|

市場調查報告書

商品編碼

1435807

鋁罐:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Aluminum Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

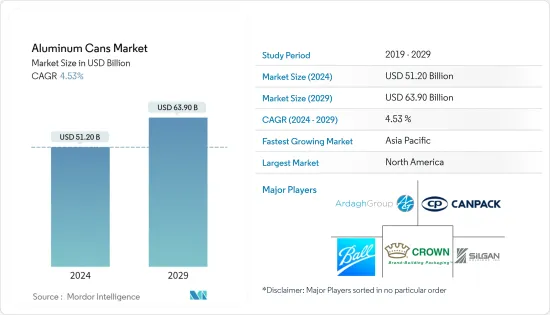

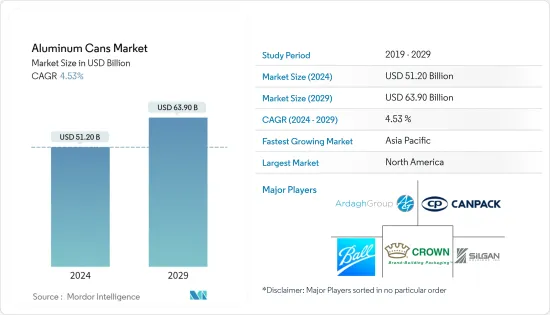

鋁罐市場規模預計到2024年為512億美元,預計到2029年將達到639億美元,在預測期內(2024-2029年)複合年成長率為4.53%。

主要亮點

- 鋁罐具有能長期保存食品品質的優點。鋁罐可提供近 100% 的防護,免受光、氧氣、濕氣和其他污染物的影響。鋁罐不生鏽且耐腐蝕,因此在所有包裝中保存期限最長。

- 鋁罐在食品和飲料行業中的使用增加可歸因於其保護性能、永續性優勢和消費者便利性。隨著製造商和消費者都認知到鋁包裝的好處,這一趨勢預計將持續下去。鋁是地球上回收率最高的材料,可回收率約 100%。鋁在回收過程中不會腐爛。因此,它可以根據需要多次回收。回收鋁可以節省數百萬噸的溫室氣體排放、能源、電力和運輸燃料。使用回收材料生產鋁罐所消耗的能源不到用礬土生產新鋁罐所需能源的 5%。

- 與競爭的包裝類型相比,鋁罐具有更高的回收率,並且含有更多的回收成分。據鋁業協會稱,它是市場上回收率最高的材料之一。 2022 年 4 月,波爾公司與 Recycle Aerosol LLC 合作,提高美國鋁氣霧罐的回收率。此次合作將增加氣霧罐的回收利用,並建立一個封閉回路型系統,將用過的氣霧罐回收成新的氣霧罐。用再生鋁製造鋁產品具有能源效率和碳效率。用於生產鋁氣霧劑的合金的高純度提高了效率,並且還減少了對主要從回收的鋁氣霧劑瓶和罐中獲取的原始鋁的需求。

- 然而,鋁罐包裝面臨來自替代包裝解決方案的激烈競爭。塑膠、紙張和玻璃包裝解決方案是業內可用的替代包裝選擇。此外,電子商務的重要性在世界範圍內日益增加,預計將影響整個包裝行業。而且,塑膠包裝的逐漸加強對市場構成了威脅,這主要集中在聚對聚對苯二甲酸乙二酯(PET)等塑膠作為替代品的普及。 PET 塑膠有可能取代食品和飲料行業的鋁罐解決方案。

- 同時,消費者對小尺寸和多包裝包裝形式的偏好等趨勢正在支持鋁罐數量的增加,特別是在即食食品領域。因此,新興地區的大多數公司都提供迷你罐裝產品,與傳統罐裝產品相比,迷你罐裝產品的容量通常較小,成本較低。例如,海鮮罐頭食品創新在東南亞正在顯著成長。

- 此外,隨著新型冠狀病毒感染疾病(COVID-19)在全球持續肆虐,所有產業都受到供應鏈中斷和政府為遏制感染傳播而實施的封鎖的嚴重影響。俄羅斯和烏克蘭之間的戰爭也導致多個國家受到經濟制裁,導致大宗商品價格飆升,供應鏈受到擾亂,全球多個市場受到影響,導致行業貿易中斷。戰爭迫使歐洲鋁公司減產,造成金屬短缺。由於烏克蘭戰爭導致依賴俄羅斯供應的歐洲製造商嚴重短缺,大宗商品貿易商正在爭奪來自中國的鋁出貨量的微薄利潤。歐洲正在經歷能源成本上漲。

鋁罐市場趨勢

成本和便利性優勢增加了對罐頭食品和飲料的需求

- 年輕人和個人消費者正在消費更多的罐頭食品和飲料。這些用戶時間緊迫且預算有限,因此他們選擇成本更低、便利性更高的產品。世界各地新興國家生活方式的改變和都市化的提高導致消費者選擇易於準備的食品。此外,隨著家庭規模的縮小和生活方式的改變,人們在家中準備和食用餐的時間減少,從而導致人們轉向食品、冷凍和已調理食品。哪些食品是最常見的包裝型態?

- 鋁罐最廣泛用於飲料,市場對攜帶性的需求導致了罐裝葡萄酒、雞尾酒、硬飲料和無酒精飲品採用金屬包裝的最顯著趨勢。根據飲料的性質,金屬罐在飲料行業中的使用可大致分為酒精飲料和非酒精飲料。雖然金屬罐歷來用於盛裝啤酒等酒精飲料,但金屬罐擴大用於盛裝傳統上裝在玻璃瓶中的其他類型的酒精飲料,例如葡萄酒。

- 罐裝食品因其攜帶性和易用性而在千禧世代和 Z 世代中流行。製造商也以罐裝包裝出售產品,因為這種設計很受年輕人歡迎。例如,2022年,全球銷售了115.82億罐紅牛。這相當於成長了 18.1%。集團收益成長 23.9%,從 78.16 億歐元(85.2 億美元)增至 96.84 億歐元(92.9 億美元)。

- 出於多種原因,包括導熱性、衛生和安全性,鋁罐成為食品包裝的首選,使其成為家庭和工業領域的便利選擇。因此,鋁罐廣泛應用於食品業,用於包裝肉類和魚貝類、水果和蔬菜、已烹調用餐、寵物食品、湯料和調味品等。如此廣泛的終端用戶市場創造了食品業對鋁罐的巨大需求。鋁也廣泛用於食品接觸材料,因為含鋁的食品接觸材料是食品鋁的人為來源。

- 此外,由於疫情導致消費行為發生變化,人們開始注重儲存保存期限長的食品,導致食品包裝中鋁罐的使用量增加,預計這將產生長期的積極影響。 。對所研究市場成長的影響。自封鎖期以來,歐洲罐頭魚的銷售量激增,尤其是在西班牙、法國和義大利等喜愛魚類的南歐國家。根據挪威統計局的數據,挪威罐頭魚的消費者物價指數(CPI)在過去幾年從2018年的111.4點上升到2022年的125.3點。

- 環保組織的努力和公眾的環境意識正在提高世界各地用戶的環保意識。消費者擴大放棄使用塑膠,而對回收產品的需求卻在增加。因此,對鋁罐等金屬包裝產品的需求不斷增加。

北美佔有很大的市場佔有率

- 由於對永續包裝材料的使用和消費的擔憂日益增加,北美在收益方面佔據了最大的市場佔有率。它佔世界鋁罐消費量的三分之一以上。

- 碳酸軟性飲料、能量飲料、碳酸水、精釀啤酒等產品穩定成長。鋁罐是最永續的飲料包裝之一,可以無限回收。它還可以快速冷卻,為印刷提供優質的金屬畫布,更重要的是,可以保護您喜愛的飲料的風味和完整性。

- 此外,隨著美國個人保健部門的擴張,對氣霧罐的需求也預計會增加。個人護理業務的成長主要與消費者可支配收入的增加及其購買奢侈品的能力有關。氣霧劑用於多種個人保健產品。因此,預計市場將受益於銷售量的增加。

- 此外,對除臭劑/止汗劑生產的需求不斷成長,導致過去幾年北美生產線安裝數量的增加。由於個人保健部門對除臭劑、造型慕絲、髮膠噴霧、髮膠和剃須摩絲等不同產品類型的需求不斷增加,北美在調查市場中佔據了很大佔有率。根據美國人口普查和西蒙斯全國消費者調查 (NHCS) 的資料,2020 年有 2.987 億美國人使用除臭劑/止汗劑。預計到 2024 年,這一數字將增至 3,0,604 萬。

- 隨著加拿大從疫情中恢復過來,加拿大政府也為加拿大企業提供了支持。政府強調透過投資創新促進強勁和持續的經濟復甦的重要性,這將使該國實現其低碳成長潛力。預計政府將進行重大投資,幫助加拿大鋁業減少溫室氣體排放。他們表示,零碳鋁冶煉是一種創新,將有助於加拿大實現其經濟和氣候變遷目標。

- 與競爭的包裝類型相比,鋁罐具有更高的回收率,並且含有更多的回收成分。據鋁業協會稱,它是市場上回收率最高的材料之一。回收可節省生產新金屬所需能源的 90% 以上,進而降低生產成本。在美國,全部區域每出貨三個鋁罐,就會回收兩個鋁罐。

- 此外,2022 年 4 月,波爾公司宣布與 Recycle Aerosol LLC 建立戰略合作夥伴關係,以提高美國鋁氣霧罐的回收率。此次合作將增加氣霧罐的回收利用,並建立一個封閉回路型系統,將用過的氣霧罐回收成新的氣霧罐。用再生鋁製造鋁產品具有很高的能源效率和碳效率。

鋁罐產業概況

由於全球和本地行業參與者的存在,鋁罐市場高度分散。主要參與者包括 Ball Corporation、Crown Holdings, Inc、Silgan Holdings Inc、Silgan Holdings Inc 和 Ardagh Group SA。該市場的供應商根據產品系列、差異化和定價參與。

2023 年 1 月,永續包裝解決方案製造商 CANPACK 加入了阿拉伯聯合大公國環球鋁業公司 (EGA) 在杜拜成立的鋁回收聯盟。 CANPACK 在阿拉伯聯合大公國 (UAE) 擁有重要的鋁罐製造廠。該聯盟匯集了阿拉伯聯合大公國飲料、廢棄物和鋁業的主要企業,教導人們如何最有效地重複利用用過的飲料瓶並提高鋁回收率。

2022 年 12 月,皇冠控股有限公司宣布與可口可樂及其專用印刷和複製工作室生產的軟性飲料品牌 Aquarius 合作,在西班牙開展一場智慧且有吸引力的促銷宣傳活動。相比之下,Aquarius 採用標準 330 毫升鋁罐包裝。這種永續的包裝形式促進了循環經濟,並且由於其無限的可回收性,有助於最大限度地減少需要從地球採購的原料的數量。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 鋁罐回收率高

- 由於成本和便利性相關的好處,對罐頭食品的需求增加

- 市場限制因素

- 替代包裝解決方案的可用性

第6章市場區隔

- 按類型

- 苗條的

- 光滑

- 標準

- 其他

- 按最終用戶產業

- 飲料

- 食品

- 氣霧劑

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Ball Corporation

- Ardagh Group SA

- Crown Holdings Inc.

- Silgan Holdings Inc.

- CAN-PACK SA

- CCL Container Inc.(CCL Industries Inc.)

- Tecnocap Group

- Saudi Arabia Packaging Industry WLL(SAPIN)

- Massilly Holding SAS

- CPMC HOLDINGS Limited(COFCO Group)

第8章投資分析

第9章市場的未來

The Aluminum Cans Market size is estimated at USD 51.20 billion in 2024, and is expected to reach USD 63.90 billion by 2029, growing at a CAGR of 4.53% during the forecast period (2024-2029).

Key Highlights

- Aluminum cans offer long-term food quality preservation benefits. Aluminum cans deliver nearly 100% protection against light, oxygen, moisture, and other contaminants. Aluminum cans do not rust and are corrosion-resistant, providing one of the most extended shelf lives considering any packaging.

- The rising application of aluminum cans in the food and beverage industry can be attributed to their protective properties, sustainability advantages, and consumer convenience. This trend is expected to continue as both manufacturers and consumers recognize the benefits associated with aluminum packaging. Aluminum can be the most recycled material on earth, with around a 100% recyclability rate. Aluminium does not decay throughout the recycling process; thus, it can be recycled numerous times. Recycling aluminum saves millions of tonnes of greenhouse gas emissions, energy, power, and transportation fuel. Producing aluminum cans using recycled materials uses less than 5% of the energy required to produce new aluminum cans from Bauxite.

- Aluminum cans have a higher recycling rate and more recycled content than competing package types. According to the Aluminum Association, it's one of the most recycled materials on the market. In April 2022, Ball Corporation partnered with Recycle Aerosol LLC to boost the recycling rates of aluminum aerosol cans in the United States. The collaboration increases aerosol can recycling and establishes a closed-loop system in which used cans are recycled into new aerosol cans. The production of aluminum goods from recycled aluminum is energy- and carbon-efficient. Because the alloys used to make aluminum aerosols are of high purity, there are efficiency improvements that also lessen the demand for virgin aluminum when they are mainly derived from recycled aluminum aerosol bottles and cans.

- However, aluminum can packaging faces high competition from alternative packaging solutions. Plastic, paper, and glass packaging solutions are the alternative packaging options available in the industry. Also, the increasing importance of e-commerce worldwide is expected to influence the overall packaging industry. Moreover, incremental enhancements in plastic packaging are posing a threat to the market, which can primarily be allocated to the popularity of plastics, such as polyethylene terephthalate (PET), as substitutes. PET plastics threaten to displace aluminum can solutions in the food and beverage sector.

- Meanwhile, consumer trends, such as a preference for small-size and multi-pack packaging formats, support the volume growth of aluminum cans, especially for the ready-to-eat food segment. Hence, most companies across emerging regions offer mini-cans, which usually contain smaller volumes of products at less cost than traditional canned products. For instance, food innovations in canned seafood in Southeast Asia are witnessing significant growth.

- Further, as COVID-19 swept across the world, all industries were affected majorly due to disruption in the supply chains and government-imposed lockdowns in the wake of controlling its spread. Also, the war between Russia and Ukraine resulted in economic sanctions against several countries, high commodity prices, supply chain disruptions, and impacts on many markets worldwide, and caused trade disruptions in the industry. War pushed European aluminum companies to cut production, leading to metal shortages. Commodity traders are competing for scarce profits from shipping aluminum from China as the war in Ukraine has created severe shortages for European manufacturers who rely on Russian supplies. Europe has experienced a surge in energy costs.

Aluminum Cans Market Trends

Increasing Demand for Canned Foods and Beverage Driven by Cost and Convenience-Related Advantages

- Younger populations and individual living consumers are consuming more canned food and beverages. These users have less time and are budget restrained, thus, opting for products with lower costs and higher convenience. Changing lifestyles in developing countries worldwide and the growing rate of urbanization is resulting in consumers opting for easy-to-cook food. Moreover, with the shrinking size of the family, along with the changing patterns in lifestyle, the declining amount of time spent on the preparation of meals and consumption at home is leading to the shift toward more processed, frozen, and pre-prepared foods in which canned foods are the most common form of packaging.

- Aluminum Cans are most widely used for beverages, with the most notable trend of canned wine, cocktails, hard beverages, and soft beverages being packaged in metal, driven by the need for portability in the market. The usage of metal cans in the beverage industry can be widely classified into alcoholic and non-alcoholic drinks based on the nature of the beverage. Alcoholic drinks, such as beer, have historically used metal cans, while other kinds of liquor, like wine, traditionally served in glass bottles, are increasingly adopting metal cans.

- Due to their portability and ease of use, cans are trendy among millennials and GenZ. Additionally, manufacturers are launching the product in can packaging because their design is popular with young people. For instance, 11.582 billion cans of Red Bull were sold worldwide in 2022. This represents an increase of 18.1%. From EUR 7.816 billion (USD 8.52 billion) to EUR 9.684 billion (USD 9.29 billion), group revenue increased by 23.9%.

- Aluminum cans are preferred for food packaging for various reasons, including heat-conductivity, hygiene, and safety, which has made it a convenient choice for the domestic and industrial sectors; owing to this, aluminum cans are widely used in the food industry for the packaging of meat and seafood, fruits and vegetables, ready meals, pet food, soups and condiments, and others. Such a broad end-user market creates significant demand for aluminum cans catering to the food industry. Also, aluminum is extensively used in food contact materials because aluminum-containing food contact materials are an anthropogenic source of dietary aluminum.

- Also, the focus on stockpiling food with long shelf life, owing to the change in consumer behavior as a result of the pandemic, has contributed to the rise in the usage of aluminum cans for packaging food and is expected to leave a long-lasting positive impact on the growth of the studied market. Canned fish sales have boomed since the lockdown period in Europe, particularly in fish-loving Southern European nations such as Spain, France, and Italy. According to Statistics Norway, the consumer price index (CPI) of canned fish in Norway increased in the past few years from 111.4 points in 2018 to 125.3 points in 2022.

- Initiatives by environmental groups and public awareness about the environment have increased awareness among users worldwide. Consumers are increasingly abandoning plastic usage, whereas the demand for recycled products is growing. As a result, it is creating a high demand for metal-packaged products, including aluminum cans.

North America to Hold a Significant Share in the Market

- North America holds the largest market share in revenue due to growing concerns regarding using and consuming sustainable packaging materials. It accounts for over one-third of the total global consumption of aluminum cans.

- There has been a steady growth in products such as sodas, energy drinks, sparkling waters, and, increasingly, craft brew beers. Aluminum cans are one of the most sustainable beverage packages and are infinitely recyclable. They also chill quickly, providing a superior metal canvas to print and, more importantly, protecting the flavor and integrity of your favorite beverages.

- Moreover, the demand for aerosol cans is anticipated to rise along with the personal care sector's expansion in the United States. The growth of the personal care business is primarily related to consumers' increased disposable income and ability to purchase luxury goods. Aerosols are utilized in several personal care products. Thus, the market is projected to profit from their rising sales.

- Additionally, the higher production demands of deodorants/antiperspirants led to the installation of an increasing number of production lines in North America over the past few years. North America accounts for a significant share of the market studied due to the increasing demand from the personal care segment, spanning products of various types, such as deodorants, antiperspirants, hair mousses, hair sprays, shaving mousses, etc. For instance, according to the US Census and Simmons National Consumer Survey (NHCS) data, 298.7 million Americans used deodorants/antiperspirants in 2020. This figure is projected to increase to 306.04 million in 2024.

- Also, as Canada recovered from the pandemic, the Government of Canada provided assistance to its businesses. The government claimed that it was vital to foster a strong and lasting economic recovery by investing in innovation, which could allow the country to achieve its potential for low-carbon growth. The government is expected to invest heavily in helping Canada's aluminum industry eliminate greenhouse gas emissions. They said that zero-carbon aluminum smelting was the kind of innovation thatthat would help meet Canada's economic and climate change objectives.

- Aluminum cans have a higher recycling rate and more recycled content than competing package types. According to the Aluminum Association, it's one of the most recycled materials on the market. Recycling saves more than 90% of the energy required to produce new metal, reducing production costs. In the United States, two aluminum cans are recycled for every three cans shipped across the region.

- Additionally, in April 2022, Ball Corporation announced its strategic partnership with Recycle Aerosol LLC to enhance aluminum aerosol can recycling rates in the United States. The collaboration increases aerosol can recycling and establishes a closed-loop system in which used cans are recycled into new aerosol cans. Utilizing recycled aluminum to manufacture aluminum products is very energy and carbon efficient.

Aluminum Cans Industry Overview

The aluminum cans market is highly fragmented, owing to the presence of various global and local industry players. Some major players are Ball Corporation, Crown Holdings, Inc, Silgan Holdings Inc, Silgan Holdings Inc, and Ardagh Group S.A. Vendors in this market participate based on product portfolio, differentiation, and pricing.

In January 2023, CANPACK, a manufacturer of sustainable packaging solutions, joined the Aluminium Recycling Coalition, established in Dubai by Emirates Global Aluminium (EGA). CANPACK has a significant aluminum can manufacturing facility in the United Arab Emirates (UAE). This Alliance, which brings together key players in the UAE's beverage, waste, and aluminum sectors, teaches people how to reuse used beverage jars most effectively to increase aluminum recycling rates.

In December 2022, Crown Holdings, Inc. announced a collaboration with Aquarius, a refreshing beverage brand produced by Coca-Cola and its dedicated print and reprographics studio, on an intelligent and engaging promotional campaign in Spain. In contrast, Aquarius was available in standard 330ml aluminum cans. This sustainable packaging format advanced a Circular Economy and helped minimize the raw materials required to be sourced from the Earth via its infinite recyclability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclability Rates of Aluminum Cans

- 5.1.2 Increasing Demand for Canned Foods driven by Cost and Convenience-related Advantages

- 5.2 Market Restraints

- 5.2.1 Availability of Alternative Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Slim

- 6.1.2 Sleek

- 6.1.3 Standard

- 6.1.4 Other Types

- 6.2 By End-user Industry

- 6.2.1 Beverage

- 6.2.2 Food

- 6.2.3 Aerosol

- 6.2.4 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Thailand

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Ball Corporation

- 7.1.2 Ardagh Group S.A.

- 7.1.3 Crown Holdings Inc.

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 CAN-PACK SA

- 7.1.6 CCL Container Inc. (CCL Industries Inc.)

- 7.1.7 Tecnocap Group

- 7.1.8 Saudi Arabia Packaging Industry WLL (SAPIN)

- 7.1.9 Massilly Holding SAS

- 7.1.10 CPMC HOLDINGS Limited (COFCO Group)