|

市場調查報告書

商品編碼

1438396

支付即服務 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Payment as a Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

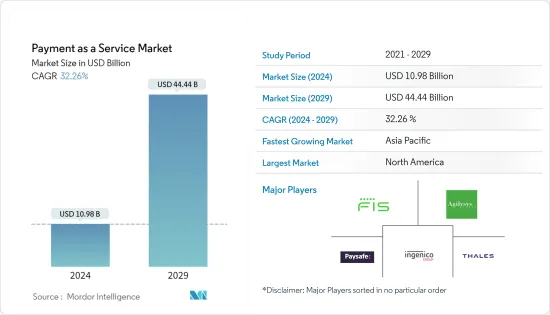

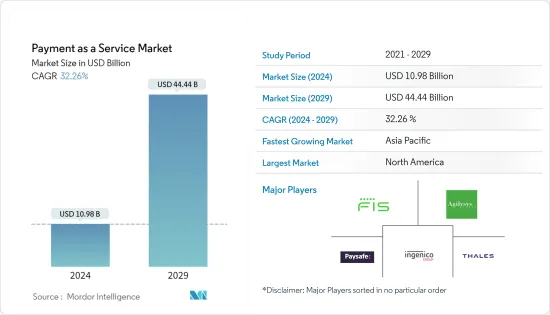

支付即服務市場規模預計到 2024 年為 109.8 億美元,預計到 2029 年將達到 444.4 億美元,在預測期內(2024-2029 年)CAGR為 32.26%。

在當前情況下,智慧型手機普及率的不斷提高正在促進透過行動應用程式廣泛銷售商品和服務的成長,從而透過提供簡單便捷的購物體驗來幫助客戶。對輕鬆便捷地購買商品和服務的需求的成長促使了向數位和無現金支付的徹底轉變。電子商務業務的成長進一步提振了全球支付服務供應商市場。

主要亮點

- 由於許多國家都在努力促進數位和線上交易,預計該業務將會增加。全球萬事達卡、Visa 和 Rupay 等支付網路的出現也將有助於 PaaS 市場的擴張,以便為客戶提供順利的支付處理。

- 對智慧型手機普及率和線上服務整合的需求不斷成長。隨著智慧型手機的使用和全球網際網路的大規模普及,預計它將保持其在市場上的主導地位。此外,隨著銀行和金融機構提供即時支付服務,客戶也越來越頻繁地使用線上支付管道。因此,市場對線上支付的需求持續上升。

- 支付行業經歷了重大變革,只需點擊一下即可將舊方法替換為新模組。此外,支付即服務 (PaaS) 不僅改變了零售商的情況。銀行現在意識到 PaaS 使用的增加是為客戶提供可靠選擇的機會。因此,對電子商務(尤其是零售業)的日益依賴,推動了支付即服務市場的發展。

- 跨國交易缺乏全球標準可能會限制市場。由於缺乏易於使用的全球支付系統、國際標準以及不同國家不同的政府規則,銀行和企業可能會受到負面影響。這通常需要人工干預來收集和糾正資料。

- 由於全球消費者擴大使用和採用線上和數位化支付方式,COVID-19 大流行對支付即服務業產生了重大影響。此外,隨著消費者逐漸熟悉市場上的支付技術,支付即服務正經歷大規模成長。然而,疫情過後,數位支付的採用率大幅上升,減少了現金攜帶和支付的趨勢,而現金又成為支付即服務市場的主要成長因素之一。

支付即服務 (PAAS) 市場趨勢

零售業預計將做出重要貢獻

- 由於電子商務行業的大幅成長,零售商正在迅速採用數位支付技術,為客戶帶來更便捷的體驗。根據行動支付大會的數據,全球有 25 億人更喜歡網上購物。到 2025 年,數位買家數量將增加至 40 億。根據英國零售聯盟 (BRC) 的數據,簽帳金融卡佔所有交易的 42.6%,而現金則佔 42.3%。據 UK Finance 稱,英國 77% 的零售支出是透過銀行卡支付的。

- 商家擴大採用尖端技術來提高他們在市場上的影響力和知名度。例如,全球最大的零售商沃爾瑪最近表示,店內購物將接受 PayPal 現金萬事達卡。該商家希望整合支付提供者的服務,以便客戶可以使用 PayPal 行動應用程式在沃爾瑪門市提取現金並為帳戶充值。

- 此外,許多提供支付服務的公司正在擴大業務以提高市場佔有率。例如,全球最廣泛的線上零售商的線上支付系統Amazon Pay向當地零售商推出了「先買後付」功能。亞馬遜已經在百貨連鎖店 Shoppers Stop 中推出了支付服務,該線上零售商擁有該連鎖店 5% 的股份,並在雜貨連鎖店 More 中建立了必要的基礎設施。

- 數位支付的另一個顯著好處是能夠收集客戶資料用於行銷目的。這使得零售商能夠在訪問或購買後建立客戶關係,並進一步努力爭取和保留客戶。

亞太地區將成為成長最快的地區

- 由於該地區對綜合支付解決方案的需求增加以及支付技術的進步,預計亞太地區將大幅成長。此外,該地區智慧型手機普及率和網路普及率的上升正在推動市場發展。

- 日本、中國、澳洲、韓國和紐西蘭等該地區國家對經濟成長做出了巨大貢獻。例如,亞洲支付網路(APN)是由中國、日本、新加坡、馬來西亞、泰國、韓國、紐西蘭、越南、印尼、菲律賓和澳洲等11個亞洲國家組成的組織,旨在促進跨境銀行交易在該區域。

- 許多小型零售商早期更依賴現金,但迅速部署數位支付以保持市場競爭力。例如,隨著印度政府啟動廢鈔計劃,消費者被迫使用電子支付。

- 各支付服務供應商也紛紛投資亞太地區,透過開拓不斷成長的市場來拓展業務。例如,Infibeam 公司打算透過積極推廣其旗艦品牌 CCAvenue 來擴大其在數位支付市場的全球影響力。CCAvenue 是印度數位支付閘道器基礎設施提供商,年營業額達 470 億美元。

支付即服務 (PAAS) 產業概述

由於有許多支付服務提供者,支付即服務市場競爭激烈且分散。市場參與者始終致力於開發創新產品。供應商越來越注重併購,以增加市場佔有率並獲得市場吸引力。

- 2022 年 11 月,領先企業首選的全球金融科技平台 Adyen 宣布北美領先的雜貨技術公司 Instacart 已選擇該公司作為額外的支付處理合作夥伴。

- 2022 年 10 月,支付受理技術合作夥伴 Ingenico 與澳洲領先的支付服務供應商之一 Live Payments 建立了長期策略合作夥伴關係,為零售商和計程車提供無縫、便捷的支付和商務解決方案。 Ingenico 將在澳洲推出用於即時支付的 AXIUM 系列 Android 智慧 POS。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 對智慧型手機滲透和線上服務整合的需求不斷增加

- 增加對電商平台的依賴

- 市場限制

- 缺乏全球支付標準

- 產業價值鏈分析

- 產業吸引力 - 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- COVID-19 對市場的影響

第 5 章:市場區隔

- 依服務類型

- 商業融資

- 監理合規性

- 安全和詐欺保護

- 支付應用程式和閘道器

- 其他服務

- 依最終用戶產業

- 零售及電子商務

- BFSI

- 款待

- 媒體與娛樂

- 其他最終用戶產業

- 依地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 墨西哥

- 巴西

- 拉丁美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 中東和非洲其他地區

- 北美洲

第 6 章:競爭格局

- 公司簡介

- FIS

- Thales Group

- Ingenico Group

- Agilysys Inc.

- Paysafe Holdings UK Limited

- Total System Services Inc.

- Mastercard

- PayPal Holdings Inc.

- Verifone

- Pineapple Payments

第 7 章:投資分析

第 8 章:市場機會與未來趨勢

The Payment as a Service Market size is estimated at USD 10.98 billion in 2024, and is expected to reach USD 44.44 billion by 2029, growing at a CAGR of 32.26% during the forecast period (2024-2029).

In the current scenario, the increasing smartphone penetration is proliferating the growth of the sale of goods and services extensively through mobile apps to assist customers by providing an easy and convenient shopping experience. The rise in demand for easy and convenient purchases of goods and services resulted in a radical shift toward digital and cashless payments. The increase in e-commerce business further boosts the global payment service provider market.

Key Highlights

- The business is anticipated to increase due to efforts being made in numerous nations to promote digital and online transactions. The expansion of the PaaS market is also expected to be aided by the advent of payment networks like Mastercard, Visa, and Rupay on a global scale for the processing of smooth payments for clients.

- The increased demand for smartphone penetration and the incorporation of online services is experiencing continuous growth. It is expected to maintain its dominance in the market with an increase in emphasis on smartphone usage and massive internet penetration across the world. In addition, customers are using online payment channels more frequently as banks and financial institutions provide real-time payment services. Therefore, demand for online payments is experiencing a continuous rise in the market.

- The payment industry has experienced a significant transformation, and the old methods are replaced with new modules with a single click. Moreover, payment as a service (PaaS) is not only changing the scene for retailers. Banks are now realizing that the rise in PaaS use is an opportunity to give their clients a reliable choice. Thus, the increasing dependence on e-commerce, especially in retail, drives the payment as a service market.

- The absence of a global standard for cross-border transactions could restrain the market. Due to the lack of a worldwide payment system that is simple to use, international standards, and differing government rules in different countries, banks and businesses may be negatively impacted. This frequently necessitates manual intervention to gather and correct data.

- The COVID-19 pandemic has significantly impacted the payment as a service industry, owing to the increased usage and adoption of online and digitalized payment methods among consumers globally. Additionally, payment as a service is experiencing massive growth as consumers become familiar with the payment technology in the market. However, post-pandemic, there was a significant rise in the adoption of digital payments, reducing the trend of carrying and paying through cash which, in turn, has become one of the primary growth factors for the payment as a service market.

Payment as a Service (PAAS) Market Trends

Retail Sector Expected to be a Significant Contributor

- Retailers are rapidly adopting digital payment technology to bring more convenient experiences to their customers, owing to the massive growth in the e-commerce industry. According to the Mobile Payments Conference, 2.5 billion people worldwide prefer online shopping. By 2025, the number will grow to 4 billion digital buyers. According to the British Retail Consortium (BRC), debit cards account for 42.6% of all transactions, whereas cash is 42.3%. According to UK Finance, 77% of all UK retail spending was made by cards.

- Merchants are increasingly implementing cutting-edge technologies to boost their presence and visibility in the market. For instance, the biggest retailer in the world, Walmart, recently said that PayPal Cash Mastercard would be accepted for in-store purchases. The merchant wants to incorporate the payment provider's service so that customers can use the PayPal mobile app to withdraw cash and top up their accounts at Walmart locations.

- In addition, many companies that offer payment services are growing their operations to boost their market presence. For instance, the world's most extensive online retailer's online payment system, Amazon Pay, rolled out "buy now pay later" capabilities to local retailers. Amazon has already introduced the payments service in the department store chain Shoppers Stop, in which the online retailer owns a 5% stake and sets up the necessary infrastructure at the grocery chain More.

- Another significant benefit of digital payment is the ability to collect customer data for marketing purposes. This enables retailers to build customer relationships after their visit or purchase and further work toward customer acquisition and retention.

Asia-Pacific to be the Fastest Growing Region

- The Asia-Pacific region is expected to depict substantial growth owing to the increased demand for integrated payment solutions and advancements in payment technologies in the region. Furthermore, the rise in the penetration of smartphones and internet penetration in the region is propelling the market.

- Countries in the region, such as Japan, China, Australia, South Korea, and New Zealand, contribute significantly toward the growth. For instance, the Asian Payments Network (APN) is a group of 11 Asian countries that include China, Japan, Singapore, Malaysia, Thailand, South Korea, New Zealand, Vietnam, Indonesia, Philippines, and Australia to promote cross-border banking transactions in the region.

- Many small retailers earlier relied more on cash but rapidly deployed digital payments to remain competitive in the market. For instance, as the Indian government launched a demonetization program, consumers were forced to use electronic payments.

- Various payment service providers also invest in the Asia-Pacific region to expand their businesses by tapping the growing market. For instance, the firm Infibeam intends to expand its global presence in the digital payments market by aggressively promoting its flagship brand CCAvenue, a provider of digital payment gateway infrastructure in India with an annual run-rate of USD 47 billion.

Payment as a Service (PAAS) Industry Overview

The payment as a service market is highly competitive and fragmented, owing to the presence of many payment service providers. The market players are consistently focusing on developing innovative products. The vendors increasingly focus on mergers and acquisitions to increase market share and gain market traction.

- In November 2022, Adyen, the global financial technology platform of choice for leading businesses, announced that Instacart, the leading grocery technology company in North America, has selected the company as an additional payments processing partner.

- In October 2022, Ingenico, the technological partner in payments acceptance, and Live Payments, one of Australia's leading payment service providers, entered a long-term strategic partnership to equip retailers and taxis with seamless, convenient payment and commerce solutions. Ingenico will roll out its AXIUM range of Android Smart POS for Live Payments across Australia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Demand for Smartphone Penetration and Incorporation of Online Services

- 4.2.2 Increase Dependence on E-Commerce Platform

- 4.3 Market Restraints

- 4.3.1 Absence of Global Standards for Payments

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Types of Services

- 5.1.1 Merchant Financing

- 5.1.2 Regulatory Compliance

- 5.1.3 Security and Fraud Protection

- 5.1.4 Payment Applications and Gateways

- 5.1.5 Other Services

- 5.2 By End-user Industry

- 5.2.1 Retail and E-commerce

- 5.2.2 BFSI

- 5.2.3 Hospitality

- 5.2.4 Media and Entertainment

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 South Korea

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Mexico

- 5.3.4.2 Brazil

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 FIS

- 6.1.2 Thales Group

- 6.1.3 Ingenico Group

- 6.1.4 Agilysys Inc.

- 6.1.5 Paysafe Holdings UK Limited

- 6.1.6 Total System Services Inc.

- 6.1.7 Mastercard

- 6.1.8 PayPal Holdings Inc.

- 6.1.9 Verifone

- 6.1.10 Pineapple Payments