|

市場調查報告書

商品編碼

1687382

天然橡膠:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Natural Rubber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

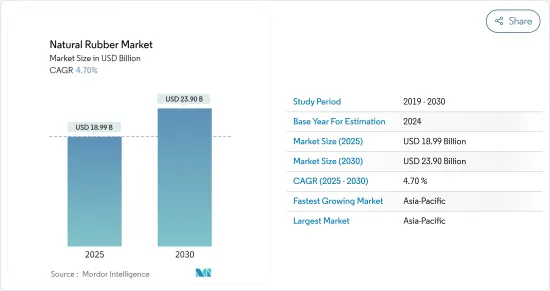

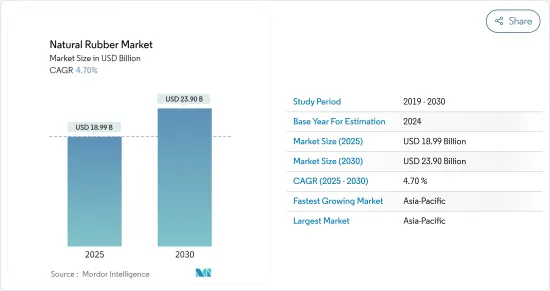

預計 2025 年天然橡膠市場規模為 189.9 億美元,到 2030 年預計將達到 239 億美元,預測期內(2025-2030 年)的複合年成長率為 4.7%。

天然橡膠是製造 40,000 多種產品的重要原料和必需聚合物。它用於製造輪胎、乳膠製品、玩具、鞋類和其他乳膠相關產品。天然橡膠由於其高抗張強度、減震性能和抗撕裂性能而比合成橡膠更受歡迎。這使得它們對建設產業和汽車行業至關重要。各國汽車市場的成長預計將增加對天然橡膠生產的需求。此外,導管、手套、皮帶等乳膠產品的需求也增加了全球對天然橡膠的需求。

亞太地區是最大的生產地區,生產了全球90%以上的天然橡膠。根據糧農組織統計資料庫,預計 2022 年天然橡膠產量將達到 1,280 萬噸,高於 2021 年的 1,250 萬噸。主要生產橡膠的國家有泰國、越南、印尼、中國和印度。

除了生產之外,由於中國、日本和印度等主要汽車製造國的存在,亞太地區也是世界上最大的天然橡膠消費國。例如,中國是世界上最大的天然橡膠進口國和消費國,每年消費全球總產量的約40.0%。根據ITC Trademap,印度將在2022年進口562,100噸天然橡膠,凸顯強勁的需求超過國內產量。因此,乳膠產品需求的不斷成長,加上全球汽車和建築行業的成長,是預測期內推動天然橡膠市場發展的主要因素之一。

天然橡膠市場趨勢

各行業需求增加

天然橡膠具有良好的金屬黏著性和耐磨性,適合製造密封件、輪胎和其他產品,因此其需求日益增加。天然橡膠具有高拉伸強度、減震性和抗撕裂性等特性,使其成為汽車工業和大型建築應用中比合成橡膠更理想和更受歡迎的選擇。橡膠的最大終端用戶是汽車零件行業,該行業每年使用大量橡膠來製造管道、墊圈、汽車輪胎、軟管和其他零件。

新興經濟體的高成長率和消費者人均收入的提高將增加對汽車的需求。這增加了這些地區對橡膠的需求。中國、印度、巴西、印尼、馬來西亞和越南等國家的工業和基礎設施成長趨勢預計將對橡膠市場產生正面影響。根據ITC貿易地圖,中國2023年進口了273萬噸天然橡膠。

天然橡膠因其耐用性、防滑性和抗張強度等特性而被用於鞋類製造,從而導致鞋類行業的需求不斷增加。天然橡膠的使用量不斷增加,導致對天然橡膠大規模生產的需求增加,導致全球天然橡膠採伐面積增加。根據聯合國糧農組織統計資料庫(FAOSTATS),2021年全球天然橡膠收穫面積達13,420,413公頃,2022年將達13,785,378公頃。因此,新興國家的需求增加以及全球產量的上升預計將推動天然橡膠市場的發展。

亞太地區佔市場主導地位

天然橡膠是一種重要的農產品,用於汽車、製造和醫療等多個行業的生產。泰國、越南和印尼是天然橡膠的主要生產國。泰國是世界最大天然橡膠生產國,2022 年天然橡膠產量約 482 萬噸。泰國約 90% 的天然橡膠由小農戶生產,10% 由種植園和大型農場生產。

小農戶生產的橡膠通常以田間乳膠、未燻片、杯塊或縐毯的形式出售,並由仲介業者處理,降低了這些農民的收入。在主要消費國中,中國是世界三大汽車生產國之一。汽車工業的成長增加了對天然橡膠等原料的需求。

泰國、越南和印尼是中國天然橡膠的主要出口國。根據ITC Trademap的數據,中國一半以上的天然橡膠進口來自泰國。根據 ITC Trademap,2022 年泰國和印尼分別出口 328 萬噸和 204 萬噸天然橡膠。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 各行業需求增加

- 消費者和產品的收入水準成長

- 對永續和生物分解性產品的需求不斷增加

- 市場限制

- 疾病和害蟲會影響橡膠樹

- 與橡膠種植相關的健康和環境問題

- 價值鏈分析

第5章 市場區隔

- 區域(生產分析、消費金額及數量分析、進口金額及數量分析、出口金額及數量分析、價格趨勢分析)

- 北美洲

- 美國

- 墨西哥

- 歐洲

- 德國

- 法國

- 義大利

- 土耳其

- 亞太地區

- 中國

- 馬來西亞

- 泰國

- 日本

- 印度

- 印尼

- 南美洲

- 巴西

- 智利

- 非洲

- 南非

- 北美洲

第6章 市場機會與未來趨勢

The Natural Rubber Market size is estimated at USD 18.99 billion in 2025, and is expected to reach USD 23.90 billion by 2030, at a CAGR of 4.7% during the forecast period (2025-2030).

Natural rubber is one of the essential polymers as it is an essential raw material used to create more than 40,000 products. It is used in manufacturing tires, latex products, toys, footwear, and other latex-related products. Natural rubber is preferred over synthetic rubber due to its high tensile strength, vibration-dampening properties, and tear resistance. This makes it important for the construction and automobile industries. The growth of the automobile market across countries is anticipated to increase the demand for natural rubber production. Furthermore, the demand for latex products, such as catheters, gloves, and belts, is also increasing the demand for natural rubber globally.

Asia-Pacific is the largest producer, producing over 90% of the global natural rubber production. According to FAOSTATS, in 2022, the production quantity of natural rubber was 12.8 million metric tons, which increased from 12.5 million metric tons in 2021. Major countries involved in rubber production are Thailand, Vietnam, Indonesia, China, and India.

Besides production, Asia-Pacific is also the world's largest consumer of natural rubber due to the presence of major automobile manufacturing countries such as China, Japan, and India. For instance, China is the world's largest importer and consumer of natural rubber, consuming around 40.0% of the total global output annually. According to the ITC Trademap, India imported 562.1 thousand metric tons of natural rubber in 2022, highlighting a strong demand that outstrips domestic production. Therefore, the rising demand for latex products, coupled with the growing global automobile and construction industry, is one of the major factors anticipated to drive the natural rubber market during the forecast period.

Natural Rubber Market Trends

Increasing Demand from Multiple Industries

The demand for natural rubber is increasing due to its characteristic properties, such as adhesion to metals and resistance to abrasion, which make it suitable for manufacturing seals, tires, etc. The properties of natural rubber, such as high tensile strength, vibration dampening, and tear resistance, make it ideal and more preferred than synthetic rubber for its application in the automobile industry and large constructions. The largest end-user of rubber is the automotive parts industry, which uses a massive amount of rubber to make pipes, gaskets, car tires, hoses, and other parts yearly.

The high growth in developing economies and the increasing per capita income among consumers in these countries increase the demand for automobiles. This, in turn, increases the demand for rubber in these regions. In countries like China, India, Brazil, Indonesia, Malaysia, and Vietnam, the growth of industrial and infrastructure industries is on the rise, which is expected to impact the rubber market positively. According to the ITC trade map, China imported 2.73 million metric tons of natural rubber in 2023.

Natural rubber is used in footwear manufacturing due to its properties, such as durability, slip resistance, and tensile resistance, resulting in increased demand from the footwear industry. The increased applications of natural rubber are increasing the demand for high natural rubber production, which has led to the harvested area of natural rubber globally. According to the FAOSTATS, in 2021, the harvested area of natural rubber globally was 13,420,413 hectares, and in 2022, it reached 13,785,378 hectares. Therefore, the increasing demand from developing countries in line with the increased global production is anticipated to drive the natural rubber market.

Asia-Pacific is Dominating the Market

Natural rubber is a vital agricultural commodity used for manufacturing in various industries, such as automotive, manufacturing, and medical. Thailand, Vietnam, and Indonesia are some of the dominant natural rubber producers. Thailand is the top producer in the world, and the country produced about 4.82 million metric tons of natural rubber in 2022. Around 90% of natural rubber production in Thailand is produced by smallholder farmers, while 10% comes from estates/large-scale holders.

The rubber produced by the smallholder farmers is generally sold as field latex, unsmoked sheets, cup lumps, or crepe blankets, and it is handled by intermediaries, reducing the income of these farmers. Among key consumers, China is one of the major three automobile manufacturers in the world. The increasing growth of the automobile industry resulted in an increased demand for raw materials, such as natural rubber.

Thailand, Vietnam, and Indonesia are some of the major exporters of natural rubber to China. According to the ITC Trademap, over half of China's natural rubber imports come from Thailand. According to the ITC Trademap, Thailand and Indonesia exported 3.28 and 2.04 million metric tons of natural rubber in 2022, respectively.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand from Multiple Industries

- 4.2.2 Growth in Income Levels of Consumers and Products

- 4.2.3 Increasing Demand for Sustainable and Biodegradable Products

- 4.3 Market Restraints

- 4.3.1 Disease and Pests are Affecting Rubber Plants

- 4.3.2 Health Hazards and Environmental Issues Associated with the Rubber Cultivation

- 4.4 Value Chain Analysis

5 MARKET SEGMENTATION

- 5.1 Geography (Production Analysis, Consumption Analysis by Value and Volume, Import Analysis by Value and Volume, and Export Analysis by Value and Volume and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Mexico

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 France

- 5.1.2.3 Italy

- 5.1.2.4 Turkey

- 5.1.3 Asia-Pacific

- 5.1.3.1 China

- 5.1.3.2 Malaysia

- 5.1.3.3 Thailand

- 5.1.3.4 Japan

- 5.1.3.5 India

- 5.1.3.6 Indonesia

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Chile

- 5.1.5 Africa

- 5.1.5.1 South Africa

- 5.1.1 North America