|

市場調查報告書

商品編碼

1438298

汽車點火線圈 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Automotive Ignition Coil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

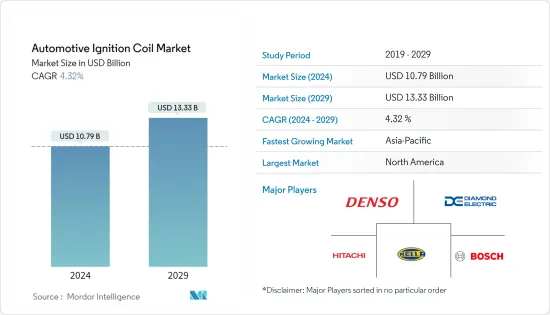

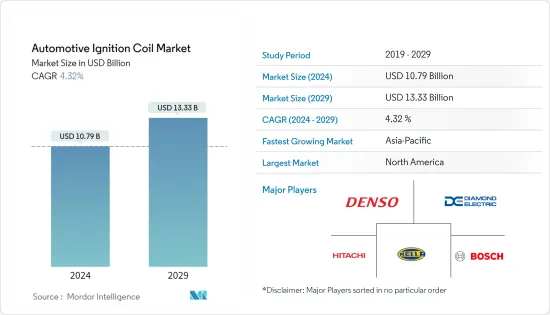

2024年汽車點火線圈市場規模預計為107.9億美元,預計到2029年將達到133.3億美元,在預測期內(2024-2029年)CAGR為4.32%。

主要亮點

- COVID-19 的爆發導致多家車輛和零件製造工廠暫時關閉。然而,隨著一些國家逐步解除封鎖,對車輛的需求也略有增加。汽車產業受到的影響尤其明顯,許多企業的生產活動和供應鏈都面臨干擾。

- 然而,隨著疫情在 2021 年下半年和 2022 年初消退,在汽車產業電氣化指數級成長的進一步推動下,該產業已恢復到疫情前的狀況。儘管成長,但電氣化是點火線圈潛在市場需求放緩的明顯跡象,並可能降低未來幾年的市場價值。

- 全球汽車銷售的成長和汽車產量的增加對汽車點火線圈的銷售產生了積極影響。儘管近期經濟狀況仍不穩定,但全球汽車產業仍取得了令人滿意的成長。在新興經濟體尤其如此,與已開發經濟體相比,新興經濟體的汽車產量預計將很高。這些新興經濟體的城市化進程不斷加快、人均收入成長以及生活水準的提高也在市場成長中發揮著至關重要的作用。

- 全球不斷成長的汽車需求預計將增加對點火系統的需求。但目前,由於多種原因,汽車需求正以緩慢的速度成長。影響各國汽車銷售和產量的首要因素是中美貿易戰,點火系統在不久的將來可能會出現緩慢的成長。

- 車輛平均壽命的延長加速了維護和修理活動,包括更換點火線圈。隨著行駛里程的增加,點火線圈的更換量增加,進一步拉動了售後市場對汽車點火線圈市場的需求。

- 另一個因素是人均收入,不同國家的人均收入不同,可能會影響車輛的平均車齡。儘管美國、中國、印度以及法國、德國等一些歐洲國家的人均收入較高,但汽車的平均車齡卻在不斷增加,乘用車接近10年,商用車接近11-14年。汽車。

汽車點火線圈市場趨勢

電動車需求的成長阻礙了汽車齒輪市場的成長

- 實現永續交通的需求在推動電動車需求方面發揮著重要作用。電動車 (EV) 市場正在成為汽車產業不可或缺的一部分,代表著實現能源效率和減少污染物及其他溫室氣體排放的途徑。

- 越來越多的環境問題和有利的政府措施是推動電動車市場成長的一些主要因素。不斷增加的能源成本和新興節能技術之間的競爭預計也將推動市場成長。

- 電動車的崛起主要還是受到政策環境的推動。電動車普及率領先的 10 個國家(中國、美國、挪威、德國、日本、英國、法國、瑞典、加拿大和荷蘭)均制定了一系列促進電動車普及的政策。

- 全球每年註冊的新電動車數量顯著增加。需求激增的原因包括新的、有吸引力的車型、政府綠色復甦基金的激勵措施、95克二氧化碳排放指令、可用性的提高以及電動車的廣泛推廣。

- 根據 EV Volumes 的數據,插電式混合動力車的同比成長率一直呈上升趨勢,其中中國在 2021 年至 2022 年期間成長了 82%。同樣,北美也出現了成長同比成長率為48%,其中歐洲2021 年至2022 年間的年成長率為15%。

- 全球和地區的電動車製造商正在利用新技術進行創新,將其服務擴展到世界各地。例如:

- 中國比亞迪在歐洲擁有龐大的生產網路,但自 2021 年以來,該網路在乘用車領域基本上沒有引起人們的注意。造成這種情況的一些主要原因是該公司計劃於 2023 年下半年開始建造的匈牙利新工廠、計劃在法國的工廠以及在英國生產電動巴士的合資企業。

- 2021年12月,戴姆勒與中國政府合作,在中國推廣電動車。電動車是戴姆勒未來出行策略的主要支柱之一。該公司正在全球推廣這項策略,特別是在中國這個全球最大的新能源汽車市場。

- 由於點火線圈不用於電動車,上述因素預計將對預測期內全球汽車點火線圈市場的成長構成重大課題。

亞太地區引領點火線圈市場

- 由於印度、中國和東協國家等國家的汽車需求不斷成長,以及建築、電子商務和採礦業的成長,商用車的需求不斷增加,預計亞太地區將主導汽車點火線圈市場活動(促使物流業的興起) 。歐洲和北美分別緊接著亞太地區之後。

- 中國、日本、印度等主要汽車市場的汽車銷售量下降,進一步影響了汽車點火線圈市場的成長。發展中經濟體的政府正在採取各種措施來增加各自國家的汽車銷售量。

- 例如,2020年中國插電式電動車銷量總計130萬輛,其次是韓國,插電式混合動力車銷量總計52萬輛。儘管電動車市場規模很大,但巨大的機會在於插電式混合動力車的巨大銷量,這仍然需要車輛使用點火線圈,從而推動整個亞太地區的市場主要成長。

- 大多數豪華車輛都配備了多個車輛點火線圈,因為它們的功率高且性能優異。發展中地區豪華車銷售大幅成長。例如,中國已發展成為豪華車銷售的主要目的地。

- 以價值計算,近三分之一的豪華車在中國銷售。從銷售來看,印度是全球最大的汽車點火線圈市場之一,豪華汽車對汽車點火線圈產生了很高的需求。然而,豪華和非豪華汽車製造商都預見到該國銷售成長的巨大潛力,並尋求進一步投資這個快速成長的市場。

汽車點火線圈產業概況

汽車點火線圈市場由日立汽車系統公司、大陸集團、鑽石電氣製造公司、電裝公司、三菱電機公司和博格華納等少數幾家公司主導。這些公司正在推出技術更先進的點火線圈,並擴大其地理分佈,以在競爭中保持領先地位。例如:

2021年9月,日立Astemo宣布將總計投資5,600萬美元,用於提高其生產點火線圈等各種汽車零件的生產工廠的工業安全和生產能力。

2021年3月,Diamond Electric Mfg.宣布將在美國西維吉尼亞州興建新廠,生產汽車點火線圈。美國點火線圈產能將提高20%。美國新工廠建築面積12,263平方公尺。除了福特現有的北美生產基地外,主要供貨目的地是日本汽車製造商的北美生產基地。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場促進因素

- 乘用車和商用車的需求不斷增加

- 其他

- 市場限制

- 電動車需求的成長阻礙了汽車齒輪市場的成長

- 其他

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 類型

- 塊點火線圈

- 插頭上的線圈

- 點火線圈導軌

- 依工作原理分類

- 單火花技術

- 雙火花技術

- 依配銷通路

- OEM

- 售後市場

- 依車型分類

- 搭乘用車

- 商務車輛

- 地理

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 世界其他地區

- 巴西

- 阿根廷

- 南非

- 其他國家

- 北美洲

第 6 章:競爭格局

- 供應商市佔率

- 公司簡介

- NGK SPARK PLUG Co. Ltd

- Denso Corporation

- Robert Bosch GmbH

- Hitachi Ltd

- HELLA GmbH & Co. KGaA

- Diamond Electric Holdings Co. Ltd

- Taiwan Ignition System Co. Ltd

- BorgWarner Inc.

- Eldor Corporation

- Furuhashi Auto Electric Parts Co. Ltd

第 7 章:市場機會與未來趨勢

The Automotive Ignition Coil Market size is estimated at USD 10.79 billion in 2024, and is expected to reach USD 13.33 billion by 2029, growing at a CAGR of 4.32% during the forecast period (2024-2029).

Key Highlights

- The outbreak of COVID-19 caused several vehicle and component manufacturing facilities to shut down temporarily. However, with the gradual removal of lockdowns in several countries, the demand for vehicles slightly increased. The impact was evident in the auto industry as many companies faced disturbances with their production activities and supply chain.

- However, with the pandemic subsiding in the latter half of 2021 and early 2022, the industry has been crawling back up to pre-pandemic conditions, further aided by the exponentially growing electrification of the automotive industry. Despite the growth, electrification is a clear sign of a potential market demand slowdown for the ignition coils and can reduce market value in the coming years.

- The rise in the sales of automobiles globally and an increase in vehicle production positively affect the sales of automotive ignition coils. Even though the recent economic conditions have remained unstable, the global automotive industry has witnessed satisfactory growth. This is especially true in emerging economies, where automotive production is expected to be significant compared to developed economies. Rising urbanization, per capita income growth, and a rise in the living standards in these emerging economies also play a crucial role in market growth.

- The growing automotive demand worldwide is expected to increase the demand for ignition systems. However, at present, vehicle demand is increasing at a slow growth rate due to various reasons. The prime factor affecting vehicle sales and production in every country is the US-China trade war, owing to which the ignition system is likely to witness a slow growth rate in the near future.

- The increase in the average life of vehicles has accelerated maintenance and repair activities, including replacing their ignition coils. As the number of miles traveled increases, the replacement of ignition coils increases, which further boosts the demand for the automotive ignition coil market in the aftermarket segment.

- Another factor is the per capita income, which varies from country to country, and may influence the average age of vehicles. Despite the United States, China, India, and some European countries, like France, and Germany, observing high per capita incomes, the average age of vehicles has been increasing and was approximated to 10 years for passenger cars and 11-14 years for commercial vehicles.

Automotive Ignition Coil Market Trends

Growing Demand for Electric Vehicles Hindering the Automotive Gear Market Growth

- The need to attain sustainable transportation plays a significant role in driving the demand for electric vehicles. The electric vehicle (EV) market is becoming an integral part of the automotive industry and represents a pathway toward achieving energy efficiency and reduced emissions of pollutants and other greenhouse gasses.

- The rising number of environmental concerns and favorable government initiatives are some of the major factors driving the growth of the electric vehicle market. The increasing energy costs and competition among emerging energy-efficient technologies are also expected to fuel market growth.

- The rise in electric vehicles is still majorly driven by the policy environment. The 10 leading countries in electric vehicle adoption (China, the United States, Norway, Germany, Japan, the United Kingdom, France, Sweden, Canada, and the Netherlands) all have a range of policies to promote the uptake of electric vehicles.

- There has been a significant increase in the number of new electric vehicles registered every year around the world. The upsurge in demand was due to the combination of new and attractive models, incentive boosts by governments' green recovery funds, the 95g CO2 mandate, improved availability, and the extensive promotion of EVs.

- According to EV Volumes, the year-on-year growth rate of Plug-In-Hybrid Electric Vehicles has been on an increasing trend, with China witnessing a huge 82% growth between the years 2021 and 2022. Similarly, North America witnessed a growth rate of 48% (Y-o-Y), with Europe registering a 15% Y-o-Y growth rate between 2021 and 2022.

- The global and regional manufacturers of electric vehicles are innovating with new technologies, expanding their services across the world. For instance:

- China's BYD has a large production network in Europe that has largely gone unnoticed since 2021 in the passenger car world. Some of the primary reasons for this are the firm's new plant in Hungary, which is scheduled to begin construction in the latter half of 2023, its planned plant in France, and its joint venture operations in the United Kingdom, manufacturing electric buses.

- In December 2021, Daimler teamed up with the Chinese government to promote e-mobility in China. Electric mobility is one of the major pillars of Daimler's future mobility strategy. The company is bringing this strategy forward globally, especially in China, the world's largest NEV market.

- As ignition coils are not used in electric cars, the factors mentioned above are expected to put a significant challenge to the growth of the global automotive ignition coil market over the forecast period.

Asia-Pacific Leading the Ignition Coil Market

- Asia-Pacific is expected to dominate the automotive ignition coil market, owing to the growing vehicle demand in countries such as India, China, and ASEAN countries and increasing demand for commercial vehicles, due to the rise in construction, e-commerce, and mining activities (resulting in a rise in the logistics industry). Europe and North America, respectively, follow the Asia-Pacific region.

- The sales of vehicles are declining in major automotive markets such as China, Japan, and India, further impacting the growth of the automotive ignition coil market. The governments of growing economies are taking various steps to increase vehicle sales in their respective countries.

- For instance, China registered a total of 1.3 million units of plug-in electric vehicle sales in 2020, followed by South Korea, witnessing a total sales of 520,000 units of plug-in hybrid electric vehicle sales. Despite the high market for electric vehicles, the significant opportunity lies in the huge plug-in hybrid electric vehicle sales, which still require the vehicles to use ignition coils, thereby driving a major market growth across the Asia-Pacific region.

- Most luxurious vehicles are equipped with multiple vehicle ignition coils due to their high power and excellent performance. A significant increase has been witnessed in the sales of luxury vehicles in developing regions. For example, China has grown to become a major destination for the sales of luxury vehicles.

- Almost one-third of luxury vehicles are sold in China in terms of value. India is one of the world's largest vehicle ignition coil markets in terms of volume, with luxury cars generating high demand for vehicle ignition coils. However, vehicle manufacturers, both luxury and non-luxury segments, foresee a high potential for sales growth in the country and seek to invest further in this fast-growing market.

Automotive Ignition Coil Industry Overview

The automotive ignition coil market is dominated by a few players, such as Hitachi Automotive Systems, Continental AG, and Diamond Electric Mfg. Co. Ltd, Denso Corp., Mitsubishi Electric Corp., and BorgWarner. The companies are launching more technologically advanced ignition coils and expanding their geographical presence to be ahead of the competition. For instance:

In September 2021, Hitachi Astemo announced that it would invest a total of USD 56 million to improve the industrial safety and production capacities of its production plants that manufacture various automotive parts, including ignition coils.

In March 2021, Diamond Electric Mfg. Co. Ltd announced that it would build a new plant in West Virginia, USA, to manufacture ignition coils for automobiles. The production capacity of ignition coils in the United States will be increased by 20%. The new US plant has a building area of 12,263 square meters. In addition to Ford's existing North American production bases, the main supply destinations are the North American production bases of Japanese automobile manufacturers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Passenger Cars and Commercial Vehicles

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 Growing Demand for Electric Vehicles Hindering the Automotive Gear Market Growth

- 4.2.2 Others

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Block Ignition Coils

- 5.1.2 Coil on Plug

- 5.1.3 Ignition Coil Rail

- 5.2 By Operating Principle

- 5.2.1 Single Spark Technology

- 5.2.2 Dual Spark Technology

- 5.3 By Distribution Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Commercial Vehicles

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Russia

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 South Africa

- 5.5.4.4 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 NGK SPARK PLUG Co. Ltd

- 6.2.2 Denso Corporation

- 6.2.3 Robert Bosch GmbH

- 6.2.4 Hitachi Ltd

- 6.2.5 HELLA GmbH & Co. KGaA

- 6.2.6 Diamond Electric Holdings Co. Ltd

- 6.2.7 Taiwan Ignition System Co. Ltd

- 6.2.8 BorgWarner Inc.

- 6.2.9 Eldor Corporation

- 6.2.10 Furuhashi Auto Electric Parts Co. Ltd