|

市場調查報告書

商品編碼

1435916

相轉移催化劑:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Phase Transfer Catalyst - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

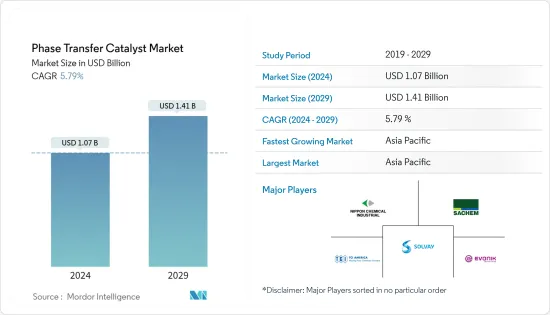

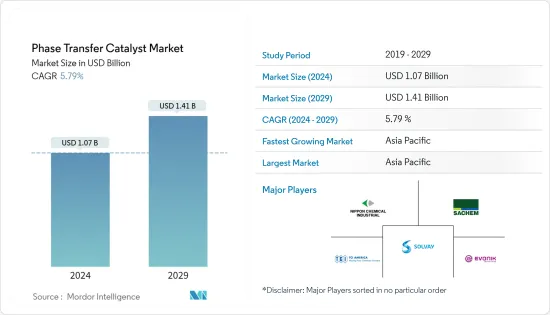

相轉移催化劑市場規模預計到 2024 年為 10.7 億美元,預計到 2029 年將達到 14.1 億美元,在預測期內(2024-2029 年)成長 5.79%,複合年成長率為

相轉移催化劑是將反應物從一個相移動到發生反應的另一個步驟的催化劑。相轉移催化劑在製藥領域的應用不斷增加正在推動市場成長。

主要亮點

- 然而,全球冠狀病毒的爆發可能會阻礙所研究市場的成長。

- 相轉移催化劑在精細化工和有機中間體生產領域的日益成長的應用很可能為未來五年的相轉移催化劑市場提供機會。

- 亞太地區主導了全球市場,最大的消費來自中國和印度等國家。

相轉移催化劑的市場趨勢

主導市場的藥品

- 製藥業可能會成為一個主要領域,因為在有機合成中採用綠色化學時,會確保嚴格的法規要求使用相轉移催化劑。

- 在製藥工業中,藥物中常用相轉移催化劑,它是透過一系列化學反應形成的複雜多功能分子。製藥業的不斷成長預計將推動市場成長。

- 此外,西部地區對醫藥產業有害化合物使用的嚴格規定,意味著相轉移催化劑在醫藥產業中不再需要使用有機溶劑和危險、不方便、昂貴的反應物,這也促使消費量增加。

- 此外,COVID-19感染疾病大流行的爆發已成為製藥業的主要成長推動者。

- 相轉移催化劑提高了化學反應的生產率和產率,因此在一些工業反應中消費量顯著增加。預計這將在預測期內推動市場成長。

- 所有上述因素預計將在預測期內推動相轉移催化劑市場。

亞太地區主導市場

- 由於相轉移催化劑廣泛應用於製藥和農化產業,亞太地區是最大且成長最快的相轉移催化劑市場。

- 根據國際製藥工程師協會的數據,亞太地區的藥品市場是僅次於北美的全球第二大藥品市場。

- 預計亞太地區醫藥市場在預測期內將以超過 8% 的複合年成長率成長。此外,COVID-19的感染疾病已成為製藥業成長的正面因素。

- 亞太地區擁有近30%的地球可用土地和60%的人口。該地區的人口結構在維持農業實踐的適宜性方面發揮重要作用,預計這將促使該地區農化產品的利用率增加,進一步推動市場成長。

- 因此,所有這些市場趨勢預計將在預測期內推動該地區相轉移催化劑市場的需求。

相轉移催化劑產業概述

全球相轉移催化劑市場本質上是分散的,因為市場參與者眾多,但市場佔有率並不大。主要企業包括 SACHEM, Inc.、TCI、 工業、Evonik Industries AG 和 Solvay。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 拓展相轉移催化劑在醫藥領域的應用

- 其他司機

- 抑制因素

- 由於COVID-19感染疾病的爆發,情況不利

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 銨鹽

- 鏻鹽

- 其他

- 最終用戶產業

- 藥品

- 化學品

- 農藥

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率/排名分析

- 主要企業採取的策略

- 公司簡介

- Alfa Aesar, Thermo Fisher Scientific.

- Cayman Chemical

- Central Drug House

- Dishman Group

- Evonik Industries AG

- Nippon Chemical Industrial CO., LTD

- SACHEM, Inc.

- Solvay

- Strem Chemicals, Inc.

- Tatva Chintan Pharma Chem Private Limited

- TCI

第7章市場機會與未來趨勢

- 擴大精細化學品和有機中間體生產的應用

- 其他機會

The Phase Transfer Catalyst Market size is estimated at USD 1.07 billion in 2024, and is expected to reach USD 1.41 billion by 2029, growing at a CAGR of 5.79% during the forecast period (2024-2029).

Phase transfer catalyst is a catalyst that enables the movement of the reactant from one phase to another step where the reaction occurs. The increasing application of phase transfer catalyst in the pharmaceutical sector has been driving the market growth.

Key Highlights

- However, the outbreak of coronavirus across the globe is likely to hinder the growth of the studied market.

- The growing application of phase transfer catalyst in the field of manufacturing of the fine chemicals and organic intermediates are likely to provide opportunities for the phase transfer catalyst market over the next five years.

- Asia-Pacific dominated the market across the globe with the largest consumption from countries such as China and India.

Phase Transfer Catalyst Market Trends

Pharmaceutical to Dominate the Market

- Pharmaceutical stand to be the dominating segment owing to ensure stringent regulations mandating the use of phase transfer catalyst as the adoption of green chemistry in organic synthesis.

- In the pharmaceutical industry, the phase transfer catalyst is used for medicines which are typically complex multifunctional molecules that are formed by a series of chemical reactions. Increased growth in the pharmaceutical industry is expected to drive the market growth.

- In addition, imposing stringent regulations on the use of harmful compounds in the pharmaceutical industry in the western regions also leads to increased consumption of phase transfer catalysts in the pharmaceutical industry, as they eliminate the need to use organic solvents and dangerous, inconvenient and expensive reactants.

- Further, the outbreak of COVID-19 pandemic disease has become a huge growth catalyst for the pharmaceutical industry.

- Phase transfer catalyst is witnessing a strong rise in consumption in several industrial reactions as it improves productivity and yield of a chemical reaction. This anticipates propelling market growth in the forecast period.

- All the aforementioned factors are expected to drive the phase transfer catalyst market during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia Pacific region stands to be the largest and fastest-growing market for phase transfer catalyst owing to wide usage in the pharmaceutical and agrochemical industry.

- According to the International Society for Pharmaceutical Engineering, the Asia Pacific pharmaceutical market is the second-largest in the world after North America.

- The pharmaceutical market in the Asia-Pacific region is projected to record a CAGR of more than 8% during the forecast period. Furthermore, the outbreak of COVID-19 disease becomes a positive factor for the growth of the pharmaceutical industry.

- Asia-Pacific accounts for almost 30% of land available on earth and 60% of the human population. Population statistics in the region have been responsible for maintaining adequacy in agricultural practices, resulting in greater utilization of agrochemical products in the region which further anticipated to propel the market growth.

- Hence, all such market trends are expected to drive the demand for the phase transfer catalyst market in the region during the forecast period.

Phase Transfer Catalyst Industry Overview

The global phase transfer catalyst market is fragmented in nature owing to the presence of numerous players in the market with no significant market share. Some of the major companies are SACHEM, Inc., TCI, Nippon Chemical Industrial CO., LTD, Evonik Industries AG, and Solvay amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Application of Phase Transfer Catalyst in Pharmaceutical Sector

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Ammonium Salts

- 5.1.2 Phosphonium Salts

- 5.1.3 Others

- 5.2 End-user Industry

- 5.2.1 Pharmaceutical

- 5.2.2 Chemical

- 5.2.3 Agrochemical

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alfa Aesar, Thermo Fisher Scientific.

- 6.4.2 Cayman Chemical

- 6.4.3 Central Drug House

- 6.4.4 Dishman Group

- 6.4.5 Evonik Industries AG

- 6.4.6 Nippon Chemical Industrial CO., LTD

- 6.4.7 SACHEM, Inc.

- 6.4.8 Solvay

- 6.4.9 Strem Chemicals, Inc.

- 6.4.10 Tatva Chintan Pharma Chem Private Limited

- 6.4.11 TCI

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Application in Manufacturing of the Fine Chemicals and Organic Intermediates

- 7.2 Other Opportunities