|

市場調查報告書

商品編碼

1435797

感應馬達(感應馬達):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Induction Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

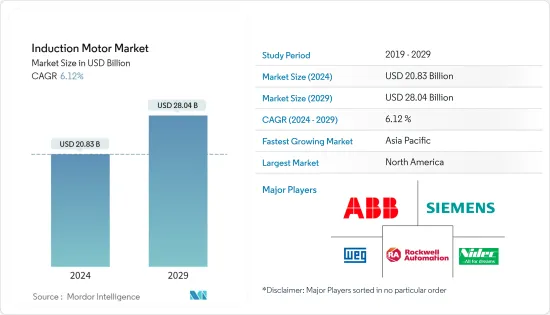

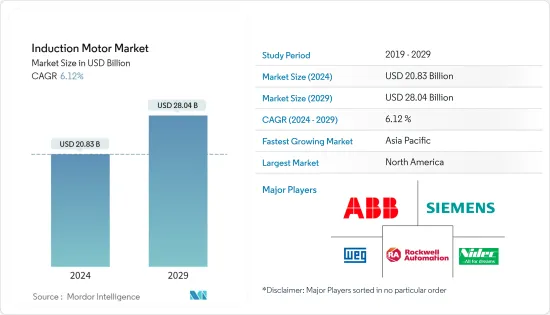

感應馬達市場規模預計到2024年為208.3億美元,預計到2029年將達到280.4億美元,在預測期內(2024-2029年)複合年成長率為6.12%,預計將會成長。

由於沒有滑環、換向器和電刷,感應馬達幾乎免維護或需要很少的維護,這是這些馬達需求不斷成長的主要因素之一。

主要亮點

- 感應馬達是一種交流馬達,其中扭矩是透過定子中產生的變化磁場與轉子線圈中感應的電流之間的反應產生的。它們被用於大多數機器,因為它們比傳統馬達更強大且更環保。它們獨特的堅固性需要很少的維護,使它們適合汽車和製造應用。在不同氣候條件下發揮作用的能力也是推動其需求的主要因素。

- 對減少溫室氣體排放的日益關注以及對低能耗產品的消費量是電動車成長的主要驅動力。國際能源總署(IEA)預計,2022年全球電動車銷量將大幅成長,第一季銷量達200萬輛,較2021年同期成長75%。電動汽車產業預計將成長。這些馬達因其堅固、可靠和低維護的特性而被電動車 (EV) 製造商廣泛使用,從而推動了對感應馬達的需求。

- 維持世界發展對電能的需求不斷增加,需要對發電進行持續大量投資,這推動了感應馬達在電力領域的應用。

- 此外,在建築物和工業設施中節省能源和降低營運成本的一些最重要的機會來自於最佳化馬達系統。根據美國能源局,美國消耗的電力大約有一半流經馬達,其中 90% 是交流 (AC)感應馬達。研究表明,將感應馬達的整體效率提高 5% 可以節省足夠的能源,與數百兆瓦的新發電廠產生的能源相匹配。

- 然而,尋找感應馬達的替代技術開發已成為成長的主要瓶頸。例如,特斯拉在 Model 3 中開發並改用同步磁阻馬達,顯著增加了續航里程。該公司還致力於用這種新馬達取代 Model S 和 X 中的感應馬達。

- 新型冠狀病毒感染疾病(COVID-19)的爆發對市場成長產生了負面影響,主要是由於離散製造業的營運暫停。例如,根據加拿大政府2021年製造業月調查,2021年4月製造業銷售額下降2.1%至571億美元,21個產業中有11個產業銷售額下降。此外,冠狀病毒感染疾病(COVID-19) 的爆發影響了全球汽車產業的生產設施,並極大地影響了所研究市場的成長。

感應馬達市場趨勢

感應馬達的工業應用顯著成長

- 馬達目前用於許多對公司生產力至關重要的工業應用。如今,每個製造公司都將最佳化生產效率作為首要目標。感應馬達經濟高效、堅固耐用、免維護,並且能夠在所有環境條件下運行,使其擴大應用於採礦、水泥、汽車、石油和天然氣、醫療保健和製造領域。這些是一些泵浦、升降機、起吊裝置、電動剃刀、起重機、破碎機、石油開採設備等。由於低排放率,整個產業的環保意識不斷增強,也促進了感應馬達的成長。

- 近年來,隨著人口從農村地區轉移到都市區尋找工作,都市化不斷加快。根據世界銀行統計,世界城市人口占總人口的比例為57%。這增加了對建設零售、商業和住宅住宅的資源需求,以滿足快速成長的需求,對工業部門的成長和感應馬達的需求產生積極影響。

- 製造是感應馬達的關鍵驅動力,因為它們用於熔爐、輸送機、捲繞機、泵浦、風洞和其他工業設備。製造業正在崛起,特別是在疫情造成的最初下滑之後,感應馬達的需求也有望進一步成長。例如,根據工業(UNIDO)的數據,2022年第一季全球製造業產量與前一年同期比較增4.2%。

- 考慮到不斷成長的需求,一些感應馬達供應商正在專注於開發具有創新功能的新型感應馬達,以滿足新工業用例的不同要求。預計這種趨勢將在未來幾年支持感應馬達市場的成長。

預計亞太地區在預測期內將出現顯著成長

- 由於許多行業對自動化各種加工步驟的投資不斷增加,預計亞太地區將在預測期內對感應馬達市場的成長做出最大貢獻。此外,效率的提高和重量的減輕導致電動車擴大採用感應馬達,取代DC馬達。

- 該地區的石油和天然氣、汽車、採礦和金屬以及建築等行業正在穩步成長,預計將為全球感應馬達公司提供巨大的成長機會。

- 東南亞擁有豐富的天然氣、石油等碳氫化合物資源。中國是該地區最大的石油生產國,2021年原油產量約400萬桶/日(資料來源:英國石油公司)。 2022年5月,中國國家能源局製定了2022年將國內原油產量增加至約15億桶的目標,表達了政府對石油探勘和生產的重要性。

- 此外,亞太地區的汽車產業也正在經歷變化的趨勢,一些國家正在推廣電動車的採用。政府的支持性監管也在電動汽車產業的發展中發揮重要作用。例如,中國政府設定了到 2030 年汽車銷售的 40% 為電動車的目標。

感應馬達產業概況

感應馬達市場競爭激烈,由羅克韋爾自動化公司、ABB 有限公司、西門子公司、WEG 電氣公司和日本電產電機公司等少數大公司主導。憑藉著顯著的市場佔有率,這些領先公司正專注於擴大海外客戶群。這些公司正在利用策略合作舉措來提高市場佔有率和盈利。然而,隨著技術進步和產品創新,中小企業正在透過贏得新合約和開拓新市場來增加其市場佔有率。

- 2022年6月 - 日本電產株式會社在美國推出結合了鼠籠感應馬達和SR馬達基本原理的高效鋁保持架SR馬達「SynRA(鋁籠轉子感應馬達磁阻馬達)」市場。啟動時,Nidec 的 SynRA 作為感應馬達旋轉,與鼠籠式感應馬達相比,損耗更低,效率更高。

- 2022 年 3 月 - Havells India 推出了節能 ECOACTIV 風扇系列,推出了 19 款新型號,涵蓋落地扇、吊扇、壁扇和通氣扇類別。新風扇包括 ECOACTIV 超高效 BLDC 和感應馬達。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章 市場促進因素

- 市場促進因素

- 擴大電動車的應用

- 住宅和工業領域對節能的需求不斷增加

- 市場限制因素

- 替代技術的研究和開發

第6章市場區隔

- 按類型

- 單相感應馬達

- 三相感應馬達

- 按用途

- 住宅

- 商業的

- 工業的

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Rockwell Automation Inc.

- Nidec Motor Corporation

- ABB Ltd

- Siemens AG

- WEG Electric Corp.

- Regal Beloit Corporation

- Baldor Electric Company

- Emerson Electric Co.

- Schneider Electric SE

- Marathon Electric

- Kirloskar Electric Company

- CG(Comton & Greaves)

- ThomasNet

第8章投資分析

第9章 市場機會及未來趨勢

The Induction Motor Market size is estimated at USD 20.83 billion in 2024, and is expected to reach USD 28.04 billion by 2029, growing at a CAGR of 6.12% during the forecast period (2024-2029).

Due to the absence of slip rings, commuters, and brushes, the induction motors are nearly maintenance-free or require low maintenance, which is among the major driving factors behind the growth in demand for these motors.

Key Highlights

- An induction motor is an AC electric motor in which torque is produced by the reaction between a varying magnetic field generated in the stator and the current induced in the coils of the rotor. It is used in most machinery as it is more powerful and eco-friendly than conventional motors. Unique robustness makes it a suitable choice for automotive and manufacturing applications, as it requires less maintenance. Its ability to work under varying climatic conditions is another major factor driving its demand.

- The rising focus on reducing greenhouse gas emissions and the demand for products that consume less energy are the major factors for the growth of electric cars. According to the International Energy Agency (IEA), the global sales of electric vehicles have been rising strongly in 2022, with 2 million sold in the first quarter, up 75% from the same period in 2021. The growth of the EV industry is expected to drive the demand for induction motors, as these motors are widely used by electric vehicle (EV) manufacturers, owing to their robust, reliable, and low maintenance features.

- The increasing demand for electrical energy to sustain global development requires consistent heavy investments in power supply generation that have driven induction motors' application in the electricity sector.

- Furthermore, some of the most significant opportunities to save energy and reduce operating costs in buildings and industrial facilities come from optimizing electric motor systems. According to the US Department of Energy, about half of all electricity consumed in the United States flows through motors, 90% of which are alternating-current (AC) induction motors. The study indicated that a 5% improvement in the overall efficiency of the induction motor would save enough energy comparable to energy produced by the new power plant of a few hundred megawatts.

- However, research on developing alternative technology for induction motors is the major bottleneck for its growth. For instance, Tesla has developed and switched to a synchronous reluctance motor in Model 3, which has significantly boosted the range. The company is also working on replacing the induction motors in their Model S and X with this new motor.

- The outbreak of COVID-19 has negatively impacted the market growth, mainly due to the stoppage in discrete manufacturing industry operations. For instance, according to the Monthly Survey of Manufacturing, 2021 by the Government of Canada, Manufacturing sales fell 2.1% to USD 57.1 billion in April 2021 on lower sales in 11 of 21 industries. Also, the outbreak of COVID-19 has affected the production facilities of automotive sectors across the globe, which has significantly impacted the growth of the studied market.

Induction Motor Market Trends

Industrial Application of Induction Motor to Experience Significant Growth

- Motors are used in many industrial applications today, which are critical to the enterprise's productivity. Presently, every manufacturing company pursues optimized production efficiency as its primary goal. As induction motors are cost-effective, robust, maintenance-free, and can operate in any environmental condition, they are increasingly being used in mining, cement, automotive, oil and gas, healthcare, and manufacturing industries. They are part of pumps, lifts, hoists, electric shavers, cranes, crushers, oil extracting equipment, etc. Increasing awareness of environmental protection across industries also contributes to the growth of induction motors, as they have a low emission rate.

- In the past few years, populations shifted from rural to urban areas in search of jobs, which led to urbanization. According to the World Bank, the global urban population as a percentage of the total population stood at 57%. This has driven the demand for resources to construct retail, commercial, and residential housing facilities to accommodate the surging need, which positively impacts the growth of the industrial sector and the demand for induction motors.

- The manufacturing industry has been the significant driver for induction motors as these motors are found in furnaces, conveyors, winders, pumps, wind tunnels, and other industrial equipment. With the manufacturing industry witnessing an upward growth trend, especially after the initial setback created by the pandemic, the demand for induction motors is also expected to grow further. For instance, according to the United Nations Industrial Development Organization (UNIDO), global manufacturing production registered a year-over-year output growth of 4.2 percent in the first quarter of 2022.

- Considering the growing demand, several induction motor providers are focusing on developing new types of induction motors with innovative functionality to fulfil various requirements of new industrial use cases. Such trends are expected to support the growth of the induction motor market in the coming years.

Asia Pacific is Expected to Register Significant Growth During the Forecast Period

- Asia-Pacific is likely to be the highest contributor to the growth of the induction motor market during the forecast period due to an increase in investment to automate various processing steps in many industries. Moreover, the increasing adoption of induction motors in electric vehicles replaced the DC motors due to their improved efficiency and lightweight.

- Industries, such as oil and gas, automotive, mining and metal, and construction, are witnessing steady growth in the region, which is expected to offer tremendous growth opportunities for the global induction motor players.

- Southeast Asia is a rich source of hydrocarbon resources, like natural gas and petroleum. China is the biggest oil producer in the region, accounting for about 4 million barrels of oil per day in 2021 (Source: British Petroleum). In May 2022, China's National Energy Agency set a target to increase domestic crude oil production to approximately 1.5 billion barrels in 2022 after the government expressed the importance of exploration and production of crude oil.

- Furthermore, the automotive industry in the Asia Pacific region is also witnessing a trend shift, with several countries promoting the adoption of electric vehicles. The supportive government regulation also plays a crucial role in the growth of the electric vehicle industry. For instance, the Chinese government had set up goals of having EVs make up 40 percent of all car sales by 2030.

Induction Motor Industry Overview

The induction motor market is competitive and dominated by a few major players, like Rockwell Automation Inc., ABB Ltd, Siemens AG, WEG Electric Corporation, and Nidec Motor Corporation. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market shares and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market presence by securing new contracts and tapping new markets.

- June 2022 - Nidec Corporation launched SynRA (Synchronous Reluctance Motor with Aluminum Cage Rotor), an aluminum cage-equipped, high-efficiency synchronous reluctance (SR) motor that combines an SR motor with the cage-type induction motor's basic principles, for the US market. Nidec's SynRA rotates as an induction motor when activated, produces less loss, and achieves higher efficiency than the cage-type induction motor.

- March 2022 - Havells India unveiled its range of energy-efficient ECOACTIV fans by launching 19 new models under the pedestal, ceiling, wall, and ventilator fan category. The new content of fans comes equipped with ECOACTIV super efficient BLDC and induction motor.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Inductry Value Chian/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DRIVERS

- 5.1 Market Drivers

- 5.1.1 Increasing Application in Electric Vehicles

- 5.1.2 Elevated Requirement of Power Savings in Residential and Industrial Sectors

- 5.2 Market Restraints

- 5.2.1 R&D of Alternative Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single-phase Induction Motor

- 6.1.2 Three-phase Induction Motor

- 6.2 By Application

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 United Kingdom

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Nidec Motor Corporation

- 7.1.3 ABB Ltd

- 7.1.4 Siemens AG

- 7.1.5 WEG Electric Corp.

- 7.1.6 Regal Beloit Corporation

- 7.1.7 Baldor Electric Company

- 7.1.8 Emerson Electric Co.

- 7.1.9 Schneider Electric SE

- 7.1.10 Marathon Electric

- 7.1.11 Kirloskar Electric Company

- 7.1.12 CG (Comton & Greaves)

- 7.1.13 ThomasNet