|

市場調查報告書

商品編碼

1438288

測試、檢驗和認證(TIC):市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Testing, Inspection, and Certification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

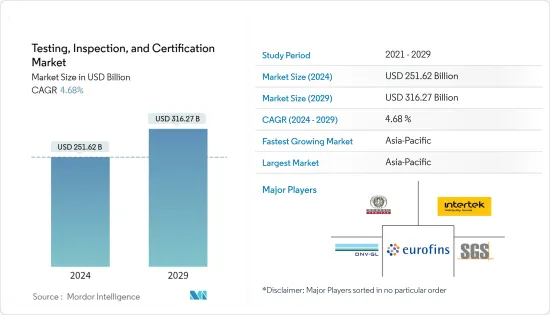

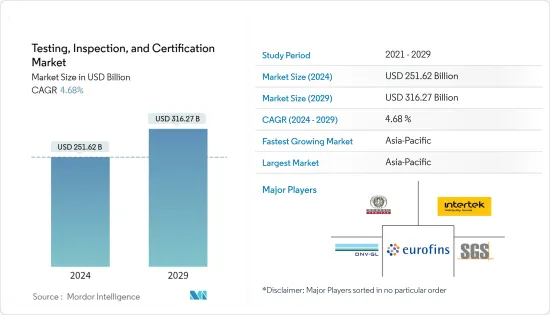

測試、檢驗和認證(TIC)市場規模預計到 2024 年為 2516.2 億美元,預計到 2029 年將達到 3162.7 億美元,預測期間(2024-2029 年)將以 4.68% 的複合年成長率成長。

主要亮點

- 測試、檢驗和認證 (TIC) 行業幫助提高行業內各種最終用戶使用的產品質量,為全球經濟做出了重大貢獻。 TIC 服務也有助於減少產量召回並維持對監管機構和各個領域標準的遵守。

- 對 TIC 服務的需求不斷增加,以促進各行業先進技術的採用以及技術的安全開發和部署,同時保持合規性。 TIC Services 還提供必要的認證,因為醫療保健和製藥、食品和飲料、汽車和工業製造等某些行業需要國際認證的產品和技術。

- 測試、檢驗和認證 (TIC) 在確保基礎設施、服務和產品符合安全和品質標準和法規方面發揮關鍵作用。由於石油和天然氣等多個行業對定期檢查和測試的需求很高,無論行業季節性如何,TIC 市場預計都會成長。

- 政府和監管機構的嚴格規定,特別是有關食品認證和建築能源效率的規定,迫使組織使用測試、檢驗和認證 (TIC) 服務。

- 為了標準化質量,印度食品業的測試和檢驗服務預計將大幅成長。食品監管機構印度食品安全和標準局 (FSSAI) 可以透過引入全國性線上平台來提高食品安全檢查和抽樣的透明度。

- 貿易全球化使供應鏈變得複雜,並可能影響產品品質。因此,為了保持相同的狀態,供應鏈的每個階段都需要TIC服務。由於全球化的快速發展、國有實驗室的私有化以及最終用戶效率標準的提高,複雜的供應鏈給 TIC 市場帶來了重大課題。

- 代表獨立第三方測試、檢驗和認證 (TIC) 行業的全球貿易協會 TIC 理事會表示,COVID-19 大流行迫使企業減少差旅和現場測試、評估和認證活動。表示實施受到阻礙。這項活動主要歸因於為遏制疫情進一步蔓延而實施的旅行限制。此外,出於對員工的謹慎考慮,公司避免親自拜訪。這導致該部門的收益總體下降。

測試、檢驗和認證 (TIC) 市場趨勢

食品和農業預計將佔據很大的市場佔有率

- 在包括食品業在內的各個行業中,品管最重要的要素是測試、檢驗和認證 (TIC)。維持食品安全和品質標準取決於 TIC。創建新穎且富有創意的解決方案來解決 COVID-19 的課題(例如虛擬檢查和遠端審核)並利用食品行業的尖端技術將有助於 TIC 行業的擴張。 TIC 服務使公司能夠提高生產力、降低風險並提高產品和服務的品質、合規性和安全性,同時遵守全球標準。

- 近年來,消費者對食品品質安全議題的意識不斷增強。這主要是由於最近的食品召回討論以及由於大流行而更加關注清潔和安全的結果。這促進了公共和商業食品部門食品安全和品質的多項標準的製定。

- 油和牛奶等食品中摻假和物質混合的發生率不斷增加,需要可靠的 TIC 系統。此外,消費者對風險和詐騙的了解也越來越多。產品測試、認證和檢驗程序確保產品品質、安全性和可靠性。

- 食品檢驗、測試和認證市場正在不斷成長,並且在未來幾年具有巨大的成長潛力。食物中毒的日益普及、檢測技術的進步、食品供應的全球化以及嚴格的食品安全國際標準是推動食品檢測、檢測和認證市場成長的主要因素。

- 污染物和化學物質可能會污染價值鏈中每個環節的食品,從收穫到製造再到消費。因此,食品品管是必要的,因為食品污染可能是食物中毒的嚴重原因。美國和加拿大執行食品安全標準的嚴格法律增加了該地區對食品安全檢驗服務的需求。美國食品安全現代化法案(FSMA)的通過顯示全球食品安全檢查的需求日益成長。

- 此外,世界衛生組織(WHO)於2022年10月17日發布了核准的《2022-2030年全球食品安全戰略》。該戰略透過加強食品安全系統和鼓勵國際合作來指導和支持世衛組織會員國。努力確定優先順序、計劃、實施、監測和定期審查措施,以盡量減少食源性疾病。

- 根據韓國MFDS統計,截至2021年,韓國政府核准的國外食品檢測設施中約有一半位於中國。資訊來源稱,此類國際檢測設施總合60個。

亞太地區佔最大市場佔有率

- 隨著中國、印度、日本和韓國等新興市場隨著本土產業的發展和隨後的出口引入而變得更具吸引力,預計亞太地區將佔據較大的市場佔有率。嚴格標準,快速都市化。

- 中國等新興市場透過本土產業的發展和隨後的出口加速、嚴格標準的引入和快速都市化而成為有吸引力的市場。

- 中國的「中國製造2025」計劃將5G視為新興產業。這為中國企業提供了在全球市場上更具競爭力和創新性的機會,並防止低品質的仿冒品進入市場,而這可以透過獲得特定行業的認證來實現。

- 與其他亞太主要國家一樣,日本在下游石油和天然氣領域也很活躍。福島核電事故,該國的幾座核能發電廠因安全原因被關閉,導致日本嚴重依賴石化燃料來滿足所有能源需求。

- 由於國內產量較低,日本政府鼓勵能源公司在世界各地增加探勘開發計劃,以確保石油和天然氣的穩定供應。這些努力使日本成為能源產業資本設備的主要出口國之一,而該產業已成為該國 TIC 服務的主要採用者之一。

- 在製造業方面,韓國政府計劃重點將國內機器人發展成為價值2,500萬美元的產業,並在年終前成為第四大公司。這正在推動機器人公司的出現。然而,要將工業機器人引入製造和服務業,企業必須獲得基於國際和地區標準的產品安全認證。

測試、檢驗和認證 (TIC) 行業概覽

測試、檢驗和認證(TIC)市場將面臨競爭對手之間的激烈競爭。由於預計未來幾年將出現高度整合,市場上競爭公司之間的敵對行動預計將進一步加劇。公司透過開發新產品、合作和收購來保持競爭力。市面上營運的主要企業有 Intertek Group PLC、SGS SA、Bureau Veritas SA、Underwriters Laboratories (UL) 和 DNV GL。

- 2023 年 5 月 - Thunderbolt 3 和 4 主機和設備的產品資格測試現已在應用安全科學領域的全球先驅 UL Solutions 位於台灣台北的工廠進行。 Thunderbolt 3 和 4 主機產品,包括筆記型電腦、桌上型電腦、顯示器和擴充塢,均在 UL Solutions 台北實驗室進行電氣和功能測試。

- 2023 年 4 月 - UL 解決方案和韓國測試認證委員會 (KTC) 在華盛頓特區簽署合作備忘錄 (MoU),合作評估電動車 (EV) 充電器的安全性和性能並進入全球市場。隨著美國電動車使用量的增加,這種合作關係將為韓國製造商滿足日益成長的電動車充電器需求鋪平道路。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代品的威脅

- 評估 COVID-19 對 TIC 產業的影響

第5章市場動態

- 市場促進因素

- 食物中毒發生率增加

- 假冒和有缺陷藥品的貿易增加

- 市場課題

- 創新技術採用率低

第6章無損檢測服務業分析

- 目前市場需求

- 市場區隔 - 石油和天然氣、建築、汽車、航太、國防等。

第7章市場區隔

- 依服務類型

- 測試和檢驗服務

- 認證服務

- 依採購類型

- 外包

- 公司內部

- 最終用戶產業

- 消費品/零售

- 食品/農業

- 油和氣

- 建設工程

- 能源/化學

- 工業產品製造

- 交通運輸(鐵路/航太)

- 工業/汽車

- 其他

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 挪威

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 土耳其

- 奈及利亞

- 其他中東和非洲

- 北美洲

第8章 競爭形勢

- 公司簡介

- Intertek Group PLC

- SGS SA

- Bureau Veritas SA

- UL Group

- DNV GL

- Eurofins Scientific SE

- Dekra Certification GmbH

- ALS Limited

- BSI Group

- SAI Global Limited

- MISTRAS Group Inc.

- Element Metech(Exova Group PLC)

- TUV SUD Ltd

- Applus Services SA

- Kiwa NV

第9章投資分析及市場展望

The Testing, Inspection, and Certification Market size is estimated at USD 251.62 billion in 2024, and is expected to reach USD 316.27 billion by 2029, growing at a CAGR of 4.68% during the forecast period (2024-2029).

Key Highlights

- The testing, inspection, and certification industry significantly contributes to the global economy as it helps improve the quality of products used across industries by various end users. Also, TIC services help reduce yield recalls and maintain compliance with regulatory authorities and standards governing different sectors.

- The introduction of advanced technologies across various sectors has further intensified the need for TIC services as they foster the safe development and adoption of technologies while maintaining compliance. TIC services also provide the required certifications as specific industries, including healthcare and pharmaceuticals, food and beverage, automotive, and industrial manufacturing, require internationally certified products and technologies.

- Testing, inspection, and certification (TIC) play a significant role in ensuring that the infrastructure, services, and products meet the standards and regulations of safety and quality. Due to the high demand for inspection and testing at regular intervals across a few industries, such as oil and gas, the TIC market is expected to witness growth, irrespective of industrial seasonality.

- Stringent regulations from government and regulatory bodies, especially in food certification and energy efficiency in construction, are compelling organizations to leverage testing, inspection, and certification (TIC) services.

- To standardize quality, testing and inspection services in India's food industry are expected to grow significantly. The Food Regulator Food Safety and Standards Authority of India (FSSAI) can bring transparency to food safety inspection and sampling by implementing a nationwide online platform.

- Globalization of trade leads to a complex supply chain that can impact product quality. Therefore, TIC services are required at every stage of the supply chain to maintain the same. Due to rapid globalization, privatization of state-owned laboratories, and increasing standards of end-user efficiency, complex supply chains have posed significant challenges to the TIC market.

- According to TIC Council, the global trade federation representing the independent third-party testing, inspection, and certification (TIC) industry, the COVID-19 pandemic hindered companies from performing testing, assessment, and certification activities by traveling and carrying out on-site activities, which was primarily attributed to the travel restrictions imposed to curb the pandemic from spreading further. Furthermore, companies discouraged in-person visits out of caution for their workers. This led to an overall decline in the revenue generated from the sector.

Testing, Inspection, and Certification Market Trends

Food and Agriculture Expected to Hold a Significant Market Share

- The most important components of quality control across a range of industries, including the food industry, are testing, inspection, and certification (TIC). Maintaining the standards for food safety and quality depends on TIC. Creating novel, inventive solutions (such as virtual inspections and remote audits) to solve the COVID-19 conundrum and utilizing cutting-edge technology in the food industry contribute to the expansion of the TIC sector. Utilizing TIC services, businesses may boost productivity, lower risk, and improve the quality, compliance, and safety of their products and services while still conforming to global standards.

- In recent years, consumer awareness of food quality and safety problems has increased, mostly as a result of debates around recent food recalls and the pandemic's increasing concern for cleanliness and safety. In the public and commercial food sectors, this has made creating several standards for food safety and quality easier.

- Due to the increased incidences of adulteration and substance mixing in food products, such as oils and milk, a reliable TIC system is needed. Additionally, consumers are becoming more informed about hazards and frauds. Procedures for testing, certifying, and inspecting products guarantee their quality, safety, and confidence.

- The food testing, inspection, and certification market is growing and has a sizable growth potential in the coming years. The rise in the prevalence of foodborne diseases, technological advancements in testing, the globalization of the food supply, and stringent international standards for food safety are the main factors driving the growth of the market for food testing, inspection, and certification.

- At every point along the value chain, from harvest to manufacture to consumption, contaminants and chemicals have the potential to contaminate food. Therefore, food quality management is necessary since contamination can be a serious cause of food poisoning. The need for food safety testing services in the area has risen due to strict laws enforcing food safety standards in the United States and Canada. The adoption of the U.S. Food Safety Modernization Act (FSMA) signals a rise in the need for food safety testing on a global scale.

- In addition to that, the World Health Organization (WHO) introduced its accepted Global Strategy for Food Safety 2022-2030 on October 17, 2022. By bolstering food safety systems and encouraging international collaboration, the strategy will direct and support WHO Member States in their efforts to prioritize, plan, execute, monitor, and routinely review measures towards minimizing foodborne diseases.

- According to the MFDS, South Korea, about half of all foreign food testing facilities authorized by the South Korean government were located in China as of 2021. The source states that there were a total of 60 such international laboratories.

Asia-Pacific Holds the Largest Market Share

- The Asia-Pacific region is anticipated to hold a significant market share due to emerging markets in countries such as China, India, Japan, and South Korea, which have become attractive through the development of indigenous industries and subsequent acceleration in exports, the introduction of stringent standards, and rapid urbanization.

- Emerging markets, such as China, have become attractive spots through developing indigenous industries and subsequent acceleration in exports, the introduction of stringent standards, and rapid urbanization.

- China's "Made in China 2025" initiative has identified 5G as an emerging industry. It offers opportunities for Chinese companies to become more competitive and innovative in the global market and prevent low-quality and counterfeit goods from entering the market, which the attainment of domain-specific certifications can achieve.

- Like other key Asia-Pacific countries, Japan is active in the downstream oil and gas sector. After the Fukushima plant accident, the shutdown of multiple nuclear power plants for safety purposes in the country made Japan largely dependent upon fossil fuels for all its energy needs.

- Owing to low domestic production in the country, the Japanese government has encouraged its energy companies to increase exploration and development projects globally to secure a stable oil and natural gas supply. These initiatives make Japan one of the major exporters of capital equipment for the energy sector and make the industry one of the country's significant adopters of TIC services.

- On the manufacturing front, the South Korean government plans to turn the nation's robotics technology into a USD 25 million industry, focusing on becoming the fourth-largest player by the end of 2023. This is fostering the emergence of robotic companies. However, companies must acquire industrial robot product safety certification based on international and local standards to bring such robots into the manufacturing and service sector.

Testing, Inspection, and Certification Industry Overview

The testing, inspection, and certification market will witness intense competitive rivalry. With high consolidation expected over the next few years, the competitive rivalry in the market is expected to increase further. The companies develop new products, collaborations, and acquisitions to remain competitive. Key players operating in the market are Intertek Group PLC, SGS SA, Bureau Veritas SA, Underwriters Laboratories (UL), and DNV GL.

- May 2023 - The Thunderbolt 3 and 4 host and device product certification testing can now be done at UL Solutions' facility in Taipei, Taiwan, a worldwide pioneer in applied safety science. The Thunderbolt 3 and 4 host goods, including laptops, desktops, monitors, and docking stations, tested electrically and functionally at the UL Solutions Taipei lab.

- April 2023 - To work together on the safety and performance assessment and worldwide market access of electric vehicle (EV) chargers, UL Solutions and the Korea Testing Certification Institute (KTC) signed a memorandum of understanding (MoU) in Washington, DC. As EV usage increases in the U.S., the alliance paves the way for Korean manufacturers to satisfy the rising need for EV chargers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitues

- 4.3 Assessment of Impact of COVID-19 on the TIC Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing incidence of foodborne diseases

- 5.1.2 Increasing trade in counterfeit and defective pharmaceutical products

- 5.2 Market Challenges

- 5.2.1 Low adoption rate of Innovative Technologies

6 ANALYSIS OF THE NDT SERVICE INDUSTRY

- 6.1 Current Market Demand

- 6.2 Market Breakdown - Oil and Gas, Construction, Automotive, Aerospace and Defense, etc.

7 MARKET SEGMENTATION

- 7.1 By Service Type

- 7.1.1 Testing and Inspection Service

- 7.1.2 Certification Service

- 7.2 By Sourcing Type

- 7.2.1 Outsourced

- 7.2.2 In-house

- 7.3 By End-user Vertical

- 7.3.1 Consumer Goods and Retail

- 7.3.2 Food and Agriculture

- 7.3.3 Oil and Gas

- 7.3.4 Construction and Engineering

- 7.3.5 Energy and Chemicals

- 7.3.6 Manufacturing of Industrial Goods

- 7.3.7 Transportation (Rail and Aerospace)

- 7.3.8 Industrial and Automotive

- 7.3.9 Other End-user Verticals

- 7.4 By Geography

- 7.4.1 North America

- 7.4.1.1 United States

- 7.4.1.2 Canada

- 7.4.2 Europe

- 7.4.2.1 United Kingdom

- 7.4.2.2 Germany

- 7.4.2.3 France

- 7.4.2.4 Spain

- 7.4.2.5 Norway

- 7.4.2.6 Rest of Europe

- 7.4.3 Asia-Pacific

- 7.4.3.1 China

- 7.4.3.2 Japan

- 7.4.3.3 South Korea

- 7.4.3.4 India

- 7.4.3.5 Rest of Asia-Pacific

- 7.4.4 Latin America

- 7.4.4.1 Brazil

- 7.4.4.2 Mexico

- 7.4.4.3 Rest of Latin America

- 7.4.5 Middle-East and Africa

- 7.4.5.1 Saudi Arabia

- 7.4.5.2 United Arab Emirates

- 7.4.5.3 Qatar

- 7.4.5.4 Turkey

- 7.4.5.5 Nigeria

- 7.4.5.6 Rest of Middle-East and Africa

- 7.4.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Intertek Group PLC

- 8.1.2 SGS SA

- 8.1.3 Bureau Veritas SA

- 8.1.4 UL Group

- 8.1.5 DNV GL

- 8.1.6 Eurofins Scientific SE

- 8.1.7 Dekra Certification GmbH

- 8.1.8 ALS Limited

- 8.1.9 BSI Group

- 8.1.10 SAI Global Limited

- 8.1.11 MISTRAS Group Inc.

- 8.1.12 Element Metech (Exova Group PLC)

- 8.1.13 TUV SUD Ltd

- 8.1.14 Applus Services SA

- 8.1.15 Kiwa NV