|

市場調查報告書

商品編碼

1438353

合成石墨 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Synthetic Graphite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

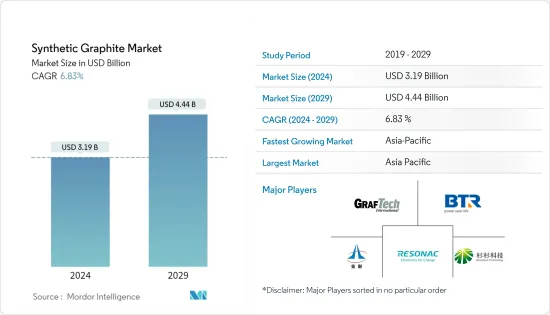

2024年合成石墨市場規模預計為31.9億美元,預計到2029年將達到44.4億美元,在預測期內(2024-2029年)CAGR為6.83%。

由於COVID-19的爆發,化學工業受到了負面影響。資源匱乏、人力資源短缺等限制嚴重阻礙了產業的擴張。 2021 年,市場恢復至 COVID-19 之前的水平,預計 2022 年將進一步恢復。

主要亮點

- 推動市場成長的主要因素是合成石墨的高純度和電動車需求的不斷成長。

- 另一方面,與天然石墨相比的高成本和嚴格的環境法規是所研究市場成長的障礙。

- 冶金在市場應用領域佔據主導地位,預計在預測期內將繼續佔據主導地位。

- 亞太地區主導了全球市場,其中中國、日本和印度的消費量最大。

合成石墨市場趨勢

冶金領域推動市場

- 石墨在冶金應用中以多種形式使用,例如電極、耐火材料、磚塊、整體坩堝等。

- 合成石墨在生產鋼、鐵合金和鋁時在電弧爐 (EAF) 方法中用作陽極。

- 合成石墨電極在冶金應用中用作製程能源。它包括在電爐中熔化廢鐵、精煉陶瓷材料、製造電石等化學物質以及其他需要高溫和清潔能源的應用。

- 全球粗鋼和鋁產量的成長預計將推動人造石墨在冶金領域的應用。然而,這些金屬生產的不規則趨勢預計會為市場需求帶來不確定性。

- 根據電流能力,合成石墨電極有多種等級,如超高功率 (UHP)、高功率 (HP) 和常規功率 (RP)。

- 根據世界鋼鐵協會統計,2022年粗鋼產量為18.7億噸,中國鋼鐵產量領先全球。 2023年4月,世界鋼鐵協會發布了2023年和2024年鋼鐵需求短期展望(SRO)預測,預計2023年鋼鐵需求將反彈2.3%,達到1,822.3公噸,預計成長2024 年成長 1.7%,達到 1,854.0 公噸

- 根據國際鋁業協會統計,全球鋁產量從2021年的6,724萬噸增加到2022年的6,900萬噸。

- 因此,基於上述方面,隨著鋼、鋁等主要金屬和合金產量的增加,人造石墨預計也會增加,進而帶動市場。

中國將主導亞太地區

- 亞太地區在研究市場中佔據主導地位,依銷售量計算佔市場總量的 50% 以上,而中國是該地區的主要消費國。

- 中國繼續主導全球合成石墨的生產和需求。鋰離子電池製造鏈的幾乎所有環節都集中在中國。中國是迄今為止最大、成長最快的鋰離子電池市場,為合成石墨的市場成長鋪平了道路。

- 中國是世界上最大的石墨生產國之一,這主要是由於鋰離子電池、電子、鋼鐵生產、太陽能工業和核工業等新興產業的巨大需求。

- 根據美國地質調查局統計,2022年該國石墨產量約佔石墨總產量的65%。

- 以寧德時代和比亞迪為首的中國電池製造商在政府產業擴張願景的支持下,正在開發大規模電池生產廠。

- 此外,去年中國是全球鋰離子電池的領導者,根據彭博新能源財經(BNEF)的數據,2021年中國在鋰離子電池供應鏈中排名第一。預計中國將控制全球80%的佔有率電池芯製造,五年內,該國產量預計將達到2太瓦時。排名的上升主要得益於政府的鼓勵政策、龐大的製造基地以及電池需求的不斷成長。

- 中國有40多家官方石墨電極生產商,過去兩年又有30多家新企業進入市場,生產其他耐火產品和電極。

- 因此,考慮到上述因素,預計預測期內中國對合成石墨的需求將會增加。

合成石墨產業概況

全球合成石墨市場本質上是部分整合的。全球人造石墨市場排名前五名的企業包括Resonac Holdings Corporation(昭和電工KK)、GrafTech International、BTR新材料集團、杉杉科技和連雲港金利碳素

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 電動車需求不斷增加

- 電弧爐製程在鋼鐵生產的應用不斷增加

- 限制

- 嚴格的環境法規

- 鋼鐵產量減少

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 原料分析

- 監理政策

- 科技景觀 - 快速簡介

- 生產分析

第 5 章:市場區隔(市場規模的價值與數量)

- 類型

- 石墨陽極

- 石墨塊(細碳)

- 其他類型(石墨電極等)

- 應用

- 冶金

- 零件

- 電池

- 核

- 其他應用

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 東協國家

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第 6 章:競爭格局

- 併購、合資、合作與協議

- 市佔率(%)**/排名分析

- 主要參與者採取的策略

- 公司簡介

- Asbury Carbons

- BTR New Materials Group Co. Ltd

- GrafTech International

- Graphit Kropfmhl GmbH

- Graphite India Limited

- Imerys

- Jiangxi Zichen Technology Co. Ltd

- Lianyungang Jinli Carbon Co. Ltd

- Mersen Property

- Mitsubishi Chemical Corporation

- Nippon Carbon Co. Ltd

- Shamokin Carbons

- Shanghai Shanshan Technology Co. Ltd

- Shenzhen Sinuo Industrial Development Co. Ltd

- Resonac Holdings Corporation (Showa Denko KK)

- Tokai Cobex GmbH

第 7 章:市場機會與未來趨勢

- 石墨烯日益普及

- 生物石墨作為電池材料的永續資源

The Synthetic Graphite Market size is estimated at USD 3.19 billion in 2024, and is expected to reach USD 4.44 billion by 2029, growing at a CAGR of 6.83% during the forecast period (2024-2029).

Due to the outbreak of COVID-19, the chemical sector was negatively affected. Lack of resources, shortage of human resources, and other constraints significantly obstructed the expansion of the industry. In 2021, the market recovered to the pre-COVID-19 level and is expected to recover further over 2022.

Key Highlights

- The major factors driving the market's growth are the high purity levels of synthetic graphite and the increasing demand for electric vehicles.

- On the flip side, the high costs compared to natural graphite and stringent environmental regulations are a roadblock to the studied market's growth.

- Metallurgy dominated the application segment of the market and is expected to continue its dominance during the forecast period.

- Asia-Pacific dominated the global market, with the largest consumption seen in China, Japan, and India.

Synthetic Graphite Market Trends

Metallurgy Segment to Drive the Market

- Graphite is used in several forms in metallurgical applications, such as electrodes, refractories, bricks, monolithic crucibles, etc.

- Synthetic graphite is used as an anode in the electric arc furnace (EAF) method while producing steel, ferroalloys, and aluminum.

- Synthetic graphite electrodes are employed in metallurgical applications as a process energy source. It includes melting scrap iron in an electric furnace, refining ceramic materials, manufacturing chemicals like calcium carbide, and other applications requiring high-temperature and clean energy sources.

- The rising crude steel and aluminum production worldwide is expected to drive the application of synthetic graphite in metallurgical applications. However, irregular trends in producing these metals are expected to provide uncertainty to the market demand.

- Synthetic graphite electrodes are made in various grades, like ultra-high power (UHP), high power (HP), and regular power (RP), based on electric current capability.

- According to the World Steel Association, crude steel production in 2022 stood at 1.87 billion tons, with China leading the global steel production. In April 2023, the World Steel Association released its Short Range Outlook (SRO) steel demand forecast for 2023 and 2024. It stated that the steel demand would see a 2.3% rebound to reach 1,822.3 Mt in 2023, and it is forecasted to grow by 1.7% in 2024 to reach 1,854.0 Mt.

- According to the International Aluminum Institute, global aluminum production increased from 67.24 million tons in 2021 to 69 million in 2022.

- Hence, based on the aspects mentioned above, with the increase in the production of major metals and alloys like steel and aluminum, synthetic graphite is also projected to increase, driving the market.

China to Dominate the Asia-Pacific Region

- The Asia-Pacific region dominated the market studied, with more than 50% of the total market by volume and China being the key consumer in the region.

- China continues to dominate the production and demand of synthetic graphite worldwide. Almost all stages of the lithium-ion battery manufacturing chain are focused on China. China is by far the largest and most rapidly growing market for lithium-ion batteries, paving the way for synthetic graphite's market growth.

- China is one of the largest graphite manufacturers in the world, mainly due to the immense demand from budding sectors like lithium-ion batteries, electronics, steel production, the solar industry, and the nuclear industry.

- According to the US Geological Survey, the country accounted for about 65% of the overall graphite production in 2022.

- China's battery manufacturers, led by CATL and BYD, supported by the government's industrial expansion vision, are developing massive battery production plants.

- Furthermore, China was the global leader in lithium-ion batteries the previous year, and according to BloombergNEF (BNEF), the country ranked first in the lithium-ion battery supply chain for 2021. The country is estimated to control 80% of the global battery cell manufacturing, and within five years, the production in the country is estimated to reach 2 TWh. The rise in position is mainly due to encouraging government policies, a huge manufacturing base, and rising demand for batteries.

- There are more than 40 official graphite electrode producers in China, with 30 more new players entering the market in the past two years, making other refractory products and electrodes.

- Therefore, considering the abovementioned factors, the demand for synthetic graphite is expected to increase in China during the forecast period.

Synthetic Graphite Industry Overview

The global market for synthetic graphite is partially consolidated in nature. The top five players in the global synthetic graphite market include Resonac Holdings Corporation (Showa Denko KK), GrafTech International, BTR New Material Group Co. Ltd, Shanshan Technology, and Lianyungang Jinli Carbon Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Electric Vehicles

- 4.1.2 Growing Utilization of Electric ARC Furnace Process for Steel Production

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Decreasing Production of Steel

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

- 4.6 Regulatory Policies

- 4.7 Technology Landscape - Quick Snapshot

- 4.8 Production Analysis

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Type

- 5.1.1 Graphite Anode

- 5.1.2 Graphite Block (Fine Carbon)

- 5.1.3 Other Types (Graphite Electrode, etc.)

- 5.2 Application

- 5.2.1 Metallurgy

- 5.2.2 Parts and Components

- 5.2.3 Batteries

- 5.2.4 Nuclear

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Asean Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Major Players

- 6.4 Company Profiles

- 6.4.1 Asbury Carbons

- 6.4.2 BTR New Materials Group Co. Ltd

- 6.4.3 GrafTech International

- 6.4.4 Graphit Kropfmhl GmbH

- 6.4.5 Graphite India Limited

- 6.4.6 Imerys

- 6.4.7 Jiangxi Zichen Technology Co. Ltd

- 6.4.8 Lianyungang Jinli Carbon Co. Ltd

- 6.4.9 Mersen Property

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 Nippon Carbon Co. Ltd

- 6.4.12 Shamokin Carbons

- 6.4.13 Shanghai Shanshan Technology Co. Ltd

- 6.4.14 Shenzhen Sinuo Industrial Development Co. Ltd

- 6.4.15 Resonac Holdings Corporation (Showa Denko KK)

- 6.4.16 Tokai Cobex GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Popularity of Graphene

- 7.2 Biographite as a Sustainable Resource for Battery Material

![合成石墨市場:趨勢、機遇、競爭分析 [2023-2028]](/sample/img/cover/42/1277673.png)