|

市場調查報告書

商品編碼

1438273

球黏土:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Ball Clay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

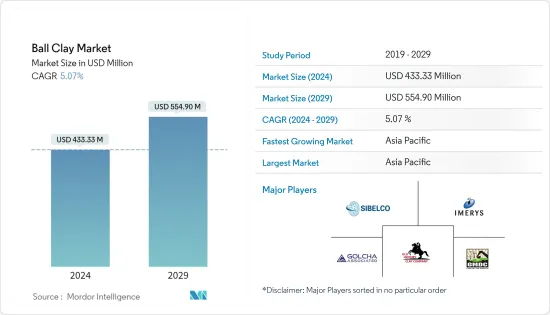

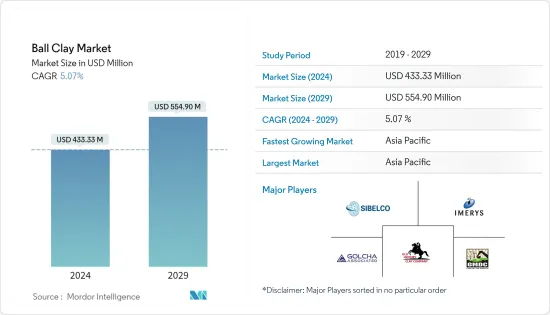

球黏土市場規模預計 2024 年為 4.3333 億美元,預計到 2029 年將達到 5.549 億美元,預測期內(2024-2029 年)複合年成長率為 5.07%。

COVID-19 大流行對市場產生了負面影響。然而,市場目前已達到疫情前的水平,預計在預測期內將穩定成長。

主要亮點

- 推動市場成長的主要因素是亞太地區對衛浴設備的需求不斷成長。

- 球黏土替代品的可用性可能會阻礙市場成長。

- 球黏土在非陶瓷應用中的使用不斷增加可能會在未來幾年創造市場機會。

- 亞太地區在市場中佔據主導地位,預計在預測期內仍將保持最高的複合年成長率。

球黏土市場趨勢

牆磚和地磚在建設產業的使用

- 球黏土在建設產業用作牆磚和地磚,與滑石、長石、高嶺土和石英/二氧化矽混合,以增加可塑性並改善黏合性能。

- 由於世界各地建設產業的投資不斷增加,牆壁和地板的瓷磚使用量不斷增加,球黏土的消費量也隨之增加。

- 近年來,由於經濟快速成長、都市化加快以及基礎設施支出增加,亞太地區的建築業經歷了穩定成長。

- 外國公司在亞太地區的不斷成長也推動了該地區建築業的成長,創造了對新辦公室、建築物、生產廠房等的需求。

- 因此,預計這些因素將在預測期內增加全球對球黏土的需求。

亞太地區主導市場

- 亞太地區的建築業是世界上最大的。由於人口成長、中階收入增加和都市化,它正在穩步成長。

- 近年來,由於中央政府推動基礎設施投資以維持經濟成長,中國建築業快速發展。

- 然而,該國目前正陷入一場持續不斷的債務鬥爭,這可能會使中國陷入衰退。

- 印度和東南亞國協也注重基礎建設。

- 此外,也取消了區內土地開發、豪華飯店、辦公大樓、國際會展中心、大型主題樂園建設營運等外資限制。

- 預計這些因素將增加該地區對衛浴設備、牆磚和地磚以及其他陶瓷的需求,從而促使預測期內對球黏土的需求增加。

球黏土業概況

球黏土市場部分整合。市場上主要企業包括(排名不分先後)Golcha Associated(Associated Soapstone Distribution Company Pvt. Ltd)、Old Hickory Clay Company、Gujarat Mineral Development Corporation Ltd、Imerys Ceramics 和 Sibelco。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 亞太地區衛浴設備需求不斷成長

- 其他司機

- 抑制因素

- 球黏土替代品的可用性

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔

- 最終用途

- 陶瓷製品

- 衛浴設備

- 牆/地磚

- 餐具

- 磚

- 其他(建築陶瓷、耐火材料)

- 非陶瓷

- 黏劑/密封劑

- 橡膠/塑膠

- 肥料/殺蟲劑

- 其他

- 陶瓷製品

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)/排名分析

- 主要企業採取的策略

- 公司簡介

- Amarnath Industries

- Ashok Alco-chem Limited(AACL)

- Golcha Associated(Associated Soapstone Distribution Company Pvt. Ltd)

- Gujarat Mineral Development Corporation Ltd

- Modkha Marine Sdn Bhd

- Stephan Schmidt KG

- Imerys

- JLD Minerals

- Mota Ceramic Solutions

- Old Hickory Clay Company

- Sibelco

第7章市場機會與未來趨勢

The Ball Clay Market size is estimated at USD 433.33 million in 2024, and is expected to reach USD 554.90 million by 2029, growing at a CAGR of 5.07% during the forecast period (2024-2029).

The COVID-19 pandemic impacted the market negatively. However, the market has now reached pre-pandemic levels and is expected to grow steadily during the forecast period.

Key Highlights

- The major factor driving the market's growth is the increasing demand for sanitary ware in Asia-Pacific.

- The availability of substitutes for ball clay is likely to hinder the market's growth.

- Growing usage of ball clay in non-ceramic applications is likely to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and register the highest CAGR during the forecast period.

Ball Clay Market Trends

Use of Wall and Floor Tiles in the Construction Industry

- Ball clay is used as wall and floor tiles in the construction industry by mixing with talc, feldspar, kaolin, and quartz/silica, as it increases the plasticity and improves bonding properties.

- With increasing investments in the construction industry worldwide, the use of tiles for walls and floors is increasing, resulting in the increased consumption of ball clay.

- The Asia-Pacific construction sector has witnessed steady growth in the recent past due to the presence of fast-growing economies, rapid urbanization, and rising infrastructure spending.

- The increasing presence of foreign companies in the Asia-Pacific region also created the demand for new offices, buildings, production houses, etc., thus driving the growth of the region's construction sector.

- Therefore, such factors are expected to boost the demand for ball clay worldwide during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific construction sector is the largest globally. It is growing at a healthy rate due to the rising population, increasing middle-class incomes, and urbanization.

- China's construction industry developed rapidly in the recent past due to the central government's push for infrastructure investment to sustain economic growth.

- However, the country is now reeling under the Evergrande Debt struggle that may put China under recession.

- India and ASEAN countries have also been focusing on infrastructure development.

- Furthermore, restrictions on foreign investment in land development, high-end hotels, office buildings, international exhibition centers, and the construction and operation of large theme parks have been lifted in the region.

- Owing to these factors, the demand for sanitary ware, wall and floor tiles, and other ceramics is expected to increase in the region, thus boosting the demand for ball clay over the forecast period.

Ball Clay Industry Overview

The ball clay market is partially consolidated. Some of the major players in the market (in no particular order) include Golcha Associated (Associated Soapstone Distribution Company Pvt. Ltd), Old Hickory Clay Company, Gujarat Mineral Development Corporation Ltd, Imerys Ceramics, and Sibelco.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Sanitary Ware in Asia-Pacific

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes for Ball Clay

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 End Use

- 5.1.1 Ceramic

- 5.1.1.1 Sanitary Ware

- 5.1.1.2 Wall and Floor Tiles

- 5.1.1.3 Tableware

- 5.1.1.4 Bricks

- 5.1.1.5 Other Ceramics (Construction Ceramics and Refractories)

- 5.1.2 Non-ceramic

- 5.1.2.1 Adhesives and Sealants

- 5.1.2.2 Rubbers and Plastics

- 5.1.2.3 Fertilizers and Insecticides

- 5.1.2.4 Other Non-ceramics

- 5.1.1 Ceramic

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Amarnath Industries

- 6.4.2 Ashok Alco - chem Limited (AACL)

- 6.4.3 Golcha Associated (Associated Soapstone Distribution Company Pvt. Ltd)

- 6.4.4 Gujarat Mineral Development Corporation Ltd

- 6.4.5 Modkha Marine Sdn Bhd

- 6.4.6 Stephan Schmidt KG

- 6.4.7 Imerys

- 6.4.8 JLD Minerals

- 6.4.9 Mota Ceramic Solutions

- 6.4.10 Old Hickory Clay Company

- 6.4.11 Sibelco

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Usage in Non-ceramic Applications