|

市場調查報告書

商品編碼

1437885

農業感測器:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Agricultural Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

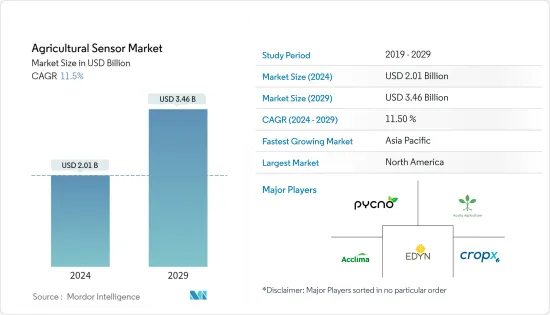

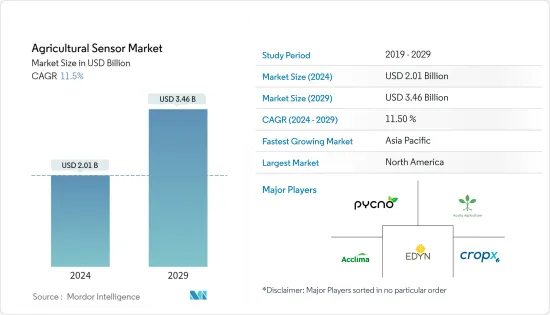

2024年農業感測器市場規模估計為20.1億美元,預計到2029年將達到34.6億美元,在預測期間(2024-2029年)以11.5%的複合年增長率增長。

主要亮點

- 農業生產需求的增加、技術實踐的變化、精密農業的集中、低耕管理、先進技術等是推動農業感測器市場的一些因素。

- 農業感測器預計將在該地區全面擴展。由於精密農業中精確定位的需求,位置感測器近年來受到廣泛關注。在中國,2018年,以「天、地、空間」為座右銘的大型農業數位園區在黑龍江現代農業示範區成立。 「Sky」是衛星遙感探測資料,「Space」是感測資料,即無人機遙感探測資料,「Ground」是地面物聯網資料。

- 許多農業科技公司正在通過開發創新模式來幫助農民擺脫劣勢,這些模式通過專注於無線平臺來實現產量監測、作物健康監測、田間測繪、灌溉計劃、收穫管理等方面的實時決策,從而使農業更容易。 其農產品的價格波動。

- 北美仍然是市場最大的地理區域,並佔據主要市場佔有率。隨著智慧農業技術的大量投資和廣泛採用,感測器農業在預測期內顯示出顯著成長的潛力。嚴格的環境法規、大大小小的農場主擴大採用精密農業以及提高田間生產力的產量監測技術預計將推動市場的發展。

農業感測器市場趨勢

減少勞動力需求

精準室內農業技術需要新技術來應對氣候條件變化和熟練勞動力減少的課題。當僅在室內種植作物時,農民可以控制光照水平、養分水平和濕度水平。具有強大功能的小型控制系統的感測器使公司能夠實現系統自動化並以更好的方式提高產量比率。安裝感測器後,可減少勞動力約20.0%。農業感測器可以解決室內農場的勞動力課題。

大型工業室內農場使用的感測器可偵測水污染、農藥殘留、營養缺乏、疾病侵襲等。室內農業和農業感測器的結合提高了作物的生產能力,並有可能推動未來農業感測器市場的發展。

因此,土壤濕度感測器等高科技灌溉工具可以幫助農民確定每個區域所需的水位。支援物聯網的設備上的智慧灌溉應用程式可以幫助控制和監控灌溉設備,並根據不斷變化的需求進行調整。兩者都代表了在地下水位下降的地區可以實施精準灌溉的廣泛領域。這些因素可能會在預測期內推動市場。

北美市場佔據主導地位

北美是農業感測器最大的區域市場。政府對增加農業產量的大力支持、基礎設施支持的可用性以及對智慧和歲差農業方法的接受增加了先進農業解決方案的採用。在北美,土壤濕度感測器的採用正在迅速增加。土壤濕度計用於運動草坪場,以更有效地監測和轉化草坪。研究表明,透過使用感測器,農民可以最大限度地減少乾旱壓力,並將保護性耕作維護和人事費用減少至少 20%。

美國是精密農業技術的早期採用者,這是該地區在全球市場中佔最大佔有率的一個主要因素。近年來,美國農業部門在採用智慧農業實踐方面經歷了一場突破性的革命。物聯網(IoT)行動電話設備、基於齒輪感測器的灌溉和施肥設備、閥門位置感測器等基於感測器的技術的出現在該領域相對較新,也是國內出現的新現象..對感測器的需求主要是由於機械化率的提高和農民採用的智慧農業實踐。加拿大對現代農業方法的高度認可促進了該行業的發展。

農業感測器產業概況

農業感測器市場較為分散,市場上有各種中小企業和少數大型企業,競爭激烈。市場上的主要企業包括 Edyan、Acclima Inc.、CropX inc.、Pycno、Acquity Agriculture 等。全球不同地區的區域市場和本土企業的發展是市場區隔的主要驅動力。北美和亞太地區是競爭對手活動最活躍的兩個地區。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 新進入者的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 類型

- 濕度感測器

- 電化學感測器

- 機械感測器

- 空氣流量感知器

- 光學感測器

- 壓力感測器

- 水感測器

- 土壤感測器

- 牲畜感測器

- 其他類型

- 目的

- 酪農管理

- 土壤管理

- 氣候管理

- 水資源管理

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 泰國

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 非洲其他地區

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Libelium Comunicaciones Distribuidas Sl

- Auroras

- Acquity Agriculture

- Pycno

- Agsmarts Inc.

- Edyn

- Acclima Inc.

- Caipos GmbH

- Vegetronix Inc.

- Sentek Ltd

- Aquaspy Inc.

- CropX

第7章市場機會與未來趨勢

The Agricultural Sensor Market size is estimated at USD 2.01 billion in 2024, and is expected to reach USD 3.46 billion by 2029, growing at a CAGR of 11.5% during the forecast period (2024-2029).

Key Highlights

- Increasing demand for agricultural production, changing technology practices, and increasing intensification, including precision agriculture, low-till management, and advanced technology, are a few factors driving the agricultural sensors market.

- Agricultural sensors are expected to achieve complete expansion in the region. Location sensors have gained immense traction in recent years for the need for precise positioning in precision agriculture. In China, a large-scale agriculture digital zone was established in the Heilongjiang Modern Agriculture Demonstration Zone in 2018 under the motto 'Sky, Earth, and Space,' where "Sky" stood for satellite remote sensing data, "Space" for drone remote sensing data, and "Ground" for ground IoT data.

- Many agritech companies developed innovative models for easing farming practices by focusing more on wireless platforms to enable real-time decision-making regarding yield monitoring, crop health monitoring, field mapping, irrigation scheduling, harvesting management, etc., for helping the farmers from adverse price fluctuations of their produce.

- North America remains the largest geographical segment of the market and accounts for a major market share. High investments and wide adoption of smart farming techniques show huge potential growth for sensor farming during the forecast period. Stringent environmental regulations and the rising adoption of precision farming and yield monitoring practices by large and small farm owners to upsurge the productivity of fields are expected to drive the market.

Agricultural Sensor Market Trends

Decreased Number of Labor Requirements

Precision and indoor farming techniques demand new techniques to address the challenges of fluctuating climatic conditions and decreased skilled labor force. The farmer can control light amounts, nutrition levels, and moisture levels when they are growing crops solely indoors. Sensors with small-scale control systems with robust functionality would allow businesses to automate their systems and increase yields in a better way. The post-adoption of sensors may reduce the labor force by around 20.0%. Agricultural sensors can address the labor challenge in indoor farms.

Big industrial indoor farms use sensors that can sense water contamination, pesticide residues, nutrient shortages, disease attacks, etc. The combination of indoor farming and agricultural sensors will likely enhance crops' production capacities, which may drive the agricultural sensors market in the future.

As such, high-technology irrigation tools, such as soil moisture sensors, can help farmers determine the level of water requirement in each area. Smart irrigation applications in IoT-enabled devices can help control and monitor the irrigation equipment to adjust it based on changing requirements. Both represent a wide scope for undertaking precision irrigation in regions with depleted groundwater levels. These factors are likely to drive the market during the forecast period.

North America Dominates the Market

North America is the largest regional market for agricultural sensors. Strong government support to increase agricultural production, availability of infrastructure support, and acceptance of smart and precession farming methods increased the deployment of advanced farming solutions. In North America, the adoption of soil moisture sensors has rapidly increased. Soil moisture instruments are used in the sports turf segment for more efficient monitoring and conversion of turfgrass. Studies indicate that adopting sensors helps farmers minimize drought stress and reduces maintenance and labor costs of protected cultivation by at least 20%.

The United States is the early adopter of precision farming technologies, the primary factor responsible for the region's most significant share in the global market. The US agricultural sector has undergone a groundbreaking revolution regarding adopting smart farming practices in recent years. Although the advent of sensor-based technologies, such as Internet of Things (IoT) cellular devices, gear tooth sensor-based irrigation and fertilization equipment, and valve position sensors, is relatively new in the domain, the country has been witnessing a new-found demand for sensors, primarily due to the increased rate of mechanization and smart agricultural practices adopted by the farmers. A considerable acceptance of modern agriculture methods by Canada is contributing to industry growth.

Agricultural Sensor Industry Overview

The agricultural sensor market is fragmented, with various small and medium-sized companies and a few big players operating in the market, resulting in stiff competition. Some of the major players in the market include Edyan, Acclima Inc., CropX inc., Pycno, and Acquity Agriculture. The development of regional markets and local players in different parts of the world is the major factor for the fragmented nature of the market. North America and Asia-Pacific are the two regions showing maximum competitor activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Humidity Sensor

- 5.1.2 Electrochemical Sensor

- 5.1.3 Mechanical Sensor

- 5.1.4 Airflow Sensor

- 5.1.5 Optical Sensor

- 5.1.6 Pressure Sensor

- 5.1.7 Water Sensor

- 5.1.8 Soil Sensor

- 5.1.9 Livestock Sensor

- 5.1.10 Other Types

- 5.2 Application

- 5.2.1 Dairy Management

- 5.2.2 Soil Management

- 5.2.3 Climate Management

- 5.2.4 Water Management

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Thailand

- 5.3.3.4 Japan

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Libelium Comunicaciones Distribuidas Sl

- 6.3.2 Auroras

- 6.3.3 Acquity Agriculture

- 6.3.4 Pycno

- 6.3.5 Agsmarts Inc.

- 6.3.6 Edyn

- 6.3.7 Acclima Inc.

- 6.3.8 Caipos GmbH

- 6.3.9 Vegetronix Inc.

- 6.3.10 Sentek Ltd

- 6.3.11 Aquaspy Inc.

- 6.3.12 CropX