|

市場調查報告書

商品編碼

1438295

電子書:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)E-book - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

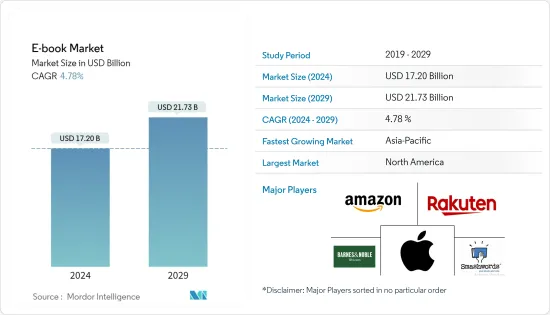

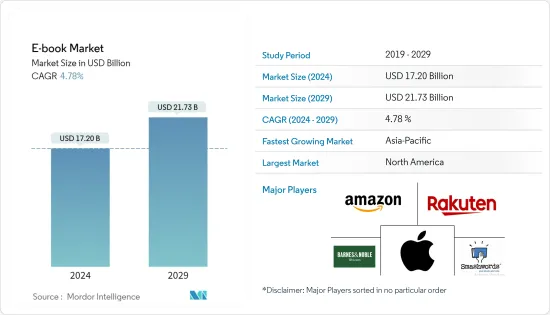

預計 2024 年電子書市場規模為 172 億美元,到 2029 年預計將達到 217.3 億美元,在預測期內(2024-2029 年)年複合成長率為 4.78%。

提供類似於閱讀實體書體驗的閱讀設備的技術發展和完善是推動全球電子書市場的關鍵因素。智慧型手機的普及和電子書的多語言功能等優勢預計將推動全球對電子書的需求。

主要亮點

- 透過應用程式和線上服務可以輕鬆存取各種電子書圖書館,這些圖書館可以透過網路取得,並且正在成為傳統交付方法的低成本替代方案。這些電子書提供的服務(例如電子借閱)正在幫助普及電子書世界。

- 此外,世界各國政府的環境保護宣傳活動,特別是保護樹木和減少紙張使用的宣傳活動,也增加了對電子書的需求。

- 受到內容提供商知識產權侵權訴訟的出版商正在限制市場成長。例如,2020年6月,四家主要圖書出版商對網路檔案館提起訴訟,指控其侵犯與開放圖書館計劃相關的版權。許多出版商都對網路檔案館提起訴訟,包括阿歇特 (Hachette)、企鵝蘭登書屋 (Penguin Random House)、威利 (Wiley) 和哈珀柯林斯 (HarperCollins)。

- 我們觀察到大流行期間讀者的整體參與度增加。在全球封鎖期間,人們轉向電子書進行娛樂。雖然書店關閉和線上零售商的交付延遲最初削弱了紙本書的紙本,但電子書銷量猛增,讀者轉向方便、即時的交付。

- 2020 年 COVID-19 的傳播以及隨後訂定的封鎖限制讓我們對實體書的依賴受到了考驗。結果是電子書的使用量急劇增加,這是圖書館員、出版商和學生都沒有預料到的。不幸的結果是,金融壓力、市場崩壞和需求增加的完美風暴加劇了本已成為主要問題的問題。於是,#ebooksos宣傳活動發起了。

電子書市場趨勢

電子設備的使用增加

- 智慧型手機和平板電腦等可攜式可讀設備數量的增加預計將成為全球電子書市場的主要成長要素。與實體書相比,消費者更喜歡電子書,因為紙本易碎、需要適當保養且價格昂貴。

- 圖書數位化和透過網路獲取圖書有望創造一個為讀者提供即時體驗的創新環境。此外,漫威、DC等著名出版商將漫畫書轉化為數位教材,並有望讓人們閱讀電子書成為可能。美國圖書館協會 (ALA) 宣布,所有 Rooster 圖書最遲將以數位格式提供,以減少浪費。

- 科技影響力的不斷增強,加上許多人(主要是千禧世代和 Z 世代)對數位化的傾向,可能會對電子書市場的成長產生積極影響。

- 數位教育和身臨其境型學習等系統也有望推動市場成長。預計將介紹最新的硬體、軟體和教育內容,創造一個為讀者提供即時體驗的身臨其境型環境。

- 它還作為傳統分發方法的低成本替代方案,使您可以透過應用程式和服務輕鬆存取各種電子書庫。此外,電子書可用的資源,例如電子書借閱,也促進了電子書市場的成長。

北美市場佔據主導地位

- 電子書是北美的早期採用者,對於尋求快速訪問和攜帶性的消費者來說,它是紙本書的自然且永久的替代品。出版商也迅速回應消費者對新閱讀設備的快速接受,不斷重新定義和擴展書籍的新概念。

- 此外,在假期季節,擁有平板電腦和電子書閱讀器(例如早期的Kindle)的人數也會增加。內容移動性的改進提高了可訪問性,並將書籍分發給更廣泛的目標受眾,從而節省了成本。此外,該地區的行業預計將受到對數位化漫畫書不斷成長的需求的推動,因此 DC Entertainment 和 MARVEL 等漫畫公司正在擴大其產品線以跟上這一趨勢。

電子書業概況

電子書市場較為分散,有許多獨立作者和出版商,但某些參與者佔據了很大的市場佔有率。亞馬遜的 KDP 和蘋果的 iBooks Author 主導著電子書市場。市場上的主要企業正在採取諸如與小型和區域出版商建立合資企業和合作夥伴關係等策略來佔領更高的市場佔有率。

- 2022年3月,英國教育科技公司Perlego進行B輪資金籌措,籌集3,820萬美元,用於國際拓展教科書訂閱服務。

- 2022 年 9 月,Book.io 完成了與 Ingram Content Group(「Ingram」)的一輪種子投資,Ingram Content Group 是全球最大的圖書經銷商之一,擁有數百萬種圖書和數以萬計的出版商。我報告說我做到了。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 評估 COVID-19感染疾病對產業的影響

- 市場促進因素

- 提高行動裝置普及

- 降低電子書成本

- 市場限制因素

- 電子賣家和圖書作者之間的隱私和版權問題

第4章市場區隔

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 西班牙

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家(瑞典、丹麥)

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區(澳洲、韓國、新加坡)

- 拉丁美洲

- 中東和非洲

- 北美洲

第5章競爭形勢

- 公司簡介

- Amazon.com Inc.

- Rakuten Kobo Inc.

- Apple Inc.

- Barnes and Noble LLC

- Smashwords Inc.

- Blurb Inc.

- BookBaby(DIY Media Group Inc.)

- Lulu Press Inc.

- Macmillan Publishers Ltd

- Scribd Inc.

第6章 投資分析

第7章 市場的未來

The E-book Market size is estimated at USD 17.20 billion in 2024, and is expected to reach USD 21.73 billion by 2029, growing at a CAGR of 4.78% during the forecast period (2024-2029).

Technical development and sophistication of reading devices that provide a similar experience to reading an actual book are the key factors driving the global e-book market. Advantages, like the increasing adoption of smartphones and the multilingual feature of e-books, are expected to drive the global demand for e-books.

Key Highlights

- The easy access to a wide range of e-book libraries through an application or online services is being consumed over the internet, thus emerging as a low-cost alternative to the traditional delivery method. Services available for these e-books, such as e-lending, encourage the worldwide adoption of e-books.

- Furthermore, environmental protection campaigns from governments across the globe, especially for saving trees to reduce the use of paper, also increase the demand for e-books.

- Publishers being subjected to IP infringement cases by content providers restrain market growth. For instance, in June 2020, four major book publishers filed suits against the Internet Archive owing to copyright violations relating to their open library project. Various publishers, such as Hachette, Penguin Random House, Wiley, and HarperCollins, have filed a suit against the Internet Archive.

- An increase in overall reader engagement was observed during the pandemic. People switched to e-books for entertainment during the period of global lockdown. As hard copies became sidelined initially due to closed bookstores and shipping delays from online retailers, e-book sales surged, with readers turning to convenient and immediate delivery.

- The reliance on physical books was tested with the spread of Covid-19 in 2020 and the subsequent implementation of lockdown restrictions . As a result, the use of e-books increased dramatically in a way that neither librarians, publishers, nor students had anticipated. The regrettable outcome was the problems, which were already a significant worry, were made worse by a perfect storm of financial pressures, a broken market, and increasing demand. As a result, the #ebooksos campaign was launched.

Ebook Market Trends

Increased Use of Electronic Devices

- The rise in the number of portable, readable devices, such as smartphones and tablets, is anticipated to be the primary growth factor for the global e-book market. Consumers prefer e-books over physical books due to the fragility of hard copies, the need for adequate care, and the high cost.

- The digitization of books and their accessibility over the internet are expected to create an innovative environment to offer a real-time experience for readers. Furthermore, the conversion of comic books into digital materials by famous publishers, such as Marvel and DC, is also expected to allow people to explore e-reading. The American Library Association (ALA) announced that every book of their rooster would be made available in a digital format at the latest to reduce wastage.

- The increasing influence of technology coupled with the inclination toward digitization by a substantial populace, mainly among the millennial and generation Z category, may positively influence the growth of the e-book market.

- Systems, such as digital education and immersive learning, are also expected to drive market growth. The introduction of the latest hardware, software, and educational content is expected to create an immersive environment to provide readers with a real-time experience.

- This also acts as a low-cost alternative to the traditional distribution method and enables easy access to various e-book libraries through applications or services. In addition, the resources available for the e-books, such as lending electronically, have also increased the growth of the e-book market.

North America Dominates the Market

- E-books in North America came early as a natural and permanent choice over printed books for consumers as they wanted speedy access and portability. Publishers have also rapidly responded to the consumers' fast-growing acceptance of new reading devices by constantly redefining and expanding new concepts of books.

- Additionally, the holiday season observes an increase in the number of people who own tablet computers and e-book readers like the early Kindles. The improving content mobility has led to cost-cutting through better accessibility and distribution of books to wider target end-users. Further, since the region's industry is expected to be driven by the rising demand for digitalized comic books, comic book companies, like DC Entertainment and MARVEL, are expanding their product lines to keep up with the trend.

Ebook Industry Overview

The e-book market is fragmented, with many independent authors and publishers, while certain players account for a majority share of the market. Amazon's KDP and Apple's iBooks Author dominate the e-books market. Key players in the market adopt strategies, such as joint ventures and partnerships with small and regional publishers, to gain higher market shares.

- In March 2022, a Series B financing round was held by the British edtech company Perlego to generate USD 38.2 million for the international expansion of its textbook subscription service.

- In September 2022, Book.io reported that it had finalized a seed investment round with Ingram Content Group ("Ingram"), one of the largest book distributors in the world, with access to millions of titles and tens of thousands of publishers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 MARKET DYNAMICS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Threat of New Entrants

- 3.2.2 Bargaining Power of Buyers

- 3.2.3 Bargaining Power of Suppliers

- 3.2.4 Threat of Substitutes

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Industry Value Chain Analysis

- 3.4 Assessment of the Impact of COVID-19 on the Industry

- 3.5 Market Drivers

- 3.5.1 Increasing Penetration of Mobile Devices

- 3.5.2 Decreasing Cost of E-books

- 3.6 Market Restraints

- 3.6.1 Privacy and Copyright Issues among E-sellers and Book Writers

4 MARKET SEGMENTATION

- 4.1 By Geography

- 4.1.1 North America

- 4.1.1.1 United States

- 4.1.1.2 Canada

- 4.1.2 Europe

- 4.1.2.1 Spain

- 4.1.2.2 United Kingdom

- 4.1.2.3 Germany

- 4.1.2.4 France

- 4.1.2.5 Italy

- 4.1.2.6 Rest of Europe (Sweden, Denmark)

- 4.1.3 Asia-Pacific

- 4.1.3.1 China

- 4.1.3.2 India

- 4.1.3.3 Japan

- 4.1.3.4 Rest of Asia-Pacific (Australia, South Korea, Singapore)

- 4.1.4 Latin America

- 4.1.5 Middle East and Africa

- 4.1.1 North America

5 COMPETITIVE LANDSCAPE

- 5.1 Company Profiles

- 5.1.1 Amazon.com Inc.

- 5.1.2 Rakuten Kobo Inc.

- 5.1.3 Apple Inc.

- 5.1.4 Barnes and Noble LLC

- 5.1.5 Smashwords Inc.

- 5.1.6 Blurb Inc.

- 5.1.7 BookBaby (DIY Media Group Inc.)

- 5.1.8 Lulu Press Inc.

- 5.1.9 Macmillan Publishers Ltd

- 5.1.10 Scribd Inc.