|

市場調查報告書

商品編碼

1435525

裝飾照明:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Decorative Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

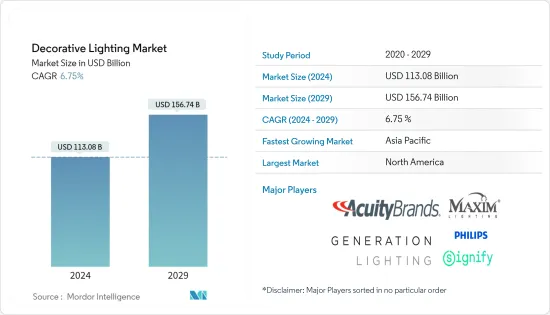

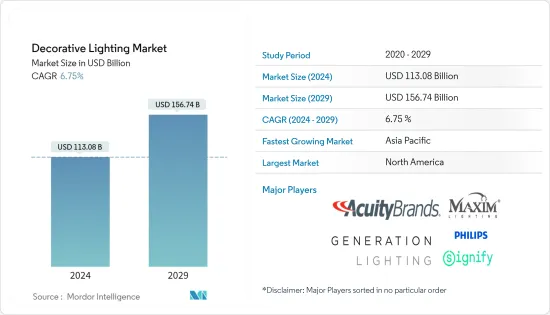

裝飾照明市場規模預計到2024年為1130.8億美元,預計到2029年將達到1567.4億美元,在預測期內(2024-2029年)複合年成長率為6.75%,預計將會成長。

裝飾照明市場的驅動力是透過使用照明來營造房間氛圍,並預計將推動各種照明燈具的使用。這些燈光透過創造視覺動態空間來控制房間的實際尺寸。除此之外,適當的照明和設備讓空間看起來舒適。

主要亮點

- 市場上的生產商在功能、設計、顏色等方面不斷創新。如果明智地選擇,現代裝飾可以與您的地板、牆壁和家具相得益彰,為您的空間帶來溫暖、誘人和實用的感覺。推動市場成長的其他因素包括社群媒體和有關消費者家居裝飾的網路系列。

- 設備有各種形狀、尺寸、設計、顏色和材質。我們建議選擇與牆壁和家具相匹配的顏色。市場普遍青睞纖維固定裝置,但陶瓷、玻璃、竹子、木雕和織物的需求也不斷增加。市場上最新的創新包括專注於物聯網的智慧照明解決方案、智慧照明系統、XLamp XP-G3 皇家藍 LED、帶照明套件的吊扇等。

- 裝飾燈應用範圍廣泛,包括商店、餐廳、家庭、水療中心、購物中心、圖書館等。這些燈深受 Erica Reitman、Amy Storm、Lisa Abern、Anissa Zajac 等設計師的歡迎。克里斯蒂娜·林 (Christina Lin)、李·約翰遜 (Lee Johnson) 和安·塞奇 (Ann Sage) 對這些燈光的風格進行了實驗,以營造一種美學氛圍。

裝飾照明市場趨勢

LED光源主導裝飾照明市場

LED 領域的成長得益於世界各國政府為節約資源所採取的監管政策。隨著市場上的消費者開始使用藝術燈、水晶燈和照明燈具,這些產品正在取代傳統光源。為了利用LED光源並取代傳統方法,LED燈絲也進入市場填補空白。此外,這些產品節能,比其他能源來源節省更多能源,控制光強度,且不含汞,對環境友善。市場上有關智慧照明解決方案的大部分創新都發生在 LED 光源的使用中。

北美市佔率最大,亞太地區成長最快

2018年,北美地區佔全球市場收益比重超過35%。該地區國家(例如美國和加拿大)幾乎所有家庭都能用上電,這在採用創新裝飾物品方面發揮了關鍵作用。局部燈光。

同時,預計亞太地區在未來幾年將繼續提供有利的機會。中國和印度等新興經濟體的人口成長和都市化預計將為照明公司提供市場進入機會。馬爾地夫、中國、印度和斯里蘭卡政府開發旅遊目的地等其他因素預計也將增加對主要使用裝飾照明的飯店和餐廳的投資。

裝飾照明行業概況

由於市場上存在許多全球和區域參與者,裝飾照明市場呈現碎片化狀態。製造商正在利用人工智慧和智慧解決方案將新產品推向市場。他們在新的固定裝置、可以使用行動電話、遠端感應器等控制的水晶燈方面進行創新。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 市場概況

- 市場促進因素

- 市場限制因素

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 洞察市場消費者購買行為

- 市場進出口趨勢洞察

- 依照明產品類型(壁燈、嵌入式安裝等)的見解

- 政府監管市場

- 市場的技術顛覆

第5章市場區隔

- 按光源分類

- LED

- 螢光

- 白熾燈

- 其他

- 依產品

- 天花板

- 壁掛

- 其他

- 按用途

- 商務用

- 家庭使用

- 按分銷管道

- 線下(大賣場、超級市場、專賣店等)

- 線上的

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭形勢

- 市場集中度概覽

- 公司簡介

- Acuity Brands Lighting Inc.

- Generation Lighting

- Maxim Lighting

- GE Lighting

- Juno Lighting LLC

- Lowe's

- Osram

- Amerlux

- Littmann

- Columbia

- AZZ Inc.

- ETC

- 其他公司(Intense、LSI、Cree)

第7章投資分析(近期併購)

第8章市場未來性與機遇

第9章 免責聲明

The Decorative Lighting Market size is estimated at USD 113.08 billion in 2024, and is expected to reach USD 156.74 billion by 2029, growing at a CAGR of 6.75% during the forecast period (2024-2029).

The decorative lighting market is driven by the use of lighting that sets the ambiance of the room and is expected to promote the use of various lighting fixtures. These lights manipulate the actual size of the room by creating a visually dynamic space. Along with this, appropriate lighting and fixture give a pleasant look to a space.

Key Highlights

- Producers in the market are constantly innovating in terms of functionality, design, color, etc. Modern decor, when chosen wisely, complements the floor, wall, and furniture, and thus, gives a warm, inviting, and functional space. Other factors that are driving the growth of the market are social media and web series on home decor for consumers.

- Fixtures come in various shapes, sizes, designs, colors, and materials. Colors that complement the wall and furniture are preferred. Fiber fixtures are commonly preferred in the market but the demand for ceramic, glass, bamboo, carved wood, the fabric is also growing. Recent innovations in the market include smart lighting solutions concentrated on IoT, smart lighting systems, XLamp XP-G3 Royal Blue LED, ceiling fans with light kits, etc.

- Decorative lights find their applications in wide areas, including shops, restaurants, homes, spas, malls, libraries, etc. These lights have been gaining popularity from a large number of designers, such as Erica Reitman, Amy Storm, Lisa Abeln, Anissa Zajac, Kristina Lynne, Lea Johnson, and Anne Sage, who then experiment with the style of these lights to create aesthetic ambiance.

Decorative Lighting Market Trends

LED Source of Lights Dominated the Decorative Lighting Market

The growth of the LED segment is attributed to the regulatory policies made by governments all over the world to conserve resources. These products are replacing traditional light sources, as consumers in the market started using art lamps, chandeliers, and fixtures. To make use of LED sources of light and replace conventional methods, LED filament also entered the market to fill the gaps. Additionally, these products are more energy-efficient, save more energy than other sources, control the intensity of light, and are also environment-friendly as they do not contain mercury. Most of the innovations in the market, in terms of smart lighting solutions, are taking place in the use of LED light sources.

North America Held the Largest Share in the Market, while Asia-Pacific is the Fastest Growing Market

North America accounted for over 35% share in the global market revenues in 2018. Almost every household in the countries of the region, such as the United States and Canada, has access to electricity, which played a crucial role in the adoption of innovative decorative lights in the region.

Asia-Pacific, on the other hand, is expected to remain a lucrative opportunity in the next few years. Population growth and urbanization in developing economies, such as China and India, are expected to provide an opportunity for lighting fixture companies in the market. Other factors such as the development of tourist destinations by the governments of Maldives, China, India, and Sri Lanka, are also expected to increase the investment in hotels and restaurants, where decorative lights find their major use.

Decorative Lighting Industry Overview

The decorative lights market is fragmented due to the presence of a large number of global and regional players in the market. Manufacturers are introducing new products in the market using artificial intelligence and smart solutions. They are innovating in terms of new fixtures, chandeliers that can be controlled using mobiles, remote sensors, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights into Consumer Purchasing Behaviour in the Market

- 4.7 Insights into Exports and Imports Trends in the Market

- 4.8 Insights into Different Types of Lighting Products (Sconce, Flush Mount, etc.)

- 4.9 Government Regulations in the Market

- 4.10 Technological Disruption in the Market

5 MARKET SEGMENTATION

- 5.1 By Light Source

- 5.1.1 LED

- 5.1.2 Fluroscent

- 5.1.3 Incandescent

- 5.1.4 Other Light Sources

- 5.2 By Product

- 5.2.1 Ceiling

- 5.2.2 Wall Mounted

- 5.2.3 Other Products

- 5.3 By End Use

- 5.3.1 Commercial

- 5.3.2 Household

- 5.4 By Distribution Channel

- 5.4.1 Offline (Hypermarkets, Supermarkets, Specialty Stores, etc.)

- 5.4.2 Online

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Acuity Brands Lighting Inc.

- 6.2.2 Generation Lighting

- 6.2.3 Maxim Lighting

- 6.2.4 GE Lighting

- 6.2.5 Juno Lighting LLC

- 6.2.6 Lowe's

- 6.2.7 Osram

- 6.2.8 Amerlux

- 6.2.9 Littmann

- 6.2.10 Columbia

- 6.2.11 AZZ Inc.

- 6.2.12 ETC

- 6.2.13 Other Companies (Intense, LSI, Cree )