|

市場調查報告書

商品編碼

1435877

鼠李醣脂:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Rhamnolipids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

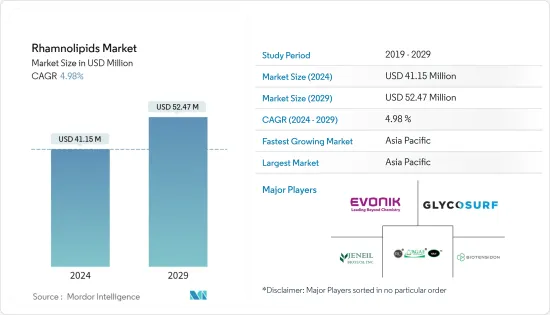

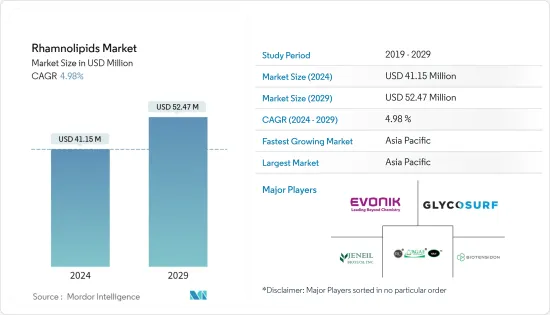

鼠李醣脂市場規模預計到 2024 年為 4,115 萬美元,預計到 2029 年將達到 5,247 萬美元,在預測期內(2024-2029 年)複合年成長率為 4.98%。

冠狀病毒感染疾病(COVID-19) 的傳播導致全球封鎖、供應鏈和製造活動崩壞以及生產停頓,所有這些都對 2020 年的市場產生了負面影響。然而,情況在 2021 年開始改善,預計市場將在預測期內恢復上升趨勢。

主要亮點

- 推動所研究市場的主要因素是界面活性劑對鼠李醣脂的需求不斷增加。此外,個人保健產品需求的增加預計也將刺激市場需求。

- 另一方面,鼠李醣脂的高生產成本阻礙了市場成長。

- 石油和天然氣行業對生物表面活性劑的需求不斷成長,預計將為預測期內的市場成長提供各種機會。

- 亞太地區是最大的市場,由於中國、印度和日本等國家的消費量不斷增加,預計亞太地區將成為預測期內成長最快的市場。

鼠李醣脂市場趨勢

界面活性劑對鼠李醣脂的需求不斷增加

- 鼠李醣脂生物界面活性劑比合成界面活性劑更容易受到大自然的攻擊。它們被認為是合成表面活性劑的更好替代品,因為它們對皮膚溫和,具有沖洗作用,並且非常環保。

- 基於鼠李醣脂的清潔劑在耐洗牢度、顏色強度和色差值方面表現出與合成清潔劑相當的清洗性能。

- 鼠李醣脂生物界面活性劑用於清潔劑、地板清潔劑、餐具清潔劑和其他清洗產品。許多公司正在向市場推出使用生物表面活性劑的清洗和清潔劑產品。

- 例如,贏創工業股份公司宣布推出永續鼠李醣脂 REWOFERM RL 100生物界面活性劑,滿足清洗解決方案市場對低排放、低影響清洗產品的需求,以永續循環經濟。

- 根據德國化妝品、洗護用品、香水和清潔劑協會 IKW 的數據,2022 年德國肥皂和合成清潔劑的收益約為 4.62 億歐元(約 4.868 億美元)。

- 此外,根據加拿大統計局的數據,2023年前三個月加拿大肥皂和清洗產品製造商的月銷售額為3.9558億加元(約3.04億美元),與前一年同期比較增加了約2,000萬日元。 。同期銷量。

- 根據巴西地區統計研究所預測,2022年巴西肥皂和清潔劑生產收益預計將超過45.2億美元。該機構還預計 2023 年收益約為 45.6 億美元。

- 因此,由於上述因素,界面活性劑鼠李醣脂的應用很可能在預測期內成為主導。

亞太地區主導市場

- 目前,由於工業和最終用途的需求,亞太地區在界面活性劑、潤滑劑和藥品全球市場中佔據最大佔有率。

- 據印度工業和國內貿易促進部稱,該國2022年計劃對肥皂、化妝品和洗護用品行業的投資約為22.6億盧比(約2,870萬美元)。

- 截至 2022 年 6 月,印度清潔劑市場規模為 1,200 億印度盧比(約 1.5 億美元)。國家都市化的不斷提高,增加了對更高品質產品的需求。為了滿足對優質清潔劑的需求,印度的頂級品牌正在開發包裝更好的產品,只需一次洗滌即可提供更多好處。

- 中國也是化妝品的主要消費國之一。 2022年,中國批發零售企業化妝品零售額總計約3,936億元人民幣(約570億美元)。然而,根據中國國家統計局的數據,這比上年略有下降,當時零售總額約為 4,026 億元人民幣(約 586 億美元)。

- 此外,根據日本經濟產業省的數據,2023 年 4 月國內廁所和洗手劑產量約為 972 萬件。

- 此外,印度是全球製藥業的重要且不斷成長的參與者。印度是全球主要學名藥供應國之一,佔全球供應量的20%。印度藥品出口到全球200多個國家,其中美國是主要市場。此外,印度學名藥滿足了美國40% 的學名藥需求和英國30% 的學名藥需求。國內製藥公司由約10,500家公司組成。

- 因此,由於上述因素,亞太地區很可能在預測期內主導鼠李醣脂市場。

鼠李醣脂產業概況

全球鼠李醣脂市場本質上是部分一體化的,只有少數主要企業主導市場。主要企業包括(排名不分先後)Evonik Industries AG、Jeneil、GlycoSurf、AGAE Technologies, LLC 和 Biotensidon GmbH。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 界面活性劑對鼠李醣脂的需求不斷增加

- 個人保健產品需求增加

- 其他司機

- 抑制因素

- 鼠李醣脂生產成本高

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭程度

第5章市場區隔(市場規模:數量)

- 類型

- 單鼠李醣脂

- 二鼠李醣脂

- 目的

- 界面活性劑

- 潤滑劑

- 農業

- 食品

- 藥品

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- AGAE Technologies, LLC

- Biosynth

- Biotensidon GmbH

- Evonik Industries AG

- GlycoSurf

- Jeneil

- Merck KGaA

- Rhamnolipid, Inc.

- Stepan Company

- TensioGreen

- Unilever

第7章市場機會與未來趨勢

- 石油和天然氣產業對生物表面活性劑的需求不斷成長

- 其他機會

The Rhamnolipids Market size is estimated at USD 41.15 million in 2024, and is expected to reach USD 52.47 million by 2029, growing at a CAGR of 4.98% during the forecast period (2024-2029).

The COVID-19 outbreak resulted in a global lockdown, a breakdown in supply chains and manufacturing activities, and production halts, all of which had a detrimental effect on the market in 2020. However, things started to get better in 2021, which allowed the market to resume its upward trend for the remainder of the projected period.

Key Highlights

- The major factor driving the market studied is the growing demand for rhamnolipids from surfactants. Moreover, the increasing demand for personal care products is also expected to fuel the market demand.

- On the flip side, the high manufacturing cost of rhamnolipids has hindered the growth of the market.

- The growing demand for bio-surfactants in the oil and gas sector is forecasted to offer various opportunities for the growth of the market over the forecast period.

- Asia-Pacific region represents the largest market and is also expected to be the fastest-growing market over the forecast period owing to the increasing consumption from countries such as China, India, and Japan.

Rhamnolipids Market Trends

Growing Demand of Rhamnolipids from Surfactants

- Rhamnolipid bio-surfactants have the property of getting dreaded easily in nature as compared to synthetic surfactants. They are believed to be a better alternative to synthetic surfactants due to their being skin-friendly, rinse-active, and very environmentally friendly.

- Rhamnolipid-based bio-detergents show comparable washing performance to synthetic detergents in terms of colorfastness to wash, color strength, and the color difference value.

- Rhamnolipid bio-surfactants are used in laundry detergents, floor cleaners, dishwashing liquids, and other cleaning products. Many companies have been introducing bio-surfactant cleaning and detergent products in the market.

- For instance, Evonik Industries AG announced the launch of sustainable rhamnolipid REWOFERM RL 100 biosurfactant meets demand from the cleaning solutions market for low-emission, low-impact cleaning products that enable a circular economy.

- According to IKW, the German Cosmetic, Toiletry, Perfumery and Detergent Association, the revenue from soaps and synthetic detergents in Germany was about EUR 462 million (~USD 486.8 million) in 2022.

- Moreover, according to Statcan, the Canadian Statistics Agency, the monthly manufacturer sales of soap and cleaning compounds in Canada in the first three months of 2023 accounted to be CAD 395.58 million (~USD 304 million), approximately 20% more than the previous year's sales for the same period.

- According to the Brazilian Institute of Geography and Statistics, the revenue generated from the manufacturing of soaps and detergents in Brazil in 2022 is expected to be over USD 4.52 billion. The institution also anticipates revenues of roughly USD 4.56 billion in 2023.

- Hence, owing to the above-mentioned factors, the application of rhamnolipids from surfactant is likely to dominate during the forecast period.

Asia-Pacific Region to Dominate the Market

- Currently, Asia-Pacific accounts for the highest share of surfactants, lubricants, and pharmaceuticals in the global market owing to the demand from the industries and end-use applications.

- According to the Department for Promotion of Industry and Internal Trade in India, the proposed investment value in the soaps, cosmetics, and toiletries sector in the country for year 2022 is around INR 2.26 billion (~USD 28.7 million).

- As of June 2022, the Indian Detergent market size was INR 12,000 crore (~USD 150 million). Due to the increasing urbanization rate in the country, there is an increasing demand for better-quality products. To meet these demands for quality washing powders, the top brands in India are innovating better-packaged products that come with many benefits in a single wash.

- China is also one of the major consumers of cosmetics. In 2022, the retail sales of cosmetics by wholesale and retail companies in China totaled about CNY 393.6 billion (~USD 57 billion). This though, indicated a slight decrease compared to the previous year which had a total retail sale of about CNY 402.6 billion (~USD 58.6 billion), as stated by the National Bureau of Statistics of China.

- Additionally, according to the Ministry of Economy, Trade and Industry in Japan, toilet and hand soap production in the country amounted to around 9.72 million units in the month of April 2023.

- Moreover, in the global pharmaceuticals sector, India is a prominent and expanding player. India is one of the world's major suppliers of generic medicines, accounting for 20% of the global supply by volume. Indian drugs are exported to more than 200 countries in the world, with the United States being the key market. Furthermore, India's generic drugs satisfy 40% of the generic drug demand of the United States and 30% of the United Kingdom. The domestic drug manufacturers consist of a chain of around 10,500 companies.'

- Hence, owing to the above-mentioned factors, Asia-Pacific is likely to dominate the rhamnolipids market during the forecast period.

Rhamnolipids Industry Overview

The global rhamnolipids market is partially consolidated in nature with only few major players dominating the market. Some of the major companies are (not in any particular order) Evonik Industries AG, Jeneil, GlycoSurf, AGAE Technologies, LLC, and Biotensidon GmbH among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand of Rhamnolipids from Surfactants

- 4.1.2 Increasing Demand for Personal Care Products

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Manufacturing Cost of Rhamnolipids

- 4.2.2 Other restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Mono-Rhamnolipids

- 5.1.2 Di-Rhamnolipids

- 5.2 Application

- 5.2.1 Surfactants

- 5.2.2 Lubricant

- 5.2.3 Agriculture

- 5.2.4 Food

- 5.2.5 Pharmaceutical

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGAE Technologies, LLC

- 6.4.2 Biosynth

- 6.4.3 Biotensidon GmbH

- 6.4.4 Evonik Industries AG

- 6.4.5 GlycoSurf

- 6.4.6 Jeneil

- 6.4.7 Merck KGaA

- 6.4.8 Rhamnolipid, Inc.

- 6.4.9 Stepan Company

- 6.4.10 TensioGreen

- 6.4.11 Unilever

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand of Bio-surfactants in Oil and Gas Sector

- 7.2 Other Opportunities