|

市場調查報告書

商品編碼

1437919

資料遮罩:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Data Masking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

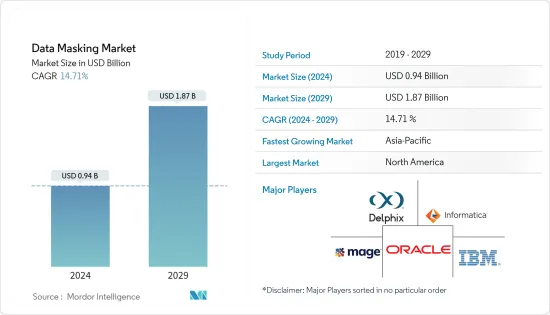

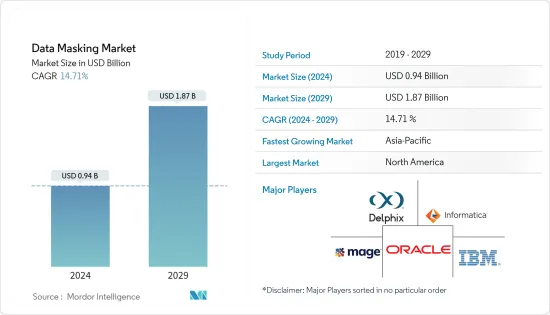

資料遮罩市場規模預計到 2024 年為 9.4 億美元,預計到 2029 年將達到 18.7 億美元,在預測期內(2024-2029 年)複合年成長率為 14.71%。

在這個資訊時代,網路安全至關重要。隨著資料外洩和惡意軟體攻擊的增加,資料遮罩正在侵入資料主導的行業。

主要亮點

- 資料遮罩是一種智慧資料的即時資料遮罩。資料遮罩技術可以在不中斷公司日常流程的情況下分析大量資料。換句話說,資料遮罩技術產生虛假但真實的組織資料版本,以保護敏感的組織資訊。

- 降低資料外洩風險的需求不斷成長,正在加速動態資料遮罩市場的成長,預計將在預測期內實現最快的成長率。此外,主動資料遮罩有助於保護資料數據和個人資料,同時支援外包、境外外包和雲端基礎的計劃。

- 此外,考慮到企業對保護金融資料的巨大需求,對資料遮罩和更好的安全解決方案的需求預計將在市場成長中發揮重要作用。資料驅動的金融要求每個組織都擁有會計部門來儲存和維護財務資料,包括大額貨幣交易。財務資料如果洩露,可能會造成公司聲譽問題、市場財務損失,甚至監管問題。 PCI DSS、HIPAA 等指令和其他實施法律。這是推動該業務功能中資料遮罩市場成長的最重要原因。

- 然而,貧窮國家和開發中國家缺乏技術純熟勞工和技術力以及缺乏標準化可能會限制市場擴張。資料整合和同步日益複雜也可能減緩行業發展。開發中國家IT基礎設施的穩健性也可能成為市場擴張的障礙。

- 由於 COVID-19 的爆發,各國正在採取預防措施。隨著學校關閉和社區被要求留在家裡,多個組織找到了讓員工在家工作的方法。這導致資料外洩事件增加,並推動了資料遮罩市場的成長。由於數位化的快速發展,即使在大流行之後,市場仍在成長。

資料遮罩市場趨勢

BFSI產業將經歷顯著成長

- BFSI 行業是關鍵基礎設施行業之一,由於其龐大的客戶群和麵臨風險的財務資訊,面臨著多次資料外洩和隱私問題。網路犯罪分子最佳化了各種邪惡的網路攻擊,以削弱金融部門作為一種利潤豐厚的營運模式,其利潤驚人,並具有相對較低的風險和可檢測性的好處。這些攻擊的威脅形勢包括木馬、ATM、勒索軟體、行動銀行惡意軟體、資料外洩、有組織的入侵、資料竊取和財務外洩。

- 銀行、保險公司、徵信機構和貸款機構依靠數據來了解消費者,與他們建立更深的關係,並確定市場是否波動並保持穩定資料。這要看情況。然而,這些有價值的資料同時受到網路犯罪分子和相關人員的追捧,資料隱私監管機構的合規要求也變得越來越嚴格。資料遮罩工具可協助您安全地為客戶設計創新、個人化的體驗。

- 2021 年 4 月,在 Mobikwik 和付款聚合商 JusPay 等業者面臨一系列資料外洩事件後,印度儲備銀行 (RBI)提案了針對付款服務供應商(PSP) 的網路安全標準。金融科技主導的付款服務供應商的標準將類似於為銀行和非銀行金融公司發布的網路衛生標準,但為了進一步確保數位安全交易,企業至少必須印度央行已明確表示有必要做的不僅僅是遵守規範。牽引力。

- 2022 年,世界各地的金融公司都受到創新勒索軟體策略的影響,這些策略可以最大限度地提高威脅行為者的投資報酬率。儘管金融公司只是勒索軟體攻擊直接目標受害者的一小部分,但他們可能而且確實遭受了針對第三方的攻擊,而第三方是主要目標。此類威脅可能會增加 BFSI 領域網路安全解決方案的使用。

亞太地區預計將成為成長最快的市場

- 由於印度和中國等新興國家是世界上最大的兩個經濟體,亞太地區的成長率預計將高於其他地區。近年來,該地區的汽車工業有所成長。這些產業的成長是由人口大量流動和可支配收入增加所推動的,從而促使需求增加。

- 目前,這兩個國家正在快速發展,許多發展活動正在這裡進行,旨在建立新的製造業和推出新產品。所有這些活動都有助於巨量資料。每天都會儲存大量資料,這一點非常重要。印度、中國和新加坡等新興經濟體的快速數位化正在產生大量非結構化資料。

- 此外,技術進步促使中國聯網設備數量增加。這是世界上最大的物聯網(IoT)市場。此外,5G 和支援 5G 的設備將顯著提高設備互連性。因此,將有更多的設備連接,直接增加市場對安全產品的需求。因此,網站很容易被第三方操縱或欺騙,網站上通訊的敏感用戶資料可能更容易被外國情報機構攔截。

- 另一方面,公共雲端運算的日益普及促使更多公司將其業務系統重新分配到雲端平台。資料安全、租戶隔離、存取控制等問題正成為這些公司關注的焦點。

- 近年來,隨著中國政府積極發布資料隱私規則和法規,資料隱私已成為中國的熱門話題。 《網路安全法》(CSL) (2017)、 《資料安全法》(DSL) (2021) 和《個人資訊保護法》(PIPL) 均已發布並目前生效。例如,2022年6月,中國發布了個人資訊跨境處理認證規範的最終版本。這可以為公司如何認證跨境資料傳輸作為其開展業務的合法途徑之一提供指導。企業不得將個人資料傳輸到中國境外。

資料遮罩產業概述

資料遮罩市場高度分散,因為該行業有許多跨國公司。這個市場競爭非常激烈。資料遮罩市場的主要競爭對手包括 IBM Corporation、Oracle Corporation、Informatica LLC、Delphix Corp. 和 Mentis, Inc. (Mage)。資料遮罩市場的主要企業正在遵循策略合作夥伴關係、併購各種本地公司以及產品創新的策略,以獲得市場競爭優勢。

- 2022 年 6 月 - IBM 公司宣布計劃收購 Randri,一家著名的攻擊面管理 (ASM) 和進攻性網路安全供應商。 Randri 協助客戶持續識別本地和雲端攻擊者可見的資產,並優先考慮構成最重大風險的風險。此次收購旨在進一步推動 IBM 的混合雲策略,並加強其人工智慧驅動的網路安全產品和服務組合。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與阻礙因素簡介

- 市場促進因素

- 組織中的資料量增加

- 市場限制因素

- 與資料遮罩相關的技術的複雜性

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 消費者議價能力

- 替代品的威脅

- 競爭公司之間敵對的強度

- COVID-19 對市場的影響

第 5 章技術概覽

第6章市場區隔

- 依類型

- 靜止的

- 動態的

- 依發展

- 雲

- 本地

- 依最終用戶產業

- BFSI

- 衛生保健

- 資訊科技和電信

- 零售

- 政府和國防

- 製造業

- 媒體與娛樂

- 其他最終用戶產業

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- IBM Corporation

- Oracle Corporation

- Informatica LLC

- Delphix Corp.

- Mentis Inc.(Mage)

- Innovative Routines International Inc.

- Solix Technologies Inc.

- K2view Ltd

- Red Gate Software Ltd

- Broadcom Inc.

第8章投資分析

第9章市場機會與未來趨勢

The Data Masking Market size is estimated at USD 0.94 billion in 2024, and is expected to reach USD 1.87 billion by 2029, growing at a CAGR of 14.71% during the forecast period (2024-2029).

In this information age, cyber security is essential. With the growth of breaches and malware attacks, data masking is making its way into the data-driven industry.

Key Highlights

- Data masking is an intelligent technology that provides real-time data masking of production data. Data masking technology allows for analyzing large amounts of data without disrupting routine company processes. In other words, data masking technology produces a fake but realistic version of organizational data to safeguard sensitive organizational information.

- The increasing need for decreasing the risk of data breaching is fueling the dynamic data masking market growth, which is expected to execute the fastest growth rate over the forecast period. Besides, active data masking helps to protect sensitive and personal data while supporting outsourcing, offshoring, and cloud-based initiatives.

- Furthermore, considering the significant demand among enterprises for securing their financial data, the requirement for data masking and better security solutions is projected to play a vital role in the market's growth. Data-driven finance has mandated that every organization have an accounting department to store and maintain financial data that includes large monetary transactions that, if leaked, could result in issues with the company's reputation and monetary losses in the market, as well as issues with regulatory directives such as PCI DSS, HIPAA, and other enforced laws. This is the most crucial reason driving the growth of the data masking market in this business function.

- However, a lack of skilled workers and technological competence in poor and developing nations and a lack of standardization may limit market expansion. Increasing complexity in data integration and synchronization may also slow industry development. A solid IT infrastructure in developing nations would also hinder market expansion.

- Due to the COVID-19 outbreak, countries have implemented preventive measures. With schools being closed and communities being asked to stay at home, multiple organizations found a way to enable employees to work from their homes. This resulted in a rise in data breaches and fuels the growth of the data masking market. Due to rapid digitization, the market is also growing after the pandemic.

Data Masking Market Trends

The BFSI Industry to Witness a Significant Growth

- The BFSI industry is one of the critical infrastructure segments that face multiple data breaches and privacy issues, owing to the massive customer base that the sector serves and the financial information at stake. Cybercriminals are optimizing various diabolical cyberattacks to immobilize the financial sector as a highly lucrative operation model with phenomenal returns and the added upside of relatively low risk and detectability. These attacks' threat landscape ranges from Trojans, ATMs, ransomware, mobile banking malware, data breaches, institutional invasion, data thefts, fiscal breaches, etc.

- Banks, insurance firms, credit bureaus, and lenders rely on data to understand and build deeper relationships with their consumers and determine whether the market fluctuates and maintains stable growth. However, this valuable data is being sought by both cybercriminals and insiders, and data privacy regulators are growing more demanding in their compliance requirements. Data masking tools help to safely design innovative, personalized experiences for their customers.

- In April 2021, the Reserve Bank of India (RBI) proposed cybersecurity norms for payment service providers (PSPs) following a series of data breaches faced by operators, including Mobikwik and payment aggregator JusPay. While the standards for fintech-driven payment services providers would be like cyber hygiene norms issued for banks and non-banking finance companies, the RBI is quite clear that firms will have to do more than observe the minimum standards to ensure digital safety transactions gain further traction.

- In 2022, financial firms worldwide were impacted by innovative new ransomware tactics that maximized ROI for the threat actors. While financial firms represent a small percentage of victims directly targeted by ransomware attacks, they can and have been impacted by attacks on third parties, who are prime targets. Such threats are poised to increase the usage of cybersecurity solutions in the BFSI sector.

Asia Pacific is Expected to be the Fastest Growing Market

- The Asia Pacific is expected to witness a higher growth rate than other regions because developing countries, such as India and China, are the world's two biggest economies. Automotive industries in the region increased over the past few years. The growth in these industries was propelled by a vast population shift and an increase in disposable incomes, which resulted in higher demand.

- Currently, these two countries are growing faster, and many developmental activities are being done here to set up new manufacturing industries and product launches. All these activities contribute to big data. Lots of data are being stored daily, which is very crucial. The rapid digitization among developing countries, such as India, China, and Singapore, has produced the bulk of unstructured data.

- Furthermore, owing to technological advancements, there is an increase in the number of connected devices in China. It is the largest global Internet of Things (IoT) market. Furthermore, 5G and 5 G-enabled devices will exponentially increase the devices' interconnectivity. As a result, it increases connected devices, directly augmenting the market's need for security products. The websites are thereby prone to be manipulated and impersonated by third parties, and sensitive user data communicated with the website can be intercepted more easily by foreign intelligence agencies.

- On the other hand, the increasing adoption of public cloud computing is leading to more enterprises re-allocating their business systems to cloud platforms. Issues concerning data security, tenant isolation, access control, etc., have gradually become a focal point of these enterprises.

- Data privacy has become a hot topic in China since the Chinese government has actively publicized data privacy rules and regulations in recent years. The Cybersecurity Law (CSL) (2017), the Data Security Law (DSL) (2021), and the Personal Information Protection Law (PIPL) have all been published and are currently in effect. For instance, in June 2022, China published the final version of the Certification Specification for Cross-Border Processing of Personal Information, which could provide companies with guidance on how to have their cross-border data transfer certified as one of the legal routes for business operators to transfer personal information outside China.

Data Masking Industry Overview

The data masking market is highly fragmented due to many global players in this industry. This market is highly competitive. Some key competitive players in the data masking market are IBM Corporation, Oracle Corporation, Informatica LLC, Delphix Corp., and Mentis, Inc. (Mage). The major players in the data masking market follow the strategy of strategic partnership, mergers or acquisitions of various local players, and product innovation to gain a competitive edge in the market.

- June 2022 - IBM Corporation announced its plans to acquire Randori, a prominent attack surface management (ASM) and offensive cybersecurity provider. Randori helps clients continuously identify assets visible to attackers, both on-premise and in the cloud, and prioritize exposures that pose the most significant risk. The acquisition aims to advance IBM's Hybrid Cloud strategy further and strengthen its AI-powered cybersecurity products and services portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increase of Organizational Data Volumes

- 4.4 Market Restraints

- 4.4.1 Technological Complexities Associated with Data Masking Challenge the Market Growth

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Consumers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Static

- 6.1.2 Dynamic

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 IT and Telecom

- 6.3.4 Retail

- 6.3.5 Government and Defense

- 6.3.6 Manufacturing

- 6.3.7 Media and Entertainment

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Oracle Corporation

- 7.1.3 Informatica LLC

- 7.1.4 Delphix Corp.

- 7.1.5 Mentis Inc. (Mage)

- 7.1.6 Innovative Routines International Inc.

- 7.1.7 Solix Technologies Inc.

- 7.1.8 K2view Ltd

- 7.1.9 Red Gate Software Ltd

- 7.1.10 Broadcom Inc.