|

市場調查報告書

商品編碼

1435939

乙烯基地板材料:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Vinyl Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

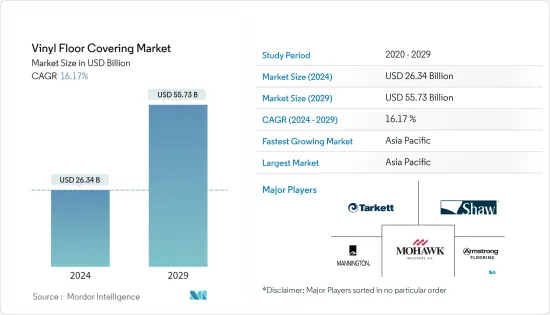

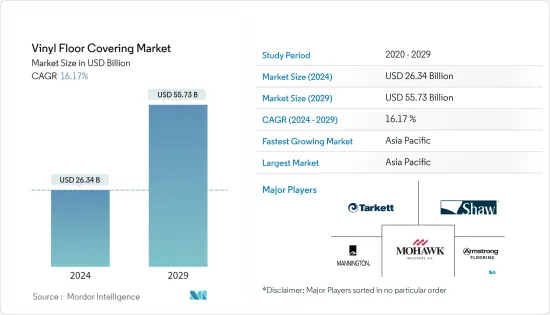

2024年乙烯基地板市場規模估計為263.4億美元,預計到2029年將達到557.3億美元,在預測期間(2024-2029年)以16.17%的複合年增長率增長。

主要亮點

- 乙烯基地板材料因其耐用性、易於維護且經濟實惠而成為住宅和商業應用的熱門選擇。該市場的推動因素包括對環保地板材料解決方案的需求不斷增加、維修和改建活動不斷增加以及豪華乙烯基瓷磚 (LVT) 和乙烯基複合瓷磚 (VCT) 的日益普及。此外,乙烯基地板材料在醫療機構、學校和其他公共建築中的使用也推動了市場的成長。

- COVID-19 在全球範圍內產生了前所未有的破壞性影響,在全球範圍內造成了負面需求衝擊。 2020年,全球市場大幅下滑約0.1%。此外,疫情期間多個建築工程計劃暫停,許多計劃因各國實施封鎖而延至 2021 年初。

- 辦公室和商業空間等人流量大的建築領域對產品的需求不斷成長,可能會支持全球市場的成長。該產品是木磚和地毯磚的經濟高效替代品。此外,這些樓層提供的卓越舒適度和噪音控制預計將在預測期內推動高層建築的需求。該產品是使用最廣泛的彈性地板材料解決方案類型。消費者正在從傳統的石材地板材料轉向彈性地板材料,因為它重量輕、易於維護且經濟高效。

- 過去幾年,製造商推出黏合地板材料的技術進步有利於產業的成長。隨著人口的成長,多用戶住宅數量的增加預計將對乙烯基地板材料市場的成長產生積極影響。此外,領先製造商增加投資以提供各種顏色、設計圖案、紋理和尺寸的客製化產品解決方案,正在推動產品在建築領域的滲透。

乙烯基地板材料市場趨勢

豪華乙烯基瓷磚區隔市場仍然是最受歡迎的類別

- 豪華乙烯基瓷磚預計仍將是乙烯基地板解決方案中最受歡迎的類別,而該區隔市場在預測期內的收益複合年成長率可能會更高。與標準乙烯基瓷磚相比,豪華乙烯基瓷磚更耐用,性能更優越,使您比同類瓷磚更具競爭優勢。

- 由於提供多種設計和紋理的產品,豪華乙烯基瓷磚領域在過去幾年中贏得了消費者的關注。將數位印刷技術引入地板材料行業,可以在這些瓷磚上輕鬆進行紋理印刷,這可能會在預測期內支持市場成長。

商業領域佔據最大市場佔有率

- 商業應用領域在乙烯基地板市場中佔據最大佔有率,預計該領域的收益在預測期內將以更高的年複合成長率(CAGR)成長。酒店和購物中心等商業建築行業預計將成為這些瓷磚的主要用戶,因為它們具有成本效益和出色的美觀性。

- 設計師和建築師對乙烯基地板材料在商業應用中的使用的影響力越來越大,預計將推動對該產品的需求。這些產品提供的易於清洗和消毒、時尚的設計、防滑和防水性能可能會在預測期內增加其商業應用的需求。

乙烯基地板材料產業概述

該報告涵蓋了在乙烯基地板材料市場營運的主要國際公司。從市場佔有率來看,目前少數大公司佔據市場主導地位。然而,隨著技術進步和產品創新,中小企業正在透過贏得新合約和開拓新市場來增加其市場佔有率。該市場的主要企業包括 Armstrong Flooring, Inc.、Mohawk Industries, Inc.、Shaw Industries Group, Inc.、Tarkett SA 和 Mannington Mills, Inc.。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察與動態

- 市場概況

- 市場促進因素

- 建設活動增加

- 對豪華乙烯基瓷磚的需求不斷成長推動了市場

- 市場限制因素

- 原物料價格波動

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 對市場創新的見解

- COVID-19 對市場的影響

第5章市場區隔

- 產品

- 乙烯基片材

- 乙烯基複合瓦

- 豪華乙烯基瓷磚

- 最終用途

- 住宅

- 商業的

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 市場競爭概況

- 公司簡介

- Armstrong Flooring, Inc.

- Mannington Mills, Inc.

- Mohawk Industries, Inc.

- Tarkett SA

- Forbo Flooring Systems

- Shaw Industries Group, Inc.

- Polyflor Ltd

- Beaulieu International Group

- Fatra as

- Gerflor

- Forbo*

第7章市場機會與未來趨勢

第 8 章 免責聲明與出版商訊息

The Vinyl Floor Covering Market size is estimated at USD 26.34 billion in 2024, and is expected to reach USD 55.73 billion by 2029, growing at a CAGR of 16.17% during the forecast period (2024-2029).

Key Highlights

- Vinyl flooring is a popular choice for residential and commercial applications due to its durability, ease of maintenance, and affordability. The market is being driven by factors such as the rising demand for eco-friendly flooring solutions, the increasing number of renovation and remodeling activities, and the growing popularity of luxury vinyl tiles (LVTs) and vinyl composite tiles (VCTs). Additionally, the use of vinyl flooring in healthcare facilities, schools, and other public buildings is also driving market growth.

- COVID-19 had an unprecedented and devastating impact worldwide, causing a negative demand shock across the globe. In 2020, the global market experienced a significant drop of around 0.1%. Additionally, several building construction projects were halted during the pandemic, and numerous projects were postponed until early 2021 due to lockdowns imposed in various nations

- Rising demand for the product in high-traffic area construction segments such as offices and commercial spaces is likely to support market growth on a global level. The product is a cost-effective alternative for wood and carpet tiles. Furthermore, superior comfort and noise control offered by these floors is expected to propel their demand in multi-story buildings over the projected period. The product is the most widely used type of resilient flooring solution. Consumers are shifting from traditional stone floorings to resilient floorings owing to their lightweight, easy maintenance, and cost-effectiveness.

- Technological advancements by manufacturers to introduce self-adhesive floorings have benefited the industry's growth over the past few years. A rising number of multifamily houses to accommodate the growing population is expected to have a positive impact on vinyl flooring market growth. Moreover, increasing investments by key manufacturers to offer customized product solutions in different colors, design patterns, textures, and dimensions are fuelling product penetration in the construction sector.

Vinyl Floor Covering Market Trends

Luxury Vinyl Tile Segment to Remain the most Popular Category

- Luxury vinyl tile is expected to remain the most popular category of vinyl flooring solutions, and the segment is likely to grow at a higher CAGR, in terms of revenue, over the forecast period. Luxury vinyl tile is more durable and offers better performance in comparison to standard vinyl tiles, which offers them a competitive advantage over their counterparts.

- The luxury vinyl tile segment has caught the attention of consumers in the past few years owing to the availability of the product in numerous designs and textures. The introduction of digital printing technology to the flooring industry, which enables easy texture printing on these tiles, is likely to support the market growth over the projected period.

Commercial Segment Hold the Largest Market Share

- The commercial application segment accounted for the largest share of the vinyl floor market, and the segment is anticipated to grow at a higher compound annual growth rate (CAGR), in terms of revenue, over the forecast period. Commercial construction segments such as hotels and shopping malls are expected to be the key users of these tiles as they offer cost-effectiveness along with superior aesthetics.

- The rising influence of designers and architects for the use of vinyl flooring in commercial applications is expected to boost product demand. Easy cleaning and sterilization and, stylish designs, and slip & water resistance offered by these products are likely to propel their demand in commercial application over the projected period.

Vinyl Floor Covering Industry Overview

The report covers major international players operating in the Vinyl floor covering market. In terms of market share, some of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets. Some major players in the market are Armstrong Flooring, Inc., Mohawk Industries, Inc., Shaw Industries Group, Inc., Tarkett S.A., and Mannington Mills, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Construction Activities

- 4.2.2 Increase in Demand for Luxury Vinyl Tiles is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Fluctuations in Raw Material Prices

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights into Technological Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Vinyl Sheet

- 5.1.2 Vinyl Composite Tile

- 5.1.3 Luxury Vinyl Tile

- 5.2 End-Use

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Armstrong Flooring, Inc.

- 6.2.2 Mannington Mills, Inc.

- 6.2.3 Mohawk Industries, Inc.

- 6.2.4 Tarkett S.A.

- 6.2.5 Forbo Flooring Systems

- 6.2.6 Shaw Industries Group, Inc.

- 6.2.7 Polyflor Ltd

- 6.2.8 Beaulieu International Group

- 6.2.9 Fatra a.s.

- 6.2.10 Gerflor

- 6.2.11 Forbo*