|

市場調查報告書

商品編碼

1438341

活性碳纖維:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Activated Carbon Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

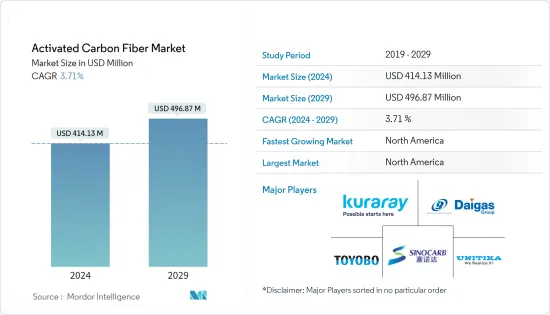

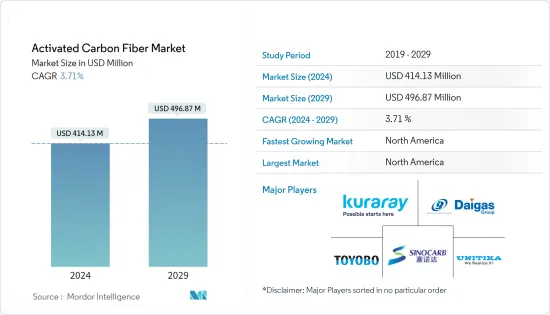

活性碳纖維市場規模預計2024年為4.1413億美元,預計到2029年將達到4.9687億美元,在預測期(2024-2029年)將成長3.71%,年複合成長率成長。

在 2020 年冠狀病毒感染疾病(COVID-19) 大流行期間,市場的生產、銷售、行銷和分銷成長急劇放緩。全球停工導致一系列市場關閉,導致許多主要行業遭受重大損失。然而,市場在兩年內復甦並錄得強勁成長。

主要亮點

- 與空氣和水污染相關的日益嚴重的環境問題以及活性碳纖維相對於粉末活性碳(PAC)和顆粒活性碳(GAC)的優越性能預計將在預測期內推動市場需求。

- 對其原料的擔憂可能會阻礙市場成長,例如合成纖維不可分解,並且容易與污水中的有害化學污染物分子結合,例如阻燃劑和殺蟲劑。

- 防護衣行業不斷成長的需求預計將成為未來的市場機會。

- 北美地區預計將主導市場,並且在預測期內也可能出現最高的年複合成長率。

活性碳纖維(ACF)市場趨勢

煉製產業需求增加

- 活性碳纖維的主要用途之一是精製。活性碳纖維由於其特性主要用於氣體和水淨化。

- 各行業和實驗室都需要高純度氣體。水分、碳氫化合物、氧氣和硫化合物等雜質的存在會導致氣體干擾和低效率使用。這就需要對工業氣體精製。

- 汽車廢氣控制、飛機機艙空氣淨化、廢氣和氣味控制、防毒面具以及維持室內空氣品質都需要氣體淨化。此外,氣體應用的多樣化和對空氣污染的日益關注正在增加許多行業的氣體純化要求。

- 根據國際汽車製造組織(OICA)統計,去年全球汽車產量約8,015萬輛,較2020年約7,771萬輛汽車成長3%,這帶動了活性碳纖維的生產需求增加。適用於汽車廢氣法規。

- 由於政府的各種舉措,印度的水淨化預計在預測期內將大幅成長。能源、環境和水理事會 (CEEW) 與 2030 水資源集團合作,計劃增加私人投資建設污水處理廠並改善印度的污水管理。

- 所有上述因素預計將在預測期內推動全球市場。

北美市場佔據主導地位

- 由於美國和加拿大等精製、化學和醫療行業的需求不斷增加,預計北美將主導活性碳纖維市場。

- 美國是一個已開發國家,產業眾多,分為大、中、小三類。該國以其繁榮的商業活動而聞名。此外,美國是世界上最大的水消耗國之一。美國水處理業約 80% 為公有和管理。

- 然而,該國農村地區獲得水處理基礎設施的機會明顯低於都市區,但也更容易獲得。自 2003 年以來,美國農業部 (USDA) 已提供約 100 億美元資金,用於建造和維護 7,500 個市政用水和污水系統,並計劃在未來幾年加大投資。生活水處理投資的增加可能會增加對活性碳纖維的需求。

- 根據美國化學理事會的數據,去年美國化學品出貨收益為 7,689 億美元,而 2020 年為 6,960 億美元,支撐了化學工業對活性碳纖維過濾器的需求。

- 老年人口的不斷成長和對治療慢性疾病的醫療設施的需求不斷增加,支持了醫療保健行業的成長以及該國各種應用的活性碳纖維的消費。

- 在加拿大醫療保健產業中,醫療設備產業是一個高度多元化、出口導向的產業,生產設備和用品。該行業由產品創新驅動。該行業可以利用加拿大大學、研究機構和醫院正在進行的世界一流的創新研究,其中一些研究正在分拆為加拿大醫療設備公司。

- 因此,上述因素導致的需求上升預計將推動北美地區的成長。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 人們對空氣和水污染的環境關注日益增加

- 活性碳纖維優異的性能

- 抑制因素

- 對原料的擔憂

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 原料

- 自然的

- 合成

- 俯仰底座

- 麵包底料

- 酚醛樹脂

- 黏膠基

- 其他材料

- 目的

- 精製

- 化學分離與催化作用

- 防護衣

- 醫療保健

- 超級電容

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 墨西哥

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- Anshan Sinocarb Carbon Fibers Co. Ltd

- China Beihai Fiberglass Co. Ltd

- Evertech Envisafe Ecology Co. Ltd

- Hangzhou Nature Technology Co. Ltd(Nature Carbon)

- HPMS Graphite

- Jiangsu Tongkang Activated Carbon Fiber Co. Ltd

- Kuraray Co. Ltd

- Nantong Yongtong Environmental Technology Co. Ltd

- Osaka Gas Chemicals Co. Ltd

- Toyobo Co. Ltd

- Unitika LTD

第7章市場機會與未來趨勢

- 防護衣的使用增加

The Activated Carbon Fiber Market size is estimated at USD 414.13 million in 2024, and is expected to reach USD 496.87 million by 2029, growing at a CAGR of 3.71% during the forecast period (2024-2029).

During the COVID-19 pandemic in 2020, the market experienced a sharp decline in growth in output, sales, marketing, and distribution. The global shutdown has resulted in a series of market closures that have resulted in significant losses to many key industries. However, the market has recovered in the two years to post strong growth.

Key Highlights

- Increasing environmental concerns related to air and water pollution, coupled with activated carbon fiber's superior properties in comparison to that of powdered activated carbons (PAC) and granular activated carbons (GAC), are expected to drive the demand for the market during the forecast period.

- Concerns related to its raw materials, such as that synthetic fiber, which is non-degradable and tends to bind with molecules of harmful chemical pollutants in wastewater, such as flame retardants and pesticides, are likely to hinder the market's growth.

- Rising demand from the protective clothing industry is projected to act as an opportunity for the market in the future.

- The North American region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Activated Carbon Fiber (ACF) Market Trends

Increasing Demand from the Purification Industry

- One of the major applications of activated carbon fiber includes purification. Gas and water purification involve the major usage of activated carbon fibers owing to their properties.

- High-purity gases are required in various industries and laboratories. The presence of impurities, such as moisture, hydrocarbons, oxygen, or sulfur compounds, can lead to interference or inefficient use of the gases. This creates a need for the purification of industrial gases.

- Gas purification is required for automotive emission control, aircraft cabin air purification, emission and odor control, gas masks, and maintaining indoor air quality. Moreover, gas purification requirements are increasing in numerous industries, with the diversifying application of gases and growing concerns about air pollution.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), around 80.15 million vehicles were produced across the world last year, witnessing a growth rate of 3% compared to ~77.71 million vehicles in 2020, thereby enhancing the demand for activated carbon fibers for automotive emission control.

- Water purification in India is expected to register a decent increase during the forecast period, owing to various government initiatives. The Council on Energy, Environment, and Water (CEEW), in association with the 2030 Water Resources Group, is planning to improve wastewater management in India, along with increasing private investments to build wastewater treatment plants.

- All the aforementioned factors are expected to drive the global market during the forecast period.

North America to Dominate the Market

- North America is expected to dominate the activated carbon fiber market due to increasing demand from purification, chemicals, and the medical industry in countries such as the United States and Canada.

- The United States is a major industrialized nation that houses multiple industries in heavy-scale, medium-scale, and small-scale categories. The country is known for its booming commercial activities. Moreover, the United States is one of the highest consumers of water in the world. Approximately 80% of the US water and wastewater treatment industry is owned and managed publicly.

- However, the rural part of the country has significantly lower access to water treatment infrastructure and facilitates in comparison to the urban areas. Since 2003, the United States Department of Agriculture (USDA) has funded around USD 10 billion for the construction and maintenance of 7,500 rural water and wastewater systems and is planning to further increase its investment in the coming years. This growing investment in water treatment in the country is likely to boost the demand for activated carbon fiber.

- According to the American Chemistry Council, the value of United States chemical shipments accounted for USD 768.9 billion last year, compared to USD 696 billion in 2020, thereby supporting the demand for activated carbon fiber-based filters from the chemical industry.

- The increasing geriatric population and the growing requirement for medical facilities for the treatment of chronic diseases have been supporting the growth of the healthcare sector, as well as the consumption of activated carbon fibers for various applications in the country.

- In the healthcare industry in Canada, the medical device sector is a highly diversified and export-oriented industry that manufactures equipment and supplies. The sector is driven by product innovation. The industry can draw on world-class innovative research being conducted in Canadian universities, research institutes, and hospitals, some of which have been spun off into Canadian medical device companies.

- Thus, rising demands from the above-mentioned factors are expected to drive growth in the North American region.

Activated Carbon Fiber (ACF) Industry Overview

The activated carbon fiber market is fragmented in nature. Key players in the activated carbon fiber market include (not in any particular order) Osaka Gas Chemicals Co. Ltd, Kuraray Co. Ltd, Unitika Ltd, Anshan Sinocarb Carbon Fibers Co. Ltd, Kuraray Co. Ltd, and Toyobo Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Environmental Concerns Related to Air and Water Pollution

- 4.1.2 Superior Properties of Activated Carbon Fiber

- 4.2 Restraints

- 4.2.1 Concerns Related to Raw Materials

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Raw Material

- 5.1.1 Natural

- 5.1.2 Synthetic

- 5.1.2.1 Pitch-based

- 5.1.2.2 Pan-based

- 5.1.2.3 Phenolic-based

- 5.1.2.4 Viscose-based

- 5.1.2.5 Other Materials

- 5.2 Application

- 5.2.1 Purification

- 5.2.2 Chemical Separation and Catalysis

- 5.2.3 Protective Clothing

- 5.2.4 Medical

- 5.2.5 Super Capacitors

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Mexico

- 5.3.2.3 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Middle East & Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anshan Sinocarb Carbon Fibers Co. Ltd

- 6.4.2 China Beihai Fiberglass Co. Ltd

- 6.4.3 Evertech Envisafe Ecology Co. Ltd

- 6.4.4 Hangzhou Nature Technology Co. Ltd (Nature Carbon)

- 6.4.5 HPMS Graphite

- 6.4.6 Jiangsu Tongkang Activated Carbon Fiber Co. Ltd

- 6.4.7 Kuraray Co. Ltd

- 6.4.8 Nantong Yongtong Environmental Technology Co. Ltd

- 6.4.9 Osaka Gas Chemicals Co. Ltd

- 6.4.10 Toyobo Co. Ltd

- 6.4.11 Unitika LTD

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application in Protective Clothing

![活性碳纖維(ACF)市場:趨勢、機遇、競爭對手分析 [2023-2028]](/sample/img/cover/42/1289752.png)