) market. One of the key reasons for the slower uptake of online FMCG has been the logistical challenges associated with ensuring fresh and perishable products arrive at the consumer in top condition. Additionally, in advanced markets, especially those with dense populations such as Germany, many FMCG products are readily available in close proximity to consumers at brick-and-mortar stores.

However, with increasing consumer demand for convenience, and better technology and other enabling conditions, online FMCG growth is accelerating across the globe. FMCG online growth will continue to outpace offline growth, and most retailers and manufacturers need Omnichannel strategies to ensure future success. Online FMCG sales are set to double globally over the next few years and will grow twice as fast in developing markets than in developed markets. The Asia region is expected to provide some of the biggest growth opportunities for online FMCG over the next five years.

The current online marketplace offers visibility of inventory status and expected delivery time and a variety of shipping options including free tracking options and easy returns. To provide free shipping, retailers need to get low-cost solutions from their logistics providers. Equally, to propose fast, including same-day delivery options to their consumers, retailers need high-priority and entirely reliable logistics services.

The rising population driving the expansion of the FMCG Industry

The growing population is one of the key reasons driving the expansion of the global FMCG industry. In actuality, the quick expansion in population is inversely correlated with the rise in consumer goods consumption. Similar factors include regular product launches, increased consumer awareness of various FMCG products, rising middle-class disposable incomes, easier access to consumer goods, a noticeable shift in consumers' lifestyles in developed and developing nations, strong brand advertising, and attractive price points, strong logistics and distribution channels of such companies, expansion of online commerce, and increased R&D spending by both established players and newcomers in the market.

Also, the increasing use of social media and the internet has created a wealth of development prospects in the past and is certain to do so in the future. As one of their primary methods to capture a sizeable portion of the market, several top international businesses in the industry are dedicated to offering consumers personalized solutions. A few of these tactics involve product introductions and acquisitions.

Consumers nowadays are increasingly looking for convenience, healthier alternatives, and locally produced organic products. This demand for ease was what gave rise to eCommerce, which has flourished. Companies are making significant investments in digital analytics, and many think that among all consumer industries, the retail sector is perhaps the ripest for transformation.

FMCG Logistics Industry Overview

The FMCG logistics market is fairly fragmented with the presence of large players and small and medium-sized local players with quite a few players who occupy the market share. DHL Group, C.H. Robinson, Kuehne + Nagel, Ceva Logistics, DB Schenker, DSV, and XPO Logistics are among Global's top competitors. Most of the global logistics players have a retail and consumer goods logistics division to meet the market needs and demand. Additionally, local players are increasingly enhancing their capabilities in terms of inventory handling, service offerings, products handled, and technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Rising consumer demand for fast and efficient delivery

- 4.2.1.2 The need for streamlined supply chain operations

- 4.2.2 Restraints

- 4.2.2.1 High trasnportation costs

- 4.2.2.2 Complexity of managing perishable goods

- 4.2.3 Opportunities

- 4.2.3.1 The adoption of advanced technologies

- 4.2.3.2 Expansion of e-commerce platforms

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Government Regulations and Initiatives

- 4.6 Global Logistics Sector (Overview, LPI Scores, Key Freight Statistics, etc.)

- 4.7 Focus on Global FMCG Industry (Overview, Distribution Channels, Major Product Categories, etc.)

- 4.8 Spotlight - Effect of E-commerce on Traditonal FMCG Logistics Supply Chain

- 4.9 Effect of FMCG Retail Sector's Fast Replenishment Cycles on the Logistics Market

- 4.10 Spotlight on the Demand for Contract Logistics and Integrated Logistics*

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.2 Warehousing, Distribution, and Inventory Management

- 5.1.3 Other Value-added Services

- 5.2 By Product Category

- 5.2.1 Food and Beverage

- 5.2.2 Personal Care

- 5.2.3 Household Care

- 5.2.4 Other Consumables

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration, Major Players)

- 6.2 Company Profiles

- 6.2.1 DHL Group

- 6.2.2 C.H. Robinson

- 6.2.3 Kuehne + Nagel

- 6.2.4 Ceva Logistics

- 6.2.5 XPO Logistics

- 6.2.6 DB Schenker

- 6.2.7 Hellmann Worlwide Logistics

- 6.2.8 DSV

- 6.2.9 Bollore Logistics

- 6.2.10 Rhenus Logistics

- 6.2.11 FM Logistic

- 6.2.12 Kenco Logistics

- 6.2.13 Penske Logistics*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 GDP Distribution, by Activity-Key Countries

- 8.2 FMCG Retail Statistics

- 8.3 Economic Statistics Transport and Storage Sector, Contribution to Economy (Key Countries)

- 8.4 Global Consumer Goods Flow Statistics