|

市場調查報告書

商品編碼

1435963

熱感紙 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029年)Thermal Paper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

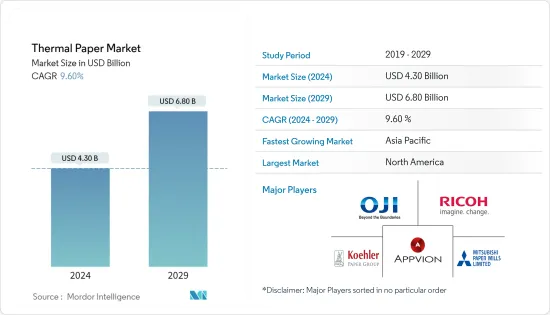

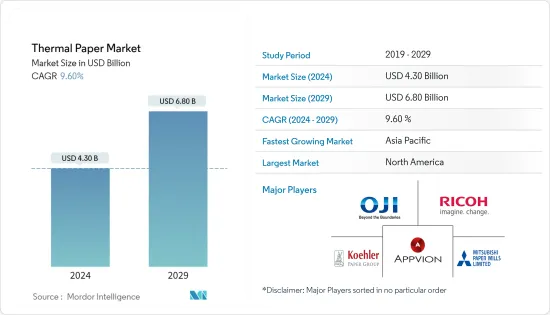

熱感紙市場規模預計到2024年為 43 億美元,預計到2029年將達到 68 億美元,在預測期內(2024-2029年)CAGR為 9.60%。

主要亮點

- 近年來,由於食品和飲料行業對標籤、標準化包裝物品品質的需求不斷成長,熱感紙變得越來越重要。提高熱感紙在標籤列印等應用中的使用率是推動市場成長的關鍵因素。根據 Label Insight 和食品行銷研究所的資料,86%的超市買家重視透明度,並且會更加信任提供完整、易於理解的成分資訊的食品製造商和零售商。

- 隨著餐廳、食品特許經營店和雜貨店向計時鐘和庫存系統過渡,POS(銷售點)系統在餐廳、食品特許經營店和雜貨店中越來越受歡迎。快節奏的生活方式經常需要使用熱感紙來製作停車票、門票和門票,這可能會增加對環保紙張的需求,促進市場成長。

- 製藥業中精確標籤的使用增加預計將推動熱感紙市場的發展。這些標籤以紙本形式使用並帶有商標,以傳達營養成分訊息,同時避免模仿行為。熱感紙在製藥業中用於傳達有關注射劑、藥物和製藥設備等物品的有效期和生產日期、條碼、成分以及相關資料的資訊。

- 然而,染料製造廠的環境限制限制了染料產量,並阻礙了熱感紙業務的整體擴張。因此,熱感紙產業原料成本的波動被視為熱感紙市場擴張的關鍵限制因素。

- 由於其易用性和耐用性,熱感紙經常用於雜貨店、餐飲店、賭場、彩券系統、咖啡店和麵包店列印標籤、票據和收據。 Jujo Thermal、Appvion 和 Oji Holdings 等製造商的強大市場影響力增加了對熱感紙的需求。此外,作為產品創新的一部分,使用環保化學品生產這些紙張的大量投資預計將成為推動未來產品需求的關鍵方面。

- COVID-19的出現也影響了熱感紙產業。由於生產力下降,該市場在疫情期間也出現下滑。然而,在疫情期間,醫療保健、製藥和包裝產業對熱感紙的需求迅速增加。由於全球危機和新冠病例數量增加,測試樣本和醫療用品的標籤和標籤需求增加。

熱感紙市場趨勢

POS 推動市場成長

- 由於零售業全球計費目標的增加,預計 POS 最終用戶產業在整個預測期內將發展更快。此外,全球超市、大賣場的崛起也將推動POS終端機的應用,促進市場拓展。連鎖超市在美國雜貨零售業中佔據主導地位。根據美國人口普查局的資料,美國雜貨店和超市的銷售額達到 8,102.8 億美元,高於2017年的 6,249.7 億美元。

- 印度等新興國家引進數位化增加了對 POS 系統的需求,增加了熱感紙捲市場。此外,產品標記在打擊假冒方面日益重要,也增加了對熱感紙捲的需求。根據印度儲備銀行印度經濟資料庫,2022年 5月零售業的 POS 業務成長了 6.17%,與2022 -2023 會計年度的上個月相比有所成長。在此期間 POS 的顯著價值零售業佔據了主要市場佔有率。

- 此外,熱感紙具有出色的高流量著色能力和高度耐用的表面,不會很快褪色。這項特性使得列印的條碼可用於 POS 食品標籤以及製造和運輸過程中的其他應用,增加了全球對熱感紙捲的需求。

- 許多行業產生的大量資料給當前組織帶來了從傳統交易技術過渡到 POS 系統的巨大壓力。 POS 終端消除了財務帳單和庫存管理的人為錯誤,同時提供了企業可靠性。因此,零售業的發展以及大型和小型機構中收據和票據列印的增加推動了熱感紙市場的成長。

- 行動 POS 終端廣泛應用於公車、鐵路和其他商業交通票務應用。此外,這些設備也用於工業廠房、政府建築和零售場所的物料管理。公共場所 POS 終端數量的增加可能會在預測的時間內維持產品需求。根據中國國務院的資料,到2022年,中國零售銷售終端(POS)設備總數從3,119萬台增加至3,556萬台。

亞太地區是熱感紙成長最快的市場

- 由於消費者對方便取得的消費品的需求不斷增加,亞太地區隨著該地區零售連鎖店的興起而主導了市場。在過去的幾十年裡,作為亞太地區主要市場參與者之一的中國工業部門取得了驚人的成長。根據中國國家統計局資料,2022年,工業增加值佔國內生產毛額的比重為33.2%。此外,該地區不斷成長的工業活動增加了標籤應用的產品需求。發展中國家對快速消費品不斷成長的需求必須提高這些商品的製造能力。因此,零售店的交易數量增加。

- 由於市場成長的增加和恢復,印度的工業標籤市場具有相當大的潛力。此外,政府也透過教育消費者正確標籤來協助市場。此外,線上購物的成長趨勢和相關倉庫營運的改善預計將有助於預測。據 IBEF表示,到2022年,印度電子商務產業預計將成長 21.5%,達到 748 億美元。電子商務已經改變了印度人開展業務的方式。2030年,印度電子商務業務價值將達到3,500億美元。

- 食品和飲料產業預計將成為亞太地區最大的消費者。中國和印度新興經濟體對包裝食品的需求不斷成長,預計將刺激對特種標籤和標籤的需求,對熱感紙業務產生有利影響。將工業 4.0 技術與列印和貼上標籤貼標機相整合,有助於食品和飲料行業提供即時監控。市場上的知名公司紛紛推出創新產品,以吸引消費者的注意並擴大其產品組合。例如,Dover Company旗下的Markem-Imaje於2022年 9月推出了 e-Touch-S 智慧列印和貼上標籤系統。

- 熱敏片廣泛應用於POS機、超市、ATM機。該地區電子商務的興起和許多自動櫃員機的存在支持了亞太地區許多熱感紙市場參與者的存在。據印度國家支付公司表示,截至2022年 1月,國家金融交換(NFS)網路中約有 25.5 萬台 ATM 機。 NFS 是印度最大的 ATM 網路,擁有約 1,200 個關聯成員和超過 3 億筆交易。

- 嚴格的環境和健康限制導致對含有雙酚A的熱感紙的使用制定了嚴格的標準,影響了產品需求。儘管如此,預計亞太地區的技術進步將在預測期內開闢新的商機。

熱感紙產業概況

熱感紙市場競爭適中,由幾個主要參與者組成。這些重要的公司目前在市場佔有率方面處於行業領先地位。此外,幾家知名製造商的加入預計將推動熱感紙市場在全球範圍內的擴張。熱感紙市場參與者採用新產能擴張、合作夥伴關係和收購以及產品發布等策略來擴大其現有產品、瞄準更大的客戶群並加速其市場地位。

2023年 6月,Appvion Operations, Inc 透過推出 CleanSlate 擴展了其下一代技術產品系列,這是一種直熱膜,可透過提供更高水準的環境耐久性來增強傳統直熱性能。 Appvion 的 CleanSlate 薄膜可用於壓敏標籤的標準熱感式印表機。 CleanSlate 憑藉其獨特的顏色,很容易區分並識別為不含酚類顯影劑的直接熱敏膠片。

2022年 12月,Koehler Group 與慕尼黑非營利組織 UnternehmerTUM GmbH 建立了合作夥伴關係,為造紙和再生能源領域的創新提供資金支持,該公司每年負責 50 家高成長的科技新創公司。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- 產業利害關係人分析

- COVID-19 對熱感紙市場影響的評估

第5章 市場動態

- 市場動態簡介

- 市場促進因素

- 增加 POS 計費操作服務的實用性

- 熱感紙具有強大的耐用性和列印精度

- 市場限制

- 原物料價格波動影響生產

- 市場挑戰

- 由於電子商務應用程式線上交易的增加,數位收據增加

第6章 市場細分

- 依最終用戶產業

- 銷售點

- 標籤

- 娛樂

- 醫療與製藥

- 其他最終用戶產業

- 按地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Ricoh Company, Ltd.

- Oji Holdings Corporation

- Appvion Operations, Inc.

- Koehler Group

- Mitsubishi Paper Mills(MPM)Limited

- Hansol Paper Co. Ltd.

- Gold Huasheng Paper Co., Ltd.

- Henan Province JiangHe Paper Co., Ltd.

- Kanzaki Specialty Papers Inc.(KSP)

- Thermal Solutions International Inc

- Thermal Paper Plus, LLC

- Jujo Thermal Limited

- NAKAGAWA Manufacturing(USA), Inc.

- Cenveo Inc

- Panda Paper Roll

- Bizerba USA Inc.

- ACYPAPER

- Rotolificio Bergamasco Srl

- Twin Rivers Paper Company Inc.

- Iconex LLC

- Telemark Diversified Graphics

第8章 投資分析

第9章 市場的未來

The Thermal Paper Market size is estimated at USD 4.30 billion in 2024, and is expected to reach USD 6.80 billion by 2029, growing at a CAGR of 9.60% during the forecast period (2024-2029).

Key Highlights

- Thermal paper has become increasingly important in recent years, owing to the growing demand for labeling in the food and beverage sector, standardizing the quality of packaged items. Improved thermal paper utilization in applications like label printing is a critical factor driving market growth. According to Label Insight and the Food Marketing Institute, 86% of supermarket buyers value transparency and would place more trust in food makers and retailers who provide complete, easy-to-understand ingredient information.

- POS (Point-of-Sale) systems are becoming increasingly popular among restaurants, food franchises, and grocery shops as they transition to time clocks and inventory systems. Fast-paced lifestyles frequently need the usage of thermal paper for parking tickets, tickets, and entrance tickets, which is likely to increase demand for eco-friendly paper, boosting market growth.

- The increased use of precise labeling in the pharmaceutical industry is expected to drive the thermal paper market. These labels are used in paper form and with a trademark to convey nutritional component facts while avoiding copycat practices. Thermal paper is used in the pharmaceutical industry to communicate information about expiration and production dates, bar codes, composition, and associated data of items such as injections, medications, and pharmaceutical equipment.

- However, environmental constraints established on the dye's manufacturing plant have limited dye output and hampered the overall expansion of the thermal paper business. As a result, the fluctuation in the cost of raw materials in the thermal paper sector is regarded as the key constraint to thermal paper market expansion.

- Due to its ease and durability, thermal paper is frequently used for printing labels, tickets, and receipts in grocery stores, caterers, gaming houses, lottery systems, coffee shops, and bakery businesses. The strong market presence of manufacturers such as Jujo Thermal, Appvion, and Oji Holdings has increased the demand for thermal papers. Also, substantial investments in producing these papers using eco-friendly chemicals as a part of product innovation are a critical aspect expected to fuel future product demand.

- The emergence of COVID-19 also impacted the thermal paper industry. Owing to the fall in production rates, this market is also witnessing a decline during the epidemic. During the pandemic, however, demand for thermal paper is fast increasing in the healthcare, pharmaceutical, and packaging sectors. The need for labels and tags for test samples and medical supplies increased due to the number of crises and COVID cases worldwide.

Thermal Paper Market Trends

POS to Drive the Market Growth

- The POS End-user sector is expected to develop quicker throughout the projected period, owing to increased global billing objectives in the retail industry. Furthermore, rising supermarkets and hypermarkets worldwide are expected to push POS terminal applications and promote market expansion. Chain supermarkets dominate the grocery retail business in the United States. According to US Census Bureau, grocery and supermarket store sales in the United States of America reached USD 810.28 billion, up from USD 624.97 billion in 2017.

- The introduction of digitization in emerging countries such as India has increased the need for POS systems and, as a result, the market for thermal paper rolls. Furthermore, the growing relevance of product marking in the fight against counterfeiting has boosted the demand for thermal paper rolls. As per the Reserve Bank of India database on the Indian Economy, the POS segment in retail increased by 6.17% in May 2022, an increase compared to the previous month for the financial year 2022 - 2023. The significant value during the period in the POS segment in retail contributes to the major market shares.

- Furthermore, the thermal paper has outstanding high-traffic coloring capabilities and a highly durable finish that does not fade quickly. This characteristic enables printed bar codes to be used in POS food labeling and other applications during manufacturing and shipping, which has increased global demand for thermal paper rolls.

- Massive data volumes generated by many industry sectors put immense pressure on current organizations to transition from traditional transactional techniques to POS systems. POS terminals eliminate human mistakes in financial bills and inventory management while providing corporate dependability. As a result, retail sector development and increasing receipt and bill printing in large and small-scale establishments drive thermal paper market growth.

- Mobile POS terminals are widely utilized in bus, rail, and other commercial transportation ticketing applications. Furthermore, these devices are employed for material management in industrial plants, government buildings, and retail establishments. A growing number of POS terminals in public places will likely sustain product demand in the predicted time frame. According to the state council of China, the total number of retail point-of-sale (POS) devices in the country escalated from 31.19 million to 35.56 million in 2022.

Asia Pacific is Fastest Growing Market for Thermal Paper

- Owing to the increased customer desire for conveniently available consumer products, Asia Pacific dominated the market with the rise of retail chains in the area. Over the last few decades, the industrial sector in China, one of the major market shareholders in the Asia Pacific, has witnessed astonishing growth. According to the National Bureau of Statistics of China, in 2022, the industrial sector contributed 33.2% of the country's GDP. Moreover, the region's growing industrial activity has increased product demand for labeling applications. The expanding demand for FMCG items in developing nations must increase these commodities' manufacturing capacity. As a result, the number of transactions at retail outlets has increased.

- India's market for industrial labels has a sizable potential because of increasing and recovering market growth. Also, the government is assisting the market by educating consumers about proper labeling. Furthermore, the growing trend of online shopping and improved related warehouse operations is expected to help the projection term. According to IBEF, the Indian e-commerce sector is anticipated to expand by 21.5% to USD 74.8 billion by 2022. E-commerce has altered the way Indians conduct business. By 2030, India's e-commerce business will be worth USD 350 billion.

- The food and beverage sectors are expected to be the largest consumers in the Asia Pacific. Rising demand for packaged food goods in China and India's rising economies is expected to stimulate demand for specialty labels and tags, favorably impacting the thermal paper business. Integrating industry 4.0 technology with the print & apply label applicators helps the food & beverage sector offer real-time monitoring. Prominent companies operating in the market announced innovative products to attract consumer attention and expand their product portfolio. For instance, Markem-Imaje, a Dover Company, launched the e-Touch-S intelligent print & apply labeling system in September 2022.

- Thermal sheets are widely used in POS machines, supermarkets, and ATMs. The rise of e-commerce in the region and the presence of many ATMs support the presence of many thermal paper market players in the Asia-Pacific region. According to the National Payments Corporation of India, as of January 2022, there were approximately 255 thousand ATMs in the National Financial Switch (NFS) network. The NFS is India's largest ATM network, with approximately 1,200 linked members and over 300 million transactions.

- Strict environmental and health restrictions have resulted in severe standards for using thermal paper containing bisphenol A, impacting product demand. Nonetheless, technological improvements in the APAC area are projected to open new business opportunities in the forecast period.

Thermal Paper Industry Overview

The Thermal Paper Market is moderately competitive and consists of several major players. These significant firms presently lead the industry in terms of market share. Furthermore, the presence of several well-known manufacturers is expected to boost the worldwide expansion of the thermal paper market. Thermal paper market players are using tactics such as new capacity expansions, partnerships and acquisitions, and product launches to expand their present offerings, target a larger client base, and accelerate their market position.

In June 2023, Appvion Operations, Inc expanded its Next Generation Technology product offering by launching CleanSlate, a direct thermal film that enhances traditional direct thermal performance by offering a higher level of environmental durability. Appvion's CleanSlate film can be used in standard direct thermal printers for pressure-sensitive labels. With its unique color, CleanSlate is easily distinguishable and recognizable as a direct thermal film free of phenolic developers.

In December 2022, Koehler Group entered into a partnership for funding innovations from the paper and renewable energy segments with the non-profit UnternehmerTUM GmbH in Munich, which is responsible for 50 high-growth tech start-ups each year.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 Assessment of Impact of COVID-19 on the Thermal Paper Market

5 MARKET DYNAMICS

- 5.1 Introduction to Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing POS Utility in Services for Billing Operations

- 5.2.2 Robust Durability and Print Precision Offered by the Thermal Paper

- 5.3 Market Restraints

- 5.3.1 Fluctuating Raw Material Prices affecting the Production

- 5.4 Market Challenges

- 5.4.1 Increase in Digital Receipt due to Rising Online Transactions for E-commerce Applications

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 POS

- 6.1.2 Labels

- 6.1.3 Entertainment

- 6.1.4 Medical & Pharmaceutical

- 6.1.5 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Ricoh Company, Ltd.

- 7.1.2 Oji Holdings Corporation

- 7.1.3 Appvion Operations, Inc.

- 7.1.4 Koehler Group

- 7.1.5 Mitsubishi Paper Mills (MPM) Limited

- 7.1.6 Hansol Paper Co. Ltd.

- 7.1.7 Gold Huasheng Paper Co., Ltd.

- 7.1.8 Henan Province JiangHe Paper Co., Ltd.

- 7.1.9 Kanzaki Specialty Papers Inc. (KSP)

- 7.1.10 Thermal Solutions International Inc

- 7.1.11 Thermal Paper Plus, LLC

- 7.1.12 Jujo Thermal Limited

- 7.1.13 NAKAGAWA Manufacturing (USA), Inc.

- 7.1.14 Cenveo Inc

- 7.1.15 Panda Paper Roll

- 7.1.16 Bizerba USA Inc.

- 7.1.17 ACYPAPER

- 7.1.18 Rotolificio Bergamasco Srl

- 7.1.19 Twin Rivers Paper Company Inc.

- 7.1.20 Iconex LLC

- 7.1.21 Telemark Diversified Graphics