|

市場調查報告書

商品編碼

1437987

不沾塗料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Non-stick Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

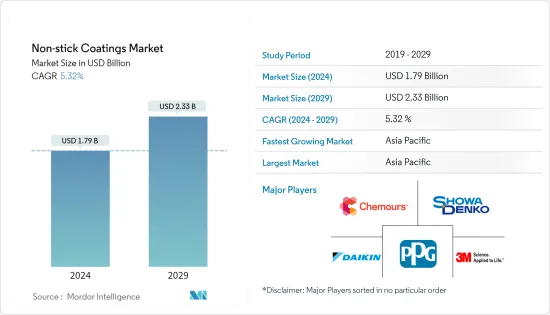

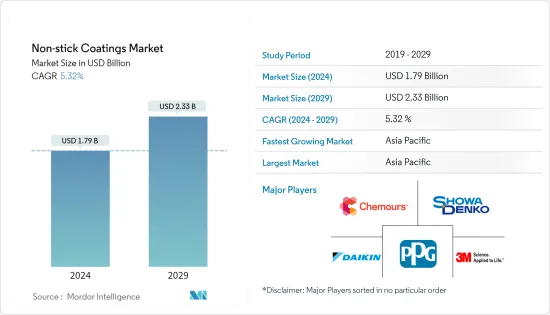

2024 年不沾塗料市場規模估計為 17.9 億美元,預計到 2029 年將達到 23.3 億美元,在預測期間(2024-2029 年)以 5.32% 的複合年增長率增長。

由於價格暴跌和需求減少,COVID-19感染疾病對製造業產生了重大影響。然而,預計市場在預測期內將穩定成長。

主要亮點

- 從中期來看,對不沾烹調器具的需求不斷成長預計將刺激不沾黏塗料市場的成長。此外,由於快速固化、乾燥、優異的硬度、耐磨性和低能耗特性,紫外線固化溶膠凝膠塗料的普及也有望推動研究市場的成長。

- 另一方面,與持續接觸不沾塗層烹調器具煙霧相關的健康危害預計將削弱市場成長。

- 然而,在預測期內,醫療和電子行業的進步和擴張可能會為醫療設備和小型電子元件中不沾塗層的應用創造有利的成長機會。

- 亞太地區主導著市場,在預測期內也可能見證最高的複合年增長率。 這一增長是由於該地區國家(包括中國、日本和印度)對耐用、時尚和設計巧妙的餐具的需求不斷增長,以及消費者對高端家居用品的支出迅速增加。

不沾塗層市場趨勢

主導市場的烹調器具應用

- 不沾塗層用於烹調器具已有 50 多年的歷史。大多數烹調器具由不銹鋼、鋁、鑄鐵、玻璃、編程和陶瓷製成,但有些烤盤由軟性矽膠製成。不沾塗層的卓越性能使其在各種食品級不沾塗抹中廣受歡迎,包括鍋碗瓢盆等烹調器具。

- 煎鍋和平底鍋等不沾烹調器具塗有聚四氟乙烯 (PTFE),也稱為鐵氟龍。特氟龍塗層烹調器具具有不沾表面,易於使用和清潔。它還使用較少的油和奶油,從而可以進行低脂烹飪和煎炸。

- 多年來,由於有毒化學物質的釋放,不沾烹調器具一直受到安全和健康問題的負面關注。食品藥物管理局的科學家已確定這種不沾塗層對人類使用是安全的。不含全氟辛酸 (PFOA) 的烹調器具被認為比使用其他不沾塗層製成的烹調器具更環保。

- 因此,傳統的 PTFE 鍋具處於烹調器具市場的低階,而非 PFOA 塗層、陶瓷和矽膠塗層則處於高階,並用作不含特氟龍產品的替代品。

- 市場逐漸向生麵包市場過渡,不沾塗層市場規模顯著擴大。

- 所有上述因素預計將在預測期內增加對烹調器具應用不沾塗層的需求。

亞太地區主導市場

- 由於該地區平均家庭收入的增加和生活品質的提高,亞太地區在全球不沾黏塗料市場佔據主導地位。在亞洲國家,人口不斷增加,住宅數量也相應增加。這將增加對廚房用具和烹調器具電器產品的需求。

- 中國和印度是亞太地區最大的不沾塗料消費國。 中國和印度對炊具的需求不斷增長,特別是因為大多數當地消費者正在經歷一個完整的過渡期,以採用更高品質的炊具。 因此,由各種材料製成的壓力鍋、不沾鍋、電鍋和電磁爐等炊具越來越多地被用作多功能和高性能的炊具。

- 中國紡織地毯工業是中國最重要的工業之一。根據中國國家統計局統計,近年來中國地毯出口大幅增加。根據聯合國COMTRADE國際貿易資料庫顯示,2021年,中國地毯和其他紡織地板材料出口總額達37.5億美元。

- 隨著中國汽車產業的擴張,對不沾塗料的需求預計將會增加。根據國際工業組織(OICA)的數據,中國是世界上最大的汽車製造國。 2021年第一季至第三季度,中國生產汽車1,8,242,588輛,約佔全球銷量的31.86%。 2021年汽車總合為2,682,220輛。

- 中國是世界上最大的電子產品生產國。智慧型手機、電視和其他個人設備等電子產品在電子產業中成長最快。該國預計將滿足國內電子需求,向其他國家出口電子產品,並維持其成長模式。

- 食品加工業是印度最大的產業之一,預計到2025-2026年產值將達到5,350億美元。該行業產量、消費量、出口量均居前五名。隨著可支配收入的增加、都市化、年輕人和核心家庭的增加,對加工食品的需求正在增加。

- 預計到2025年,印度數位經濟價值將達到1兆美元。到 2025 年,電子系統設計和製造 (ESDM) 產業預計將產生超過 1,000 億美元的經濟價值。包括印度製造、電子產品淨零進口和零缺陷在內的多項政策表明了對增加國內製造業、減少進口依賴以及重振出口和製造業的承諾。在預測期內,由於電子產業的擴張,對不沾黏塗料的需求預計將增加。

- 日本的食品加工業是世界上最先進、最精密的工業之一,2021 年食品和飲料產品的產值為 2,164 億美元。與2020年相比,該產業受惠於兌美元外匯小幅升值,允許邊際價值成長。

- 所有上述因素都可能在預測期內推動亞太不沾塗料市場的成長。

不沾塗料行業概況

不沾塗料市場本質上是整合的。市場的主要企業包括科慕公司、PPG工業公司、Daikin Industries Ltd.、昭和電工株式會社和3M等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 不沾烹調器具的需求不斷增加

- 增加紫外線固化溶膠凝膠塗料的使用

- 抑制因素

- 使用不沾烹調器具對健康的危害

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 監理政策

第5章市場區隔(以金額為準的市場規模)

- 類型

- 氟樹脂

- 陶瓷製品

- 矽膠

- 其他類型

- 目的

- 烹調器具

- 食品加工

- 織物和地毯

- 醫療保健

- 電氣和電子

- 工業機械

- 車

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業採取的策略

- 公司簡介

- 3M

- AAA Industries

- Cavero Coatings

- Daikin Industries Ltd

- Metal Coatings

- Metallic Bonds Ltd

- PPG Industries Inc.

- Showa Denko KK

- The Chemours Company

- Weilburger

第7章市場機會與未來趨勢

- 對醫療和電子應用的需求不斷成長

The Non-stick Coatings Market size is estimated at USD 1.79 billion in 2024, and is expected to reach USD 2.33 billion by 2029, growing at a CAGR of 5.32% during the forecast period (2024-2029).

The COVID-19 pandemic profoundly impacted manufacturing operations, with prices collapsing and demand falling. However, the market is expected to grow steadily during the forecast period.

Key Highlights

- Over the medium term, the growing demand for non-stick cookware is expected to stimulate the growth of the non-stick coatings market. Furthermore, the popularization of UV-cured sol-gel coatings, owing to their rapid curing, drying, superior hardness, abrasion resistance, and low energy consumption properties, is also expected to drive the growth of the market studied.

- On the other hand, the health hazards associated with continuous exposure to fumes from overcooked non-stick coated cookware are expected to depreciate the market's growth.

- However, the advancements and expansion in the medical and electronics sectors are likely to create lucrative growth opportunities for the applications of non-stick coatings in medical equipment and miniaturized electronic components in the forecast period.

- The Asia-Pacific region dominates the market, and it is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the rapid rise in consumer expenditure on high-grade home furnishings, coupled with ascending demand for durable, sleek, and smart designs in utensils in the countries of this region, including China, Japan, and India.

Non-Stick Coatings Market Trends

Cookware Application to Dominate the Market

- Non-stick coatings have been used on cookware for more than five decades. Most cookware is made of stainless steel, aluminum, cast iron, glass, program, and ceramic, while some bakeware is made from flexible silicone. The superior properties of non-stick coatings make them popular for various food-grade non-stick applications, including cookware, such as pots and pans.

- Non-stick cookware such as frying pans and saucepans are coated with polytetrafluoroethylene (PTFE), sometimes called Teflon. Teflon-coated cookware is easy to use and clean due to its non-stick surface. It also uses less oil or butter, making it a low-fat way of cooking and frying meals.

- Over the years, non-stick cookware has received negative attention regarding its safety and health issues due to the emission of toxic chemicals. The non-stick coatings have been confirmed safe for human use by Food and Drug Administration scientists. Cookware without perfluorooctanoic acid (PFOA) is considered more environmentally friendly than those made with other non-stick coatings.

- Hence, traditional PTFE pans are at the low end of the cookware market, whereas non-PFOA coatings, ceramics, and silicone-based coatings are at the high end, used as an alternative to Teflon-free products.

- The market is slowly shifting toward the green pans market, significantly expanding the market size of non-stick coatings.

- All the aforementioned factors are expected to augment the demand for non-stick coatings for cookware applications during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global non-stick coatings market owing to the increasing average household income and improving quality of life in the region. The population of the countries in Asia is increasing, resulting in an increased number of houses. This, in turn, increases the demand for household appliances, including kitchen appliances and cookware.

- China and India are the largest consumers of non-stick coatings in the Asia-Pacific region. China and India's demands for cookware have grown, especially since most local consumers are undergoing a full transition of adopting cookware with better quality. As a result, a wider range of colorful, advanced cookware functions, such as pressure cookers of various materials, non-stick cookers, electric hot pots, induction cookers, and other cookware products, are being used more frequently.

- China's fabrics and carpet industry are one of the country's most important industries. According to China's National Bureau of Statistics, the country's carpet export volume has increased significantly in recent years. According to the United Nations COMTRADE database on international trade, China's exports of carpets and other textile floor coverings totaled USD 3.75 billion in 2021.

- The expansion of China's automotive segment is expected to boost demand for non-stick coatings. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the largest global automaker. From Q1 to Q3 of 2021, the country produced 1,82,42,588 vehicles, accounting for approximately 31.86% of the global volume. The vehicle production for 2021 totaled 2,60,82,220 units.

- China is the world's largest producer of electronics. Electronic products, such as smartphones, televisions, and other personal devices, grew the fastest in the electronics segment. The country meets domestic electronic demand, exports electronic output to other countries, and is expected to sustain the growth pattern.

- The food processing industry is one of India's largest, with output expected to reach USD 535 billion by 2025-26. This industry ranks among the top five in terms of production, consumption, and exports. With rising disposable income levels, urbanization, a young population, and nuclear families, there is an increase in demand for processed foods.

- India's digital economy is expected to be worth USD 1 trillion by 2025. The electronics system design and manufacturing (ESDM) sector is expected to generate more than USD 100 billion in economic value by 2025. Several policies, including Make in India, the National Policy of Electronics, Net Zero Imports in Electronics, and the Zero Defect Zero Effect, demonstrate a commitment to increasing domestic manufacturing, reducing import dependence, and reviving exports and manufacturing. Over the forecast period, the expansion of the electronics industry is expected to boost demand for non-stick coatings.

- The Japanese food processing industry is among the most advanced and sophisticated globally, producing USD 216.4 billion in food and beverage products in 2021. Compared to 2020, the industry benefited from a slightly higher exchange rate relative to the dollar, allowing for marginal value growth.

- All factors mentioned above are likely to fuel the growth of the Asia-Pacific non-stick coatings market over the forecast period.

Non-Stick Coatings Industry Overview

The non-stick coatings market is consolidated in nature. Some of the major players in the market include The Chemours Company, PPG Industries Inc., Daikin Industries, Ltd, Showa Denko K.K., and 3M, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Non-stick Cookware

- 4.1.2 Increasing Use of UV-cured Sol-gel Coatings

- 4.2 Restraints

- 4.2.1 Health Hazards of Using Non-stick Cookware

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulatory Policies

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Fluoropolymer

- 5.1.2 Ceramic

- 5.1.3 Silicone

- 5.1.4 Other Types

- 5.2 Application

- 5.2.1 Cookware

- 5.2.2 Food Processing

- 5.2.3 Fabrics and Carpets

- 5.2.4 Medical

- 5.2.5 Electrical and Electronics

- 5.2.6 Industrial Machinery

- 5.2.7 Automotive

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AAA Industries

- 6.4.3 Cavero Coatings

- 6.4.4 Daikin Industries Ltd

- 6.4.5 Metal Coatings

- 6.4.6 Metallic Bonds Ltd

- 6.4.7 PPG Industries Inc.

- 6.4.8 Showa Denko K. K.

- 6.4.9 The Chemours Company

- 6.4.10 Weilburger

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Medical and Electronics Applications