|

市場調查報告書

商品編碼

1435848

全球金屬印刷包裝 - 市場佔有率分析、行業趨勢與統計、成長預測(2024 - 2029)Global Metal Print Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

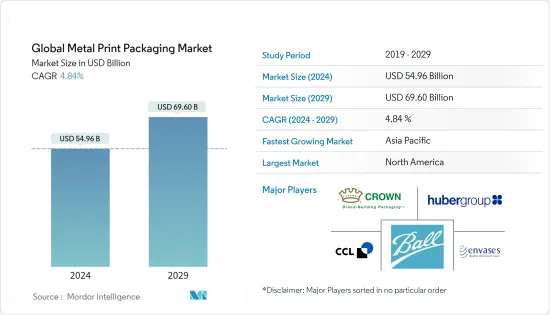

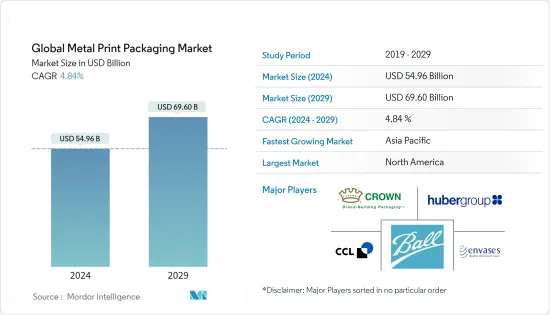

2024年全球金屬印刷包裝市場規模預估為549.6億美元,預估至2029年將達696億美元,在預測期間(2024-2029年)CAGR為4.84%。

客製化和高階化的成長趨勢、金屬包裝的日益採用以及對回收和可重複使用包裝材料的日益關注是推動全球金屬印刷包裝市場的一些主要因素。印刷技術的進步也為市場供應商擴大其影響力創造了機會。

主要亮點

- 金屬印刷包裝可以讓製造商提高產品的品牌知名度,吸引用戶的注意並推動他們購買產品。隨著印刷設備數位化趨勢的不斷發展,對金屬印刷包裝的需求大幅成長。這一趨勢反映在飲料和化妝品行業,這些行業擴大採用金屬罐進行包裝。

- 據聯合國(UN)表示,世界迅速城市化;據聯合國(UN)表示,到2050年,居住在城市地區的人口比例預計將增加到 66%。隨著城市化進程的加速和富裕程度的提高,人們的飲食習慣發生變化,其特徵是對包裝食品的高需求。因此,大型有組織的零售商已開始堆放大量罐頭食品和飲料。如今,線下和線上零售商在其商店裡備有各種品牌的包裝食品。

- 食品和飲料、化妝品和人員護理等行業也在探索可重複使用和部分可重複使用的金屬包裝選項,以及先進且有吸引力的印刷技術。 Verity 是一家總部位於美國的個人護理產品包裝新創公司,生產可路邊回收的鋁材,以取代難以回收的塑膠。該公司生產用於除臭劑的鋁製和不銹鋼外殼,並考慮更廣泛的個人護理市場。該公司目前向美國除臭劑生產商 Noniko 供應金屬包裝。 Noniko 目前提供 Verity 採用可重複使用不銹鋼包裝的除臭劑。

- 由於 COVID-19,食品業的要求發生了很大變化。由於餐廳關門,人們在家吃飯,並且購買更多可以立即食用的小包裝食品。疫情過後,這一趨勢預計將持續下去,消費者也意識到金屬包裝是可回收的,而用金屬包裝包裝的環保產品,如罐頭和容器,保存期限更長,可以在常溫下保存。

- 此外,隨著全球零食市場等行業的蓬勃發展,零食的高階化大幅成長。由於包裝是高階化的三個關鍵要素之一,最終用戶擴大投資於所研究的市場。例如,Crown Food Europe 提倡使用金屬為「蓬勃發展」的零食市場的包裝帶來優質感。據該公司表示,金屬給人一種優質的感覺,是一種堅固耐用的材料,給人一種裡面的東西值得保護的印象。

金屬印刷包裝市場趨勢

平版印刷預計將保持顯著的市場成長

- 平版印刷是廣泛用於創建印刷材料的包裝印刷方法之一。與其他包裝印刷方法相比,平版印刷適合經濟地生產大量高品質印刷品,幾乎不需要維護。

- 平版印刷具有印刷品質高、印刷速度快等優點,進一步帶動了包裝印刷類型的高需求,包裝印刷類型也獲得了金屬類型市場。在歐洲等地區,平版印刷因其材質堅硬且不吸水性而成為金屬罐上廣泛採用的印刷方法。

- Crown Holdings Inc. 等公司利用平版印刷印刷 2 件式和 3 件式金屬包裝,將油墨塗在印刷板上,轉移到橡皮布上,然後轉移到金屬本身。兩片罐在成型時進行印刷,而三片罐則在板材上印刷。 Crown Food Europe 為零食行業的許多客戶生產金屬印刷包裝,包括 100%可回收用於 Bier Nuts 鬆脆塗層花生的金屬格式容器;並在金屬罐中印製滿意零食沙拉(as)洋芋片概念的包裝。

- 儘管使用平版印刷生產的印刷品品質很高,但更好的印刷方法(例如輪轉凹印和照相凹印)也存在缺陷。由於印版是陽極氧化鋁材料,容易氧化生鏽,所以平版印刷所使用的印版需要充分保養;預計這些缺點將限制平版印刷在金屬包裝領域的發展。

亞太地區將見證顯著成長

- 由於製造商致力於創造低成本的包裝印刷選擇,亞太地區在全球金屬印刷包裝行業的價值方面佔據很大佔有率。隨著已開發國家數位印刷包裝市場日趨成熟,預計中國和印度市場將在未來七到八年內快速成長。由於電子零售和食品行業便利包裝的不斷成長,預計該地區在預測期內也將實現最高的發展。

- 亞太地區金屬印刷包裝市場的主要促進因素包括包裝食品(包括冷凍和冷藏食品)銷售的成長、可支配收入的增加、生活方式的改變、經濟穩定成長以及飲料(酒精和非酒精)的增加消耗。

- 此外,不斷成長的食品飲料和製藥行業增加了對金屬印刷解決方案的需求,因為金屬印刷可以幫助製造商提高產品的品牌知名度,吸引用戶的注意力並推動他們購買產品。綠色商業印表機的推出使用環保列印技術來最大限度地減少浪費並使用更少的能源,也對該行業產生了積極影響。例如,2020年 8月,ExOne 推出了一種創新過濾器,可在銅或不銹鋼上進行 3D 列印,以安裝在各種口罩和其他醫療設備內。

- 該市場主要由數位印刷技術的不斷發展所推動,特別是在印度、中國和越南。最新技術的出現已經用具有高速列印功能的商業印表機取代了傳統印表機。

金屬印刷包裝產業概況

金屬印刷包裝市場競爭適中,由大量全球和區域參與者組成。這些參與者在市場上佔有很大佔有率,並致力於擴大其在全球的消費者基礎。這些參與者正致力於研發投資,引進新的解決方案、策略合作夥伴關係以及其他有機和無機成長策略,以在預測期內贏得競爭優勢。

- 2021年 6月 - CCL Container 推出了直徑達 76 毫米、高度達 265 毫米的超大鋁製容器。 CCL 的大直徑鋁製容器是北美唯一生產的這種尺寸的容器。這種大尺寸,加上令人驚嘆的造型和裝飾選項,確保所有產品 - 無論是汽車燃油添加劑、驅蟲劑還是髮膠 - 在銷售點給消費者留下深刻的印象。創意設計進一步區分品牌並影響消費者的購買決策。此外,這些 100%原生鋁容器的無限可回收性對於具有環保意識的品牌和消費者來說是雙贏的。

- 2021年 5月 - HuberGroup Print Solutions 宣佈在波蘭弗羅茨瓦夫地區開設一家最先進的生產工廠,為整個歐洲的客戶提供服務。在新大樓中,hubergroup 生產用於柔版印刷和凹版印刷的水性清漆以及溶劑型油墨,並擁有平版印刷油墨(包括 UV 油墨)的配料線。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

第5章 市場動態

- 市場促進因素

- 數位印刷技術的快速發展

- 市場挑戰

- 印刷油墨價格波動

第6章 COVID-19 對金屬包裝產業的影響

第7章 金屬包裝市場格局

- 依類型分類的金屬包裝需求

- 依地區分類的金屬包裝需求

- 最終用戶產業的金屬包裝需求

第8章 印刷油墨與塗料概況

- 依類型分類的印刷油墨需求(溶劑型、水性、油性、UV固化和其他類型)

第9章 市場細分

- 按印刷過程

- 平版印刷

- 凹版印刷

- 柔版印刷

- 數位

- 其他印刷技術

- 按地理

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第10章 競爭格局

- 公司簡介

- Toyo Seihan Co. Ltd(Toyo Seikan Group Holdings Ltd)

- Ball Corporation

- Hubergroup Deutschland GmbH

- Envases Metalurgicos de Alava SA

- CCL Container(CCL Industries Inc.)

- Koenig & Bauer AG

- Tonejet Limited

- Crown Holdings Inc.

第11章 市場的未來

The Global Metal Print Packaging Market size is estimated at USD 54.96 billion in 2024, and is expected to reach USD 69.60 billion by 2029, growing at a CAGR of 4.84% during the forecast period (2024-2029).

The growing trend of customization and premiumization, increasing adoption of metal packaging, and growing focus on recycling and reusable packaging materials are some of the major factors driving the global metal print packaging market. The advancements in printing technologies are also creating opportunities for the market vendors to expand their presence.

Key Highlights

- The metal printed packaging allows the manufacturers to improve the brand visibility of the products, thus, attracting the user's attention and propelling them to buy the product. With the growing trend of digitization in printing facilities, the demand for metal print packaging has witnessed significant growth. This trend is reflected across the beverage and cosmetic industries, where metal cans are increasingly being adopted for packaging.

- According to the United Nations (UN), the world is urbanizing rapidly; the proportion of people living in urban areas is expected to increase to 66% by 2050, according to the United Nations (UN). As urbanization is picking up and growing affluence, diet is changing, characterized by a high demand for packaged food. Therefore, large organized retailers have started to stack vast amounts of canned food and beverages. Nowadays, offline and online retailers stock a wide range of brands of packaged food items in their stores.

- Industries like Food and Beverage, cosmetic, and personnel care are also exploring reusable and partially reusable metal packaging options, along with advanced and attractive printing technologies. Verity, a US-based startup making packaging for personal care products, is producing curbside-recyclable aluminum options in lieu of hard-to-recycle plastic. The company manufactures aluminum and stainless steel cases for deodorant and is looking into the wider personal care market. The company currently supplies its metal packaging to the US-based deodorant producer, Noniko. Noniko is currently offering deodorant in reusable stainless steel packaging from Verity.

- The requirements of the food industry have changed considerably due to COVID-19. With restaurants closed, people are eating at home, and they are buying more miniature packs of food, which can be consumed immediately. Post-COVID, this trend is expected to continue, and consumers have also realized that metal packaging is recyclable, and environment-friendly products packed in metal packagings, such as cans and containers, have a longer shelf life and can be stored at ambient temperatures.

- Furthermore, as industries like global snacking markets are booming, premiumization in Snacks is witnessing massive growth. And as the packaging is one of three key elements of premiumization, the end-users are increasingly investing in the studied market. For instance, Crown Food Europe is advocating the use of metal to convey a premium feel to packaging in the 'booming' snacks market. According to the company, metal conveys a premium feel, being a solid and robust material that gives the impression the contents are worth protecting.

Metal Print Packaging Market Trends

Offset Lithography is Expected to Hold a Significant Market Growth

- Offset lithography is one of the widely used packaging printing methods used for creating printed materials. Compared to the other packaging printing methods, offset lithography printing is suitable for economically producing large volumes of high-quality prints requiring little maintenance.

- Offset printing offers advantages, such as high print quality and high-speed printing, further leading to the high demand for the packaging printing type, which has also gained its metal type market. In a region like Europe, offset printing is a widely adopted method for printing on metal cans owing to its hard and non-absorbent material.

- Companies like Crown Holdings Inc. utilize offset printing for a 2-piece and 3-piece metal packaging so that ink is applied to a printing plate, transferred to a blanket, and then on to the metal itself. 2-piece cans are printed when formed, whereas Three-piece are printed on sheets. Crown Food Europe has produced metal print packaging for many clients in the snacks sector, including metal format containers that are 100% recyclable for Bier Nuts' crunchy, coated peanuts; and print packaging for Satisfied Snacks' Salad (as) Crisps concept in metal tins.

- Although the quality of prints produced using offset printing is high, it is flawed by better printing methods, such as rotogravure and photogravure. Because printing plates are anodized aluminum materials, which could rust from oxidation, the plates used for offset printing need to be adequately maintained; such disadvantages have been anticipated to restrict the growth of offset lithography printing in metal packaging.

Asia Pacific to Witness Significant Growth

- The Asia Pacific region accounts for a large share in the global metal printing packaging industry in terms of value due to the manufacturers' focus on creating low-cost packaging printing options. As the digital printing packaging market in established nations is reaching maturity, the Chinese and Indian markets are expected to grow at high rates in the next seven to eight years. The region is also anticipated to register the highest development during the forecast period, owing to the growing e-retail sales and convenience packaging in the food industry.

- Key driving factors for the metal print packaging market in the APAC region include the rising sale of packaged food products, including frozen and chilled food, rising disposable income, changing lifestyle, steady economic growth, and increasing beverage (both alcoholic & non-alcoholic) consumption.

- Furthermore, the growing food and beverage and pharmaceutical sectors have increased the demand for metal printing solutions, as metal printing allows manufacturers to improve the brand visibility of the products, thus, attracting the user's attention and propelling them to buy the product. The introduction of green commercial printers that use environmentally sound printing techniques to minimize waste and utilize less energy also positively impacts the industry. For instance, in August 2020, ExOne introduced an innovative filter that can be 3D printed on either copper or stainless steel to fit inside a variety of face masks and other medical devices.

- The market is predominantly driven by the growing developments in digital printing technologies, especially in India, China, and Vietnam. The advent of the latest technologies has substituted conventional printers with commercial printers with high-speed printing capabilities.

Metal Print Packaging Industry Overview

The metal print packaging market is moderately competitive and comprises a significant number of global and regional players. These players account for a large share in the market and are focusing on expanding their consumer base across the world. These players are focusing on the research and development investment in introducing new solutions, strategic partnerships, and other organic and inorganic growth strategies to earn a competitive edge during the forecast period.

- June 2021 - CCL Container launched supersized Aluminum containers measuring up to 76 mm in diameter by 265 mm in height. CCL's large-diameter aluminum containers are the only ones of this size produced in North America. This large size, coupled with stunning shaping and decorating options, ensures that all products - whether an automotive fuel additive, insect repellent, or hairspray - make a big impression on consumers at the point of sale. Creative designs further distinguish brands and influence consumer-buying decisions. In addition, the endless recyclability of these 100% virgin aluminum containers is a win-win for environmentally conscious brands and consumers alike.

- May 2021 - HuberGroup Print Solutions announced the opening of a state-of-the-art production plant in the Wroclaw area in Poland, which delivers to customers throughout Europe. In the new buildings, hubergroup produces water-based varnishes as well as solvent-based inks for flexography and gravure printing and has dosing lines for offset inks, including UV inks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Evolution of Digital Print Technology

- 5.2 Market Challenges

- 5.2.1 Fluctuations in the Prices of Printing Inks

6 IMPACT OF COVID-19 ON THE METAL PACKAGING INDUSTRY

7 METAL PACKAGING MARKET LANDSCAPE

- 7.1 Metal Packaging Demand by Type

- 7.2 Metal Packaging Demand by Region

- 7.3 Metal Packaging Demand by End-User Industry

8 PRINTING INKS AND COATINGS LANDSCAPE

- 8.1 Printing Inks Demand by Type (Solvent-Based, Water Based, Oil-Based, UV Curing, and Other Types)

9 MARKET SEGMENTATION

- 9.1 By Printing Process

- 9.1.1 Offset Lithography

- 9.1.2 Gravure

- 9.1.3 Flexography

- 9.1.4 Digital

- 9.1.5 Other Printing Technologies

- 9.2 By Geography

- 9.2.1 North America

- 9.2.2 Europe

- 9.2.3 Asia Pacific

- 9.2.4 Latin America

- 9.2.5 Middle East and Africa

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 Toyo Seihan Co. Ltd (Toyo Seikan Group Holdings Ltd)

- 10.1.2 Ball Corporation

- 10.1.3 Hubergroup Deutschland GmbH

- 10.1.4 Envases Metalurgicos de Alava SA

- 10.1.5 CCL Container (CCL Industries Inc.)

- 10.1.6 Koenig & Bauer AG

- 10.1.7 Tonejet Limited

- 10.1.8 Crown Holdings Inc.