|

市場調查報告書

商品編碼

1438392

生物基 1,4-丁二醇:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)Bio-based 1,4-Butanediol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

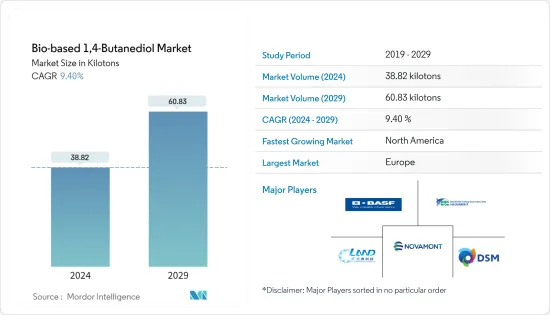

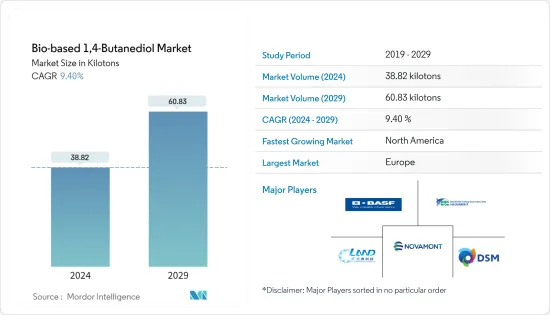

生物基1,4-丁二醇市場規模預計到2024年為38,820噸,在預測期內(2024-2029年)預計到2029年將達到60,830噸,年複合成長率為9.40%。

由於員工隔離、一般企業關閉和供應鏈中斷,冠狀病毒感染疾病(COVID-19) 大流行對生物基 1,4-丁二醇市場產生了影響。疫情期間,許多負責生產生物基1,4-丁二醇的工廠關閉。這些製造廠的關閉導致生物基 1,4-丁二醇的銷量下降。汽車、電氣/電子和紡織等行業已暫時擱置。然而,在目前的情況下,市場成長已經恢復。

主要亮點

- 推動市場成長的主要因素是各行業對聚對聚丁烯對苯二甲酸酯(PBT)的需求不斷增加以及嚴格的政府法規。

- 另一方面,來自石化燃料產品的大規模競爭仍然是所研究市場的一個擔憂。

- 在預測期內,重點轉向環保產品可能會為受調查的市場提供機會。

- 歐洲主導了全球市場。汽車、電子和電器產品等行業擴大使用生物基 1,4-丁二醇,推動了該地區的需求。

生物基1,4-丁二醇市場趨勢

紡織品市場需求增加

- 1,4 BDO 用作皮革、塑膠、聚酯層壓板和聚氨酯鞋類的黏劑。 1,4-丁二醇是一種用於生產熱塑性聚氨酯(TPU)的即時化學品,也用於生產合成革鞋底材料。

- 然而,1-4 BDO 會產生四氫呋喃 (THF)。四氫呋喃 (THF) 用於生產服飾工業中捕獲的氨綸纖維。氨綸是一種輕質、柔軟、滑爽的合成纖維,具有獨特的彈性。由於其彈性,用於生產可拉伸的服裝類。

- 由 80% 聚四亞甲基醚二醇(PTMEG 或 PolyTHF)組成的氨綸纖維可拉伸至其原始長度的 500% 至 700%,並持久保持其形狀。

- 氨綸纖維的成長率預計在10%左右,遠高於化纖的成長率。舒適服裝類的趨勢正在推動該行業的需求。

- 2022 年 9 月,萊卡公司宣布全球首次大規模商業化生產生物基氨綸,使用 QIRA 生物基 1,4-BDO 作為其關鍵成分之一。該公司與 Qore 合作生產下一代生物基萊卡。該產品中 70% 的萊卡纖維成分來自可再生原料,有助於將萊卡纖維的碳排放減少約 44%。預計到 2024 年,第一批使用 QIRA 生物基 1,4-BDO 製成的可再生萊卡纖維將在萊卡公司位於新加坡大士的生產工廠生產。萊卡公司正在尋求與準備追求生物纖維的各種品牌和零售客戶簽訂合約。我們開發了服裝解決方案。

- 此外,根據日本財務省的數據,2021 年日本紡織製造業的外商直接投資 (FDI) 達 5,600 萬美元,而 2020 年為 3,900 萬美元。

- 這些因素顯示市場在預測期內將觀察到紡織業成長停滯。

預計歐洲將主導市場

- 歐洲地區主導了全球市場佔有率。所研究市場的需求是由汽車、電子和電器產品等行業不斷成長的需求所推動的。

- 德國擁有歐洲最重要的電子和汽車工業。德國的電氣和電子市場是歐洲最大、世界第五大。

- 根據ZVEI統計,2021年德國電子和數位產業銷售額達2,004億歐元(2,181.9億美元),較2020年的1,819億歐元(1,980.5億美元)成長10.2%,創下了成長率。 2021年電子數位產業銷售額為1,629億歐元(1,773.6億美元),而2020年為1,496億歐元(1,628.8億美元),成長率為8.8%。國內電子和半導體應用1,4-丁二醇產業的這些趨勢正在增加對生物基產品的需求。

- 德國也引領歐洲汽車市場,擁有41家組裝和引擎生產廠,佔歐洲汽車總產量的三分之一。 2021年全年,全國生產汽車3,096,165輛,比2020年同期的3,742,454輛下降12%。汽車產業的衰退可能會影響所研究的市場。然而,汽車產業預計將在預測期下半年復甦和成長。

- 英國是歐洲最大的高階消費性電子產品市場,擁有約 18,000 家英國電子公司。由於對技術先進的電子設備的需求,國內電器產品市場錄得顯著成長。這種需求的增加預計將推動國內電子產品生產,並導致電子應用中對生物基 1,4-丁二醇的需求。

- 過去幾年,法國汽車工業的表現比其他歐洲主要經濟體好得多。 2021年全年,該國生產了約917,907輛汽車,比2020年成長了3%。

- 而且,隨著人口收入的增加,對空調、冰箱、洗衣機、微波爐等家電電器產品的需求大幅增加,進一步推動電器產品市場的成長。

- 因此,所有這些有利的市場趨勢預計將在預測期內推動該地區原料應用中生物基 1,4-丁二醇的需求。

生物基1,4-丁二醇產業概況

全球生物基1,4-丁二醇市場由寡占主導,Novamont SpA 佔據壓倒性的產能佔有率。市場知名企業包括Novamont SpA、山東藍電生物科技、帝斯曼、BASF、環球生化科技Group Limited(排名不分先後)等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 聚對聚丁烯對苯二甲酸酯(PBT) 需求增加

- 嚴格的政府法規

- 抑制因素

- 來自石化燃料產品的巨大競爭

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 專利分析

第5章市場區隔(市場規模(數量))

- 目的

- 四氫呋喃 (THF)

- 聚丁烯對苯二甲酸酯(PBT)

- γ-丁內酯 (GBL)

- 聚氨酯(PU)

- 其他用途

- 最終用戶產業

- 車

- 電氣和電子

- 纖維

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 世界其他地區

- 南美洲

- 中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業採取的策略

- 公司簡介

- BASF SE

- DSM

- Genomatica Inc.

- Global Bio-chem Technology Group Company Limited

- Novamont SpA

- Qira

- Shandong LanDian Biological Technology Co. Ltd

- Yuanli Science and Technology

第7章市場機會與未來趨勢

- 將重點轉向環保產品

- 其他機會

The Bio-based 1,4-Butanediol Market size is estimated at 38.82 kilotons in 2024, and is expected to reach 60.83 kilotons by 2029, growing at a CAGR of 9.40% during the forecast period (2024-2029).

The COVID-19 pandemic affected the bio-based 1,4-butanediol market because of quarantined workforces, general businesses shut down, and disrupted supply chains. During the pandemic, many factories responsible for bio-based 1,4-butanediol production were shut down. The closure of these manufacturing plants dampened bio-based 1,4-butanediol sales. Sections like automobile, electrical and electronics, and textile were temporarily held. However, in the present scenario, the market growth recovered.

Key Highlights

- The major factors driving the market's growth are the increasing polybutylene terephthalate (PBT) demand from various industries and stringent government regulations.

- On the flip side, massive competition from fossil fuel-based products remains a concern for the market studied.

- The shift in focus toward eco-friendly products will likely provide opportunities for the market studied during the forecast period.

- Europe dominated the market across the world. The demand in the region is driven by the growing usage of bio-based 1,4-butanediol in industries such as automotive, electronics, and consumer appliances.

Bio-based 1,4-Butanediol Market Trends

Increasing Demand in the Textile Market

- 1,4 BDO is used as an adhesive in leather, plastics, polyester laminates, and polyurethane footwear. 1,4-butanediol is an immediate chemical used in thermoplastic polyurethane (TPU) production, further used in making synthetic leather sole material.

- However, 1-4 BDO produces tetrahydrofuran (THF), used to make spandex fiber captured in the garment industry. Spandex is a lightweight, soft, smooth synthetic fiber with a unique elasticity. Due to its elastic property, it is used in making stretchable clothing.

- Spandex fibers, consisting of 80% polytetramethyleneether glycol (PTMEG or PolyTHF), can be stretched to between 500% and 700% of their original length and durably retain their shape.

- The growth rates for spandex fiber are estimated to be around 10%, much higher than those for textiles. The trend toward comfortable clothing with high wearing comfort is driving demand in this area.

- In September 2022, Lycra Company announced the world's first large-scale commercial manufacturing of bio-derived spandex using QIRA bio-based 1,4-BDO as one of its key ingredients. The company collaborated with Qore to manufacture next-generation bio-derived LYCRA. This manufacturing involves 70% of the LYCRA fiber content sourced from renewable feedstock, helping to reduce the carbon footprint of LYCRA fiber by nearly 44%. The first renewable LYCRA fiber made using QIRA bio-based 1,4-BDO will be produced at the LYCRA Company's production facility in Tuas, Singapore, by 2024. The LYCRA Company is seeking commitments with various brands and retail customers ready to pursue bio-derived solutions for their apparel.

- Moreover, according to the Ministry of Finance Japan, the inward foreign direct investment (FDI) in the Japanese textile manufacturing industry accounted for USD 56 million in 2021, compared to USD 39 million in 2020.

- Such factors depict that the market will observe stagnant growth from the textile industry during the forecast period.

Europe is Expected to Dominate the Market

- The European region dominated the global market share. The demand in the market studied is driven by the growing demand from industries such as automotive, electronics, and consumer appliances.

- Germany includes the most significant electronic and automobile industry in Europe. The German electrical and electronics market is Europe's largest and the 5th largest worldwide.

- According to the ZVEI, Germany's electro and digital industry turnover accounted for EUR 200.4 billion (USD 218.19 billion) in 2021, witnessing a growth rate of 10.2% compared to EUR 181.9 billion (USD 198.05 billion) in 2020. Furthermore, the production from the electro and digital industry accounted for EUR 162.9 billion (USD 177.36 billion) in 2021, registering a growth rate of 8.8% compared to EUR 149.6 billion (USD 162.88 billion) in 2020. Such trends in the industry have enhanced the demand for bio-based 1,4 butanediol for electronics and semiconductor applications in the country.

- Also, Germany leads the European automotive market, with 41 assembly and engine production plants contributing to one-third of Europe's total automobile production. In the overall 2021, the country produced 3,096,165 vehicles which declined by 12% compared to 3,742,454 cars in the same period in 2020. The declining automotive industry is likely to affect the market studied. However, the automotive industry is estimated to recover and grow later in the forecast period.

- The United Kingdom is the largest European market for high-end consumer electronics products, with about 18,000 UK-based electronics companies. The demand for technologically-advanced electronic devices registered significant growth in the consumer electronics market in the country. This increase in demand is expected to drive electronics production in the country, leading to the need for bio-based 1,4-Butanediol for electronic applications.

- The France automobile industry fared much better when compared to other major economies in Europe in the past few years. In overall 2021, the country produced about 917,907 units of vehicles, which increased by 3% in comparison to 2020.

- Besides, with the increasing population income, consumer appliance demand, such as air-conditioners, fridges, washing machines, microwaves, etc., noticeably increased, further driving the consumer appliances market growth.

- Hence, all such favourable market trends are expected to drive the demand for bio-based 1,4-butanediol for raw material applications in the region during the forecast period.

Bio-based 1,4-Butanediol Industry Overview

The global bio-based 1,4 butanediol market is an oligopoly, where Novamont SpA holds the dominant production capacity share. Some of the noticeable players in the market include Novamont SpA, Shandong Landian Biological Technology, DSM, BASF SE, and Global Bio-chem Technology Group Company Limited (not in a particular order), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Polybutylene Terephthalate (PBT)

- 4.1.2 Stringent Government Regulations

- 4.2 Restraints

- 4.2.1 Huge Competition From Fossil Fuel-based Products

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Tetrahydrofuran (THF)

- 5.1.2 Polybutylene Terephthalate (PBT)

- 5.1.3 Gamma-Butyrolactone (GBL)

- 5.1.4 Polyurethane (PU)

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Electrical and Electronics

- 5.2.3 Textile

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 DSM

- 6.4.3 Genomatica Inc.

- 6.4.4 Global Bio-chem Technology Group Company Limited

- 6.4.5 Novamont S.p.A

- 6.4.6 Qira

- 6.4.7 Shandong LanDian Biological Technology Co. Ltd

- 6.4.8 Yuanli Science and Technology

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shift in Focus toward Eco-friendly Products

- 7.2 Other Opportunities