|

市場調查報告書

商品編碼

1438351

高壓壓鑄 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)High-Pressure Die Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

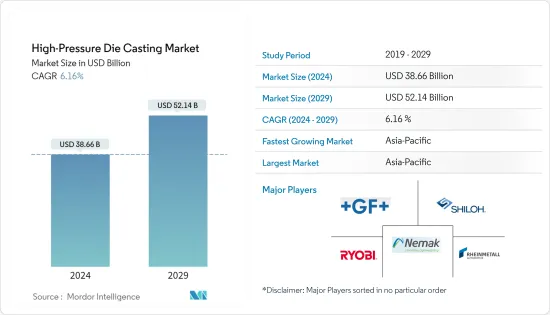

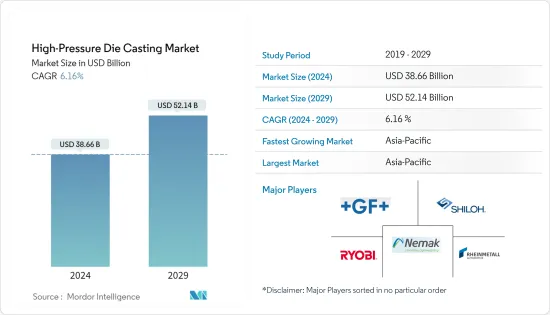

2024年高壓壓鑄市場規模預計為386.6億美元,預計到2029年將達到521.4億美元,在預測期內(2024-2029年)CAGR為6.16%。

主要亮點

- 由於全球供應鏈中斷和貿易限制,COVID-19 對製造業務產生了重大影響,市場出現放緩。然而,隨著世界各地經濟活動的恢復,全球市場預計將在預測期內穩定發展。

- 從長遠來看,預計汽車市場不斷擴大,壓鑄件在汽車零件和工業機械中的滲透率不斷提高,建築業不斷發展,鋁壓鑄件在汽車、電氣和電子行業的使用也不斷增加來帶動市場。

- 事實證明,壓鑄是生產這些引擎鑄件的最可行的選擇,可提供更高的產量和零件設計的巨大靈活性。隨著新壓鑄機設計的開發和模具製造流程的變化,這種方法可能會變得更具吸引力。壓鑄機一直採用先進的模具設計並利用模擬技術和動力通風系統。這些技術與壓鑄件的熱分析相結合,生產出滿足活塞使用和組裝特定問題的離合器活塞。

- 此外,對鋁產品日益成長的偏好以及鋁用量持續增加的趨勢預計將推動市場的顯著成長。

- 例如,2022 年 4 月:福特汽車公司在墨西哥阿帕塞奧埃爾格蘭德 (Apaseo elGrande) 設立了 ARBOMEX 工廠,並獲得了著名的 Q1 稱號。 ARBOMEX 為福特奇瓦瓦引擎廠的 1.5 升 12V DOHC L3 Dragon 引擎生產平衡軸,該引擎用於 Hermosillo 組裝的 Bronco Sport、Escape crossover 和其他車型。 ARBOMEX 除了是福特的優先供應商之外,還向 Stellantis 和馬自達等其他原始設備製造商 (OEM) 供應鐵、鋼和鋁零件。

- 此外,企業平均燃油效率 (CAFE) 法規和環保署 (EPA) 減少汽車排放和提高燃油效率的舉措正在促使汽車製造商使用輕質有色金屬來減輕車輛重量。因此,高壓鑄的使用可能會在預測期內促進市場的成長。

- 由於中國和印度汽車需求的成長、技術進步和創新的成長以及鋁壓鑄件在該地區各種應用中的使用增加,預計亞太地區將主導高壓壓鑄市場,進一步擴大市場。由於輕型汽車產量的成長,預計北美也將在高壓壓鑄市場的成長中發揮關鍵作用。

高壓壓鑄市場趨勢

汽車領域預計將在預測期內脫穎而出

- 「近年來,由於印度、中國等發展中國家乘用車和商用車銷量的增加,全球汽車產業出現了顯著而穩定的成長。此外,電動車和自動駕駛汽車等技術進步正在推動汽車產業的發展。歐洲和北美市場,有助於整體市場穩定。

- 採用高壓壓鑄方法製造的汽車零件包括引擎缸體、變速箱殼體、曲軸箱、離合器蹄片、閥體、合金輪圈等。為了滿足汽車產業不斷成長的需求,一些壓鑄機製造商也在升級他們的產品。

- 壓鑄在汽車應用中發現了潛在的用例。變速箱箱體、結構件、電子零件、引擎零件、汽缸零件等關鍵零件仍然是最重要的鑄造產品。此外,越來越多的電動車生產商對將大型鑄件或巨型鑄件整合到其車輛結構中表現出興趣,以解決可修復性、生命週期和老化等課題。

- 例如,2022年9月,美鋁公司宣佈在合金開發和部署方面取得新的創新成果,進一步鞏固了其作為先進鋁合金供應商的地位。該公司的創新包括推出新型高強度 6000 系列合金 A210 ExtruStrongTM,該合金為各種擠壓應用帶來優勢,包括運輸、建築、工業和消費品。

- 此外,減少碳排放、政府加強促進輕型車輛的使用以及汽車壓鑄機技術的快速發展等因素預計將推動市場需求。此外,新興經濟體不斷壯大的中產階級以及隨之而來的汽車擁有量的成長引發了人們對溫室氣體排放和自然資源稀缺的擔憂,無法滿足越來越多的人的需求。

- 預計後續車輛及其相關零件的生產將推動對各種壓鑄方法(包括高壓壓鑄)的需求。製造商正致力於透過採用自動化等最新生產技術來提高其市場佔有率,以進一步穩定預測期內的需求。考慮到上述因素,不斷成長的汽車工業很可能在高壓壓鑄市場的整體發展中發揮關鍵作用。”

- 修訂版對標點符號進行了調整,為了清晰起見重新措辭了一些句子,並添加了缺失的單字以保持連貫性。然而,這仍然是一個又長又密的段落。如果可能的話,請考慮將其分成更小的段落,以增強可讀性和組織性。

亞太地區預計將在預測期內實現最高成長

- 亞太地區預計將主導全球高壓壓鑄市場,並且預計在預測期內將出現最快的成長速度。在亞太地區,中國、印度、日本等國家可能在市場中扮演關鍵角色。

- 例如,中國是壓鑄件的主要生產國之一,佔了亞太地區壓鑄市場的大部分佔有率。中國金屬鑄造業擁有超過26,000 家工廠,其中8,000 家生產有色鑄件。中國鑄件產量超過4930萬噸。

- 節能汽車的日益普及和壓鑄技術的最新進步預計將進一步促進市場的發展。因此,由於這些好處,該地區的汽車製造商正在簽訂長期協議,以實現原料的不間斷供應、擴建工廠等。

- 鑄造廠越來越注重改進創新,生產滿足消費者偏好和國際標準的產品,這為市場參與者提供了新的機會。鑄造廠注重技術品質和品牌導向,被認為是亞太地區壓力鑄市場的主要成長動力。這些發展和實例可能有助於整個亞太地區市場的整體發展。

高壓壓鑄產業概況

高壓壓鑄市場高度分散,全球有許多地區和國際參與者。近年來,隨著許多來自發展中國家的中小企業進入並擴大市場業務,市場競爭加劇。這些參與者正在採取各種成長策略,以獲得相對於市場上其他參與者的競爭優勢。

例如,2022年9月,DGS Druckguss Systeme sro宣布其Frdlant工廠已開始營運,為汽車產業生產鋁鎂合金壓鑄件。

市場上一些公認的主要參與者包括 Nemak、Georg Fischer Automotive、Ryobi Die Casting、Rheinmetal AG、Form Technologies Inc. (Dynacast) 和 Shiloh Industries。其他一些著名的參與者包括 Koch Enterprise、Linamar Corporation 和 Bocar Group。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場促進因素

- 壓鑄設備中擴大使用鋁以增加市場需求

- 市場限制

- 原物料價格波動

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔(市場規模,價值百萬美元)

- 原料類型

- 鋁

- 鋅

- 鎂

- 應用

- 汽車

- 電氣和電子

- 工業應用

- 其他應用

- 地理

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太

- 印度

- 中國

- 日本

- 韓國

- 亞太其他地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第 6 章:競爭格局

- 供應商市佔率

- 公司簡介

- Georg Fischer AG

- Shiloh Industries Ltd

- Ryobi Die Casting Inc.

- Nemak SAB De CV

- Rheinmetall AG (Rheinmetall Automotive, formerly KSPG AG)

- Sundaram - Clayton Ltd

- Koch Enterprises Inc. (Gibbs Die Casting Group)

- Engtek Group

- Officine Meccaniche Rezzatesi SpA

- Endurance Group

- Rockman Industries

- Dynacast (Form Technologies Inc.)

第 7 章:市場機會與未來趨勢

The High-Pressure Die Casting Market size is estimated at USD 38.66 billion in 2024, and is expected to reach USD 52.14 billion by 2029, growing at a CAGR of 6.16% during the forecast period (2024-2029).

Key Highlights

- Due to supply chain disruptions and trade restrictions across the world, COVID-19 had a significant influence on manufacturing operations, and the market experienced a slowdown. However, as economic activity resumed across the world, the global market is expected to develop steadily over the forecast period.

- Over the long term, expanding the automotive market, increasing penetration of die-casting parts in automotive components and industrial machinery, growing the construction sector, and increasing the use of aluminum die-casting parts in the automotive and electrical, and electronics industries are anticipated to drive the market.

- Die casting has proven to be the most feasible option for producing these engine castings, offering higher output and immense flexibility in component design. The approach may grow even more attractive following the development of a new die-casting machine design and changes in the die-making process. Die casters have been employing advanced die design and utilizing simulation techniques and power venting systems. These, coupled with thermal analysis of the die casting, produce clutch pistons catering to specific concerns of piston use and assembly.

- Further, the growing preference for aluminum products, as well as the ongoing trend of increased aluminum usage, are expected to drive significant market growth.

- For instance, in April 2022: Ford Motor Company presented the ARBOMEX plant in Apaseo elGrande, Mexico, with the prestigious Q1 designation. ARBOMEX manufactures balance shafts for Ford's Chihuahua engine plant's 1.5-liter 12V DOHC L3 Dragon engine, which is used in the Hermosillo-assembled Bronco Sport, the Escape crossover, and other models. ARBOMEX supplies iron, steel, and aluminum components to other original equipment manufacturers (OEMs), including Stellantis and Mazda, in addition to being a priority supplier to Ford.

- Moreover, Corporate Average Fuel Efficiency (CAFE) regulations and Environmental Protection Agency (EPA) initiatives to reduce automobile emissions and improve fuel efficiency are prompting automakers to use lightweight non-ferrous metals to reduce vehicle weight. As a result, the use of high-pressure die casting is likely to enhance the growth of the market during the forecast period.

- Asia-Pacific is expected to dominate high pressure die casting market due to a rise in the demand for automobiles in China and India, a rise in technological advancements and innovation, and a rise in the use of aluminum die casting for various applications in this region, further augmenting the market. North America also is expected to play a key role in terms of growth in the high-pressure die-casting market due to growing output from lightweight vehicles.

High Pressure Die Casting Market Trends

Automotive Segment Expected to Gain Prominence During the Forecast Period

- "The global automotive industry has witnessed notable and steady growth in recent years, owing to increasing sales of passenger and commercial vehicles across developing countries like India, China, etc. Additionally, technological advancements, such as electric vehicles and autonomous vehicles, are driving the market across Europe and North America, contributing to overall market stability.

- Automobile parts manufactured by the high-pressure die-casting method include engine blocks, gearbox housing, crankcases, clutch shoes, valve bodies, alloy wheels, and others. To meet the rising demands of the automotive industry, several die-cast machine manufacturers are also upgrading their offerings.

- Die casting finds potential use cases in automotive applications. Key components, including gearbox cases, structural components, electronic components, engine components, and componentry for cylinders, remain the most important casting products. Furthermore, an increasing number of EV producers are showing interest in integrating large castings, or mega-castings, into their vehicle structures to address challenges like repairability, life cycle, and aging.

- For instance, in September 2022, Alcoa Corporation announced new innovations in alloy development and deployment, further strengthening its position as a supplier of advanced aluminum alloys. The company's innovations include the introduction of a new high-strength, 6000 series alloy, A210 ExtruStrongTM, which delivers benefits across a wide range of extruded applications, including transport, construction, industrial, and consumer goods.

- Moreover, factors such as reducing carbon emissions, increased government initiatives to promote the usage of lighter vehicles and rapid development of technology in automotive die-casting machines are anticipated to boost demand in the market. Additionally, the expanding middle classes in emerging economies and the associated growth in automobile ownership raise concerns about greenhouse gas emissions and the scarcity of natural resources to meet the demands of an increasing number.

- Subsequent vehicles and their associated component production are anticipated to drive the demand for various die-casting methods, including high-pressure die-casting. Manufacturers are focusing on improving their market presence by adopting the latest production techniques, such as automation, etc., to further stabilize demand during the forecast period. Considering the aforementioned factors, the growing automotive industry is likely to play a key role in the overall development of the high-pressure die-casting market."

- In the revised version, I've made adjustments to punctuation, rephrased some sentences for clarity, and added missing words for coherence. However, it is still a long and dense paragraph. Consider breaking it down into smaller paragraphs to enhance readability and organization, if possible.

Asia-Pacific Region Expected to Witness the Highest Growth During the Forecast Period

- The Asia-Pacific region is expected to dominate the global high-pressure die-casting market, and it is also expected to witness the fastest growth rate during the forecast period. In the Asia-Pacific region, countries like China, India, Japan, etc., are likely to play a key role in the market.

- For instance, China is one of the major producers of die-casting parts and accounts for the majority of the regional (Asia-Pacific) die-casting market share. The metal casting industry in China has more than 26,000 facilities, out of which 8,000 facilities produce non-ferrous castings. China produces over 49.3 million metric tons of castings.

- The increasing popularity of fuel-efficient vehicles and the latest advancements in die-casting techniques are expected to further contribute to the market's development. Thus, due to such benefits, automakers in the region are entering long-term deals for uninterrupted supply of raw materials, expansion of plants, etc.

- The growing focus of foundries on improving innovation to produce products that meet consumer preferences and international standards is offering new opportunities for players in the market. Foundries are focusing on technical quality and brand orientation, which are considered major growth drivers for the Asia-Pacific high-pressure die-casting market. Such developments and instances are likely to contribute to the overall development of the market across the Asia-Pacific region.

High Pressure Die Casting Industry Overview

The high-pressure die-casting market is highly fragmented, with the presence of many regional and international players across the globe. The competition in the market has increased, as many small and medium-scale players from developing countries entered and expanded their business in the market over recent years. These players are adopting various growth strategies to gain a competitive edge over other players in the market.

For instance, in September 2022, DGS Druckguss Systeme s.r.o. announced that it had begun operations at the Frdlant plant and produces die castings made of aluminum and magnesium alloy for the automotive industry.

Some of the major recognized players in the market are Nemak, Georg Fischer Automotive, Ryobi Die Casting, Rheinmetall AG, Form Technologies Inc. (Dynacast), and Shiloh Industries. Some other notable players include Koch Enterprise, Linamar Corporation, and Bocar Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand

- 4.2 Market Restraints

- 4.2.1 Fluctuations in Raw Material Prices

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Million)

- 5.1 Raw Material Type

- 5.1.1 Aluminum

- 5.1.2 Zinc

- 5.1.3 Magnesium

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Electrical and Electronics

- 5.2.3 Industrial Applications

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Georg Fischer AG

- 6.2.2 Shiloh Industries Ltd

- 6.2.3 Ryobi Die Casting Inc.

- 6.2.4 Nemak SAB De CV

- 6.2.5 Rheinmetall AG (Rheinmetall Automotive, formerly KSPG AG)

- 6.2.6 Sundaram - Clayton Ltd

- 6.2.7 Koch Enterprises Inc. (Gibbs Die Casting Group)

- 6.2.8 Engtek Group

- 6.2.9 Officine Meccaniche Rezzatesi SpA

- 6.2.10 Endurance Group

- 6.2.11 Rockman Industries

- 6.2.12 Dynacast (Form Technologies Inc.)